Addressing Investor Anxiety: BofA's View On Elevated Stock Market Valuations

Table of Contents

The current stock market exhibits elevated valuations, sparking significant investor anxiety. Bank of America (BofA), a leading financial institution, recently offered insights into this concerning trend, providing crucial perspectives for navigating these uncertain times. This article will dissect BofA's analysis, exploring the factors driving high valuations and offering strategies to mitigate investor anxiety related to elevated stock prices and market volatility. We'll delve into BofA's market outlook, examine the drivers behind high valuations, and suggest actionable investment strategies to help you manage your portfolio effectively.

H2: BofA's Assessment of Current Market Conditions

BofA's recent market analysis reflects a cautious optimism tempered by concerns about elevated stock market valuations. Their assessment weighs various economic indicators and valuation metrics to paint a comprehensive picture of the current market landscape. While acknowledging strong corporate earnings in certain sectors, BofA highlights the potential risks associated with current price levels. Specific sectors, particularly those heavily reliant on continued low interest rates, are identified as potentially vulnerable to future corrections.

- BofA's specific valuation metrics used: BofA analysts utilize a range of metrics, including the Price-to-Earnings (P/E) ratio, the Shiller P/E ratio (cyclically adjusted P/E ratio), and other forward-looking valuation models to assess whether current market prices are justified by future earnings expectations.

- Their view on the impact of inflation and interest rate hikes on stock prices: BofA's analysis emphasizes the impact of rising inflation and potential interest rate hikes on stock valuations. Higher interest rates typically lead to decreased valuations as the opportunity cost of investing in stocks increases.

- Any mention of geopolitical risks or other macroeconomic factors influencing valuations: Geopolitical uncertainties, supply chain disruptions, and potential energy crises are factored into BofA's outlook, acknowledging their potential impact on market volatility and investor sentiment.

- BofA's prediction for future market performance (short-term and long-term): While specific predictions are generally avoided due to the inherent unpredictability of the market, BofA's outlook suggests a need for caution in the short term, emphasizing the potential for market corrections. The long-term outlook remains positive, contingent on economic stability and continued corporate earnings growth.

H2: Understanding the Drivers of Elevated Stock Market Valuations

Several factors contribute to the current high stock market valuations. These drivers, while potentially positive in the short term, also introduce significant risk.

- Impact of monetary policy (e.g., quantitative easing) on stock prices: Years of low interest rates and quantitative easing (QE) policies have injected significant liquidity into the market, driving up asset prices, including stocks. This artificial boost to valuations is a key concern.

- The role of technological innovation in driving growth and valuations: Technological advancements, particularly in sectors like artificial intelligence and renewable energy, have fueled significant growth and investor enthusiasm, contributing to higher valuations in related companies.

- Analysis of corporate earnings growth and its sustainability: While corporate earnings have been robust in many sectors, the sustainability of this growth in the face of inflation, rising interest rates, and potential economic slowdowns remains a crucial question.

- Influence of investor behavior and market psychology: Investor sentiment and market psychology play a significant role. Optimism and fear can create bubbles and corrections, making accurate valuation difficult. Current market psychology is characterized by both excitement about technological growth and anxiety about inflation.

H2: Strategies to Manage Investor Anxiety in a High-Valuation Market

Navigating a high-valuation market requires a robust investment strategy focused on risk management. While completely avoiding the market isn't advisable, proactive measures can significantly mitigate investor anxiety.

- Diversifying investment portfolios across asset classes: Diversification is crucial. Spreading investments across stocks, bonds, real estate, and other asset classes reduces the impact of any single market segment's downturn.

- Adopting a defensive investment strategy, potentially shifting towards less volatile assets: In a high-valuation market, considering a more defensive approach with a focus on less volatile assets like high-quality bonds or dividend-paying stocks can help reduce risk.

- Focusing on value investing and identifying undervalued companies: Value investing involves seeking companies whose market prices are below their intrinsic worth. Thorough research and fundamental analysis are essential.

- Regularly reviewing and rebalancing investment portfolios: Regularly reviewing and rebalancing your portfolio ensures it aligns with your risk tolerance and long-term goals, addressing any imbalances created by market fluctuations.

- Seeking professional financial advice: Consider consulting with a qualified financial advisor to create a personalized investment strategy tailored to your specific circumstances and risk tolerance.

H3: The Importance of Long-Term Investment Strategies

Maintaining a long-term perspective is paramount. Market fluctuations are inherent; focusing on long-term financial goals rather than short-term market movements helps manage investor anxiety. Consistent investing, disciplined portfolio management, and a well-defined financial plan are crucial components of a successful long-term strategy. Remember that market cycles exist, and periods of high valuations are often followed by corrections. Patience and a well-structured plan are essential for weathering these cycles.

Conclusion:

This article summarized BofA's perspective on elevated stock market valuations and the consequent investor anxiety. We explored the factors driving these high valuations and outlined strategies to manage risk and mitigate anxiety. BofA's analysis, while highlighting the concerns, encourages a balanced and informed approach to investment decision-making. Understanding BofA's view on elevated stock market valuations is crucial for navigating current market conditions. By implementing sound investment strategies and managing your risk effectively, you can address investor anxiety and achieve your long-term financial goals. Learn more about addressing investor anxiety and optimizing your investment portfolio today!

Featured Posts

-

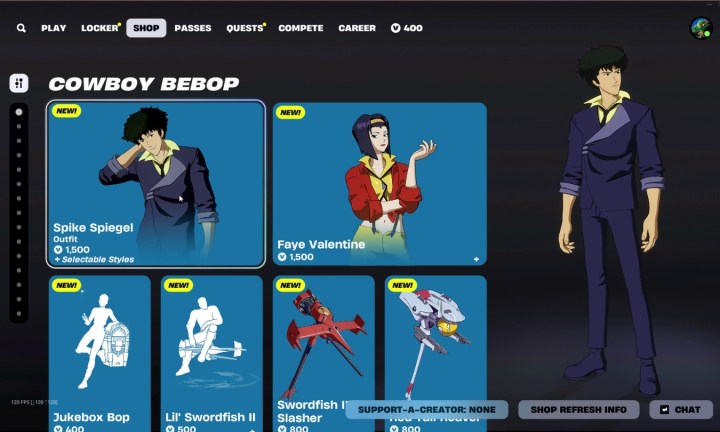

Dont Miss Out Free Cowboy Bebop Items Now In Fortnite

May 02, 2025

Dont Miss Out Free Cowboy Bebop Items Now In Fortnite

May 02, 2025 -

Mental Health Services Coming Soon Trust Care Healths Portfolio Expansion

May 02, 2025

Mental Health Services Coming Soon Trust Care Healths Portfolio Expansion

May 02, 2025 -

Priscilla Pointer Actress And Sf Actor Workshop Co Founder Passes Away At 100

May 02, 2025

Priscilla Pointer Actress And Sf Actor Workshop Co Founder Passes Away At 100

May 02, 2025 -

Annual Donkey Roundup Rocks Southern California Town

May 02, 2025

Annual Donkey Roundup Rocks Southern California Town

May 02, 2025 -

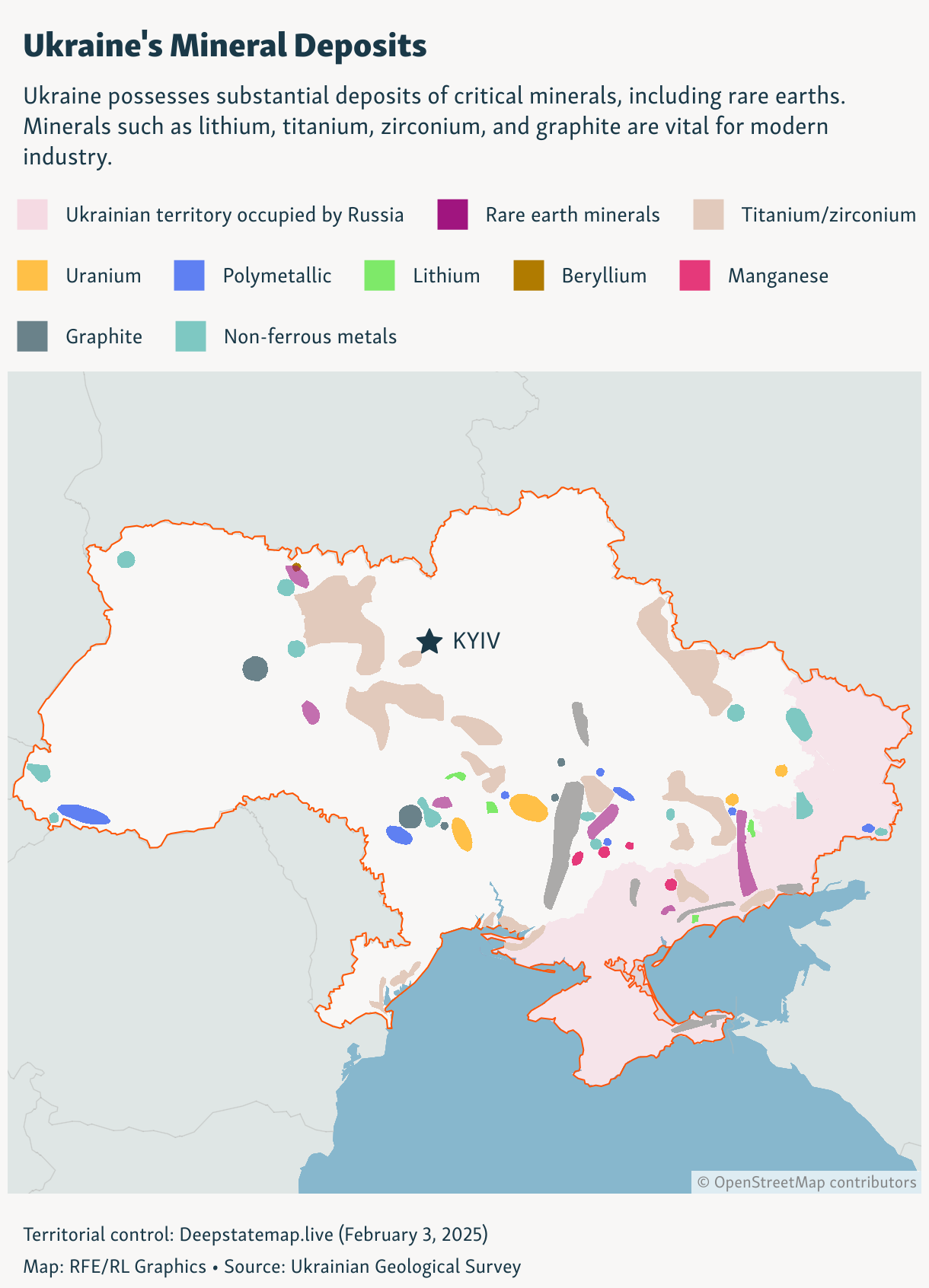

New Economic Deal Ukraine And The U S Collaborate On Rare Earth Minerals

May 02, 2025

New Economic Deal Ukraine And The U S Collaborate On Rare Earth Minerals

May 02, 2025

Latest Posts

-

Discover This Country Your Essential Travel Guide

May 02, 2025

Discover This Country Your Essential Travel Guide

May 02, 2025 -

Discover This Country Your Ultimate Travel Planner

May 02, 2025

Discover This Country Your Ultimate Travel Planner

May 02, 2025 -

This Country A Travelers Handbook

May 02, 2025

This Country A Travelers Handbook

May 02, 2025 -

Understanding This Country Politics Economy And Society

May 02, 2025

Understanding This Country Politics Economy And Society

May 02, 2025 -

Exploring This Country Culture History And Travel

May 02, 2025

Exploring This Country Culture History And Travel

May 02, 2025