LVMH Q1 Sales Figures Miss Expectations, Shares Down 8.2%

Table of Contents

Q1 Sales Figures Below Analyst Forecasts

LVMH's Q1 2024 financial report revealed sales figures that significantly missed analyst consensus estimates. While the exact figures will vary depending on the reporting source, the reported revenue fell considerably short of expectations, representing a considerable drop in sales growth compared to previous quarters and projections. This underperformance was particularly noticeable in certain key brands within the LVMH portfolio. For example, [Insert specific brand and sales data if available – e.g., "Dior's sales growth slowed to X%, significantly below the projected Y%."]. This suggests underlying weaknesses despite the overall strength of the LVMH brand portfolio.

- LVMH Revenue: [Insert actual LVMH revenue figure]

- Analyst Consensus Estimate: [Insert analyst consensus estimate]

- Percentage Difference: [Insert percentage difference between actual and estimated figures]

- Underperforming Brands: [List specific brands and brief explanation of underperformance]

- Earnings Per Share (EPS): [Insert EPS data if available and compare to expectations]

The disappointing Q1 earnings cast a shadow over the overall financial report, raising questions about the company's short-term financial outlook and strategic direction. The disparity between actual and predicted results indicates a need for deeper analysis of market trends and internal operational efficiency.

Impact of External Factors on LVMH's Performance

Several external factors contributed to LVMH's weaker-than-expected Q1 performance. These global economic headwinds significantly impacted consumer spending on luxury goods.

Slowdown in China's Luxury Market

China's economic slowdown played a crucial role in LVMH's underperformance. The Chinese luxury market, a significant revenue driver for LVMH, experienced a noticeable contraction. [Insert specific data on sales from the Chinese market if available, e.g., "Sales in mainland China decreased by X% compared to the same period last year."]. This decline can be attributed to several factors, including stricter government regulations, reduced consumer confidence, and geopolitical uncertainties.

- China Luxury Market: Shrinking growth rates indicate a weakening demand among Chinese consumers.

- Chinese Consumers: Decreased spending power and shifting priorities impacted luxury purchases.

- Economic Slowdown: Macroeconomic factors in China directly impact consumer spending on luxury goods.

- Geopolitical Risks: Global geopolitical instability further dampens consumer confidence and investment.

Global Inflation and Consumer Spending

Global inflation significantly impacted consumer spending habits. Rising prices for essential goods and services reduced disposable income, leading to decreased demand for luxury items. Consumers are increasingly prioritizing essential spending, squeezing budgets allocated to discretionary purchases like high-end fashion and accessories.

- Inflation: Rising prices erode purchasing power, impacting luxury goods demand.

- Consumer Confidence: Lower consumer confidence translates to reduced spending on non-essential items.

- Luxury Spending: Decreased discretionary spending directly affects luxury brands like LVMH.

- Disposable Income: Reduced disposable income limits the purchasing power for luxury goods.

Supply Chain Disruptions

Although supply chain disruptions have eased compared to the height of the pandemic, lingering issues continue to affect production costs and timelines. Increased raw material costs and logistical challenges add pressure to profit margins, impacting the overall financial performance.

- Supply Chain: Lingering logistical bottlenecks add to production costs.

- Logistics: Increased transportation costs impact product pricing and profitability.

- Production Costs: Higher input costs directly influence the final price of luxury goods.

- Raw Materials: Fluctuations in raw material prices affect production efficiency and margins.

Market Reaction and Investor Sentiment

The release of LVMH's disappointing Q1 sales figures triggered a significant negative market reaction. The 8.2% drop in LVMH's share price reflects investor concern regarding the company's future prospects. This substantial decline highlights the market's sensitivity to unexpected underperformance in the luxury goods sector. Several analysts downgraded their forecasts for LVMH's performance, further exacerbating the negative investor sentiment.

- Stock Market: Significant drop in LVMH's share price reflects negative investor sentiment.

- Share Price: 8.2% decline underscores the market's reaction to disappointing Q1 results.

- Investor Confidence: Decreased confidence in LVMH's short-term performance.

- Analyst Ratings: Several analysts revised their forecasts downward after the Q1 report.

- Market Volatility: The incident emphasizes the volatility in the luxury goods sector.

Analyzing LVMH's Q1 Performance and Future Outlook

LVMH's disappointing Q1 2024 results stem from a combination of external headwinds, including the slowdown in the Chinese luxury market, global inflation impacting consumer spending, and lingering supply chain disruptions. These external factors, coupled with potential internal challenges, created a perfect storm that negatively affected the company's Q1 performance. The significant 8.2% drop in the share price underscores the severity of the situation and the market's concern over LVMH's future performance. While LVMH possesses significant brand strength and resources, navigating these challenges will require strategic adjustments and a close monitoring of global economic trends. The company's response to this setback will be crucial in determining its long-term growth trajectory.

To stay informed on future LVMH financial reports and the evolving landscape of the luxury goods market, subscribe to our newsletter or follow us on social media for further updates on Q2 performance and in-depth market analysis. Monitor LVMH's stock performance closely to understand the market’s evolving perception of the company’s future prospects.

Featured Posts

-

Heinekens Strong Revenue Growth Outlook Confirmed Despite Tariff Challenges

May 25, 2025

Heinekens Strong Revenue Growth Outlook Confirmed Despite Tariff Challenges

May 25, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Classic Art Week Indonesia 2025

May 25, 2025

Rayakan Seni Dan Otomotif Di Porsche Classic Art Week Indonesia 2025

May 25, 2025 -

Lower Uk Inflation Impact On Boe Interest Rate Decisions And The Pound Sterling

May 25, 2025

Lower Uk Inflation Impact On Boe Interest Rate Decisions And The Pound Sterling

May 25, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 25, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 25, 2025 -

Brest Urban Trail Benevoles Artistes Et Partenaires Au C Ur De L Evenement

May 25, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires Au C Ur De L Evenement

May 25, 2025

Latest Posts

-

The Thames Water Bonus Scandal Examining Executive Remuneration

May 25, 2025

The Thames Water Bonus Scandal Examining Executive Remuneration

May 25, 2025 -

Bof As Reassuring View Why High Stock Market Valuations Shouldnt Worry Investors

May 25, 2025

Bof As Reassuring View Why High Stock Market Valuations Shouldnt Worry Investors

May 25, 2025 -

Thames Waters Executive Pay Was It Justified

May 25, 2025

Thames Waters Executive Pay Was It Justified

May 25, 2025 -

Addressing Environmental Concerns Rio Tintos Response To Pilbara Criticism

May 25, 2025

Addressing Environmental Concerns Rio Tintos Response To Pilbara Criticism

May 25, 2025 -

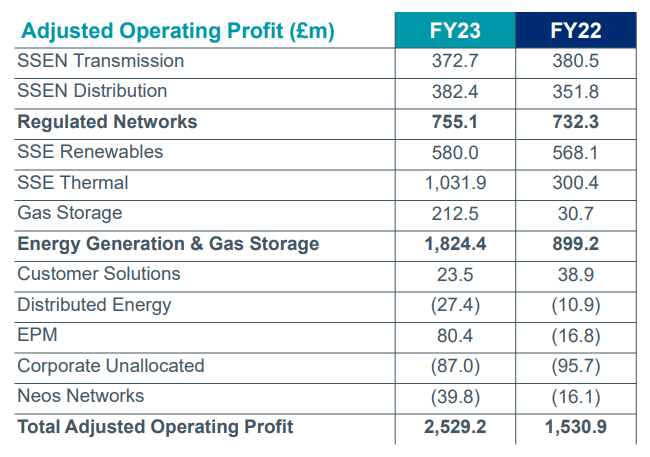

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025