BofA's View: Why Stretched Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Rationale: Underlying Economic Strength and Corporate Profitability

BofA's bullish outlook isn't blind optimism; it's rooted in a strong assessment of the underlying economic fundamentals and robust corporate profitability. Two key pillars support their argument.

Robust Corporate Earnings Growth

BofA projects continued, albeit potentially moderated, corporate earnings growth in the coming quarters. This prediction isn't a blanket statement; it's supported by sector-specific analysis.

- Technology: Despite recent pullbacks, BofA anticipates continued growth in cloud computing, artificial intelligence, and cybersecurity sectors, projecting average earnings growth of 15-20% for select companies.

- Healthcare: The aging population and advancements in medical technology continue to fuel robust growth in the pharmaceutical and biotech industries, with projected earnings growth of 10-15% for leading players, according to BofA research.

- Financials: While interest rate hikes impact margins, BofA anticipates sustained profitability due to increased net interest income, projecting a conservative 5-10% earnings growth.

These projections, supported by extensive BofA research and analysis, point towards a resilient corporate sector capable of driving stock market performance despite high valuations. The key here is focusing on quality, not just overall market price.

Resilient Consumer Spending and Economic Indicators

Despite inflationary pressures, consumer spending remains relatively robust. This resilience, coupled with positive economic indicators, further strengthens BofA's case.

- GDP Growth: While slowing, GDP growth remains positive, suggesting a healthy economy capable of supporting higher stock valuations.

- Unemployment Rate: The unemployment rate remains low, indicating a strong labor market and continued consumer confidence.

- Consumer Confidence: While fluctuating, consumer confidence indices, although showing some decline, haven't plummeted, suggesting a degree of resilience in the face of economic challenges.

BofA's analysis of these economic growth indicators suggests that the market's valuation, while high, is not necessarily detached from underlying economic reality. The resilience in consumer spending and other economic indicators provide a solid foundation for the current market levels.

Addressing Valuation Concerns: Why High P/E Ratios Shouldn't Be a Dealbreaker

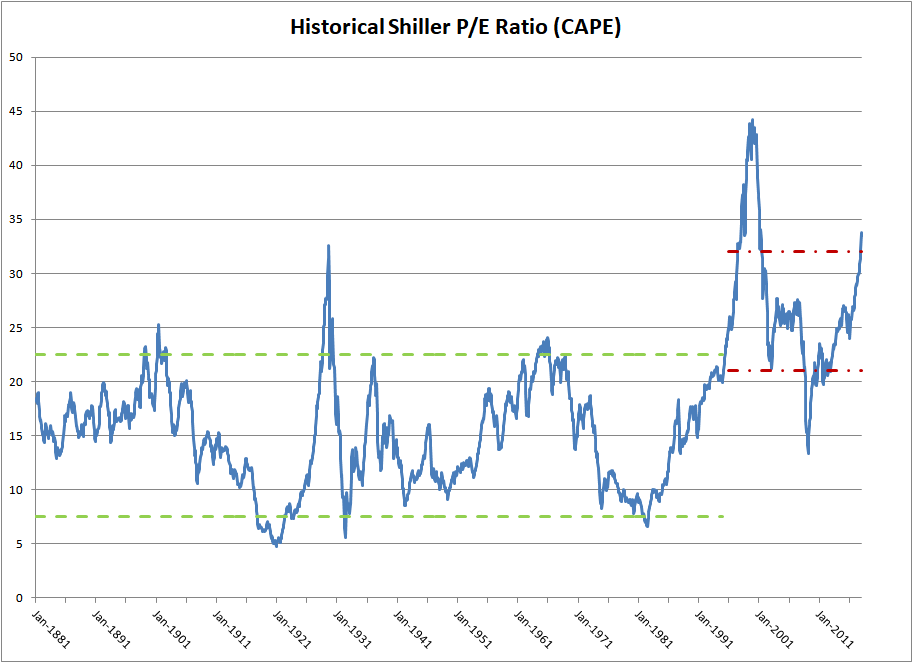

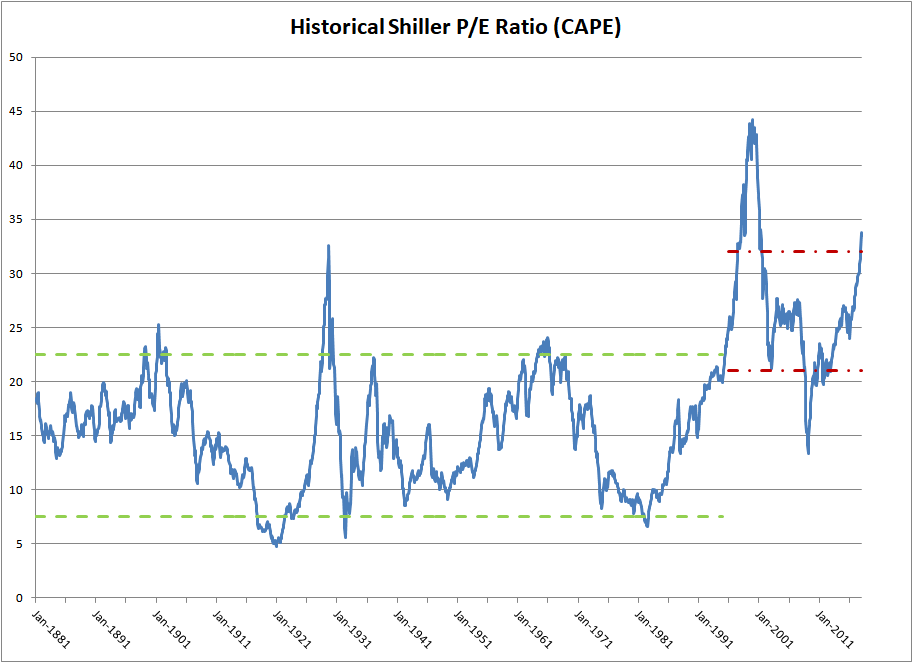

High price-to-earnings (P/E) ratios are a major concern for many investors. However, BofA argues that a short-term focus on these metrics can be misleading.

The Importance of Long-Term Perspective

History shows that focusing solely on short-term valuation metrics like P/E ratios can be detrimental to long-term investment success.

- Historical Market Cycles: Numerous market cycles demonstrate that periods of high valuations are often followed by periods of strong returns. Focusing on the long-term picture minimizes the impact of short-term volatility.

- Compounding Returns: The power of compounding returns over time significantly outweighs the impact of short-term fluctuations in P/E ratios.

A long-term investment strategy that incorporates diversification and a focus on high-quality companies can mitigate the risks associated with high valuations.

The Role of Interest Rates and Inflation

Current interest rate environments and inflation are undeniably impacting stock valuations. BofA, however, anticipates a potential softening of inflationary pressures and a stabilization of interest rates, which could positively affect stock market valuations over time.

- BofA's Inflation Forecasts: BofA's analysts project a gradual decline in inflation, although the timeline remains uncertain. This prediction is a key component of their overall market outlook.

- Interest Rate Impacts: While higher interest rates can impact company borrowing costs and potentially reduce valuations in the short term, BofA sees this as a temporary factor in the broader long-term growth narrative.

Strategic Investment Opportunities Amidst High Valuations

Even with stretched stock market valuations, BofA highlights strategic investment opportunities for discerning investors.

Sector-Specific Opportunities

BofA identifies sectors poised for continued growth despite the overall market conditions.

- Renewable Energy: The global transition towards renewable energy sources presents significant long-term growth opportunities, with several companies well-positioned for success.

- Artificial Intelligence (AI): AI is transforming numerous industries and BofA expects continued investment and growth in this sector.

- Healthcare Technology: The convergence of healthcare and technology is expected to unlock further innovation and market expansion.

It's crucial to remember that even within high-growth sectors, thorough due diligence and careful risk assessment are paramount.

Diversification Strategies

In a potentially volatile market, diversification is crucial. BofA recommends employing diversified investment strategies.

- Asset Allocation: Balancing investments across various asset classes (stocks, bonds, real estate, etc.) can help mitigate risks associated with individual sector or market downturns.

- Geographic Diversification: Spreading investments across different geographies reduces reliance on a single market's performance.

- Risk Management: Establishing stop-loss orders and other risk management techniques helps protect against significant losses.

Conclusion: Navigating Stretched Stock Market Valuations with BofA's Guidance

BofA's analysis suggests that while stretched stock market valuations are a valid concern, they shouldn't deter long-term investors. The underlying economic strength, robust corporate earnings, and potential for long-term growth provide a compelling case for continued investment. Don't let stretched stock market valuations discourage you. Learn more about BofA's investment insights and strategies to navigate the current market and build a robust investment portfolio tailored to your risk tolerance and long-term goals.

Featured Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Ai Stuwt Relx Groei Door Economische Onzekerheid Heen

May 24, 2025

Ai Stuwt Relx Groei Door Economische Onzekerheid Heen

May 24, 2025 -

Analiz Svadebnykh Tseremoniy Na Kharkovschine Dannye Za Posledniy Mesyats

May 24, 2025

Analiz Svadebnykh Tseremoniy Na Kharkovschine Dannye Za Posledniy Mesyats

May 24, 2025 -

Goroskopy I Predskazaniya Lyubov Karera Finansy

May 24, 2025

Goroskopy I Predskazaniya Lyubov Karera Finansy

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Polniy Obzor

May 24, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Polniy Obzor

May 24, 2025

Latest Posts

-

Did A Mishap Cause A Rift Between Dylan Dreyer And Her Today Show Co Stars

May 24, 2025

Did A Mishap Cause A Rift Between Dylan Dreyer And Her Today Show Co Stars

May 24, 2025 -

Horoscopo Completo Semana Del 1 Al 7 De Abril De 2025

May 24, 2025

Horoscopo Completo Semana Del 1 Al 7 De Abril De 2025

May 24, 2025 -

Predicciones Astrologicas Horoscopo Semanal 11 17 Marzo 2025

May 24, 2025

Predicciones Astrologicas Horoscopo Semanal 11 17 Marzo 2025

May 24, 2025 -

Goroskopy I Predskazaniya Chto Ozhidat V Buduschem

May 24, 2025

Goroskopy I Predskazaniya Chto Ozhidat V Buduschem

May 24, 2025 -

Tu Horoscopo Semana Del 1 Al 7 De Abril De 2025

May 24, 2025

Tu Horoscopo Semana Del 1 Al 7 De Abril De 2025

May 24, 2025