Investor's Guide: Understanding Uber Stock's Recessionary Behavior

Table of Contents

Uber's Business Model and Recessionary Vulnerability

Uber's business model, built on providing on-demand transportation and food delivery services, inherently possesses vulnerabilities during economic downturns. Its susceptibility stems primarily from the discretionary nature of its services.

Demand Elasticity and Discretionary Spending

Uber's services are considered discretionary spending. This means that during a recession, when consumers cut back on non-essential expenses, demand for Uber rides and Uber Eats deliveries typically decreases.

- Reduced ridership during recessions: People may opt for cheaper alternatives like public transportation or carpooling.

- Impact on Uber Eats orders: Consumers might cook more at home or choose cheaper dining options, reducing food delivery demand.

- Correlation between unemployment rates and Uber usage: Higher unemployment rates directly correlate with decreased disposable income, impacting Uber's overall usage.

The concept of price elasticity of demand is highly relevant here. While Uber might adjust pricing to stimulate demand, the overall impact of reduced disposable income significantly affects its revenue streams. Furthermore, increased competition from other ride-sharing and food delivery services intensifies the pressure during economic hardship.

Impact on Driver Supply and Earnings

Economic downturns also affect the supply side of Uber's equation. As economic conditions worsen:

- Drivers seeking alternative employment: Drivers may seek more stable employment opportunities with guaranteed income, reducing the overall driver pool available for Uber.

- Potential for reduced driver income impacting service availability: Lower demand translates to fewer rides and deliveries, leading to lower earnings for drivers, potentially encouraging them to leave the platform.

- Increased competition from other gig economy platforms: Drivers may switch to competing platforms offering potentially better incentives or more consistent work.

This decrease in driver supply can directly impact Uber's operational efficiency and its ability to meet customer demand, further exacerbating the challenges during a recession.

Analyzing Uber's Historical Performance During Recessions

Examining Uber's historical performance during previous recessions provides valuable insights into its resilience and vulnerability.

Past Recessionary Data

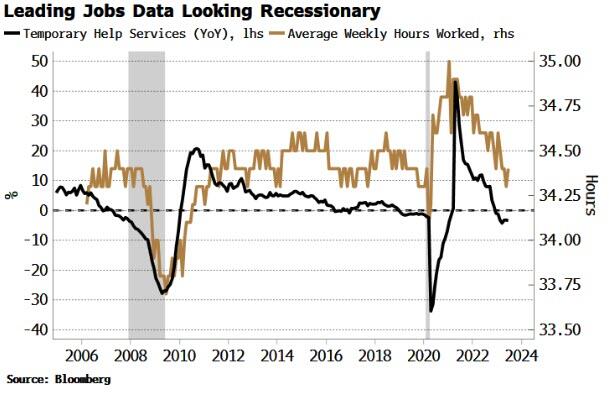

Analyzing Uber's stock performance and financial reports from previous economic downturns is crucial. While Uber is a relatively new public company, we can still glean insights by looking at its performance since its IPO and comparing it to overall market trends during periods of economic contraction.

- Stock price fluctuations: Historically, Uber's stock price has shown volatility during periods of economic uncertainty. Analyzing the magnitude and duration of these fluctuations can provide valuable insights.

- Revenue changes: Tracking revenue growth during previous recessions reveals the sensitivity of Uber's business model to economic downturns.

- Profit margins: Monitoring profit margins helps assess Uber's ability to maintain profitability despite decreased demand and increased operational challenges.

- Impact of government stimulus packages on Uber's business: Government interventions, such as stimulus packages, can influence consumer spending and consequently Uber's performance. Understanding this influence is vital for forecasting future behavior.

(Note: This section would ideally include charts and graphs visualizing Uber's historical performance data during previous economic downturns.)

Key Financial Indicators to Monitor

Investors should carefully track specific financial indicators to effectively gauge Uber's resilience during a recession. These include:

- Revenue growth: A consistent positive revenue growth, even during economic slowdowns, would indicate stronger resilience.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This metric provides a clearer picture of Uber's operational profitability.

- Free cash flow: Positive free cash flow demonstrates Uber's ability to generate cash after covering its operational expenses.

- User engagement metrics (rides per user, etc.): These indicate the level of customer loyalty and usage patterns.

- Driver acquisition and retention rates: These metrics highlight the platform's ability to attract and retain drivers, impacting operational capacity.

Strategies for Investing in Uber Stock During a Recession

Investing in Uber stock during a recession requires a carefully crafted strategy that balances potential rewards with inherent risks.

Risk Assessment and Diversification

Effective risk management is paramount.

- Assessing the level of risk associated with Uber stock: Uber stock carries a higher risk profile compared to more established, recession-resistant companies.

- The role of diversification in minimizing potential losses: Diversifying your investment portfolio across different asset classes mitigates the impact of potential losses in any single investment.

- Identifying other investment opportunities: Explore alternative investment options to balance the risk associated with Uber stock.

Long-Term vs. Short-Term Investment Strategies

The approach to investing in Uber stock during a recession can be tailored to different time horizons.

- Advantages and disadvantages of long-term holding versus short-term trading: Long-term investors benefit from potential long-term growth, while short-term traders aim for quick profits but face higher volatility risks.

- Consideration of personal financial goals: Your investment strategy should align with your individual financial goals and risk tolerance.

- Understanding market timing challenges: Accurately predicting market movements is difficult, making it crucial to develop a long-term strategy.

Alternative Investment Options

Consider diversifying your portfolio with alternative investments known for greater recession resistance.

- Examples of recession-resistant stocks or asset classes: Examples include consumer staples, healthcare, and utility companies. Also consider government bonds or precious metals.

- Emphasizing the importance of a well-balanced portfolio: A balanced portfolio effectively reduces overall risk while pursuing long-term growth.

Conclusion

Understanding Uber stock's recessionary behavior requires a comprehensive assessment of its business model, its historical performance during economic downturns, and the effective management of investment risks. Factors like demand elasticity, driver supply, and key financial indicators significantly influence its resilience during recessions. While Uber presents exciting growth potential, it's crucial to remember that it's not a recession-proof investment.

Call to Action: While understanding Uber stock's recessionary behavior is crucial for informed investment decisions, remember to conduct thorough due diligence before investing. Develop your own comprehensive investment strategy to successfully navigate the complexities of investing in Uber stock during economic downturns. Learn more about mitigating risks when investing in Uber stock and building a diversified portfolio that aligns with your financial goals.

Featured Posts

-

Moto News Gncc Mx Sx Flat Track And Enduro Racing Updates

May 17, 2025

Moto News Gncc Mx Sx Flat Track And Enduro Racing Updates

May 17, 2025 -

The Problem Of False Angel Reese Quotes Circulating On Social Media

May 17, 2025

The Problem Of False Angel Reese Quotes Circulating On Social Media

May 17, 2025 -

Car Drives Into Crowd Near Barcelona Football Stadium 13 Injured

May 17, 2025

Car Drives Into Crowd Near Barcelona Football Stadium 13 Injured

May 17, 2025 -

Fortnite Item Shop The Return Of Highly Demanded Skins 1000 Days

May 17, 2025

Fortnite Item Shop The Return Of Highly Demanded Skins 1000 Days

May 17, 2025 -

Trumps Relationships With Arab Leaders A Look At His Bromances

May 17, 2025

Trumps Relationships With Arab Leaders A Look At His Bromances

May 17, 2025

Latest Posts

-

Detroit Pistons Vs New York Knicks Comparing Roster Strength And Play Styles

May 17, 2025

Detroit Pistons Vs New York Knicks Comparing Roster Strength And Play Styles

May 17, 2025 -

Analyzing The Detroit Pistons And New York Knicks Key Differences And Potential Success

May 17, 2025

Analyzing The Detroit Pistons And New York Knicks Key Differences And Potential Success

May 17, 2025 -

Pistons Vs Knicks Predicting The 2023 2024 Season Outcome

May 17, 2025

Pistons Vs Knicks Predicting The 2023 2024 Season Outcome

May 17, 2025 -

27 Puntos De Anunoby Impulsan Victoria De Knicks Sobre 76ers

May 17, 2025

27 Puntos De Anunoby Impulsan Victoria De Knicks Sobre 76ers

May 17, 2025 -

Octava Derrota Consecutiva De Los Sixers Anunoby Anota 27 Ante Knicks

May 17, 2025

Octava Derrota Consecutiva De Los Sixers Anunoby Anota 27 Ante Knicks

May 17, 2025