Is Apple Vulnerable? Analyzing The Impact Of Tariffs On Buffett's Investment

Table of Contents

Apple's Reliance on Chinese Manufacturing and Supply Chains

Apple's manufacturing and supply chain are heavily reliant on China. This dependence creates significant vulnerability to tariffs and geopolitical instability.

- Significant portion of Apple products manufactured in China: A substantial percentage of iPhones, iPads, Macs, and other Apple products are assembled in China, leveraging the country's extensive manufacturing infrastructure and skilled workforce.

- Dependence on Chinese suppliers for components and assembly: Many key components for Apple devices are sourced from Chinese suppliers, creating a complex and interconnected supply chain. Disruptions at any point in this chain can have cascading effects.

- Risk of increased production costs due to tariffs on imported goods: Tariffs imposed on goods imported from China directly increase Apple's manufacturing costs, potentially squeezing profit margins.

- Potential for supply chain disruptions due to geopolitical instability: Escalating trade tensions and geopolitical uncertainty between the US and China can disrupt the smooth flow of goods and components, leading to production delays and shortages.

The intricate nature of Apple's manufacturing in China is undeniable. While the exact percentage of Apple products manufactured in China is not publicly disclosed, it's widely acknowledged to be substantial. Shifting this manufacturing base would require a massive undertaking, involving significant investment in new facilities, workforce training, and logistical adjustments.

The Impact of Tariffs on Apple's Profitability

Tariffs directly impact Apple's profitability through increased costs and potential reductions in consumer demand.

- Increased costs passed onto consumers leading to higher prices: To maintain profit margins, Apple might pass increased costs due to tariffs onto consumers through higher product prices.

- Potential reduction in consumer demand due to higher prices: Higher prices could reduce consumer demand, particularly in price-sensitive markets. This could lead to lower sales volumes and impact overall revenue.

- Impact on Apple's profit margins and overall financial performance: The combined effect of increased costs and potential decrease in demand can significantly impact Apple's profit margins and its overall financial performance.

- Analysis of Apple's historical responses to price fluctuations: Examining Apple's past responses to price increases or economic downturns can provide insights into how the company might react to tariff-related challenges.

Analyzing Apple's financial reports and assessing consumer behavior in response to price changes is crucial to understanding the long-term effects of tariffs on the company's profitability. Any significant erosion of profit margins could negatively affect the company's stock price and investor confidence.

Buffett's Investment Strategy and Risk Assessment

Warren Buffett's investment philosophy, centered on long-term value investing, suggests a cautious approach to short-term market fluctuations.

- Buffett's long-term investment philosophy and its resilience to short-term market fluctuations: Buffett is known for his long-term perspective, often holding investments for years, even decades. This approach mitigates the impact of short-term market volatility.

- Berkshire Hathaway's diversified portfolio mitigating risk: Berkshire Hathaway's portfolio is highly diversified, reducing the overall risk associated with any single investment, including Apple.

- Analysis of Buffett's likely assessment of the tariff risk to Apple: It is likely that Buffett and his team have carefully assessed the tariff risk to Apple, considering various scenarios and their potential impact on the company's long-term prospects.

- Potential for adjustments to Berkshire Hathaway's Apple holdings: While unlikely to make drastic changes based on short-term tariff pressures, Buffett might adjust Berkshire Hathaway's Apple holdings based on his long-term assessment of the situation.

Buffett's long-term view likely minimizes the immediate impact of tariffs. However, a sustained and significant negative impact on Apple's performance could lead to adjustments in Berkshire Hathaway's portfolio allocation.

Alternative Manufacturing Locations and their Feasibility

Apple is exploring options to diversify its manufacturing beyond China.

- Exploration of potential alternative manufacturing locations (e.g., Vietnam, India): Vietnam and India are among the countries being considered as potential alternatives for manufacturing due to lower labor costs and improved infrastructure.

- Challenges associated with relocating manufacturing, including infrastructure, labor costs, and logistics: Relocating manufacturing faces significant challenges including the need for substantial infrastructure investments, skilled labor training, and complex logistical adjustments.

- The feasibility of diversifying Apple's supply chain to reduce reliance on China: Diversifying the supply chain is a complex and long-term undertaking, requiring substantial investments and strategic partnerships.

The feasibility of relocating manufacturing depends on various factors, including the availability of skilled labor, reliable infrastructure, and supportive government policies. A complete shift away from China is unlikely in the near future.

The Broader Geopolitical Context

The ongoing US-China trade war significantly impacts Apple's operations and the global economy.

- The impact of broader geopolitical tensions between the US and China on Apple's operations: The broader geopolitical climate, including ongoing trade tensions, impacts Apple's operations and its ability to plan for the long term.

- The implications of a prolonged trade war for Apple and the global economy: A prolonged trade war would have significant implications not only for Apple but also for the global economy, impacting consumer confidence and investment.

- Uncertainty surrounding future trade policies and their potential impact on Apple: The uncertainty surrounding future trade policies adds to the challenges faced by Apple and makes long-term planning more difficult.

The evolving geopolitical landscape presents significant uncertainty for Apple and other multinational corporations. Close monitoring of US-China relations and potential changes in trade policies is crucial for understanding the long-term implications.

Conclusion

Apple's significant reliance on Chinese manufacturing creates vulnerability to tariffs and geopolitical risks. While Buffett's long-term investment strategy offers some resilience to short-term fluctuations, the potential impact on Apple's profitability and stock price remains a concern. Diversifying manufacturing and supply chains is a long-term strategy to mitigate this risk. Further research into Apple's strategic responses to tariff pressures is needed to fully assess the long-term implications for investors. Understanding the vulnerability of tech giants like Apple to global trade policies is crucial for informed investment decisions. Stay informed about the evolving impact of tariffs on Apple and other global companies.

Featured Posts

-

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 24, 2025

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 24, 2025 -

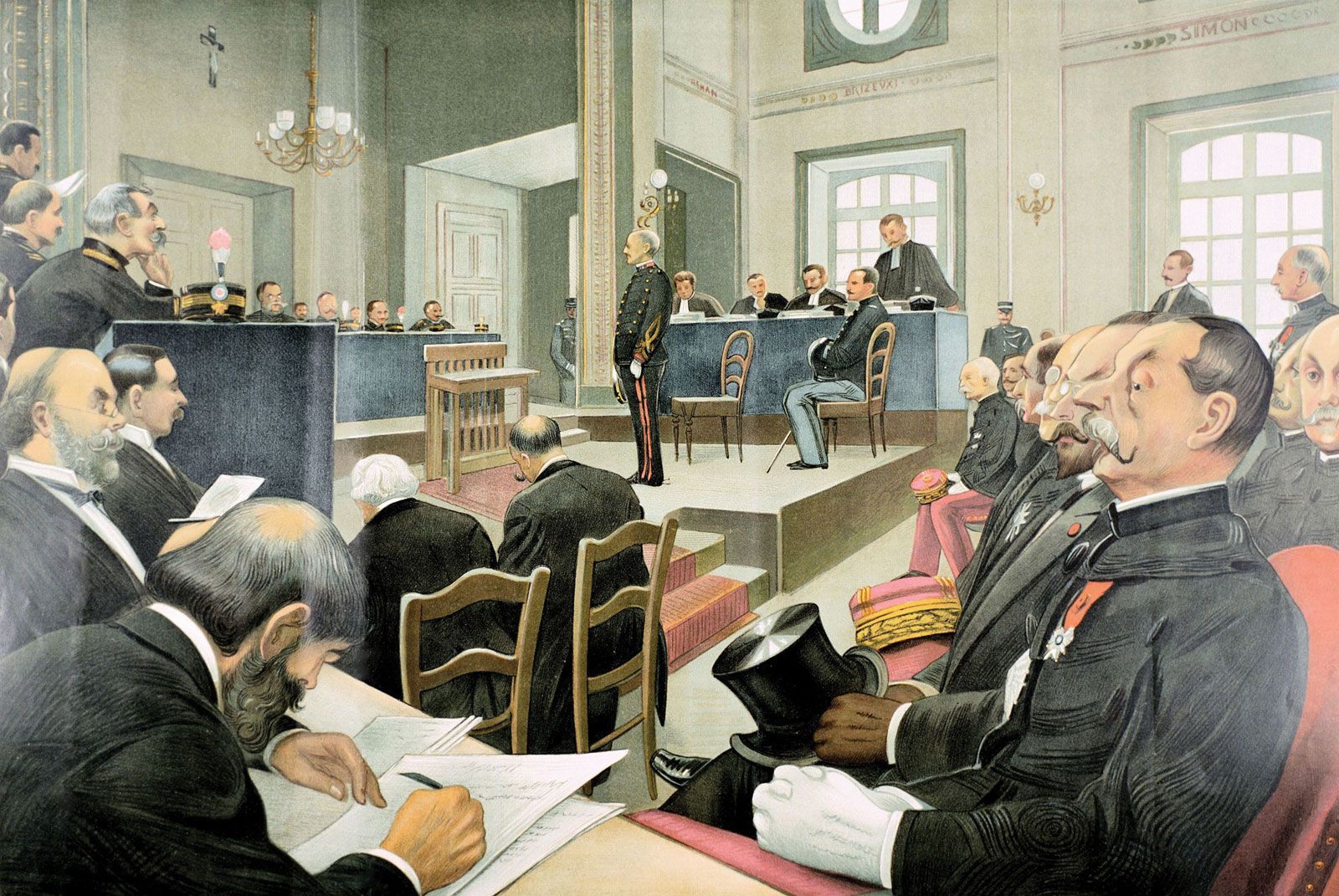

France Revisits Dreyfus Affair Lawmakers Advocate For Promotion

May 24, 2025

France Revisits Dreyfus Affair Lawmakers Advocate For Promotion

May 24, 2025 -

Evroviziya Kak Izglezhda Konchita Vurst Dnes

May 24, 2025

Evroviziya Kak Izglezhda Konchita Vurst Dnes

May 24, 2025 -

Najvaecsie Nemecke Firmy Prepustaju Tisice Pracovnych Miest V Ohrozeni

May 24, 2025

Najvaecsie Nemecke Firmy Prepustaju Tisice Pracovnych Miest V Ohrozeni

May 24, 2025 -

Nisan Ayinda Zengin Olmaya Hazirlanan Burclar

May 24, 2025

Nisan Ayinda Zengin Olmaya Hazirlanan Burclar

May 24, 2025

Latest Posts

-

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025 -

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025 -

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025 -

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025 -

Odd Burgers Vegan Expansion A Nationwide 7 Eleven Launch

May 24, 2025

Odd Burgers Vegan Expansion A Nationwide 7 Eleven Launch

May 24, 2025