Analyzing The Net Asset Value (NAV) Of The Amundi DJIA UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets per share. For the Amundi DJIA UCITS ETF, this means the total value of its holdings, which closely track the 30 companies comprising the Dow Jones Industrial Average (DJIA). The calculation involves several key components:

- Market value of underlying assets: This is the most significant factor, representing the current market price of each stock held within the ETF, multiplied by the number of shares owned.

- Liabilities of the ETF: This includes any outstanding expenses, payable fees, and other obligations.

- Expense ratio: The annual fee charged by the fund manager to cover administrative and operational costs is deducted.

- Other relevant fees: Minor fees, if any, that may apply.

The NAV is then calculated by subtracting the liabilities and expenses from the total market value of the assets and dividing the result by the total number of outstanding ETF shares. Currency fluctuations can impact the NAV if the ETF's underlying assets are denominated in currencies other than the ETF's base currency. For example, if the ETF is in Euros but holds US dollar-denominated stocks, changes in the EUR/USD exchange rate will affect the calculated NAV. Keywords used here include: NAV calculation, ETF NAV, Amundi DJIA UCITS ETF components, asset valuation.

Factors Affecting the Amundi DJIA UCITS ETF NAV

Several factors significantly influence the Amundi DJIA UCITS ETF's NAV. Understanding these dynamics is key to effective investment strategies:

- Market fluctuations of the Dow Jones Industrial Average: As the ETF tracks the DJIA, its NAV will directly reflect the performance of the index. Positive market movements generally increase the NAV, while negative movements decrease it.

- Dividend payouts from underlying stocks: When the companies within the DJIA pay dividends, the ETF receives these payouts, which are then distributed to ETF shareholders or reinvested, influencing the NAV.

- Expense ratios and management fees: These fees directly reduce the NAV, as they are deducted from the total asset value. Therefore, higher expense ratios result in a lower NAV.

- Currency exchange rate changes: If the ETF is not denominated in US dollars, changes in the exchange rate between the ETF's base currency and the US dollar will affect the NAV. Keywords used here include: Market volatility, DJIA performance, dividend impact, expense ratio, currency risk, NAV fluctuations.

Analyzing Historical NAV Data of the Amundi DJIA UCITS ETF

Accessing historical NAV data for the Amundi DJIA UCITS ETF is relatively straightforward. You can find this data on various online brokerage platforms, financial websites, and the Amundi website itself. Analyzing this historical data allows you to:

- Identify trends and patterns: Observing the NAV's historical performance can reveal long-term trends, seasonal fluctuations, or recurring patterns.

- Compare NAV to the market price: Slight discrepancies between the NAV and the ETF's market price may indicate arbitrage opportunities. However, this requires careful consideration and understanding of market mechanics. Keywords used here include: Historical NAV, price-to-NAV ratio, ETF performance, historical data analysis, trend analysis.

Using NAV to make informed investment decisions with the Amundi DJIA UCITS ETF

Monitoring the NAV of the Amundi DJIA UCITS ETF can inform your investment decisions in several ways:

- Timing buy and sell decisions: A consistently rising NAV may suggest a favorable time to buy, while a declining NAV could indicate a potential opportunity to sell or hold off on further investments.

- Comparing to other ETFs: The NAV allows for a direct comparison of the Amundi DJIA UCITS ETF to other similar ETFs tracking the DJIA or broader market indices, helping to assess relative value and performance.

- Considering NAV alongside other performance indicators: While NAV is a crucial factor, you should also consider other metrics like total return, expense ratio, and volatility for a complete investment assessment.

- Risk management strategies: By consistently tracking the NAV, you can develop better risk management strategies, adjusting your portfolio based on market fluctuations and changes in the ETF's NAV. Keywords used here include: Investment strategy, buy signals, sell signals, ETF comparison, risk management, performance indicators.

Conclusion: The Importance of Understanding Amundi DJIA UCITS ETF NAV

The Amundi DJIA UCITS ETF's NAV is influenced by various interconnected factors, primarily the performance of the Dow Jones Industrial Average, dividend payouts, expense ratios, and currency fluctuations. Monitoring the NAV is vital for making informed investment decisions, allowing investors to time their entries and exits more effectively and compare the ETF to competitors. Start analyzing the Amundi DJIA UCITS ETF NAV today to make better investment choices! Learn more about effectively utilizing Net Asset Value data for your investment strategy with the Amundi DJIA UCITS ETF.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 25, 2025 -

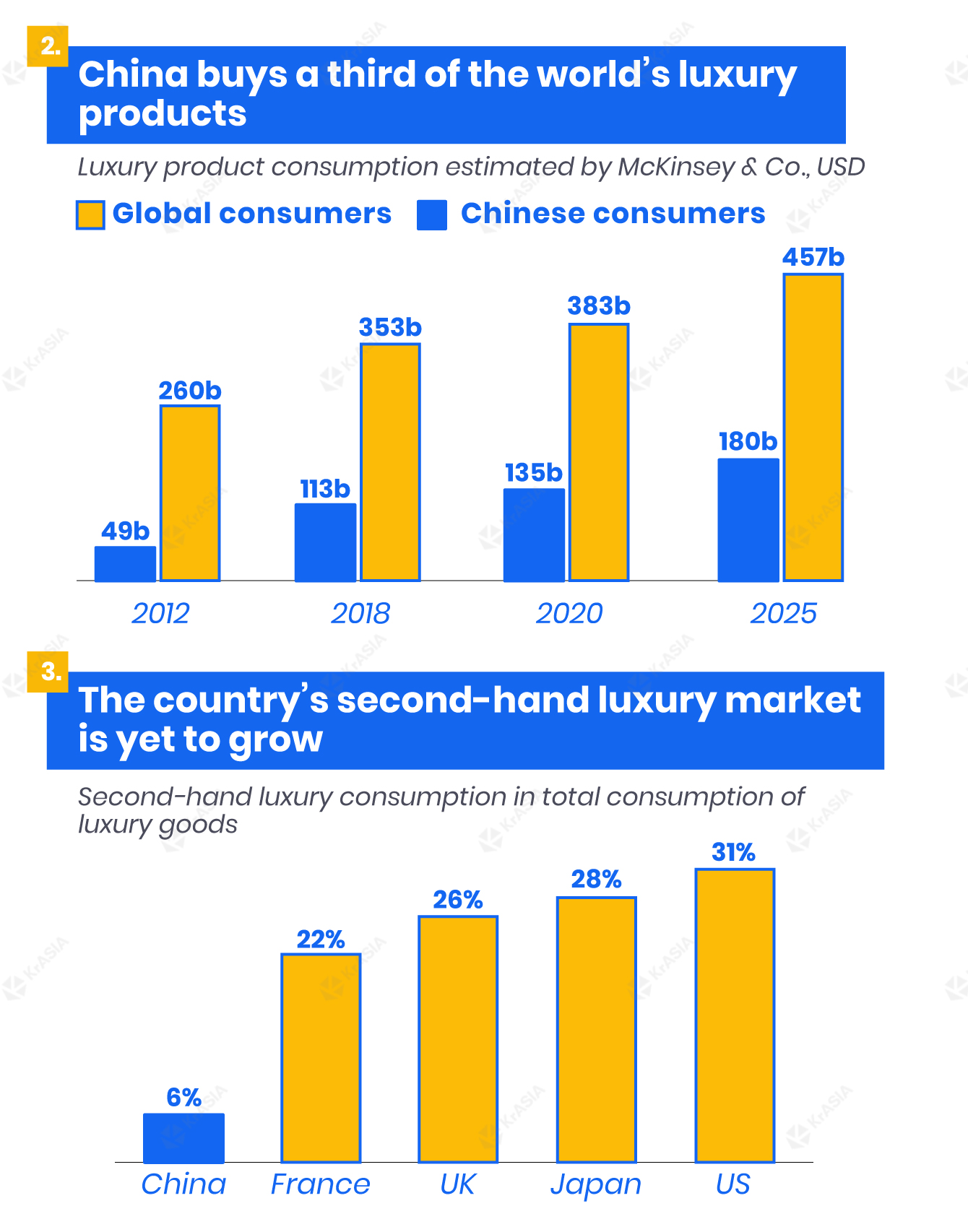

Paris Economic Slowdown Impact Of Luxury Sector Decline

May 25, 2025

Paris Economic Slowdown Impact Of Luxury Sector Decline

May 25, 2025 -

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025 -

Sinatras Four Marriages A Comprehensive Overview Of His Relationships

May 25, 2025

Sinatras Four Marriages A Comprehensive Overview Of His Relationships

May 25, 2025 -

Finding Your Dream Country Home For Under 1 Million

May 25, 2025

Finding Your Dream Country Home For Under 1 Million

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025