High Stock Market Valuations: A BofA Analysis And Investor Guidance

Table of Contents

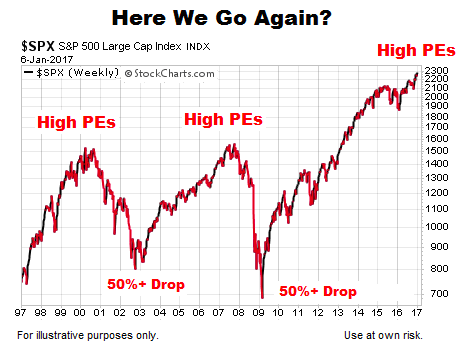

What constitutes "high stock market valuations"? High valuations are generally characterized by elevated price multiples relative to historical averages and projected future earnings. Key metrics used to assess valuations include the Price-to-Earnings ratio (P/E), which compares a company's stock price to its earnings per share; the Price-to-Sales ratio (P/S), comparing stock price to revenue; and the cyclically adjusted price-to-earnings ratio (CAPE), which smooths out earnings fluctuations over a longer period. When these ratios are significantly above historical averages, it suggests the market may be overvalued. This article aims to analyze BofA's perspective on these elevated metrics and provide investors with actionable strategies.

BofA's Analysis of Current High Stock Market Valuations

BofA's research consistently flags the elevated valuation levels in the current market. Understanding their analysis is crucial for informed investment decisions.

Key Findings from BofA Reports

BofA's recent reports paint a picture of a market with significant upside potential, yet also considerable risk. Their analyses incorporate a variety of macroeconomic factors and specific sector assessments.

- Projected Growth Rates: BofA projects moderate growth in corporate earnings over the next few years, but this is insufficient to fully justify the current high valuations.

- Potential Market Corrections: BofA acknowledges the possibility of a market correction, emphasizing the need for cautious optimism and robust risk management strategies.

- Sector-Specific Outlooks: BofA's sector analysis often points towards certain sectors being overvalued, while others may present more attractive investment opportunities. For example, they may identify specific technology sub-sectors as particularly susceptible to a downturn.

- Inflationary Pressures: BofA analysts often incorporate the impact of inflation on future earnings growth, which can significantly affect valuation models.

Specific analysts at BofA, such as [Insert Name and Title if available], have been vocal in their assessments of market conditions, offering valuable insights into the complexities of the current situation. [Insert link to relevant BofA research reports here].

Methodology Used by BofA

BofA employs sophisticated analytical methods to assess market valuations, incorporating both quantitative and qualitative factors.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value, providing an intrinsic valuation for a company or the overall market.

- Comparable Company Analysis: This method compares a company's valuation multiples (P/E, P/S, etc.) to those of its peers to gauge relative valuation.

BofA leverages extensive databases and proprietary models to gather and process this data. While these methods offer valuable insights, they also have limitations; for instance, accurate future projections are crucial for the DCF model, yet they remain inherently uncertain.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations.

Low Interest Rates and Monetary Policy

Historically low interest rates and expansive monetary policies enacted by central banks worldwide have played a significant role in driving asset prices higher.

- Quantitative Easing (QE): The injection of liquidity into financial markets through QE has fueled demand for assets, including stocks, pushing prices upward.

- Near-Zero Interest Rates: Low interest rates reduce the opportunity cost of investing in stocks, making them relatively more attractive than bonds or other fixed-income instruments.

Future changes in monetary policy, particularly interest rate hikes, could significantly impact market valuations. A shift towards tighter monetary policy could lead to a decline in asset prices.

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and expectations of future growth have also fueled higher valuations. This is not uniform across all sectors.

- Technology Sector Growth: The technology sector has been a major driver of market growth, with strong earnings from large-cap companies.

- Sustainable Growth? The sustainability of this growth is a key question. While some sectors show promising long-term growth, others may be experiencing a temporary surge.

Careful analysis of individual company performance and sector trends is necessary to identify opportunities and potential risks.

Increased Investor Confidence and Market Sentiment

Positive investor sentiment and a "fear of missing out" (FOMO) mentality have significantly contributed to the current market exuberance.

- Market Speculation: Speculative trading can inflate asset prices beyond their fundamental value.

- Herding Behavior: Investors tend to follow market trends, exacerbating price swings both upward and downward.

Understanding the psychological drivers of market behavior is crucial for navigating potential shifts in sentiment.

Investor Guidance and Strategies for High-Valuation Markets

Given the current landscape, investors need to adopt prudent strategies.

Risk Management Strategies

In a high-valuation environment, risk management is paramount.

- Diversification: Spreading investments across different asset classes and sectors can help mitigate potential losses.

- Hedging Strategies: Using derivatives or other hedging instruments can help protect against downside risk.

- Well-Defined Investment Plan: A well-defined investment plan, tailored to your risk tolerance and financial goals, is essential.

A diversified portfolio, coupled with a well-defined risk tolerance, forms the bedrock of a successful long-term investment strategy.

Identifying Undervalued Assets

Even in an overvalued market, there are opportunities to find undervalued assets.

- Fundamental Analysis: Thorough fundamental analysis can help identify companies trading below their intrinsic value.

- Value Investing: A value investing approach focuses on identifying companies with strong fundamentals that are trading at a discount.

- Due Diligence: Meticulous due diligence is crucial in identifying undervalued assets.

Considering Alternative Investments

Alternative investments may offer better risk-adjusted returns compared to overvalued stocks.

- Real Estate: Real estate can offer diversification and potential for income generation.

- Bonds: While bond yields may be low, they offer stability compared to the volatility of equities.

- Commodities: Commodities can provide a hedge against inflation.

However, alternative investments also carry risks, and careful due diligence is necessary.

Conclusion: Navigating High Stock Market Valuations – A Call to Action

BofA's analysis, along with the factors discussed above, highlight the complexities of the current high stock market valuation environment. Prudent investors need to adopt a cautious, diversified approach, focusing on risk management and a long-term perspective. It’s crucial to assess your portfolio for high stock market valuations, understand the risks associated with high stock market valuations, and develop a strategy to navigate high stock market valuations effectively. Conduct thorough research, consult with qualified financial advisors, and develop a personalized investment plan that reflects your risk tolerance and financial goals. Don't hesitate to adjust your strategy as market conditions evolve. Understanding and managing the risks associated with high stock market valuations is key to achieving your long-term investment objectives.

Featured Posts

-

3 Billion Slash To Sse Spending Plan Impact Of Economic Slowdown

May 24, 2025

3 Billion Slash To Sse Spending Plan Impact Of Economic Slowdown

May 24, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Twist

May 24, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Twist

May 24, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

May 24, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

May 24, 2025 -

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Musk Zuckerberg E Bezos A Confronto

May 24, 2025

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Musk Zuckerberg E Bezos A Confronto

May 24, 2025 -

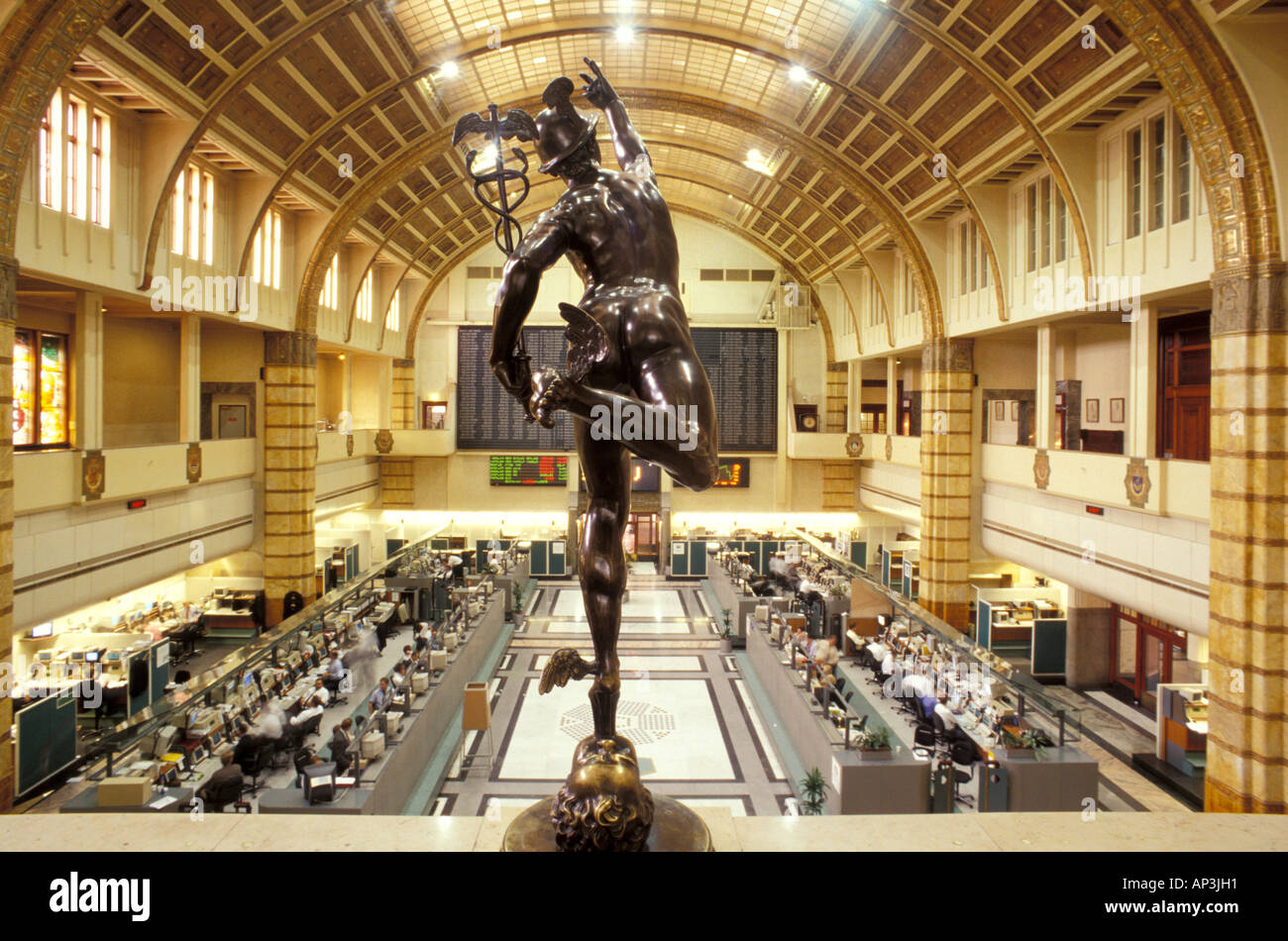

Three Day Slump On Amsterdam Stock Exchange Market Instability And Future Outlook

May 24, 2025

Three Day Slump On Amsterdam Stock Exchange Market Instability And Future Outlook

May 24, 2025

Latest Posts

-

The Today Shows Dylan Dreyer Strained Relationships Following A Workplace Mishap

May 24, 2025

The Today Shows Dylan Dreyer Strained Relationships Following A Workplace Mishap

May 24, 2025 -

Dylan Dreyer Family Update Celebrating With Husband Brian Fichera

May 24, 2025

Dylan Dreyer Family Update Celebrating With Husband Brian Fichera

May 24, 2025 -

Dylan Dreyers Challenging Situation Stuns Today Show Colleagues

May 24, 2025

Dylan Dreyers Challenging Situation Stuns Today Show Colleagues

May 24, 2025 -

Dylan Dreyer And Brian Ficheras Family Celebrates A Joyful Update

May 24, 2025

Dylan Dreyer And Brian Ficheras Family Celebrates A Joyful Update

May 24, 2025 -

Fallout On The Today Show Dylan Dreyers Relationship With Co Stars After An Incident

May 24, 2025

Fallout On The Today Show Dylan Dreyers Relationship With Co Stars After An Incident

May 24, 2025