Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

BofA's Bullish Argument: Why High Valuations Aren't Necessarily a Red Flag

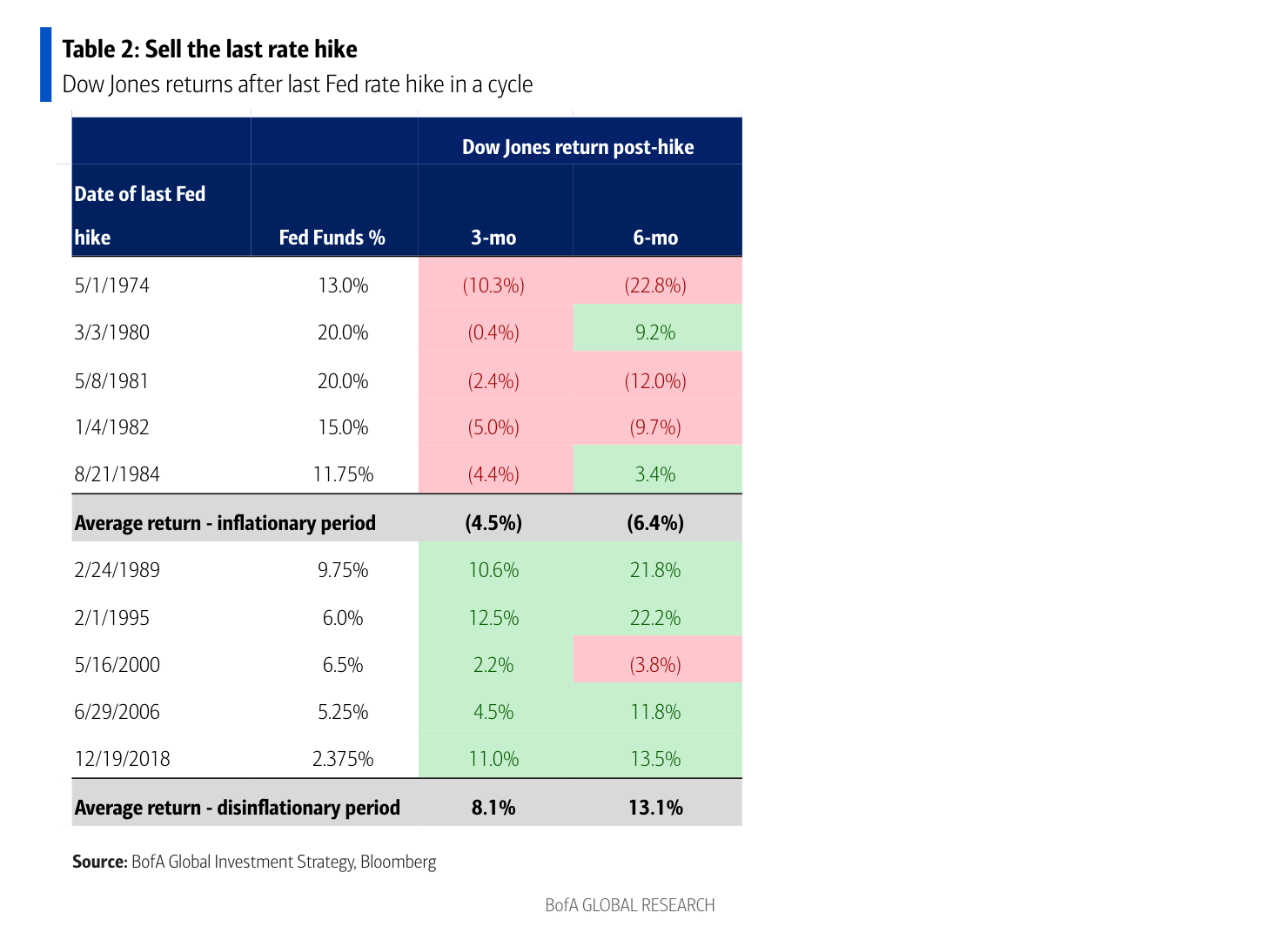

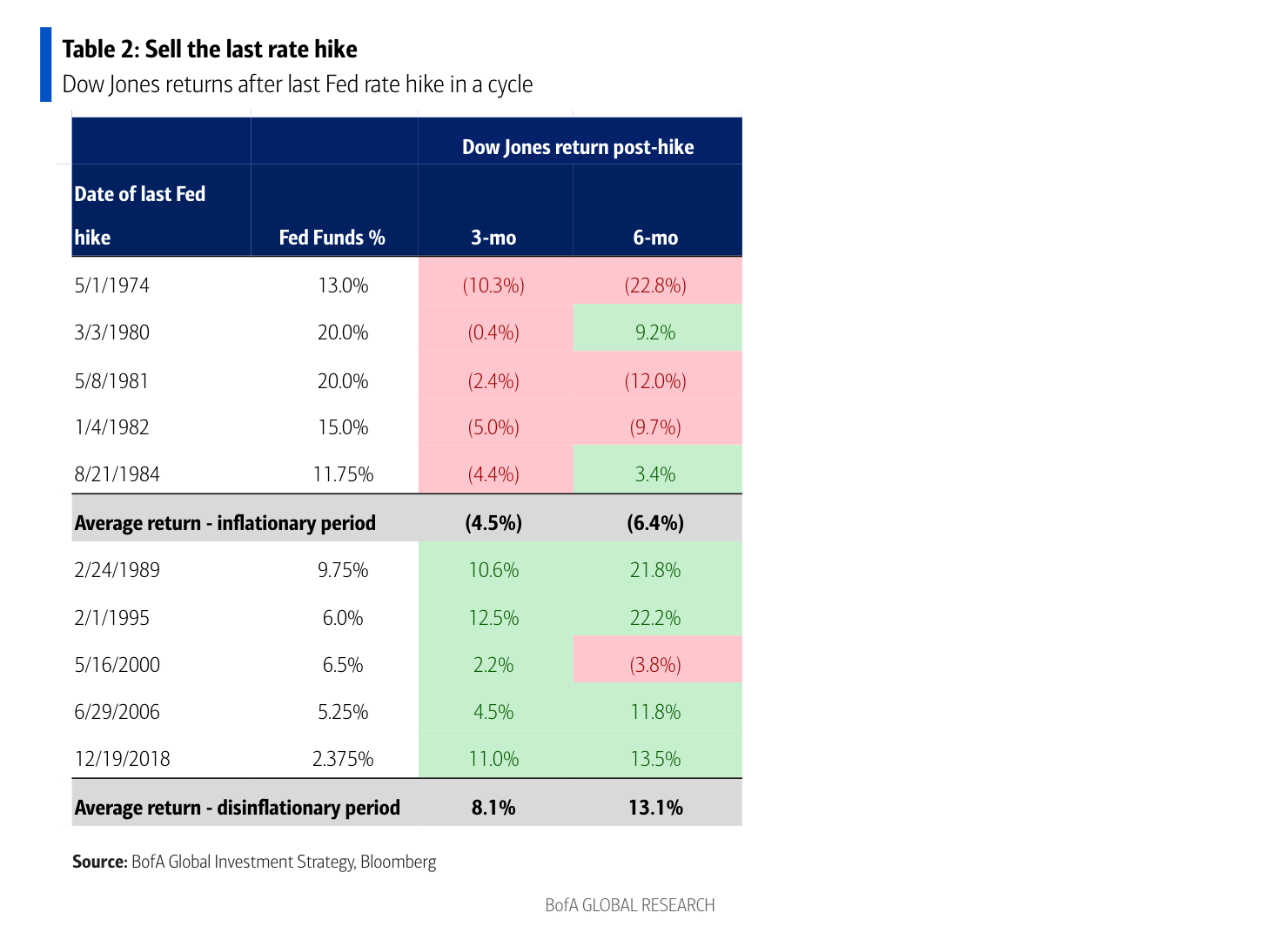

BofA's core argument against the prevailing concerns of overvaluation rests on several pillars. They contend that current high stock market valuations are justifiable given the prevailing economic landscape and future growth potential. Their bullish stance isn't blind optimism; rather, it's grounded in a specific analysis of several key factors:

-

Low Interest Rates Supporting Higher Valuations: Historically low interest rates make borrowing cheaper for companies, fueling investment and growth. This, in turn, supports higher valuations as investors are willing to pay more for future earnings potential in a low-interest-rate environment. BofA's research highlights a strong correlation between low interest rates and sustained high stock market valuations.

-

Strong Corporate Earnings Growth Justifying Current Prices: BofA points to robust corporate earnings growth as a significant factor justifying current high stock market valuations. Many companies have exceeded expectations, demonstrating financial strength and resilience, which supports higher price-to-earnings (P/E) ratios. Their reports cite specific sectors demonstrating exceptional growth.

-

Technological Advancements Driving Future Growth Potential: The rapid pace of technological innovation is a key element in BofA's analysis. They argue that transformative technologies in areas like artificial intelligence, cloud computing, and biotechnology are driving future growth, making current high stock market valuations a reflection of long-term potential rather than a bubble.

-

BofA's Data and Reports: BofA's optimistic outlook is not based on speculation. Their analysis is backed by extensive research and data presented in various reports, readily available on their website. These reports delve into detailed macroeconomic indicators and company-specific performance data to justify their bullish stance on stock market valuation.

Examining the Key Metrics: Assessing Current Market Conditions

Understanding the current market conditions requires analyzing key valuation metrics. Let's examine some of the most important:

-

Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio generally suggests investors are willing to pay more for each dollar of earnings, indicating higher expectations for future growth. Current market P/E ratios are indeed elevated compared to historical averages, but BofA argues this is justified given the factors mentioned above.

-

Shiller PE Ratio (CAPE Ratio): This is a cyclically adjusted P/E ratio that smooths out earnings fluctuations over a ten-year period. It provides a longer-term perspective on valuation. While the CAPE ratio also shows elevated levels, BofA’s analysis suggests this reflects long-term growth prospects rather than unsustainable levels.

-

Comparing to Historical Averages: It's crucial to compare current metrics to historical averages to understand the context. While current stock market valuations are high relative to historical averages, BofA's research emphasizes the unique circumstances of low interest rates and strong technological advancements that differ from previous periods of high valuations.

Counterarguments and Potential Risks: Addressing the Bearish Case

While BofA presents a compelling case, it's crucial to acknowledge potential risks and counterarguments:

-

Potential for a Market Correction or Downturn: High stock market valuations inherently increase the risk of a correction or even a more significant downturn. A sudden shift in investor sentiment or unexpected economic events could trigger a sell-off.

-

Inflationary Pressures Impacting Future Earnings: Rising inflation could erode corporate profits, potentially impacting future earnings growth and justifying lower stock valuations. This is a key risk that BofA acknowledges, but they argue that current inflation is manageable and unlikely to derail the overall economic trajectory.

-

Geopolitical Risks and Their Influence on the Market: Geopolitical instability and unexpected international events can significantly impact market sentiment and stock prices. These events are difficult to predict, but they present a potential threat to the optimistic outlook.

-

BofA's Mitigation Strategies: BofA doesn't ignore these risks. Their strategy involves recommending diversification across sectors and asset classes to mitigate the impact of potential market downturns.

Long-Term Outlook and Investment Strategies: Navigating High Valuations

BofA's long-term outlook remains cautiously optimistic, even with high stock market valuations. They suggest several investment strategies:

-

Sector-Specific Investments: Focus on sectors expected to experience continued growth, leveraging technological advancements and strong earnings.

-

Diversification Strategies: Spread investments across various asset classes and sectors to reduce risk.

-

Long-Term Investing: Prioritize long-term investment strategies over short-term speculation. High stock market valuations shouldn't deter long-term investors with a well-defined strategy.

-

Risk Management: Employ risk management techniques, including stop-loss orders and diversification, to mitigate potential losses during periods of market volatility.

Conclusion: High Stock Market Valuations: A Balanced Perspective

BofA's analysis suggests that while high stock market valuations are a legitimate concern, they aren't necessarily a cause for immediate alarm. Their arguments, supported by data on low interest rates, robust corporate earnings, and technological advancements, paint a cautiously optimistic picture. However, it's essential to acknowledge potential risks such as market corrections, inflationary pressures, and geopolitical uncertainties.

Ultimately, navigating high stock market valuations requires a balanced perspective. Conduct your own thorough research, consider a long-term investment strategy tailored to your risk tolerance, and stay informed about market trends. Remember to consult financial professionals for personalized advice. By understanding the nuances of high stock market valuations and the arguments presented by institutions like BofA, you can make more informed investment decisions. Stay informed about market trends related to high stock market valuations and adjust your strategy accordingly. For further insights, explore resources like BofA's financial reports and reputable financial news websites.

Featured Posts

-

Protecting Our Future The Importance Of Investing In Childhood Mental Well Being

May 02, 2025

Protecting Our Future The Importance Of Investing In Childhood Mental Well Being

May 02, 2025 -

Project Muse A Shared Experience Of Scholarly Resources

May 02, 2025

Project Muse A Shared Experience Of Scholarly Resources

May 02, 2025 -

Understanding The Crucial Role Of Middle Managers In Modern Organizations

May 02, 2025

Understanding The Crucial Role Of Middle Managers In Modern Organizations

May 02, 2025 -

Winning Lotto Numbers Wednesday April 30th 2025

May 02, 2025

Winning Lotto Numbers Wednesday April 30th 2025

May 02, 2025 -

The Rise Of Male Eyelash Shaving Understanding The Reasons Behind It

May 02, 2025

The Rise Of Male Eyelash Shaving Understanding The Reasons Behind It

May 02, 2025

Latest Posts

-

Celebrity Traitors On Bbc Chaos Ensues As Siblings Quit Weeks Before Shoot

May 02, 2025

Celebrity Traitors On Bbc Chaos Ensues As Siblings Quit Weeks Before Shoot

May 02, 2025 -

Bbc Celebrity Traitors Sibling Withdrawals Cause Chaos Before Filming

May 02, 2025

Bbc Celebrity Traitors Sibling Withdrawals Cause Chaos Before Filming

May 02, 2025 -

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025 -

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025 -

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025