High Stock Market Valuations: A BofA Analyst's Take And Why You Shouldn't Worry

Table of Contents

BofA's Bullish Outlook Despite High Stock Market Valuations

Bank of America (BofA) maintains a surprisingly bullish outlook on the stock market despite acknowledging high valuations. Recent BofA reports highlight several factors contributing to this perspective. While acknowledging elevated price-to-earnings (P/E) ratios, they emphasize the broader context and long-term growth potential.

-

Key Arguments for a Bullish Outlook: BofA analysts point to strong corporate earnings growth, continued low interest rates (at least in the near term), and ongoing technological innovation as key drivers for sustained market growth. They believe that these factors justify, to some extent, the current high valuations.

-

Undervalued Sectors: BofA has identified specific sectors, such as certain technology sub-segments and select emerging markets, as potentially undervalued despite the overall high market valuations. They believe these areas offer attractive entry points for long-term investors.

-

Supporting Data and Economic Indicators: BofA's analysis relies on a combination of macroeconomic data, including GDP growth forecasts, inflation projections, and consumer confidence indices, alongside detailed company-specific financial analyses. Their forecasts suggest continued, albeit potentially slower, economic growth in the coming years.

-

Impact of Interest Rates: The current low-interest-rate environment plays a crucial role in BofA's analysis. Low rates make borrowing cheaper for corporations, supporting investment and fueling growth. However, this is a dynamic factor, and any significant interest rate increases could impact valuations.

Understanding the Nuances of Valuation Metrics

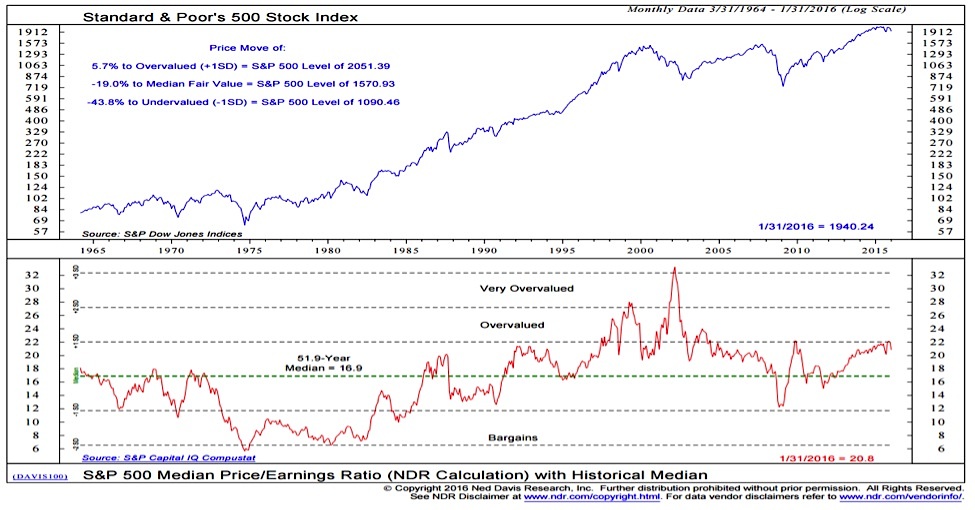

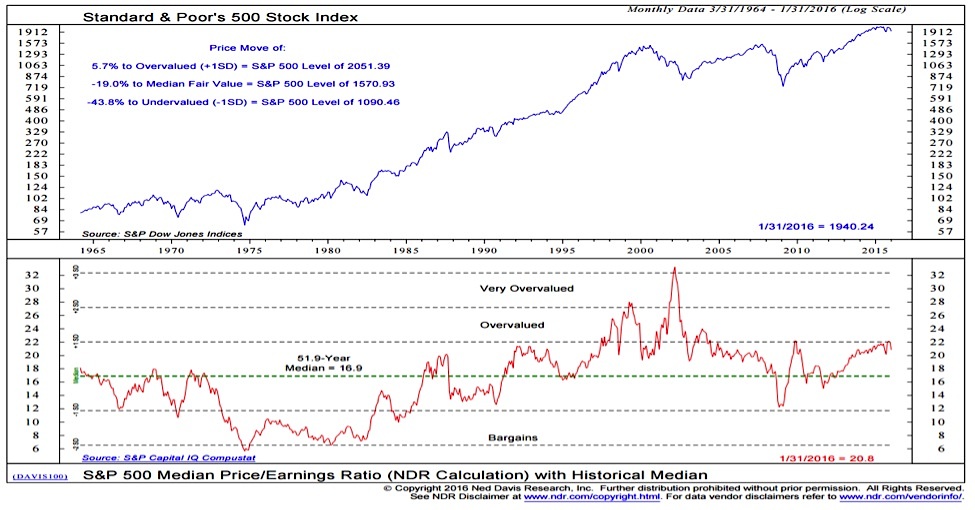

Relying solely on traditional valuation metrics like the P/E ratio can be misleading. While high P/E ratios often signal overvaluation, it's crucial to consider the context and limitations of these metrics.

-

Impact of Low Interest Rates: Low interest rates artificially inflate valuations across asset classes, including equities. This means that a high P/E ratio might not necessarily indicate overvaluation in a low-interest-rate environment.

-

Beyond P/E Ratios: A comprehensive valuation requires analyzing various other factors. These include:

- Future growth prospects: Companies with high growth potential can justify higher P/E ratios.

- Industry trends: Analyzing industry dynamics and competitive landscapes is essential.

- Company-specific factors: Strong management teams, innovative products, and robust balance sheets can support higher valuations.

-

Alternative Valuation Metrics: Investors should consider alternative metrics like Price-to-Sales (P/S) ratio, Price-to-Book (P/B) ratio, and Discounted Cash Flow (DCF) analysis to gain a more holistic view.

-

Market Sentiment and Investor Behavior: Market psychology and investor behavior significantly influence valuations. Periods of high optimism can lead to inflated prices, while fear can drive prices down, irrespective of fundamental values.

Long-Term Growth Potential and the Power of Patience

The long-term growth potential of the market is a key factor mitigating concerns about high stock market valuations. While short-term fluctuations are inevitable, a long-term perspective is crucial.

-

Innovation and Technological Advancements: Continuous technological innovation drives productivity growth and creates new market opportunities, supporting long-term market expansion.

-

Historical Resilience: The stock market has historically shown resilience, recovering from periods of high valuations and even crashes. Examining historical data reveals that those who maintained a long-term investment approach generally fared well.

-

Long-Term Investment Strategy: A long-term investment horizon allows investors to ride out short-term market volatility and benefit from long-term growth.

-

Dollar-Cost Averaging: In a high-valuation market, dollar-cost averaging—investing a fixed amount at regular intervals—can reduce the risk of investing a large sum at a market peak.

Managing Risk in a High-Valuation Environment

Even with a bullish outlook, managing risk in a potentially volatile market is essential.

-

Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

-

High-Quality Companies: Focus on fundamentally strong companies with consistent earnings, robust balance sheets, and a history of dividend payments.

-

Regular Review and Adjustment: Periodically review and adjust your investment strategy based on market conditions and your personal financial goals.

-

Professional Advice: Consider seeking professional financial advice from a qualified advisor to create a personalized investment plan.

Conclusion

BofA's bullish stance on the stock market, despite high stock market valuations, highlights the importance of considering multiple factors beyond simple valuation metrics. While elevated P/E ratios warrant attention, low interest rates, ongoing innovation, and historical market resilience contribute to a more nuanced perspective. For long-term investors, a balanced approach—incorporating diversification, focusing on high-quality companies, and utilizing strategies like dollar-cost averaging—remains crucial. Don't let fear paralyze you. Understand the nuances, focus on long-term growth potential, and make informed decisions. Learn more about navigating high stock market valuations by [link to relevant resource].

Featured Posts

-

Donkey Roundup Celebrating Community In Southern California

May 02, 2025

Donkey Roundup Celebrating Community In Southern California

May 02, 2025 -

England Women Vs Spain Women Preview Predicted Lineups And Match Outcome

May 02, 2025

England Women Vs Spain Women Preview Predicted Lineups And Match Outcome

May 02, 2025 -

Market Reaction Canadian Dollar Soars On Trump Carney Deal News

May 02, 2025

Market Reaction Canadian Dollar Soars On Trump Carney Deal News

May 02, 2025 -

Play Station Portal Expanding Cloud Streaming To Classic Games

May 02, 2025

Play Station Portal Expanding Cloud Streaming To Classic Games

May 02, 2025 -

8 000 Km A Parcourir Le Defi Sans Stress De Trois Jeunes Du Bocage Ornais

May 02, 2025

8 000 Km A Parcourir Le Defi Sans Stress De Trois Jeunes Du Bocage Ornais

May 02, 2025

Latest Posts

-

The High Stakes Why An Iconic Band Will Only Play A Life Or Death Festival

May 02, 2025

The High Stakes Why An Iconic Band Will Only Play A Life Or Death Festival

May 02, 2025 -

Will Iconic Band Play Only If Its Life Or Death

May 02, 2025

Will Iconic Band Play Only If Its Life Or Death

May 02, 2025 -

Kate And Lila Mosss Stunning Little Black Dresses A London Fashion Week Highlight

May 02, 2025

Kate And Lila Mosss Stunning Little Black Dresses A London Fashion Week Highlight

May 02, 2025 -

Bands Extreme Festival Requirement A Life Or Death Scenario

May 02, 2025

Bands Extreme Festival Requirement A Life Or Death Scenario

May 02, 2025 -

Mother And Daughter Style Icons Kate And Lila Mosss Matching Lbds At Lfw

May 02, 2025

Mother And Daughter Style Icons Kate And Lila Mosss Matching Lbds At Lfw

May 02, 2025