The Target Controversy: A Deep Dive Into The Effects Of A Reduced DEI Commitment

Table of Contents

Financial Implications of Reduced DEI Commitment

A perceived reduction in DEI commitment can translate into significant financial losses for businesses. The Target situation perfectly illustrates this.

Stock Value and Investor Confidence

The negative publicity and subsequent boycotts following the Target controversy led to considerable volatility in the company's stock price.

- Stock Fluctuations: Target's stock experienced a noticeable dip following the backlash, impacting investor confidence. While precise figures are complex due to market fluctuations, reports suggest a correlation between negative news cycles and stock performance.

- Analyst Reports: Several financial analysts issued reports expressing concerns about the long-term impact of the controversy on Target's brand and financial performance. These reports highlighted the risk of lost investor confidence.

- Investor Reactions: Many investors expressed their disapproval through divestment or reduced investment in Target, demonstrating the sensitivity of the market to perceived failures in DEI. The loss of potential investors wary of companies perceived as lacking DEI commitment further exacerbates the financial risk.

Loss of Revenue and Market Share

The boycotts and negative publicity directly impacted Target's revenue streams. Consumers, increasingly conscious of a company's social responsibility, demonstrated their willingness to shift their loyalty to brands aligning with their values.

- Consumer Behavior: Surveys indicate a growing trend among consumers to prioritize brands with demonstrable commitment to DEI. This trend suggests a potential for significant loss of market share for companies perceived as lacking in this area.

- Brand Loyalty Surveys: Studies show a strong correlation between a company's DEI initiatives and consumer brand loyalty. Target's experience underscores the vulnerability of companies neglecting this crucial aspect of brand building.

- Estimates of Revenue Losses: While precise figures are difficult to determine, experts suggest that the negative publicity and boycotts resulted in substantial revenue losses for Target. Conversely, companies with robust and visible DEI initiatives often report increased revenue and market share.

Increased Costs Associated with Damage Control

Responding to the backlash required significant financial investment from Target. The costs associated with damage control extended beyond the immediate crisis.

- PR Campaigns: Target undoubtedly incurred substantial costs in launching PR campaigns aimed at mitigating the damage to its brand image. Such campaigns are often expensive and require significant time and resources.

- Legal Fees: Potential legal challenges and the need for legal counsel further added to the financial burden. Addressing legal ramifications associated with the controversy added another layer of expense.

- Reputational Repair: The long-term cost of repairing Target's damaged reputation will likely be significant, demanding sustained investment in rebuilding trust with stakeholders.

Reputational Damage and Brand Image

The Target controversy inflicted considerable damage to its brand image and reputation, extending far beyond the immediate financial impact.

Negative Media Coverage and Public Perception

The extensive negative media coverage surrounding the controversy significantly impacted public perception of Target.

- Negative News Articles: Countless news articles and social media posts condemned Target’s actions, resulting in widespread negative publicity. This coverage fueled the negative public sentiment.

- Social Media Reactions: The intensity of negative reactions on social media platforms amplified the negative narrative, showcasing the power of online sentiment in shaping public opinion.

- Public Statements: Public statements from advocacy groups and concerned citizens further fueled the controversy, solidifying a negative brand association. The long-term effect of these negative associations will require sustained effort to counteract.

Loss of Employee Morale and Talent Acquisition

The perceived reduction in DEI efforts negatively impacted Target's internal environment.

- Employee Surveys: Internal surveys likely revealed decreased employee morale among Target's workforce, especially those from marginalized communities. This decline in morale can negatively impact productivity and innovation.

- Reports on Employee Turnover: A decline in employee morale often translates into increased employee turnover. Losing skilled and talented employees further compounds the negative impact.

- Difficulty Attracting Diverse Talent Pools: The controversy could make it more difficult for Target to attract and retain diverse talent in the future, hindering its ability to foster a truly inclusive workplace.

Impact on Stakeholder Relationships

The fallout extended beyond consumers and employees, impacting relationships with various stakeholders.

- Cancelled Partnerships: Potential partners and collaborators may reconsider their affiliations with Target following the controversy, leading to lost opportunities.

- Boycotts from Suppliers: Suppliers may reconsider their relationship with Target, leading to supply chain disruptions.

- Stakeholder Activism: Activist groups and investors may engage in actions aimed at influencing Target's future DEI policies, leading to further disruption.

Social and Ethical Considerations

The Target controversy highlighted the social and ethical implications of reduced DEI commitment, extending far beyond financial consequences.

Impact on Marginalized Communities

The controversy had a profound and negative impact on LGBTQ+ individuals and other marginalized groups.

- Statements from Advocacy Groups: Statements from LGBTQ+ advocacy groups denounced Target's actions, highlighting the harm caused to marginalized communities.

- Social Media Conversations: Social media conversations revealed the hurt and disappointment felt by members of these communities.

- Accounts of Personal Experiences: Personal accounts shared online showcased the emotional toll of the perceived betrayal of trust by a company previously associated with inclusivity.

Broader Societal Impact

The Target situation set a precedent, raising concerns about the potential for other companies to follow suit.

- Examples of Other Companies Facing Similar Criticism: Other companies facing similar criticism regarding their DEI commitment demonstrate the pervasiveness of this issue.

- Potential Long-Term Effects on Societal Acceptance: The controversy raises concerns about the potential erosion of societal acceptance and progress toward inclusivity.

- Erosion of Trust in Corporations: The incident highlights the erosion of public trust in corporations perceived as prioritizing profit over social responsibility.

Conclusion: Navigating the Challenges of DEI Commitment

The Target controversy serves as a cautionary tale, demonstrating the significant financial losses, reputational damage, and social consequences of a perceived reduction in DEI commitment. The financial impact extends beyond immediate stock fluctuations to encompass lost revenue, increased costs for damage control, and decreased investor confidence. Reputational damage manifests in negative media coverage, decreased employee morale, and strained stakeholder relationships. Socially, the consequences include alienation of marginalized communities and a broader erosion of trust in corporate social responsibility. Therefore, businesses must prioritize and strengthen their DEI commitment, investing in inclusive practices and avoiding the pitfalls of reduced DEI efforts. Ignoring DEI initiatives, as the Target example shows, is not a viable strategy for long-term success. Invest in inclusive practices, foster a culture of belonging, and safeguard your company's reputation and financial well-being. Strengthen your DEI commitment today and secure a more equitable and prosperous future.

Featured Posts

-

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025 -

Dragons Den Little Coffees Four Investment Offers

May 01, 2025

Dragons Den Little Coffees Four Investment Offers

May 01, 2025 -

Channel 4 Unveils Teaser Images For Upcoming Drama Trespasses

May 01, 2025

Channel 4 Unveils Teaser Images For Upcoming Drama Trespasses

May 01, 2025 -

France Wins Six Nations Englands Victory Over Wales Scotland And Ireland Underperform

May 01, 2025

France Wins Six Nations Englands Victory Over Wales Scotland And Ireland Underperform

May 01, 2025 -

Pasifika Sipoti A Concise Overview For April 4th

May 01, 2025

Pasifika Sipoti A Concise Overview For April 4th

May 01, 2025

Latest Posts

-

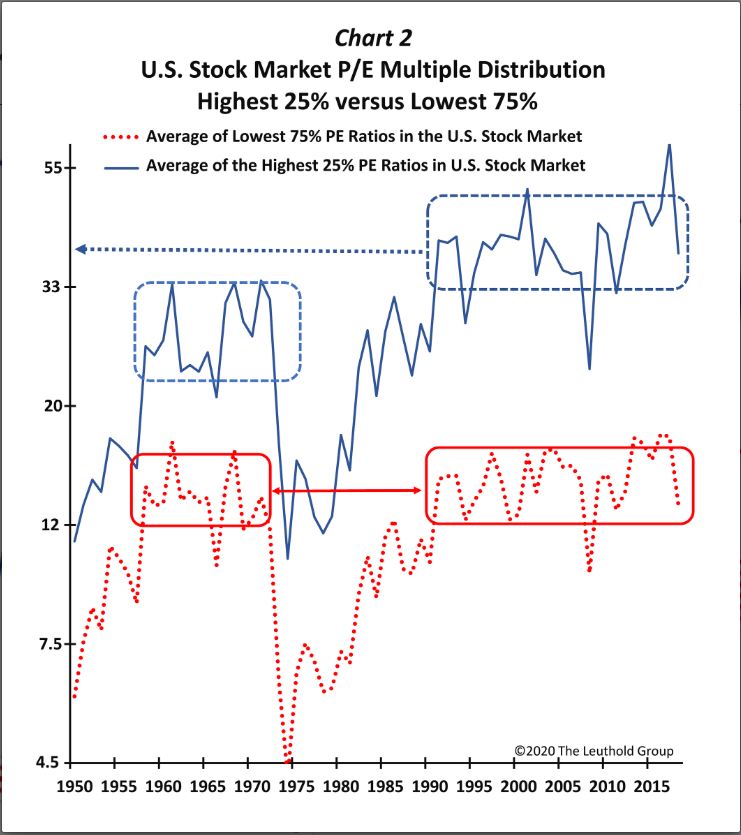

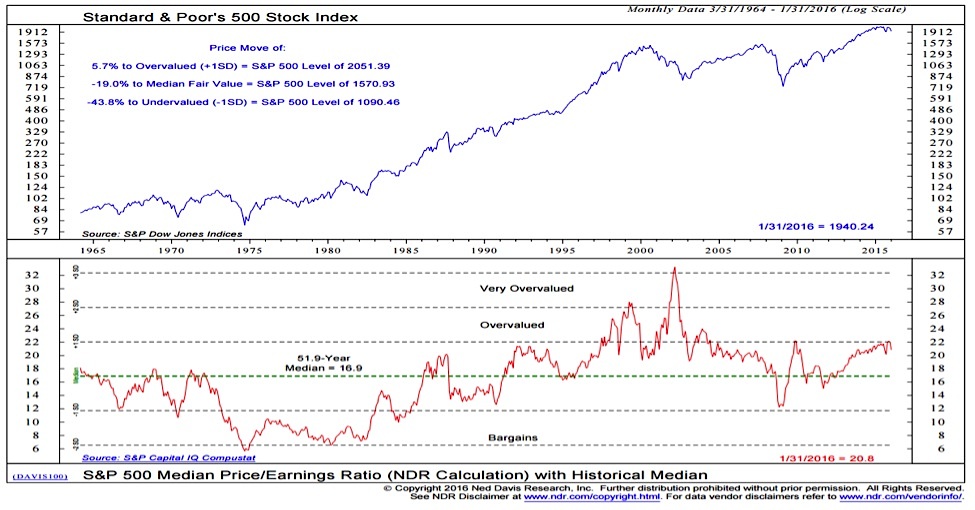

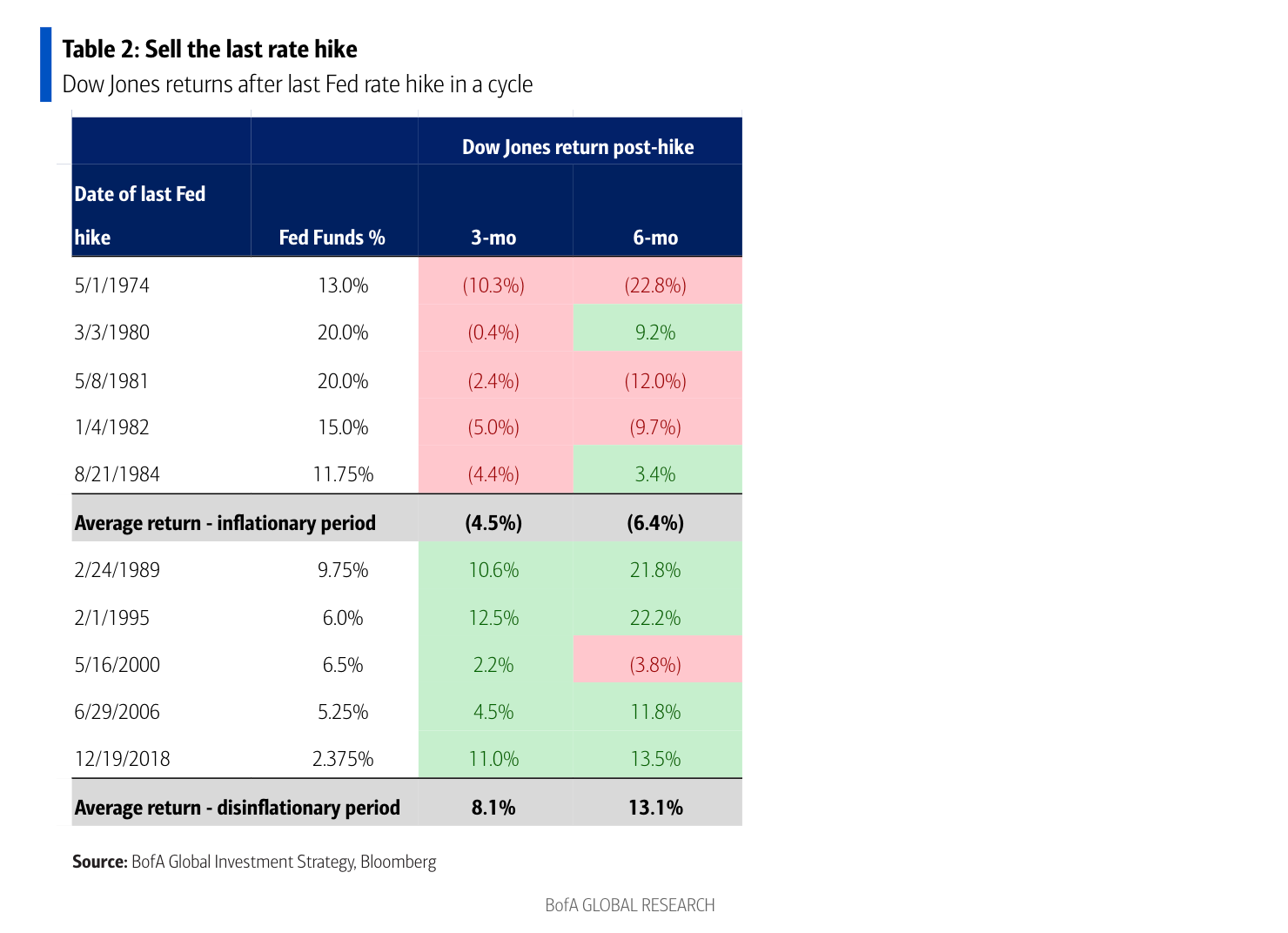

Why High Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 02, 2025

Why High Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 02, 2025 -

Addressing Investor Anxiety Bof As View On Elevated Stock Market Valuations

May 02, 2025

Addressing Investor Anxiety Bof As View On Elevated Stock Market Valuations

May 02, 2025 -

High Stock Market Valuations A Bof A Analysts Take And Why You Shouldnt Worry

May 02, 2025

High Stock Market Valuations A Bof A Analysts Take And Why You Shouldnt Worry

May 02, 2025 -

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 02, 2025

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 02, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 02, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 02, 2025