Understanding Network18 Media & Investments Stock Performance: April 21, 2025

Table of Contents

Analyzing Network18 Media & Investments' Financial Performance (Q4 2025)

Understanding Network18 Media & Investments' financial health is paramount to assessing its stock performance. Analyzing the company's Q4 2025 results provides valuable insights into its recent trajectory.

Revenue & Earnings Growth

Network18's revenue streams are multifaceted, including advertising revenue, subscription fees, and other income sources. Analyzing the growth (or decline) of these segments compared to previous quarters and the same period last year provides a comprehensive view of the company's financial performance.

- Advertising Revenue: Let's assume, for illustrative purposes, that Q4 2025 advertising revenue saw a 15% increase compared to Q4 2024, reaching ₹X billion. This growth could be attributed to factors like successful ad sales strategies, increased viewership across its TV channels, and a robust digital advertising market.

- Subscription Revenue: Suppose subscription revenue for its various digital platforms experienced a more modest 8% growth, reaching ₹Y billion. This might indicate challenges in attracting new subscribers or competition in the streaming market.

- Overall Revenue Growth: Combining these figures and other income streams, let's assume a total revenue growth of 12% for Q4 2025 compared to Q4 2024. This represents a positive trend, though further investigation into specific revenue streams is crucial.

- Earnings Per Share (EPS): Assuming the company's EPS for Q4 2025 shows a significant improvement compared to the previous quarter, this further strengthens the positive picture of its financial performance, indicating increased profitability. A detailed breakdown of the financial statements is needed for a conclusive assessment.

Debt and Liquidity

Assessing Network18's debt levels and liquidity position is vital to understanding its long-term financial stability and its capacity to weather economic downturns.

- Debt-to-Equity Ratio: A lower debt-to-equity ratio suggests a healthier financial position and lower risk. This ratio needs to be analyzed in detail to determine the company's leverage.

- Current Ratio: A higher current ratio signifies better short-term liquidity, indicating the ability to meet its immediate obligations.

- Cash Flow Analysis: Examining Network18's operating cash flow, investing cash flow, and financing cash flow provides critical insights into its cash management capabilities and overall financial health. A strong positive cash flow generally suggests a healthy and sustainable business.

Impact of Market Trends on Network18 Media & Investments Stock

The performance of Network18 Media & Investments stock is not solely dependent on its internal financial performance. Broader market trends and the media sector's overall performance play significant roles.

Broader Market Conditions

Macroeconomic factors significantly influence stock market movements.

- Correlation with SENSEX and NIFTY: The correlation between Network18's stock price and major Indian market indices like SENSEX and NIFTY needs careful examination. A strong positive correlation suggests that the stock's performance mirrors overall market trends.

- Impact of Global Events: Global economic events, interest rate changes, and geopolitical instability can all indirectly impact Network18's stock price.

Media Sector Performance

The competitive landscape and broader trends within the media and entertainment sector greatly influence Network18's stock performance.

- Competitor Stock Performance: Comparing Network18's performance with its competitors in the Indian media landscape helps assess its relative strength and position within the market.

- Digital Disruption and Advertising Revenue Shifts: The shift towards digital media consumption presents both challenges and opportunities. The company's ability to adapt to these shifts will impact its future performance.

- Regulatory Changes: Any changes in media regulations can significantly affect the company's operations and stock valuation.

Future Outlook and Investment Implications for Network18 Media & Investments Stock

Predicting the future is inherently uncertain, but analyzing Network18's growth prospects and potential risks is essential for informed investment decisions.

Growth Prospects

Network18's strategic initiatives and future plans will significantly influence its future growth potential.

- New Ventures and Expansion Plans: Any diversification into new media segments or expansion into new markets can significantly impact the company's growth trajectory.

- Technological Investments: Investments in digital technologies and platforms are crucial for long-term growth and competitiveness. The company's success in this area is a significant factor.

- Potential Acquisitions: Strategic acquisitions can enhance the company's market position and revenue streams.

Investment Recommendation

Based on the above analysis (and remembering this is not financial advice), investing in Network18 Media & Investments stock presents a mix of opportunities and risks. Investors need to consider their own risk tolerance and investment goals.

- Potential Upside: The company's strong brand presence, diverse portfolio, and potential for growth in the digital media space present a significant upside potential.

- Downside Risks: Competition, regulatory changes, and macroeconomic instability represent potential downside risks.

Conclusion

Network18 Media & Investments stock performance as of April 21, 2025, is a complex interplay of internal financial health and external market forces. While the company shows positive signs in some areas, a thorough understanding of its financial performance, the broader media landscape, and its future strategic initiatives is crucial for making informed investment decisions. Investors should conduct their own in-depth due diligence before making any investment in Network18 Media & Investments stock. Stay informed on Network18 Media & Investments stock performance by regularly checking reliable financial news sources and conducting your own thorough analysis. Following the company's official announcements and financial reports will also provide valuable insights. Remember to always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

From The Closet To The Pitch Josh Cavallos Inspirational Story

May 17, 2025

From The Closet To The Pitch Josh Cavallos Inspirational Story

May 17, 2025 -

Canadas New Tariffs On Us Goods Near Zero Rates With Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Near Zero Rates With Key Exemptions

May 17, 2025 -

Analyzing Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025

Analyzing Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025 -

Controversial Foul Call Pistons Bitter Game 4 Defeat

May 17, 2025

Controversial Foul Call Pistons Bitter Game 4 Defeat

May 17, 2025 -

Rossiya Ukreplyaet Pozitsii V Ekonomike Uzbekistana

May 17, 2025

Rossiya Ukreplyaet Pozitsii V Ekonomike Uzbekistana

May 17, 2025

Latest Posts

-

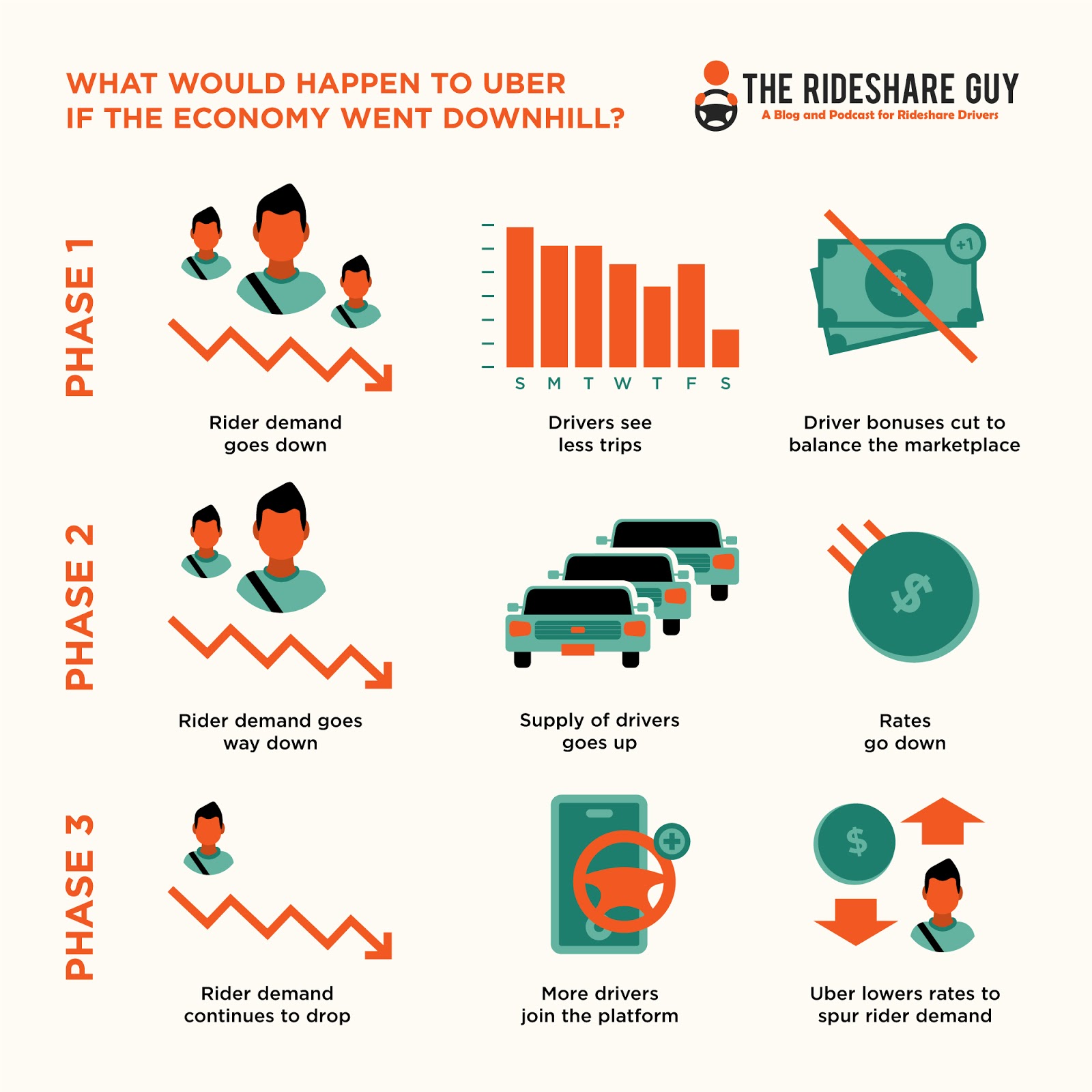

Examining Ubers Stock Its Potential During A Recession

May 17, 2025

Examining Ubers Stock Its Potential During A Recession

May 17, 2025 -

Uber Stock And Recessions What Analysts Are Saying

May 17, 2025

Uber Stock And Recessions What Analysts Are Saying

May 17, 2025 -

Investors Guide Understanding Uber Stocks Recessionary Behavior

May 17, 2025

Investors Guide Understanding Uber Stocks Recessionary Behavior

May 17, 2025 -

Analyzing Ubers Stock Performance During Economic Slowdowns

May 17, 2025

Analyzing Ubers Stock Performance During Economic Slowdowns

May 17, 2025 -

Can Uber Stock Survive A Recession Expert Opinions

May 17, 2025

Can Uber Stock Survive A Recession Expert Opinions

May 17, 2025