Auto Tariff Relief Speculation Lifts European Markets; LVMH Shares Plunge

Table of Contents

The Impact of Auto Tariff Relief Speculation on European Markets

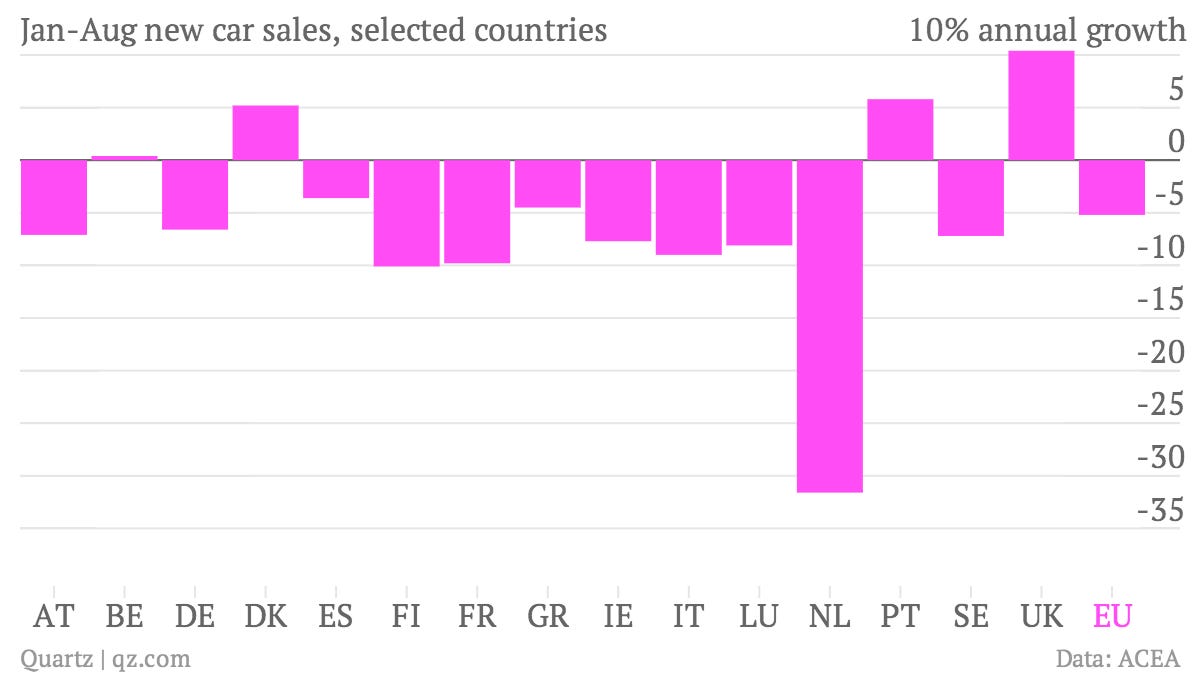

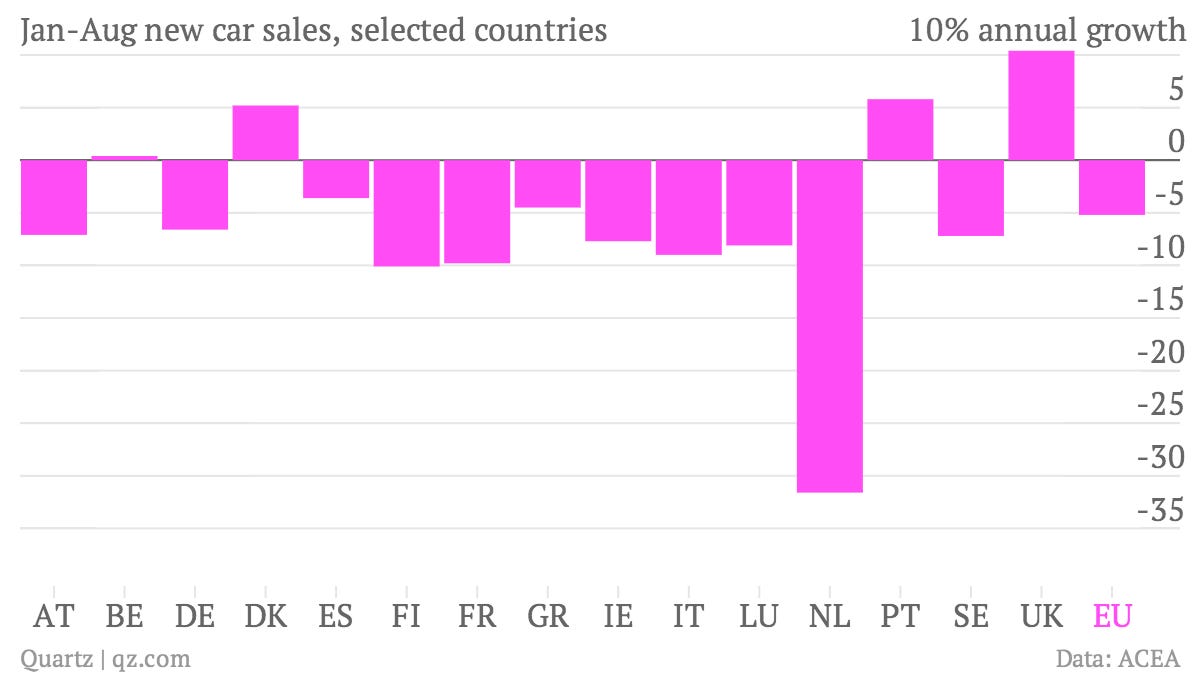

The European automotive industry currently faces significant challenges due to existing auto tariffs, impacting trade relations and competitiveness. Speculation surrounding potential relief or adjustments to these tariffs, particularly concerning transatlantic trade, has created considerable uncertainty. This uncertainty is a major factor influencing investor decisions and overall market sentiment. The potential implications for the European Union are substantial, extending beyond the automotive sector itself.

Changes in auto tariffs could have a profound effect on the EU economy.

- Increased investor confidence: Reduced or eliminated tariffs could significantly boost investor confidence in the European automotive sector, leading to increased investment and production.

- Positive impact on automotive sector growth and employment: Tariff relief could revitalize the sector, creating jobs and stimulating economic growth.

- Ripple effects on related industries: The positive effects would extend to parts suppliers, logistics companies, and other related businesses within the supply chain.

- Potential for increased trade with the US: Easing of tariffs could foster increased trade between the EU and the US, benefiting both economies.

LVMH Share Plunge: A Case Study in Market Sensitivity

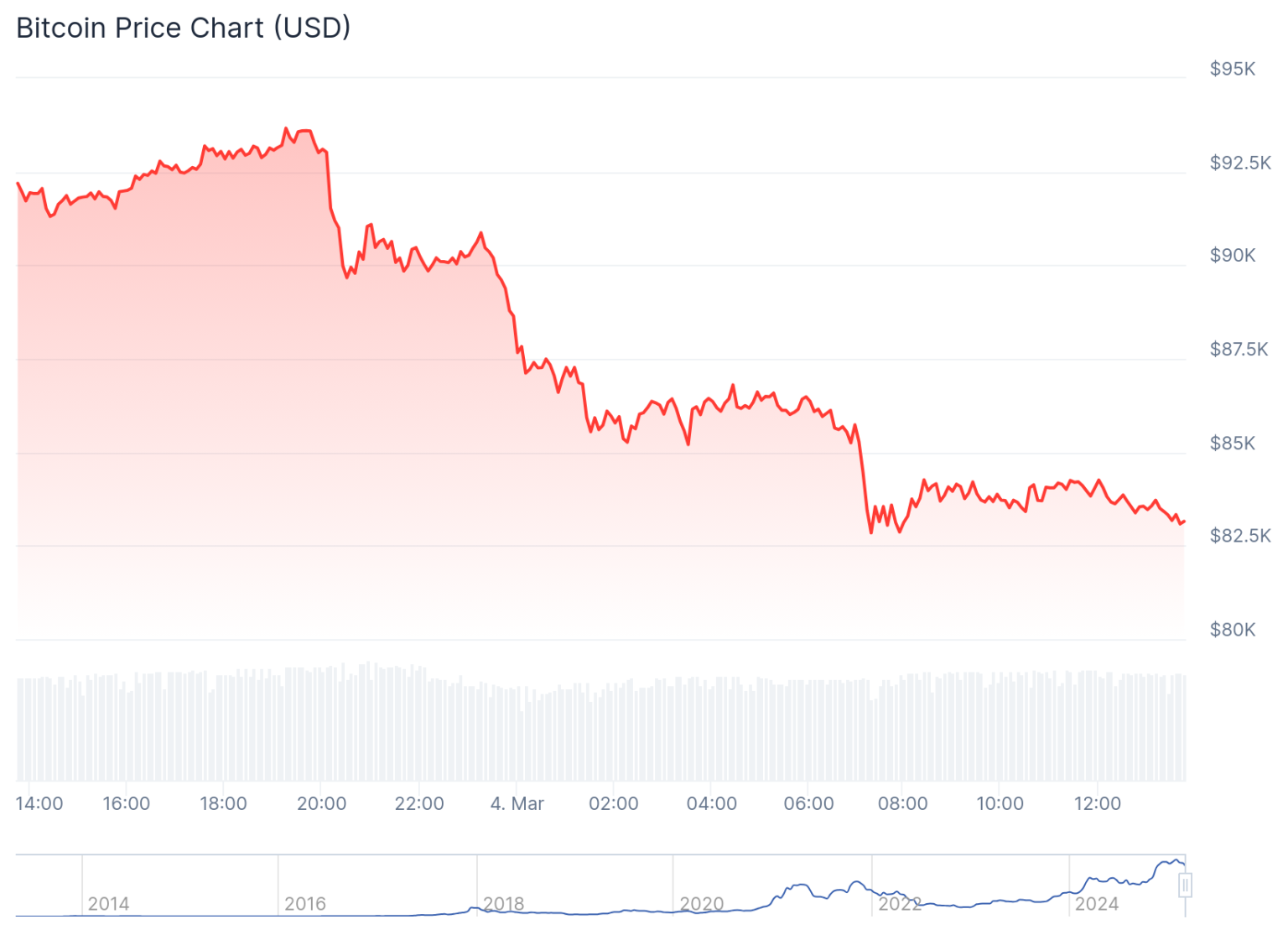

LVMH, a powerhouse in the luxury goods market, is acutely sensitive to global economic shifts. While the recent plunge in its share price is multi-faceted, auto tariff relief speculation plays a role, albeit indirectly. The complexities of global markets mean that several factors beyond tariff changes influenced LVMH's performance.

- Impact of changing consumer sentiment on luxury purchases: Economic uncertainty, often linked to trade disputes and tariff anxieties, can dampen consumer spending on luxury goods.

- Analysis of LVMH's financial performance and investor reports: A closer examination of LVMH's recent financial statements and investor communications reveals additional factors beyond tariff speculation contributing to the share price drop.

- Comparison with other luxury brands' market performance: Comparing LVMH's performance with that of other luxury brands helps isolate the specific factors affecting its stock price.

- Expert opinions on the future outlook for LVMH: Analyzing expert commentary and market forecasts provides insights into potential future performance and recovery.

Analyzing the Interplay Between Auto Tariffs and the Luxury Sector

The relationship between auto tariffs and the luxury goods sector might seem tenuous, but the connection exists through the lens of global economic health. Both sectors are sensitive to shifts in overall consumer confidence and investor sentiment, which are heavily influenced by broader economic factors, including trade relations and tariff policies.

- Examination of consumer spending habits and their sensitivity to economic uncertainty: Consumers are less likely to spend on luxury goods during periods of economic instability, even if indirectly caused by changes in auto tariffs.

- Impact of global supply chain disruptions on both sectors: Supply chain issues can significantly affect both the automotive and luxury industries, creating further uncertainty and influencing market performance.

- Analysis of investor sentiment and portfolio diversification strategies: Investors often adjust their portfolios based on perceived risk, moving funds from one sector (like automotive) to another (like luxury) depending on the news regarding auto tariffs and other factors.

- Predictions for future market trends based on current data: Analyzing current market data and expert predictions allows for a more informed assessment of future market trends in both sectors.

Conclusion: Understanding the Implications of Auto Tariff Relief Speculation

In conclusion, the speculation surrounding auto tariff relief significantly impacts European markets, as evidenced by the recent volatility and the notable drop in LVMH shares. The interplay between different market sectors is complex, and understanding the interconnectedness of seemingly disparate industries is crucial for effective financial planning and informed decision-making. The resolution (or lack thereof) of auto tariff uncertainties will play a major role in shaping future market scenarios.

To stay informed about the evolving landscape of auto tariff relief speculation and its impact on European markets, continue following financial news, conducting thorough research, and subscribing to reliable sources for up-to-date information. Understanding the nuances of auto tariff relief and its ripple effects is vital for navigating the complexities of the global economy.

Featured Posts

-

Sharp Decline In Amsterdam Stock Market Aex Index Hits 1 Year Low

May 25, 2025

Sharp Decline In Amsterdam Stock Market Aex Index Hits 1 Year Low

May 25, 2025 -

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 25, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 25, 2025 -

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 25, 2025

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 25, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 25, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 25, 2025 -

Why News Corp Might Be More Valuable Than You Think

May 25, 2025

Why News Corp Might Be More Valuable Than You Think

May 25, 2025

Latest Posts

-

Is Elon Musk Selling His Dogecoin Analyzing Recent Market Trends

May 25, 2025

Is Elon Musk Selling His Dogecoin Analyzing Recent Market Trends

May 25, 2025 -

Ai Driven Podcast Creation A New Approach To Scatological Document Analysis

May 25, 2025

Ai Driven Podcast Creation A New Approach To Scatological Document Analysis

May 25, 2025 -

Elon Musks Dogecoin Stance Whats Next For The Cryptocurrency

May 25, 2025

Elon Musks Dogecoin Stance Whats Next For The Cryptocurrency

May 25, 2025 -

Dogecoins Future Is Elon Musk Really Pulling Out

May 25, 2025

Dogecoins Future Is Elon Musk Really Pulling Out

May 25, 2025 -

The Nvidia Rtx 5060 Performance Controversy And Consumer Protection

May 25, 2025

The Nvidia Rtx 5060 Performance Controversy And Consumer Protection

May 25, 2025