Investing In Amundi MSCI All Country World UCITS ETF USD Acc: A NAV Perspective

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV is calculated daily by taking the total market value of all the securities held in the ETF's portfolio, subtracting any liabilities, and dividing by the total number of outstanding shares. This process ensures that the price you see reflects the true value of the assets you're buying.

- Definition of NAV: The net asset value (NAV) is the value of a fund's assets minus its liabilities, divided by the number of outstanding shares.

- Formula for calculating ETF NAV: (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

- Frequency of NAV updates: The Amundi MSCI All Country World UCITS ETF USD Acc NAV is typically updated daily, reflecting the closing market prices of its constituent securities.

- Accessing real-time NAV data: Real-time NAV data for this ETF is usually available through your brokerage account or on financial data websites.

- Impact of currency fluctuations on USD Acc NAV: Because this is a USD-denominated share class (USD Acc), fluctuations in exchange rates against other currencies can impact the NAV expressed in those currencies. However, your returns in USD will be unaffected by these fluctuations unless you are converting to a different currency.

Analyzing NAV Performance and Trends

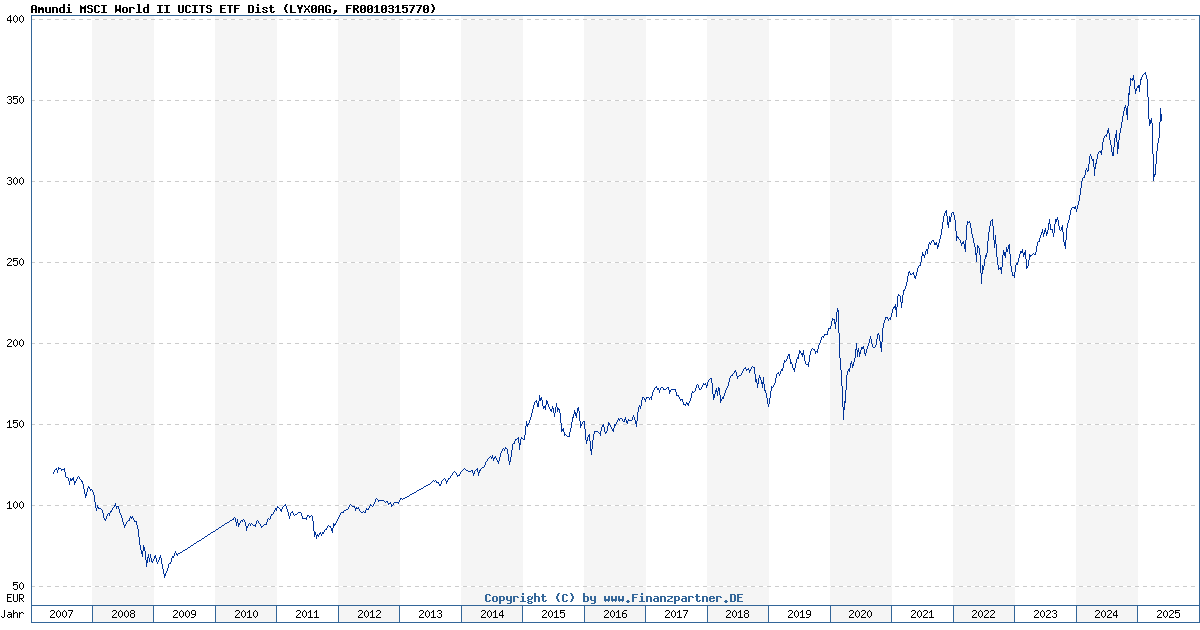

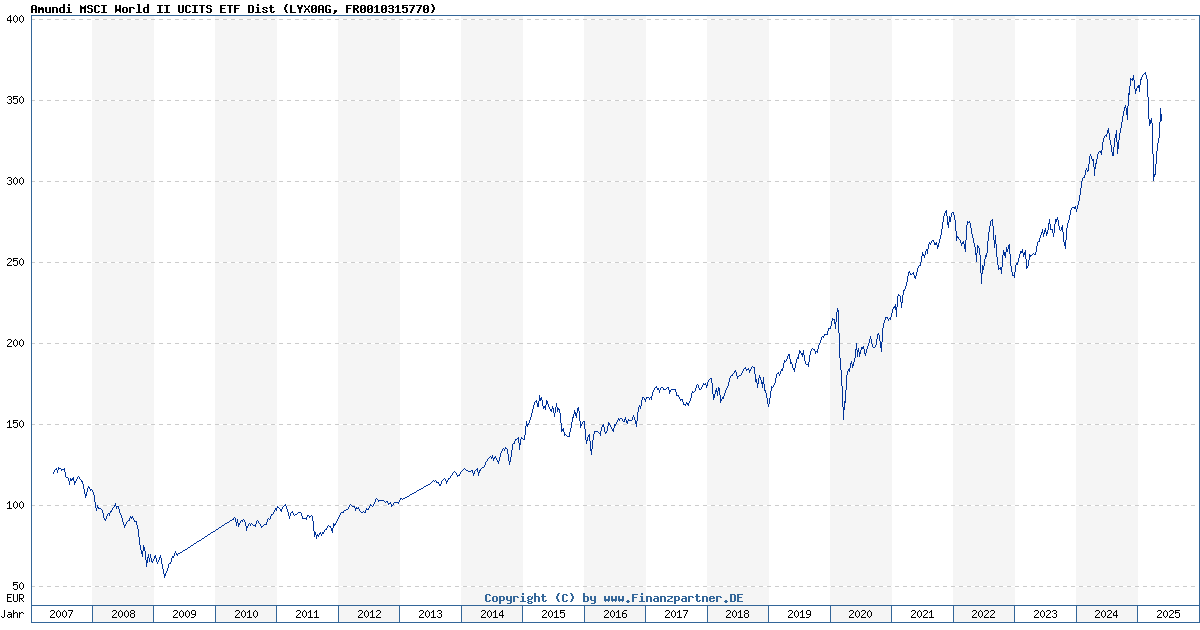

Analyzing the historical NAV performance of the Amundi MSCI All Country World UCITS ETF USD Acc provides valuable insights into its potential as an investment. [Insert a chart showing historical NAV performance here]. This chart will illustrate long-term growth trends and short-term volatility.

- Long-term NAV growth chart: [Insert chart showing long-term trend]. This visualization allows investors to assess the overall growth trajectory of the ETF over time.

- Short-term NAV fluctuations analysis: [Insert chart showing short-term fluctuations]. This analysis helps to understand the degree of risk associated with the ETF.

- Comparison with competitor ETFs' NAV: Comparing the NAV performance of the Amundi World ETF to similar global ETFs, such as those tracking the MSCI ACWI index, provides a benchmark for evaluating its relative performance.

- Correlation between NAV and market indices: Analyzing the correlation between the ETF's NAV and major market indices (e.g., S&P 500, MSCI World Index) will help investors understand its responsiveness to broader market movements.

Factors Affecting Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several macroeconomic and microeconomic factors can influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc.

- Global economic growth's effect on NAV: Global economic expansion generally leads to higher corporate earnings, boosting the value of the underlying companies and thus the ETF's NAV. Conversely, economic downturns can negatively affect the NAV.

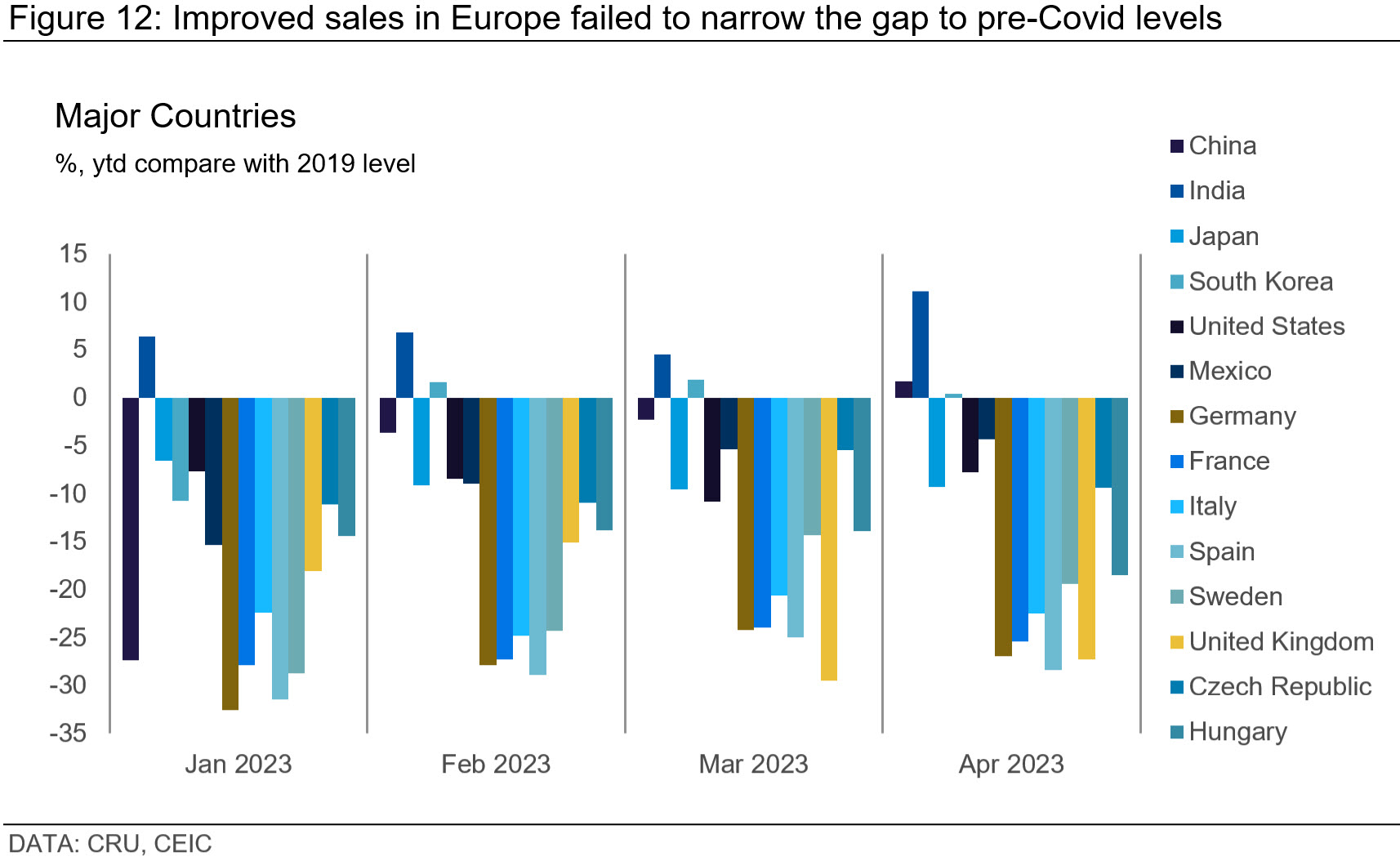

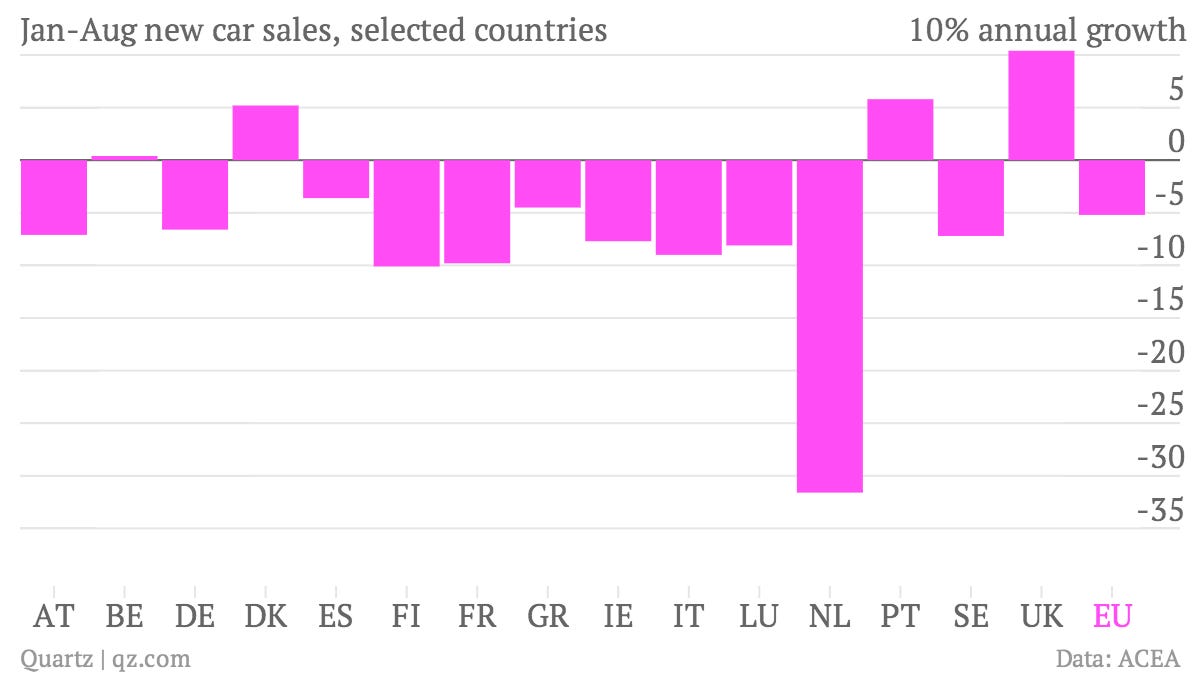

- Impact of specific country or sector performance on NAV: The performance of individual countries or sectors within the portfolio can significantly influence the overall NAV. Strong performance in a particular sector will positively impact the NAV, while underperformance will have the opposite effect.

- Effect of USD fluctuations on USD Acc share class: Changes in the value of the US dollar relative to other currencies will impact the NAV expressed in other currencies, even though the USD value of holdings will remain the same.

- Risk factors affecting NAV volatility: Geopolitical events, interest rate changes, and unexpected market shocks can all lead to significant fluctuations in the ETF's NAV. Understanding these risk factors is essential for informed investment decisions.

Practical Implications of NAV for Investors

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for making sound investment decisions.

- Using NAV to identify potential entry/exit points: While not a perfect predictor, monitoring NAV trends can help investors identify potential opportunities to buy low and sell high.

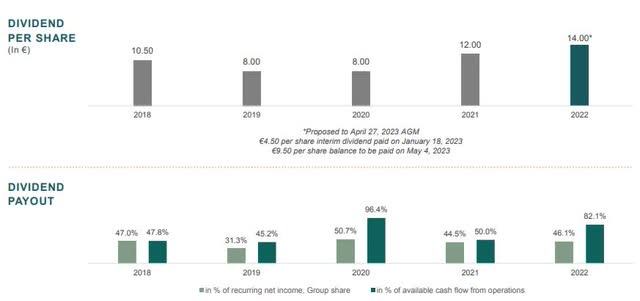

- Calculating total return based on NAV changes: The change in NAV, along with any dividend distributions, reflects the total return on your investment.

- Understanding the relationship between NAV and expense ratios: The expense ratio (the annual fee charged by the ETF) will slightly erode the NAV over time.

- Importance of tracking NAV for long-term investment strategies: Regular NAV monitoring is particularly important for long-term investors to track progress and adjust their investment strategy as needed.

Conclusion

Investing in the Amundi MSCI All Country World UCITS ETF USD Acc requires a thorough understanding of its Net Asset Value (NAV) and the factors that influence it. By analyzing historical NAV performance, identifying key influencing factors, and utilizing NAV data in your investment strategy, you can make more informed decisions. Regularly monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV, along with broader market conditions, is crucial for maximizing your investment potential. Start monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV today and make informed investment choices. For more information on this ETF and access to real-time NAV data, visit [insert relevant links here].

Featured Posts

-

South Floridas Ferrari Challenge A Racing Event Not To Miss

May 25, 2025

South Floridas Ferrari Challenge A Racing Event Not To Miss

May 25, 2025 -

Confirmed Glastonbury 2025 Acts Olivia Rodrigo The 1975 And Other Music Legends

May 25, 2025

Confirmed Glastonbury 2025 Acts Olivia Rodrigo The 1975 And Other Music Legends

May 25, 2025 -

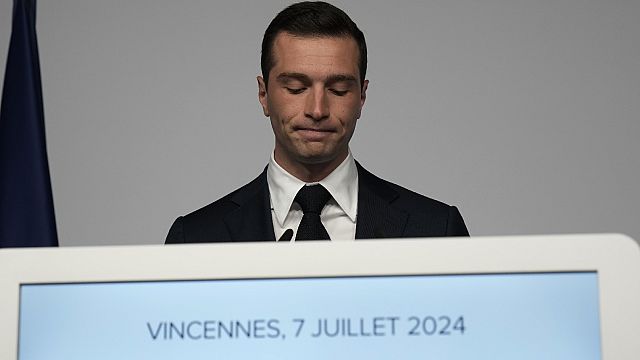

Jordan Bardella And The 2027 French Presidential Election

May 25, 2025

Jordan Bardella And The 2027 French Presidential Election

May 25, 2025 -

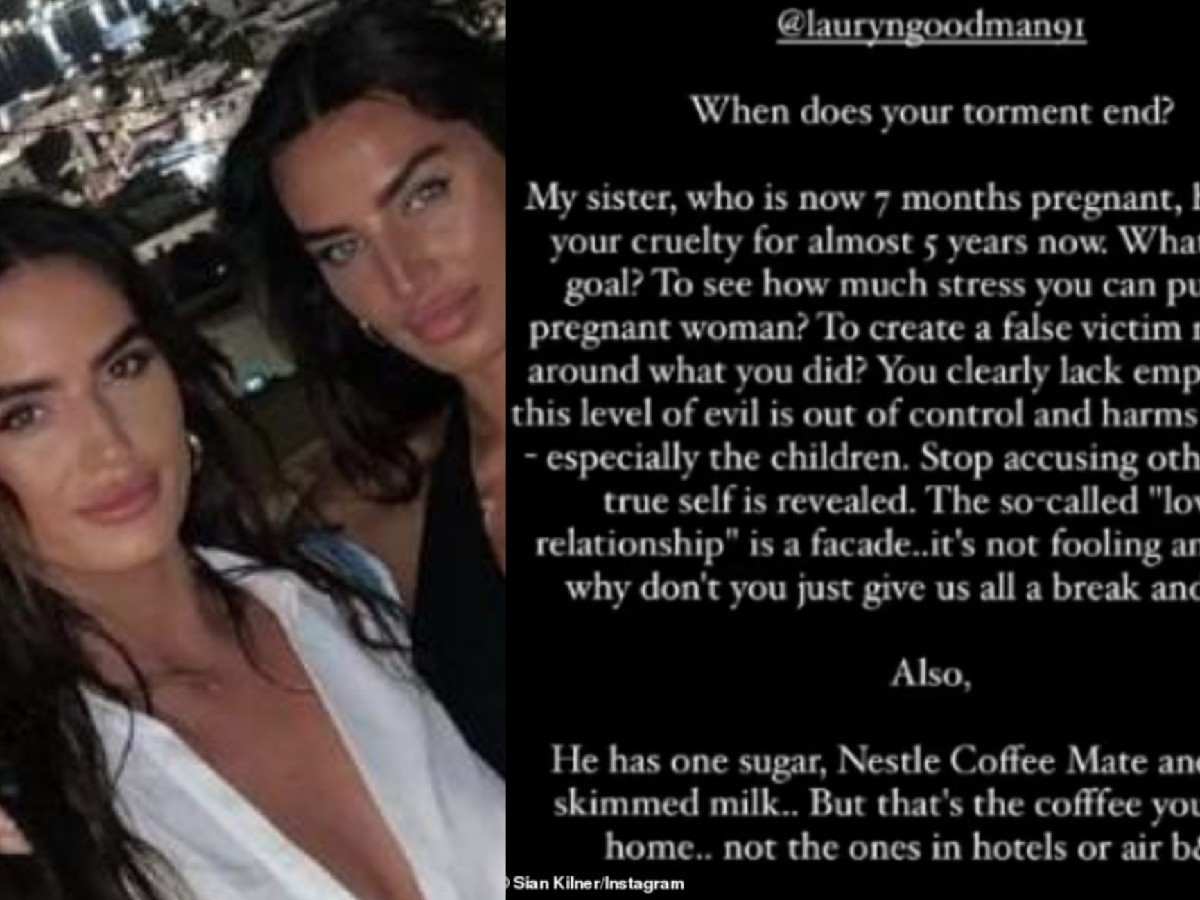

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Djia Ucits Etf

May 25, 2025

Analyzing The Net Asset Value Nav Of The Amundi Djia Ucits Etf

May 25, 2025

Latest Posts

-

Auto Sector Rebound Fuels European Market Growth Lvmh Stock Suffers

May 25, 2025

Auto Sector Rebound Fuels European Market Growth Lvmh Stock Suffers

May 25, 2025 -

Auto Tariff Relief Speculation Lifts European Markets Lvmh Shares Plunge

May 25, 2025

Auto Tariff Relief Speculation Lifts European Markets Lvmh Shares Plunge

May 25, 2025 -

Public Disagreement Ex French Pm And President Macron

May 25, 2025

Public Disagreement Ex French Pm And President Macron

May 25, 2025 -

Kerings Q1 Results Trigger 6 Share Price Decline

May 25, 2025

Kerings Q1 Results Trigger 6 Share Price Decline

May 25, 2025 -

Lvmh Q1 Sales Figures Miss Expectations Shares Down 8 2

May 25, 2025

Lvmh Q1 Sales Figures Miss Expectations Shares Down 8 2

May 25, 2025