Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

The Impact of Interest Rates on Stock Market Valuations

A fundamental principle of finance dictates an inverse relationship between interest rates and stock valuations. Higher interest rates generally lead to lower stock valuations, as investors seek higher returns from fixed-income instruments. Conversely, lower interest rates can support higher stock valuations, making equities more attractive.

BofA's prediction for interest rate movements is crucial in understanding current stock market valuations. While some anticipate continued increases, BofA's analysis suggests a potential stabilization or even a decrease in interest rates in the near future. This prediction stems from several factors, including slowing economic growth and potential easing of inflationary pressures.

- Lower interest rates: Fuel higher stock valuations by reducing the opportunity cost of investing in equities. Investors are less incentivized to shift funds to bonds offering lower yields.

- Interest rate stabilization or decrease: Provides a supportive environment for current stock valuations, reducing the pressure for a market correction driven solely by rising interest rates.

- Alternative investment options: With lower yields on bonds and other fixed-income securities, the relative attractiveness of stocks increases.

Strong Corporate Earnings and Future Growth Projections

BofA's analysis highlights robust corporate earnings and positive future growth projections as key justifications for current stock market valuations. Many companies have exceeded earnings expectations, demonstrating resilience and adaptability in the face of economic challenges. This strong performance stems from several factors:

- Innovation: Companies are continuously innovating, creating new products and services to meet evolving consumer demands.

- Consumer demand: Despite economic uncertainties, consumer demand remains relatively strong in several key sectors, driving sales and profits.

- BofA's forecasts: Project continued earnings growth across various sectors, indicating a sustained period of positive performance. For example, BofA expects the technology sector to experience strong growth driven by advancements in artificial intelligence and cloud computing.

Inflation's Role in Determining Stock Market Valuations

Inflation erodes purchasing power, raising concerns about the real value of stock market gains. However, BofA's valuation models explicitly incorporate inflation, providing a more nuanced perspective. Companies are employing various strategies to manage inflationary pressures:

- Passing on increased costs: Many companies successfully pass on increased costs to consumers, mitigating the impact of inflation on profit margins.

- BofA's inflation outlook: Suggests that while inflation remains a factor, the likelihood of sustained high inflation is decreasing, reducing its negative impact on stock valuations.

- Efficient cost management: Companies are actively implementing strategies for efficient cost management, improving operational efficiency and maintaining profitability.

Long-Term Investing Strategy and Risk Mitigation

A long-term investment strategy is crucial for navigating market volatility and capitalizing on long-term growth potential. BofA advises investors to mitigate risks through:

- Diversification: Spreading investments across different asset classes and sectors to reduce overall portfolio risk.

- Focusing on fundamentals: Investing in companies with strong fundamentals, consistent earnings growth, and a clear path to future success.

- Disciplined approach: Maintaining a disciplined investment approach, avoiding emotional decision-making based on short-term market fluctuations.

Reassessing Stock Market Valuations: A Call to Action

BofA's analysis demonstrates that current stock market valuations, while high, are not necessarily cause for alarm. Strong corporate earnings, positive growth projections, and a potentially stabilizing interest rate environment all support current valuations. It's crucial to remember that long-term growth potential should outweigh short-term market fluctuations.

Don't let anxieties over stock market valuations deter you from building a robust portfolio. Understand the factors influencing valuations, and make informed decisions based on long-term prospects. Consult with a financial advisor to discuss your investment strategy and learn more about stock market valuations. [Link to BofA's relevant resources/reports]

Featured Posts

-

Daily Lotto Results Thursday 17th April 2025

May 02, 2025

Daily Lotto Results Thursday 17th April 2025

May 02, 2025 -

Gewinnzahlen Lotto 6aus49 Ziehung Vom 12 April 2025

May 02, 2025

Gewinnzahlen Lotto 6aus49 Ziehung Vom 12 April 2025

May 02, 2025 -

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 02, 2025

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 02, 2025 -

Centennial Celebration Ends Dallas Icon Passes

May 02, 2025

Centennial Celebration Ends Dallas Icon Passes

May 02, 2025 -

Pussy Riots Maria Alyokhina Announces Riot Day For Edinburgh Fringe Festival 2025

May 02, 2025

Pussy Riots Maria Alyokhina Announces Riot Day For Edinburgh Fringe Festival 2025

May 02, 2025

Latest Posts

-

Discover This Country Your Essential Travel Guide

May 02, 2025

Discover This Country Your Essential Travel Guide

May 02, 2025 -

Discover This Country Your Ultimate Travel Planner

May 02, 2025

Discover This Country Your Ultimate Travel Planner

May 02, 2025 -

This Country A Travelers Handbook

May 02, 2025

This Country A Travelers Handbook

May 02, 2025 -

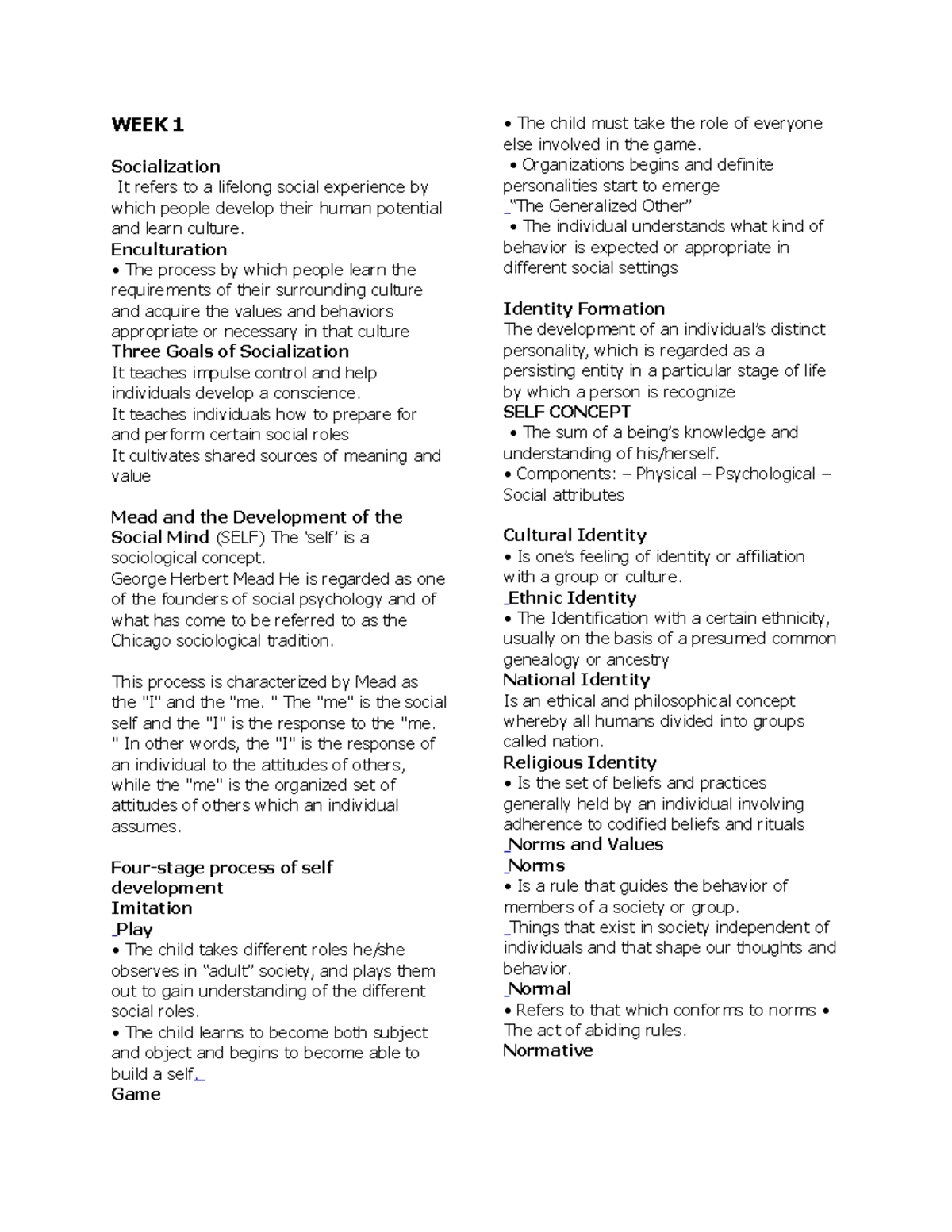

Understanding This Country Politics Economy And Society

May 02, 2025

Understanding This Country Politics Economy And Society

May 02, 2025 -

Exploring This Country Culture History And Travel

May 02, 2025

Exploring This Country Culture History And Travel

May 02, 2025