Why High Stock Market Valuations Shouldn't Deter Investors: A BofA Analysis

Table of Contents

BofA's Analysis: Deconstructing High Valuations

BofA's research offers a valuable framework for understanding current high stock market valuations. Instead of focusing solely on surface-level indicators, they encourage a deeper, more comprehensive analysis.

Understanding Current Market Conditions

Several factors contribute to seemingly high valuations:

- Low Interest Rates: Historically low interest rates reduce the discount rate used in discounted cash flow (DCF) models, leading to higher present values of future earnings. This means that the value of future profits is inflated, contributing to seemingly higher valuations.

- Strong Corporate Earnings: Many companies have reported robust earnings growth, driven by factors such as economic recovery and technological advancements. Strong earnings can justify higher price-to-earnings (P/E) ratios, even in a high valuation environment.

- Economic Recovery: Following periods of economic uncertainty, a strong recovery often leads to increased investor confidence and higher stock prices. This boosts market valuations across the board.

Beyond P/E Ratios: A Multifaceted Approach

Relying solely on P/E ratios to assess market valuations is insufficient and potentially misleading. A more comprehensive approach considers multiple metrics:

- Price-to-Sales (P/S) Ratio: This ratio compares a company's market capitalization to its revenue, offering insights even when earnings are volatile or negative.

- Price-to-Book (P/B) Ratio: The P/B ratio compares a company's market value to its book value (assets minus liabilities), providing a measure of how much investors are willing to pay for each dollar of net assets.

- Dividend Yield: The dividend yield, calculated as the annual dividend per share divided by the share price, provides an indication of the income return an investor can expect.

High P/E ratios can be justified by strong future earnings growth, a fact often overlooked when only focusing on this single metric. A holistic analysis, integrating these various valuation metrics, offers a clearer picture of market conditions and individual stock valuations.

Sector-Specific Analysis

Valuations differ significantly across sectors. While some sectors might appear overvalued based on overall market metrics, others might offer compelling investment opportunities:

- Technology: The technology sector often exhibits high valuations, reflecting strong growth prospects. However, sub-sectors within technology may show varying degrees of valuation, with some offering attractive entry points.

- Healthcare: The healthcare sector is known for its stability and long-term growth potential. Specific companies within this sector may offer strong value propositions despite overall high market valuations.

- Financials: The financial sector's valuation often fluctuates significantly based on economic conditions and interest rates. Careful analysis of individual financial institutions is crucial for identifying attractive investment opportunities.

Long-Term Growth Potential: Why High Valuations Shouldn't Deter Long-Term Investors

High stock market valuations are not a novel phenomenon. A historical perspective demonstrates that periods of high valuations have often been followed by substantial market growth.

Historical Perspective on Market Valuations

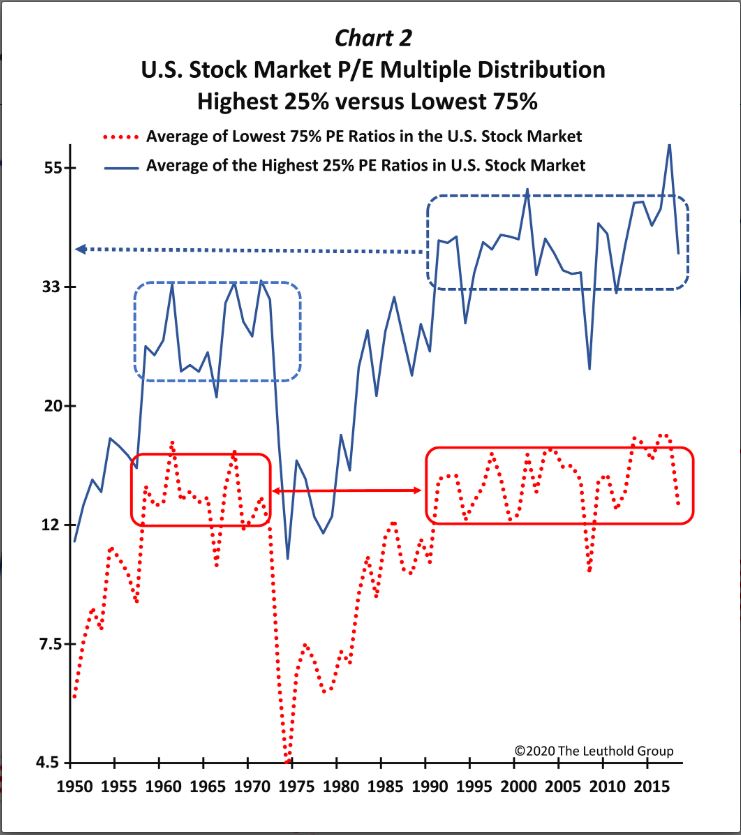

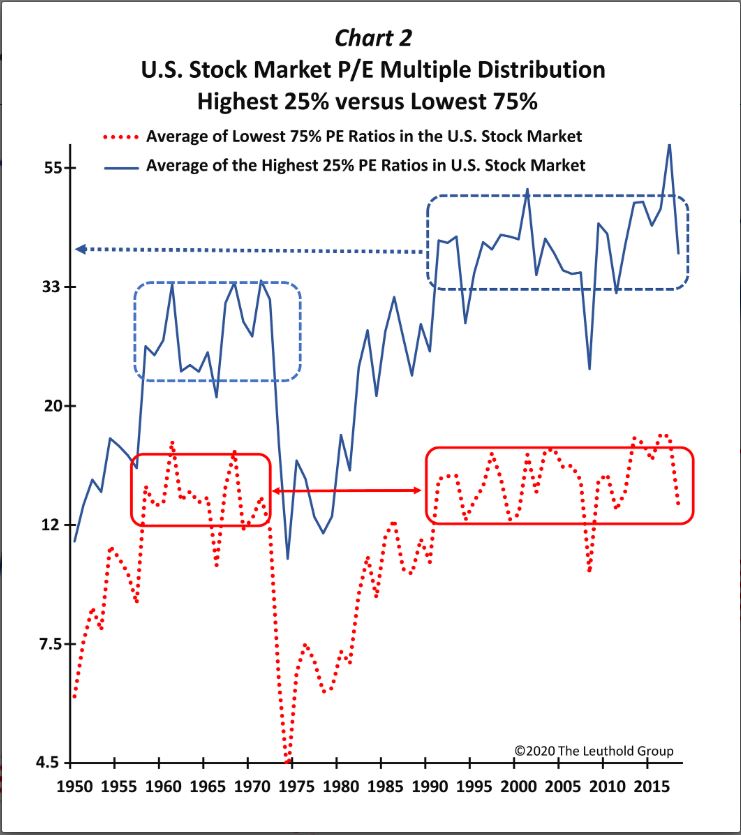

Analyzing historical market data reveals that periods of high valuations, similar to what we see today, have not necessarily preceded market crashes. In fact, many have been followed by years of significant market appreciation. (Insert chart/graph showing historical valuations and subsequent returns here)

The Power of Compounding

The power of compounding returns over the long term is undeniable. Even with high initial valuations, consistent investment can lead to substantial wealth accumulation over time. A small, regular investment, compounded over decades, can generate remarkable returns, even if the starting market valuation is high.

- Example: Investing $500 per month for 30 years, even at a relatively modest average annual return, can result in a significant portfolio. The impact of high initial valuations diminishes significantly over such a long timeframe.

Risk Mitigation Strategies for High Valuation Markets

Several strategies help mitigate risks in high valuation markets:

- Diversification: Spreading investments across different asset classes, sectors, and geographies reduces the overall portfolio risk.

- Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals, regardless of market fluctuations, helps reduce the impact of market volatility.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer attractive risk-adjusted returns, even in a high-valuation environment.

Conclusion

BofA's analysis demonstrates that high stock market valuations, while a legitimate concern, shouldn't automatically deter long-term investors. A holistic valuation approach, incorporating multiple metrics and considering sector-specific analysis, provides a more nuanced perspective. The historical record shows that periods of high valuations have often been followed by substantial market growth, and the power of compounding ensures that long-term investors benefit over time. Don't let high stock market valuations deter you. Use this analysis to inform your investment strategy and start building your portfolio today. Consult a financial advisor to discuss your personal investment plan in light of current high stock market valuations. Remember to diversify your holdings and employ strategies like dollar-cost averaging to mitigate risk. Understanding the complexities of market valuation is key to making informed investment decisions.

Featured Posts

-

Explore The New Harry Potter Shop In Chicago

May 02, 2025

Explore The New Harry Potter Shop In Chicago

May 02, 2025 -

Kellers 500 Point Milestone A Win For Missouri Hockey

May 02, 2025

Kellers 500 Point Milestone A Win For Missouri Hockey

May 02, 2025 -

Rechtszaak Kampen Enexis Problemen Met Stroomnetaansluiting

May 02, 2025

Rechtszaak Kampen Enexis Problemen Met Stroomnetaansluiting

May 02, 2025 -

Laukiama Hario Poterio Parko Atidarymo Sanchajuje 2027 Metais

May 02, 2025

Laukiama Hario Poterio Parko Atidarymo Sanchajuje 2027 Metais

May 02, 2025 -

80s Soap Opera Legend And Dallas Star Dies

May 02, 2025

80s Soap Opera Legend And Dallas Star Dies

May 02, 2025

Latest Posts

-

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025 -

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025 -

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025 -

Celebrity Traitors Uk Two Stars Quit The Game

May 02, 2025

Celebrity Traitors Uk Two Stars Quit The Game

May 02, 2025 -

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025