Amsterdam Stock Exchange Plunges 7% On Intensifying Trade War Concerns

Table of Contents

Trade War as the Primary Catalyst

The escalating trade war is the primary catalyst behind the Amsterdam Stock Exchange's sharp decline. Increased tariffs and retaliatory measures are directly impacting Dutch businesses, leading to decreased profits and decreased investor confidence in the Amsterdam Stock Exchange.

Impact of Tariffs and Retaliatory Measures

The imposition of new tariffs and trade restrictions has created a ripple effect throughout the Dutch economy. Several key sectors are feeling the pinch:

- Agriculture: Dutch agricultural exports, particularly dairy products and flowers, are facing increased tariffs in key markets, resulting in significant losses for farmers and exporters. Companies like FrieslandCampina, a major dairy producer, have already reported decreased profits.

- Technology: The tech sector is also feeling the pressure, with increased tariffs on imported components impacting manufacturing costs and competitiveness. This is impacting the profitability of Dutch technology firms listed on the Amsterdam Stock Exchange.

- Manufacturing: Many Dutch manufacturers rely heavily on global supply chains. Disruptions caused by the trade war are leading to production delays and increased costs, negatively impacting their bottom line and share prices.

The impact on export-oriented businesses is particularly severe. These companies, which form a significant part of the Dutch economy, are seeing their export revenues decline, putting pressure on their profitability and stock valuations on the Amsterdam Stock Exchange.

Geopolitical Uncertainty and Investor Sentiment

Beyond specific tariffs, the broader uncertainty surrounding the trade war is severely impacting investor sentiment. This uncertainty is driving a "flight to safety," where investors are moving their capital away from riskier assets, including stocks listed on the Amsterdam Stock Exchange, into safer havens like government bonds.

- Capital Outflows: We are seeing potential capital outflows from the Amsterdam Stock Exchange as investors seek less volatile investment opportunities.

- Foreign Direct Investment (FDI): The trade war uncertainty is deterring foreign direct investment into the Netherlands, further dampening economic growth and impacting the performance of the Amsterdam Stock Exchange.

Vulnerability of the Dutch Economy

The Netherlands' economy is particularly vulnerable to the effects of the trade war due to its significant reliance on global trade.

Netherlands' Dependence on Global Trade

The Netherlands has historically been a major trading hub in Europe, with a highly export-oriented economy. This dependence makes it extremely susceptible to global economic shocks like the current trade war.

- Trading Hub: The country’s strategic location and extensive port infrastructure make it a critical node in international trade.

- Strong Export Sector: A large portion of the Dutch GDP is generated from exports, making it highly sensitive to trade restrictions and tariffs.

- Long-Term Implications: The prolonged trade war could significantly hinder long-term economic growth in the Netherlands.

Impact on Key Economic Sectors

Several key sectors of the Dutch economy are directly experiencing the negative impact of the trade war and the subsequent market plunge on the Amsterdam Stock Exchange.

- Shipping: Disruptions to global trade routes are affecting Dutch shipping companies, impacting their revenues and share prices.

- Finance: The uncertainty is creating volatility in financial markets, impacting banks and financial institutions listed on the Amsterdam Stock Exchange.

- Tourism: Trade wars can lead to reduced international travel and tourism, impacting this vital sector of the Dutch economy.

Potential Future Implications and Mitigation Strategies

The current situation raises significant concerns about the future outlook for the Amsterdam Stock Exchange and the Dutch economy.

Short-Term Market Outlook

The short-term outlook for the Amsterdam Stock Exchange remains uncertain. Further volatility is expected, with the market's performance heavily dependent on the resolution (or escalation) of the trade war.

- Expert Opinions: Financial analysts are closely monitoring the situation and offering varied predictions, many forecasting continued volatility in the short-term.

- Support Levels: Technical analysts are identifying potential support levels for the market, but these are subject to change based on global economic developments.

- Potential Scenarios: Several scenarios are possible, ranging from a quick resolution of the trade dispute to further escalation and prolonged economic uncertainty.

Government Response and Economic Policies

The Dutch government is likely to take steps to mitigate the negative impacts of the trade war on the economy.

- Fiscal Policy: Fiscal stimulus measures, such as tax cuts or increased government spending, could be implemented to boost economic activity.

- Monetary Policy: The Dutch central bank may adjust its monetary policy to support economic growth and counteract the effects of the trade war.

- Support Packages: Support packages for affected businesses could help them weather the storm and maintain employment.

- Diversification Strategies: The government may encourage businesses to diversify their export markets to reduce their reliance on any single trading partner.

Conclusion

The 7% plunge in the Amsterdam Stock Exchange highlights the significant and immediate impact of the escalating trade war. The vulnerability of the Dutch economy, its reliance on global trade, and the resulting negative investor sentiment all contributed to this sharp decline. The short-term outlook remains uncertain, with potential for further volatility.

The Amsterdam Stock Exchange's performance will be closely tied to developments in the trade war. Stay informed about further developments and their implications for the Amsterdam Stock Exchange and global markets. Monitor Amsterdam Stock Exchange news closely for updates and consider diversifying your investment portfolio to mitigate potential risks associated with escalating trade tensions. Understanding the intricacies of the Amsterdam Stock Exchange and global market trends is crucial in navigating these uncertain times.

Featured Posts

-

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025 -

Paris Faces Financial Strain Amid Luxury Goods Market Downturn

May 24, 2025

Paris Faces Financial Strain Amid Luxury Goods Market Downturn

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Importance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Importance

May 24, 2025

Latest Posts

-

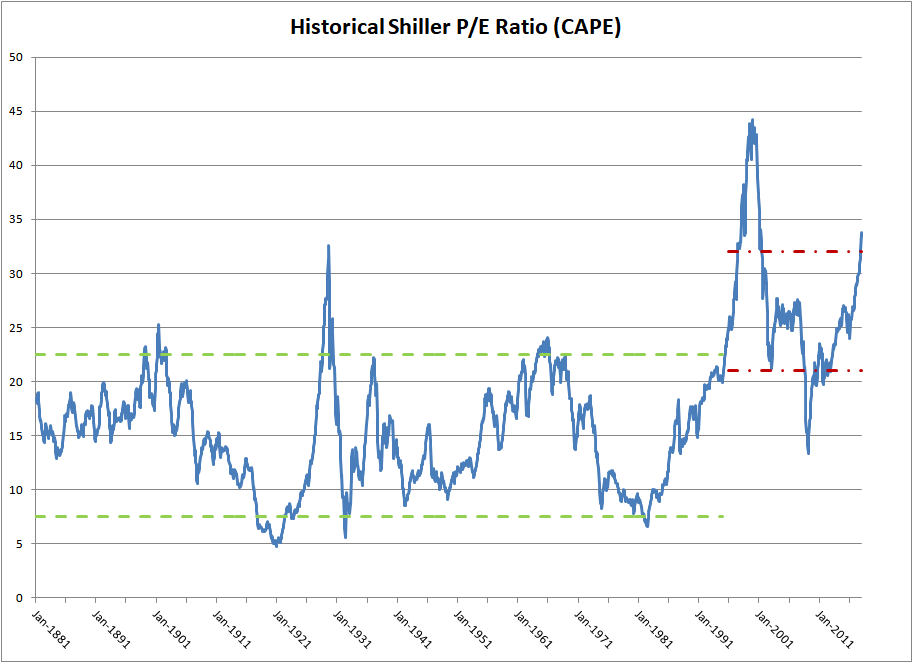

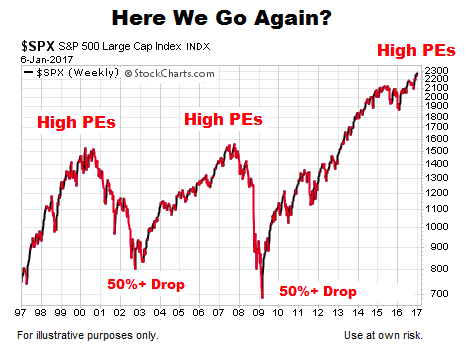

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025