Kering's Q1 Results Trigger 6% Share Price Decline

Table of Contents

Disappointing Sales Figures Across Key Brands

Kering's Q1 2024 sales figures revealed a concerning underperformance across several key brands. While precise figures may vary depending on the final report, initial reports indicated a slowdown in growth compared to previous quarters and industry expectations. Let's examine the performance of some key players:

- Gucci: While still a significant revenue generator, Gucci's sales growth reportedly decelerated considerably in Q1, falling short of analysts' predictions. This slowdown might be attributed to several factors, including changing consumer preferences and increased competition.

- Yves Saint Laurent (YSL): YSL also experienced a less-than-stellar performance, indicating a broader trend affecting Kering's portfolio. Further investigation is needed to pinpoint specific contributing factors within this brand.

- Bottega Veneta: Similar to Gucci and YSL, Bottega Veneta's Q1 sales also failed to meet expectations. This suggests a possible broader issue impacting Kering's overall strategy or market positioning.

Sub-points:

- Regional Sales Differences: While some regions might have shown relatively strong performance, others experienced significant drops in sales, highlighting the uneven impact of various factors across different markets. The Asia-Pacific region, traditionally a strong performer for luxury brands, might have faced challenges impacting sales.

- Product Category Performance: Certain product categories within Kering's portfolio may have underperformed, suggesting the need for a reassessment of product strategies and marketing campaigns. For instance, specific handbag lines or ready-to-wear collections might have experienced weaker sales compared to others.

- Comparison to Previous Quarters and Benchmarks: Comparing the Q1 2024 results to the previous year’s Q1 and other recent quarters reveals a clear decline, underscoring the seriousness of the situation and the need for corrective actions. Benchmarking against other luxury players might reveal further insights into the industry-wide factors influencing Kering's performance. Keywords: Gucci sales, Yves Saint Laurent sales, Bottega Veneta sales, regional sales performance, product category performance.

Impact of Macroeconomic Factors

The disappointing Q1 results cannot be attributed solely to internal factors. Several significant macroeconomic challenges significantly impacted Kering's performance:

Sub-points:

- Inflation's Impact on Consumer Spending: Rising inflation globally has reduced consumer disposable income, affecting spending on discretionary luxury goods. This reduced purchasing power is particularly noticeable in the luxury sector, where price sensitivity remains a relevant factor despite brand loyalty.

- Supply Chain Disruptions: Ongoing global supply chain disruptions caused delays in production and delivery, affecting product availability and potentially leading to lost sales opportunities. This includes increased raw material costs and logistical challenges, directly affecting the bottom line.

- Geopolitical Instability: Geopolitical uncertainties, including the ongoing war in Ukraine and other regional conflicts, contribute to market volatility and uncertainty, affecting consumer confidence and investment in the luxury sector. Such instability can also lead to currency fluctuations, impacting sales and profitability. Keywords: Inflation impact, supply chain disruption, geopolitical risk, consumer spending, luxury market trends.

Management's Response and Future Outlook

In response to the disappointing Q1 results, Kering's management has outlined several strategies to address the challenges and improve future performance. These strategies may include:

Sub-points:

- Cost-Cutting Measures: Implementing cost-cutting measures is a common response to financial setbacks. These might include streamlining operations, reducing workforce in certain areas, and optimizing supply chains to enhance efficiency.

- Strategic Investments: While implementing cost-cutting measures, the company might also announce strategic investments in new product development, marketing campaigns, or digital initiatives to reinvigorate the brand and attract new customer segments.

- Revised Financial Guidance: Kering is likely to revise its financial guidance for the year, taking into account the weaker-than-expected Q1 performance. This revised guidance will offer a clearer outlook on the company's projected performance for the remainder of the year.

- Marketing and Product Strategy Adjustments: Kering may adjust its marketing and product strategies to better cater to changing consumer preferences and market demands. This may involve launching new product lines, rebranding existing ones, or adopting new marketing approaches. Keywords: Kering strategy, financial guidance, cost-cutting measures, marketing strategy, product strategy.

Investor Sentiment and Market Reaction

The 6% share price drop is only one aspect of the market's reaction to Kering's Q1 results. The overall investor sentiment is likely cautious, reflecting concerns about the company's near-term prospects:

- Analyst Ratings: Analyst ratings for Kering's stock might have been downgraded following the disappointing Q1 results, further dampening investor confidence.

- Investor Confidence: Overall investor confidence in Kering's future performance has likely decreased, leading to potential sell-offs and impacting the share price volatility.

- Stock Trading Volume: The volume of Kering's stock traded might have increased significantly following the release of the Q1 results, indicating heightened market activity and investor response to the news. Keywords: Investor confidence, stock market reaction, analyst ratings, share price volatility.

Conclusion

Kering's disappointing Q1 results, marked by a 6% share price decline, highlight a combination of internal challenges and external headwinds impacting the luxury goods market. Understanding the factors contributing to this underperformance—from weak sales across key brands to the influence of macroeconomic factors—is crucial for assessing the company's future trajectory. Kering's management response, including potential cost-cutting measures and strategic investments, will be vital in determining its ability to navigate these challenges. Stay informed about future developments in the luxury market and Kering's performance by following [link to relevant source/website/your site]. Monitor the Kering share price and analyze upcoming Q2 results for a clearer picture of the company's trajectory. Keywords: Kering Q1 results analysis, luxury market outlook, Kering share price forecast, upcoming Q2 results.

Featured Posts

-

Kapitaalmarktrentes Toekomstperspectief Voor De Euro En De Markt

May 25, 2025

Kapitaalmarktrentes Toekomstperspectief Voor De Euro En De Markt

May 25, 2025 -

2025 Memorial Day Travel Finding The Least Crowded Flights

May 25, 2025

2025 Memorial Day Travel Finding The Least Crowded Flights

May 25, 2025 -

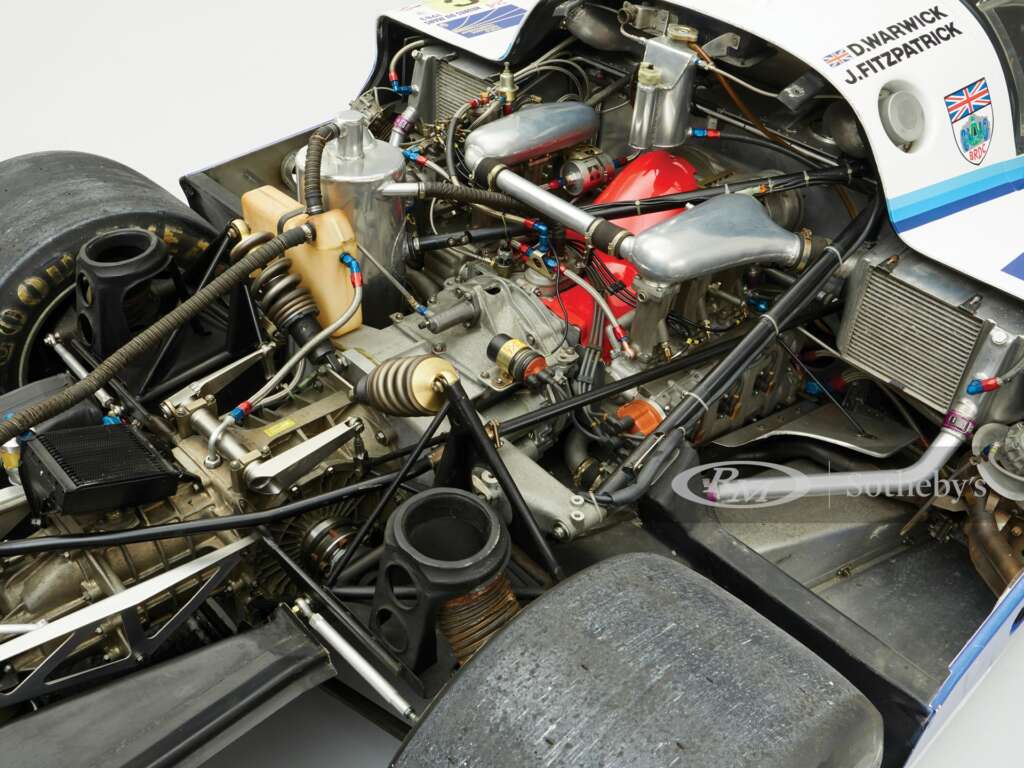

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025 -

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 25, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 25, 2025 -

Woody Allen Sexual Abuse Accusations Reignited Following Sean Penns Backing

May 25, 2025

Woody Allen Sexual Abuse Accusations Reignited Following Sean Penns Backing

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025