Examining Uber's Stock: Its Potential During A Recession

Table of Contents

Uber's Business Model and Recessionary Trends

Uber operates a dual-sided marketplace connecting riders with drivers, creating a dynamic and adaptable system. This core business is further diversified through Uber Eats, its food delivery service, and other transportation options, offering a degree of resilience against economic shocks. While historical data on Uber's performance during previous major recessions is limited, we can analyze its inherent strengths and vulnerabilities within a recessionary context.

- Increased price sensitivity among riders: During a recession, consumers become more price-conscious. This could lead to a decrease in demand for premium ride options and an increase in demand for cheaper alternatives.

- Potential for decreased driver supply: Economic hardship might cause some drivers to reduce their working hours or leave the platform altogether, impacting Uber's ability to meet rider demand.

- Increased demand for cost-effective transportation and delivery options: Conversely, the need for affordable transportation and food delivery may increase, potentially offsetting some of the negative impacts of reduced discretionary spending.

- Potential for increased marketing to attract cost-conscious customers: Uber may need to adapt its marketing strategies to target budget-minded consumers, emphasizing value propositions and promotions.

Analyzing Uber's Financial Health and Stability

Assessing Uber's financial health is crucial to understanding its recessionary potential. Key financial metrics like revenue, profitability, and debt levels provide critical insights into its resilience. The company's cash reserves and ability to manage expenses during a downturn will play a significant role in its survival.

- Current debt-to-equity ratio: A high debt-to-equity ratio could increase vulnerability during a recession, as servicing debt becomes more challenging in a tighter credit market.

- Recent profitability trends and projections: Consistent profitability, or a demonstrable path towards profitability, indicates a stronger ability to withstand economic pressure.

- Capital expenditure plans: Aggressive capital expenditures during a downturn could strain resources, while strategic investments could position the company for growth after the recession.

- Impact of rising interest rates on Uber's financing: Higher interest rates increase borrowing costs, potentially impacting Uber's profitability and financial flexibility.

Demand Elasticity and the Uber Platform During a Recession

Demand elasticity, the responsiveness of demand to price changes, is critical in analyzing Uber's resilience. Ride-sharing services are generally considered discretionary rather than essential, meaning demand is more sensitive to economic fluctuations.

- Impact of reduced discretionary spending on ride-hailing demand: As disposable income decreases, consumers may reduce non-essential spending, including ride-hailing services.

- Potential increase in demand for budget-friendly ride options: This could lead to a shift towards cheaper options within the Uber platform.

- Shift in demand from premium services to economy options: Consumers may opt for cheaper rides to save money.

- Potential for increased usage by individuals seeking gig work: Conversely, a recession might lead to an increase in individuals seeking supplemental income through driving for Uber.

Competitive Landscape and Market Share

Uber faces intense competition within both the ride-sharing and food delivery markets. This competition could intensify during a recession, leading to price wars and market consolidation.

- Key competitors and their strengths/weaknesses: Analyzing the financial health and strategies of competitors like Lyft and DoorDash is essential for understanding Uber's relative position.

- Potential for mergers or acquisitions: Recessions can spur consolidation as weaker companies are acquired by stronger players.

- Strategies to gain a competitive edge during a downturn: Uber might employ cost-cutting measures, strategic partnerships, or aggressive marketing campaigns to maintain market share.

Investing in Uber Stock During Uncertain Times

Uber's potential during a recession presents a complex picture. While the inherent flexibility of its business model and diversification offer some resilience, challenges related to demand elasticity and competitive pressures remain. Its financial health and strategic responses will be crucial determinants of its success. The opportunities and challenges are substantial, making it imperative to conduct thorough research and analysis before making any investment decisions.

Conduct thorough due diligence and consider the factors discussed before making any decisions regarding Uber's stock during this uncertain economic period. For further information, consult reputable financial resources and seek professional investment advice.

Featured Posts

-

Kendrick Perkins Wants Jalen Brunson To End His Podcast

May 17, 2025

Kendrick Perkins Wants Jalen Brunson To End His Podcast

May 17, 2025 -

Reakcije Na Prosvjed U Teslinom Izlozbenom Prostoru U Berlinu

May 17, 2025

Reakcije Na Prosvjed U Teslinom Izlozbenom Prostoru U Berlinu

May 17, 2025 -

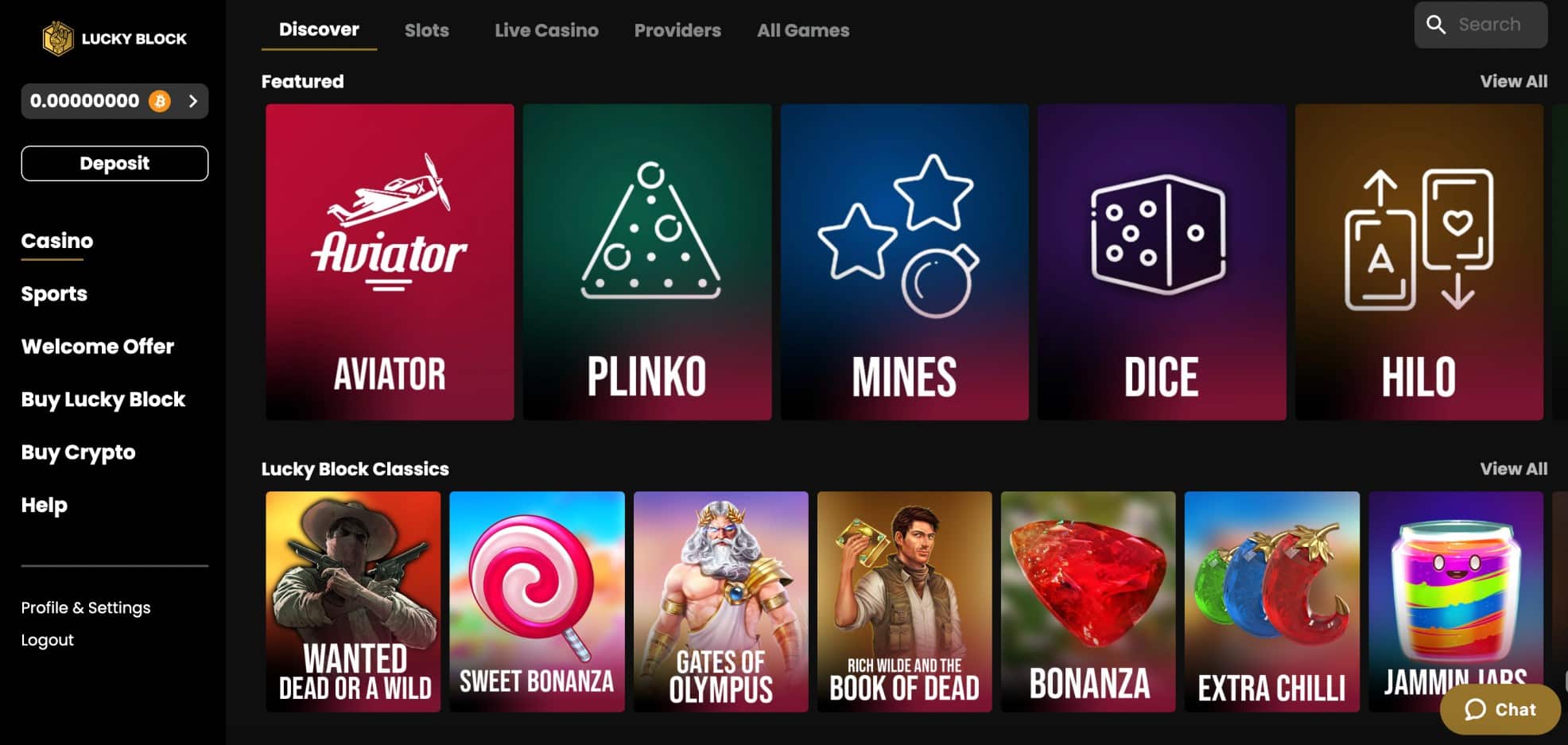

Canadas Top Online Casinos 2025 7 Bit Casino Among The Best

May 17, 2025

Canadas Top Online Casinos 2025 7 Bit Casino Among The Best

May 17, 2025 -

Replacing Stake The Best Casino Alternatives For 2025

May 17, 2025

Replacing Stake The Best Casino Alternatives For 2025

May 17, 2025 -

Should I Refinance My Federal Student Loans Factors To Consider

May 17, 2025

Should I Refinance My Federal Student Loans Factors To Consider

May 17, 2025

Latest Posts

-

Knicks Overtime Heartbreak Did Their Worst Fears Come True

May 17, 2025

Knicks Overtime Heartbreak Did Their Worst Fears Come True

May 17, 2025 -

Jalen Brunson Injury Update Expected Back In Action Sunday

May 17, 2025

Jalen Brunson Injury Update Expected Back In Action Sunday

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers For Wednesday

May 17, 2025

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers For Wednesday

May 17, 2025 -

Dallas Mavericks Jalen Brunsons Free Agency And The Luka Doncic Trade Conundrum

May 17, 2025

Dallas Mavericks Jalen Brunsons Free Agency And The Luka Doncic Trade Conundrum

May 17, 2025 -

Brunsons Absence The Knicks Critical Vulnerability Revealed

May 17, 2025

Brunsons Absence The Knicks Critical Vulnerability Revealed

May 17, 2025