Should Investors Worry About High Stock Market Valuations? BofA's Take.

Table of Contents

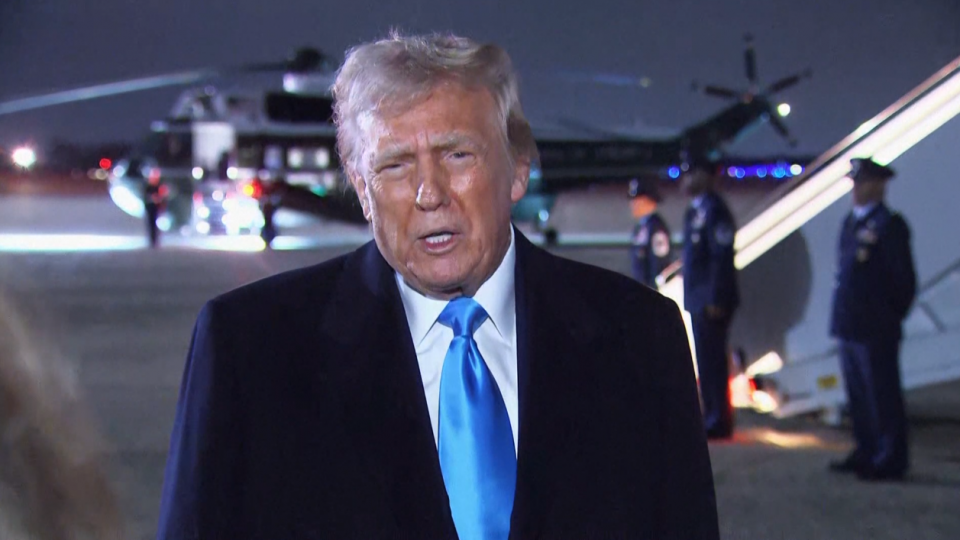

BofA's Current Stance on Stock Market Valuations

BofA's stance on current stock market valuations is nuanced, reflecting the complexities of the global economic environment. While they acknowledge the elevated levels of certain market indicators, their outlook isn't uniformly bearish. Recent reports suggest a cautious optimism, highlighting both potential risks and opportunities. Their analysis considers several key factors, leading to a strategy that emphasizes selectivity and risk management rather than outright pessimism. Keywords: BofA market outlook, BofA stock market predictions, BofA valuation analysis.

-

BofA's Rationale: BofA's analysts point to the continued strength of corporate earnings, fueled by factors such as resilient consumer spending and technological innovation, as a counterpoint to the high valuations. However, they also caution that these earnings may not justify current prices indefinitely.

-

Key Indicators: BofA's valuation analysis incorporates various metrics, including price-to-earnings ratios (P/E), interest rates, inflation rates, and economic growth forecasts. They closely monitor shifts in these indicators to refine their market outlook.

-

Specific Sectors: BofA’s research frequently highlights specific sectors they deem overvalued or undervalued. For instance, they may flag certain technology stocks as potentially overvalued given their high growth expectations, while identifying opportunities in sectors experiencing robust earnings growth but relatively lower valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. These factors intertwine to create a complex dynamic that impacts asset prices. Understanding these factors is crucial for effective investment decision-making. Keywords: market capitalization, price-to-earnings ratio (P/E), interest rate impact, inflation impact, economic growth, quantitative easing.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for corporations, boosting investment and potentially driving up stock prices. This makes bonds less attractive, pushing investors towards equities.

-

Quantitative Easing (QE): Central banks' extensive use of QE injected significant liquidity into the market, further supporting asset prices. This increased money supply can contribute to inflation and higher asset valuations.

-

Economic Growth (or the expectation of it): Strong economic growth, or even the expectation of future strong growth, fuels investor confidence and drives demand for stocks, thus pushing prices higher. However, the sustainability of this growth needs careful consideration.

-

Inflation's Impact: While moderate inflation can be positive, high inflation erodes purchasing power and can impact corporate earnings, potentially creating downward pressure on stock prices. BofA's analysis carefully weighs the influence of inflation on valuations.

Investment Strategies in a High-Valuation Market

Given BofA's assessment and the prevailing market conditions, investors need to adopt strategies that acknowledge the elevated valuations and mitigate potential risks. This may involve a shift towards more conservative approaches. Keywords: diversification, portfolio management, risk management, value investing, growth investing, defensive investing.

-

Risk Mitigation: Diversification across different asset classes (stocks, bonds, real estate, etc.) is paramount. Hedging strategies can also help limit potential losses during market corrections.

-

Asset Allocation: Consider allocating a portion of your portfolio to less volatile asset classes like bonds or high-quality dividend-paying stocks to balance potential risks. Alternative investments might also be considered.

-

Investment Timelines: Investors with longer time horizons may be better positioned to weather potential market corrections, while those with shorter time horizons might need to adopt more conservative strategies.

Potential Risks and Opportunities

While high valuations present risks, they also create opportunities for discerning investors. A thorough understanding of the potential downsides and upside potential is essential for informed decision-making. Keywords: market correction, market crash, potential returns, risk assessment, long-term investment, short-term investment.

-

Market Correction Potential: The possibility of a market correction, or even a more significant downturn, exists. This risk needs to be considered and factored into investment strategies.

-

Valuation Increases: Several factors, such as continued strong corporate earnings or further monetary easing, could potentially drive valuations even higher.

-

Opportunities for Risk-Tolerant Investors: For investors with a higher risk tolerance, the current market may offer opportunities to selectively invest in undervalued companies or sectors with strong growth prospects.

Conclusion: Navigating High Stock Market Valuations – BofA's Insights and Your Next Steps

BofA's perspective on high stock market valuations highlights a cautious optimism, emphasizing the need for selective investment and robust risk management. While potential risks exist, opportunities remain for those who understand the market dynamics and adopt appropriate strategies. A well-diversified portfolio and a thorough risk assessment are crucial. This analysis is not financial advice; always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Learn more about managing your investments in a high-valuation market by exploring additional resources and seeking professional financial guidance to create a robust investment strategy tailored to your specific needs and risk tolerance. Keywords: high stock market valuations, stock market valuation, investment strategy, investor concerns, BofA analysis.

Featured Posts

-

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

Country Living Awaits Your Step By Step Guide To An Escape

May 24, 2025

Country Living Awaits Your Step By Step Guide To An Escape

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025 -

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda 2024 Guida Completa

May 24, 2025

Dazi Stati Uniti Prezzi Moda 2024 Guida Completa

May 24, 2025

Latest Posts

-

Rybakina Eks 3 Raketka Mira Pryamaya Translyatsiya Matcha

May 24, 2025

Rybakina Eks 3 Raketka Mira Pryamaya Translyatsiya Matcha

May 24, 2025 -

Elena Rybakina Otsenka Sobstvennoy Igry I Planov Na Buduschee

May 24, 2025

Elena Rybakina Otsenka Sobstvennoy Igry I Planov Na Buduschee

May 24, 2025 -

Pryamaya Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira Za 4 Milliarda

May 24, 2025

Pryamaya Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira Za 4 Milliarda

May 24, 2025 -

Andreescu Defeats Rybakina In Straight Sets At Italian Open

May 24, 2025

Andreescu Defeats Rybakina In Straight Sets At Italian Open

May 24, 2025 -

Rybakina Otkrovenno O Fizicheskoy Podgotovke

May 24, 2025

Rybakina Otkrovenno O Fizicheskoy Podgotovke

May 24, 2025