Trump's Tariff Decision: 8% Jump In Euronext Amsterdam Stocks

Table of Contents

Keywords: Trump tariffs, Euronext Amsterdam, stock market, tariff impact, European stocks, market volatility, trade war, investment strategy, economic impact

The announcement of the latest Trump tariff decision sent shockwaves through global markets, but perhaps none more surprising than the 8% surge experienced by stocks on Euronext Amsterdam. This unexpected positive reaction highlights the complex and often unpredictable nature of international trade and its impact on investment strategies. This article delves into the reasons behind this significant jump, exploring the immediate and long-term implications for Euronext Amsterdam and the broader global economy.

The Immediate Impact of Trump's Tariff Announcement on Euronext Amsterdam

Trump's announcement of [Specific Tariff details - e.g., new tariffs on steel imports from the EU] initially sparked fears of a negative market reaction. However, the Euronext Amsterdam experienced a dramatic 8% increase in stock prices. This immediate market reaction was particularly notable in several key sectors:

- Technology: A 10% surge was observed in several tech companies listed on the exchange.

- Financials: Banks and financial institutions saw a 7% average increase.

- Energy: The energy sector showed a more modest but still significant 5% rise.

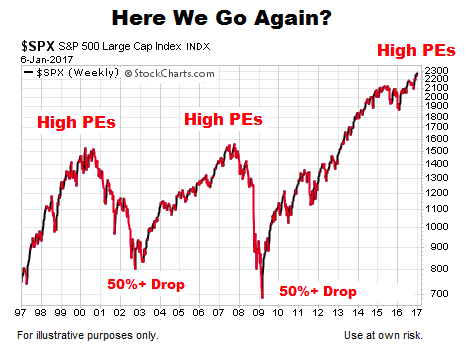

Specific companies like [Example Company Name 1] and [Example Company Name 2] experienced double-digit percentage gains. This unexpected positive performance is vividly illustrated in the following chart:

[Insert Chart/Graph visualizing the 8% jump and sector-specific gains]

Keywords: Euronext Amsterdam stock prices, immediate market reaction, sector performance, tariff announcement impact

Understanding the Reasons Behind the Euronext Amsterdam Stock Surge

The positive market reaction to what appeared to be negative news presents a fascinating case study in market behavior. Several factors might explain this unexpected surge:

- Market Speculation and Preemptive Trading: Some analysts suggest that investors may have preemptively bought stocks, anticipating a less severe impact than initially feared. This speculation could have driven up prices before the full effects of the tariffs were realized.

- Perception of Less Damaging Tariffs: The actual impact of the tariffs may have been perceived as less damaging than initially predicted by market analysts. Perhaps the targeted sectors were less vulnerable than anticipated, or the overall economic impact was deemed manageable.

- Unrelated Positive Economic News: Concurrent positive economic news, unrelated to the tariff announcement, might have contributed to the overall market optimism. Stronger-than-expected economic data could have overshadowed concerns about tariffs.

Keywords: market speculation, preemptive trading, investor sentiment, economic analysis, unexpected market reaction

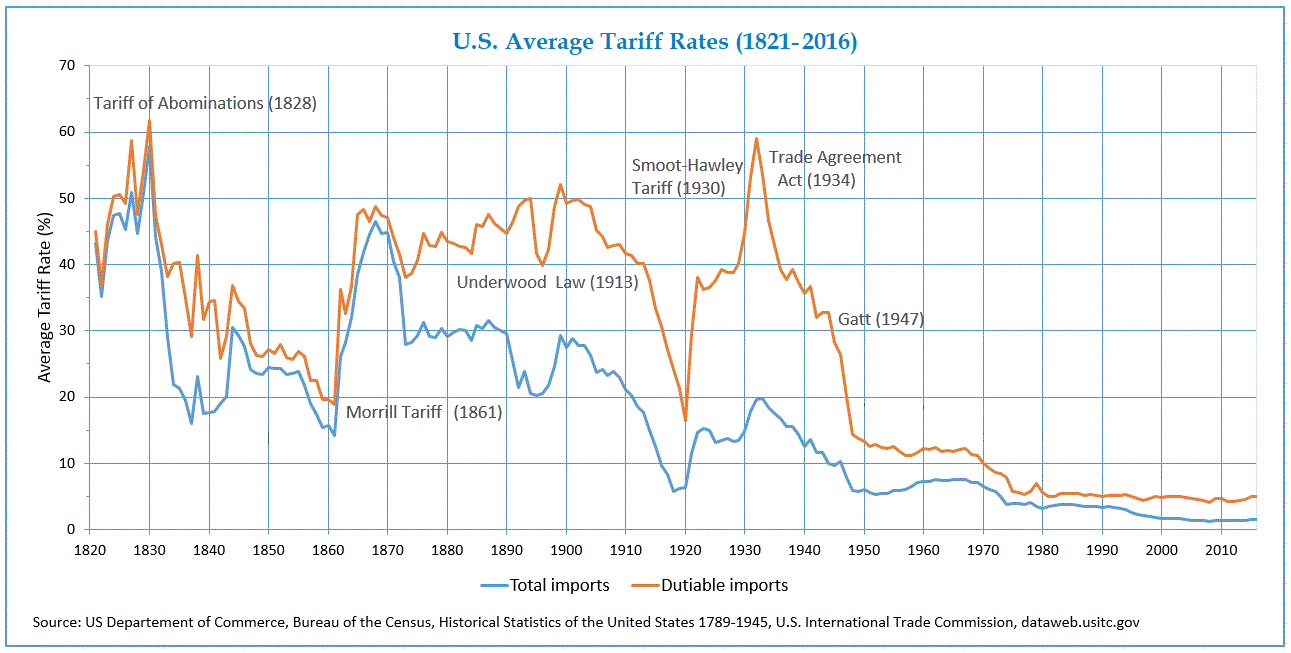

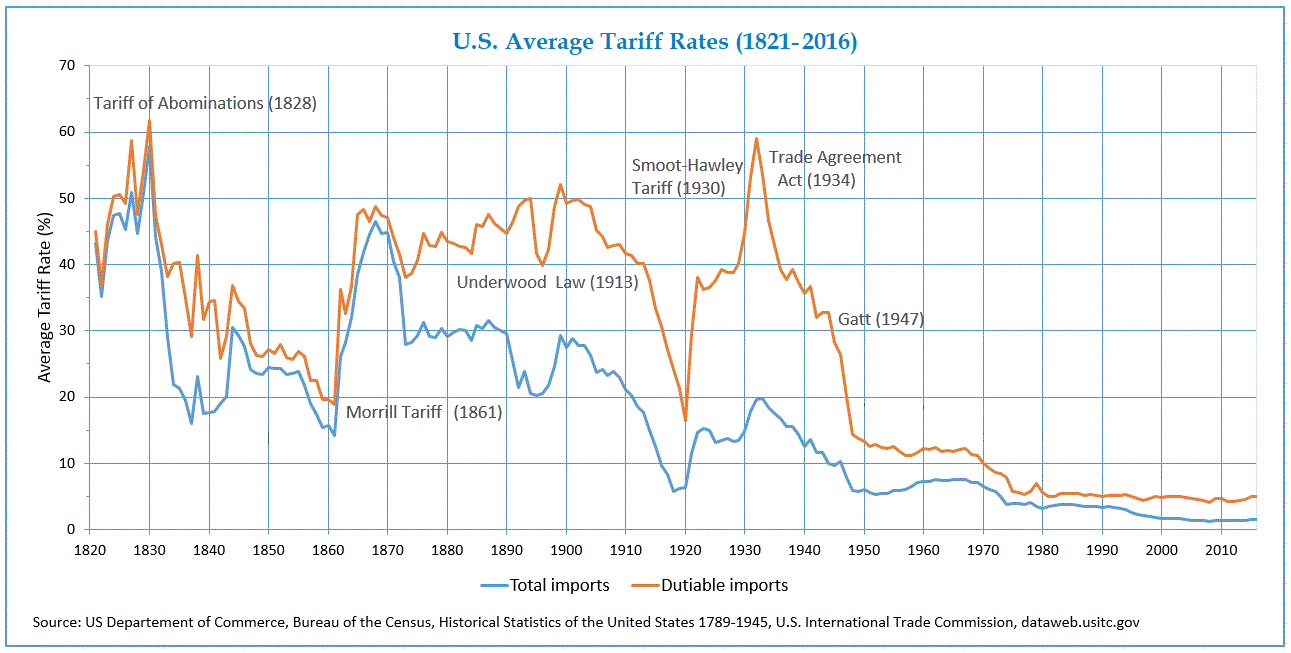

The Broader Context: Trump's Tariff Policies and Global Market Effects

Trump's tariff policies have been a defining feature of his presidency, significantly impacting global trade relations. His strategy of imposing tariffs on various goods has created a complex web of trade disputes and retaliatory measures. The interconnectedness of global markets means that actions taken in one region invariably impact others. The US's tariff decisions have far-reaching consequences, affecting not only the EU but also economies in Asia and elsewhere. For instance, [Mention the response of other markets like China or Canada].

Keywords: global trade, trade wars, international markets, global economic outlook, interconnected markets

Long-Term Implications and Investment Strategies Following the Euronext Amsterdam Jump

While the immediate reaction was positive, the long-term implications of Trump's tariff policies on Euronext Amsterdam remain uncertain. Investors need to carefully assess potential risks and opportunities:

- Increased Market Volatility: Trade wars and tariff disputes inherently increase market volatility, creating both risks and opportunities for savvy investors.

- Sector-Specific Impacts: Some sectors are more vulnerable to tariffs than others. Investors should carefully analyze the potential impact on specific companies and sectors within Euronext Amsterdam.

- Diversification: Diversification remains a key strategy to mitigate risk in a volatile market environment.

Investment strategies should be tailored to individual risk tolerance. Conservative investors might choose to maintain a cautious approach, while more aggressive investors might seek opportunities arising from market fluctuations.

Keywords: long-term investment, risk assessment, investment strategies, market volatility, future market predictions

Expert Opinions and Analysis on the Euronext Amsterdam Market Reaction

[Include quotes from financial analysts and experts, citing reputable sources such as the Financial Times, Bloomberg, or Reuters]. These expert opinions offer diverse perspectives on the market reaction, highlighting the complexity of interpreting the impact of Trump's tariff decisions.

Keywords: financial analysis, expert opinion, market forecast, economic commentary

Conclusion

The 8% jump in Euronext Amsterdam stocks following Trump's tariff decision is a striking example of the unpredictable nature of global markets. While the immediate reaction was positive, potentially driven by speculation, preemptive trading, or unrelated positive economic news, the long-term effects remain uncertain. Understanding the impact of Trump's tariff policies is crucial for developing effective investment strategies in a period of increased market volatility. It's vital to stay informed about the evolving situation regarding Trump tariffs and their effect on Euronext Amsterdam and other global markets. Continue to monitor the Trump tariffs and their impact on your investment portfolio. Learn more about effective investment strategies during periods of market volatility.

Featured Posts

-

Ferrari 296 Speciale Novo Hibrido De 880 Cv Chega Ao Mercado

May 24, 2025

Ferrari 296 Speciale Novo Hibrido De 880 Cv Chega Ao Mercado

May 24, 2025 -

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025 -

Is Apple Vulnerable Analyzing The Impact Of Tariffs On Buffetts Investment

May 24, 2025

Is Apple Vulnerable Analyzing The Impact Of Tariffs On Buffetts Investment

May 24, 2025 -

Amsterdam Stock Exchange Plunges 7 On Intensifying Trade War Concerns

May 24, 2025

Amsterdam Stock Exchange Plunges 7 On Intensifying Trade War Concerns

May 24, 2025 -

Thames Waters Executive Pay Outrage Over Bonuses Amidst Crisis

May 24, 2025

Thames Waters Executive Pay Outrage Over Bonuses Amidst Crisis

May 24, 2025

Latest Posts

-

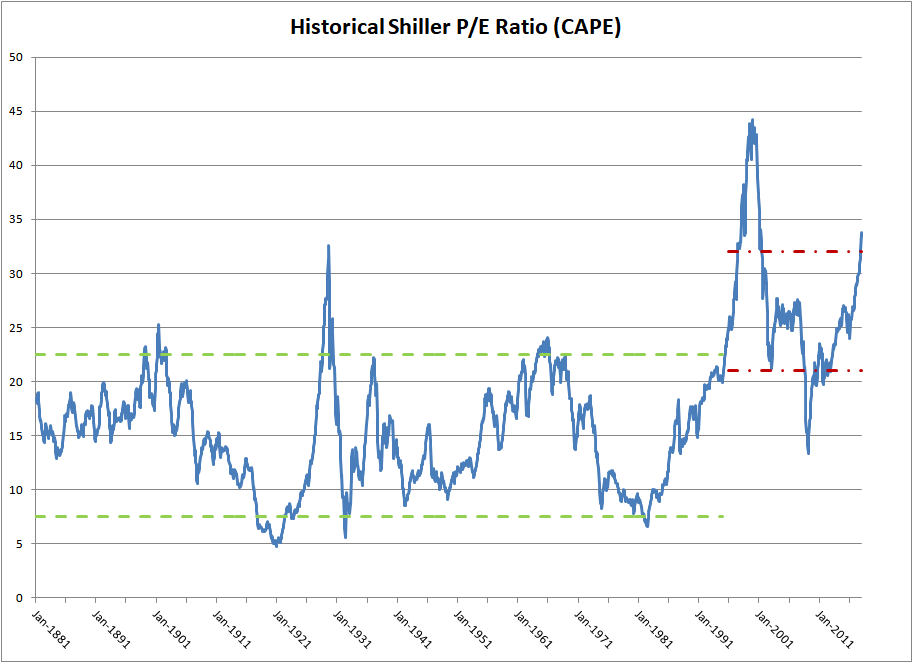

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025