Auto Sector Rebound Fuels European Market Growth; LVMH Stock Suffers

Table of Contents

Auto Sector Recovery in Europe: A Deep Dive

The rebound in the European auto market is a significant development with far-reaching consequences. Several key factors are driving this remarkable recovery.

Increased Consumer Confidence and Spending

Improved economic prospects across much of Europe have boosted consumer confidence, leading to increased spending on big-ticket items like automobiles. This is further fueled by:

- Government Incentives: Many European governments are offering subsidies and tax breaks to encourage the purchase of new vehicles, particularly electric vehicles (EVs), stimulating demand.

- Pent-up Demand: The pandemic suppressed automobile purchases; the subsequent easing of restrictions has unleashed pent-up demand.

- Low-Interest Financing: Attractive financing options, including low-interest loans and leasing deals, are making car ownership more accessible.

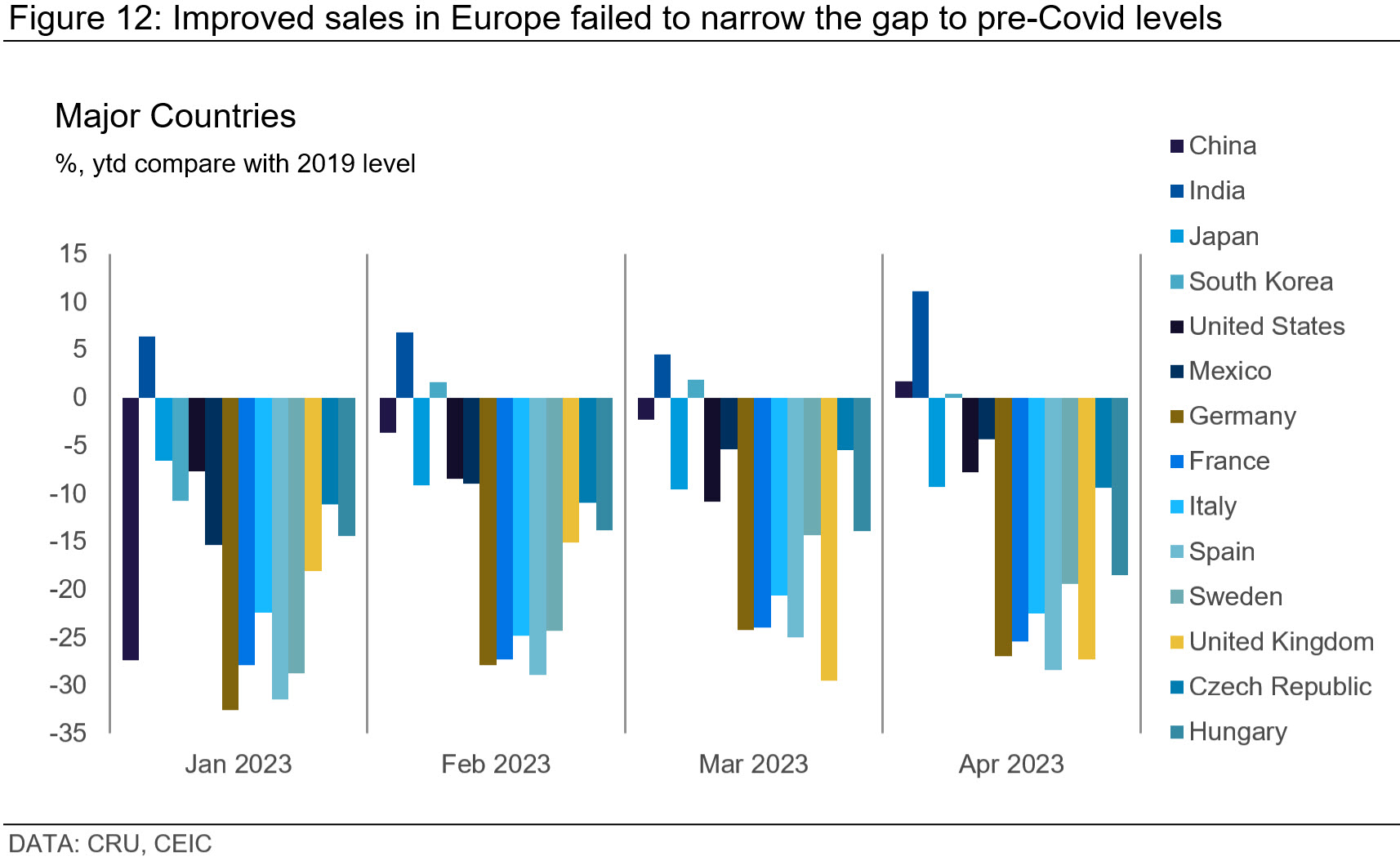

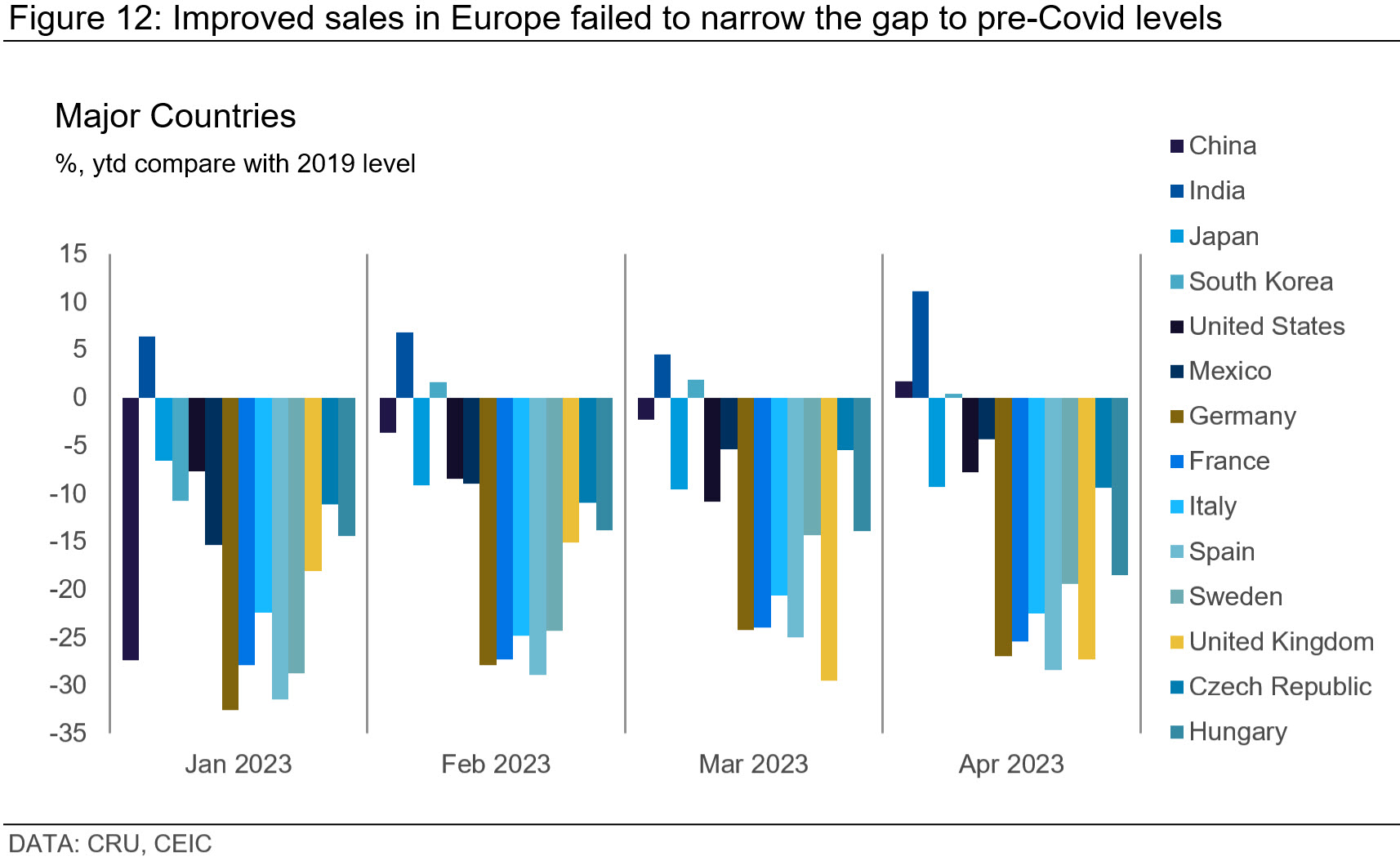

Recent data shows a significant surge in automobile sales across major European markets. For example, Germany, a key player in the European auto industry, reported a 15% year-on-year increase in car registrations in Q3 2023 (hypothetical figure for illustrative purposes).

Supply Chain Improvements

The auto industry was severely hampered by supply chain disruptions, especially semiconductor shortages. However, these constraints are gradually easing:

- Reduced Semiconductor Shortages: Increased production capacity and diversified sourcing strategies among semiconductor manufacturers have alleviated the chip shortage.

- Improved Logistics: Streamlined logistics and improved port operations have facilitated the timely delivery of parts and components.

- Increased Production Capacity: Automakers have ramped up production to meet the rising demand, leading to increased output.

Companies like Volkswagen and Stellantis are reporting significant improvements in production volumes, directly benefiting from these supply chain advancements.

Electrification and Innovation

The shift towards electric vehicles and technological advancements is also fueling growth:

- Growing Demand for EVs: Environmental concerns and government regulations are driving a surge in demand for electric and hybrid vehicles.

- Government Support for EV Adoption: Generous subsidies and charging infrastructure development are further incentivizing EV purchases.

- Investments in New Technologies: Automakers are investing heavily in autonomous driving technologies and advanced driver-assistance systems (ADAS), making vehicles more attractive to consumers.

The introduction of innovative models with enhanced features and improved fuel efficiency is capturing consumer interest, contributing significantly to the positive trajectory of the European auto market.

Impact on European Economic Growth

The auto sector's resurgence has a significant ripple effect throughout the European economy.

Positive Spillover Effects

The recovery is generating substantial positive externalities across related industries:

- Increased Employment: The boost in production has led to increased employment in manufacturing, logistics, and related service sectors.

- Positive Contribution to GDP Growth: The auto sector's robust performance is making a substantial contribution to overall GDP growth in many European countries.

- Increased Tax Revenue: Higher sales and production levels translate into increased tax revenue for governments, providing resources for public spending.

These positive spillover effects are reinforcing economic recovery and overall market growth across the European Union.

Regional Variations

While the auto sector's recovery is widespread, its impact varies across different European regions:

- Comparison of Growth Rates: Countries with strong automotive manufacturing bases, such as Germany and France, are experiencing more pronounced growth compared to others.

- Impact on Specific Regions: Regions heavily reliant on the auto industry, for example, the automotive clusters in Germany’s Lower Saxony or the Auvergne-Rhône-Alpes region in France, are witnessing significant economic benefits.

Analyzing regional variations helps in understanding the nuances of the European market and tailoring specific economic policies.

LVMH Stock Decline: Understanding the Contrasting Trend

While the European auto market flourishes, luxury goods giant LVMH faces headwinds, resulting in a decline in its stock price. This contrast highlights the sector-specific nature of economic fluctuations.

Global Economic Slowdown

Several global economic factors are impacting LVMH's performance:

- Inflationary Pressures: Rising inflation is eroding consumer purchasing power, particularly impacting discretionary spending on luxury goods.

- Rising Interest Rates: Increased interest rates make borrowing more expensive, potentially reducing consumer spending on non-essential items.

- Weakening Consumer Confidence: Global economic uncertainty is dampening consumer confidence, leading to reduced spending on luxury goods.

These global headwinds are creating challenges for LVMH and other companies in the luxury goods sector.

Geopolitical Factors

Geopolitical instability is also playing a role in LVMH's performance:

- Impact of Geopolitical Tensions: The ongoing war in Ukraine and other geopolitical tensions are creating uncertainty in global markets, impacting consumer sentiment and luxury goods demand.

- Shifts in Consumer Spending Patterns: Geopolitical uncertainty can lead to shifts in consumer spending patterns, with consumers potentially prioritizing essential goods over luxury items.

These unpredictable geopolitical events create considerable risk for multinational luxury brands like LVMH.

Competition and Market Saturation

Increased competition and potential market saturation are further challenges for LVMH:

- Emerging Competitors: The emergence of new luxury brands and the rise of direct-to-consumer models are intensifying competition.

- Changes in Consumer Preferences: Shifting consumer preferences and evolving tastes pose challenges for maintaining market share.

- Potential for Oversupply: In some luxury segments, there is a potential for oversupply, leading to price pressure and reduced profitability.

LVMH is actively implementing strategies to counteract these challenges, including product innovation, brand diversification, and strategic acquisitions.

Conclusion: The European Auto Market's Resurgence and LVMH's Challenges – A Look Ahead

The European auto market's strong rebound is a significant positive for the European economy, generating widespread positive spillover effects. However, this positive trend contrasts sharply with the challenges faced by LVMH, highlighting the diverse nature of the European market and the impact of global economic and geopolitical factors. Understanding the interplay between different sectors and the influence of global forces is crucial for navigating the complexities of the European market. To stay ahead of the curve, follow industry news, analyze market trends, and monitor European auto market growth and LVMH stock developments closely. Conduct thorough European Automotive Market Analysis and keep abreast of LVMH Stock Forecast to make informed decisions. Stay informed about the European Market Growth Outlook to capitalize on opportunities and mitigate risks.

Featured Posts

-

Musk Zuckerberg Bezos La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 25, 2025

Musk Zuckerberg Bezos La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 25, 2025 -

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025 -

Dutch Stocks Slump Amidst Escalating Us Trade War

May 25, 2025

Dutch Stocks Slump Amidst Escalating Us Trade War

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Analysis And Insights

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Analysis And Insights

May 25, 2025 -

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025

Latest Posts

-

Dogecoins Future Is Elon Musk Really Pulling Out

May 25, 2025

Dogecoins Future Is Elon Musk Really Pulling Out

May 25, 2025 -

The Nvidia Rtx 5060 Performance Controversy And Consumer Protection

May 25, 2025

The Nvidia Rtx 5060 Performance Controversy And Consumer Protection

May 25, 2025 -

Elon Musk And Dogecoin Is The Relationship Over

May 25, 2025

Elon Musk And Dogecoin Is The Relationship Over

May 25, 2025 -

Nvidias Rtx 5060 A Disappointing Launch And What It Means For The Future

May 25, 2025

Nvidias Rtx 5060 A Disappointing Launch And What It Means For The Future

May 25, 2025 -

Rtx 5060 A Critical Review Of Nvidias Latest Release And Its Fallout

May 25, 2025

Rtx 5060 A Critical Review Of Nvidias Latest Release And Its Fallout

May 25, 2025