Can Uber Stock Survive A Recession? Expert Opinions

Table of Contents

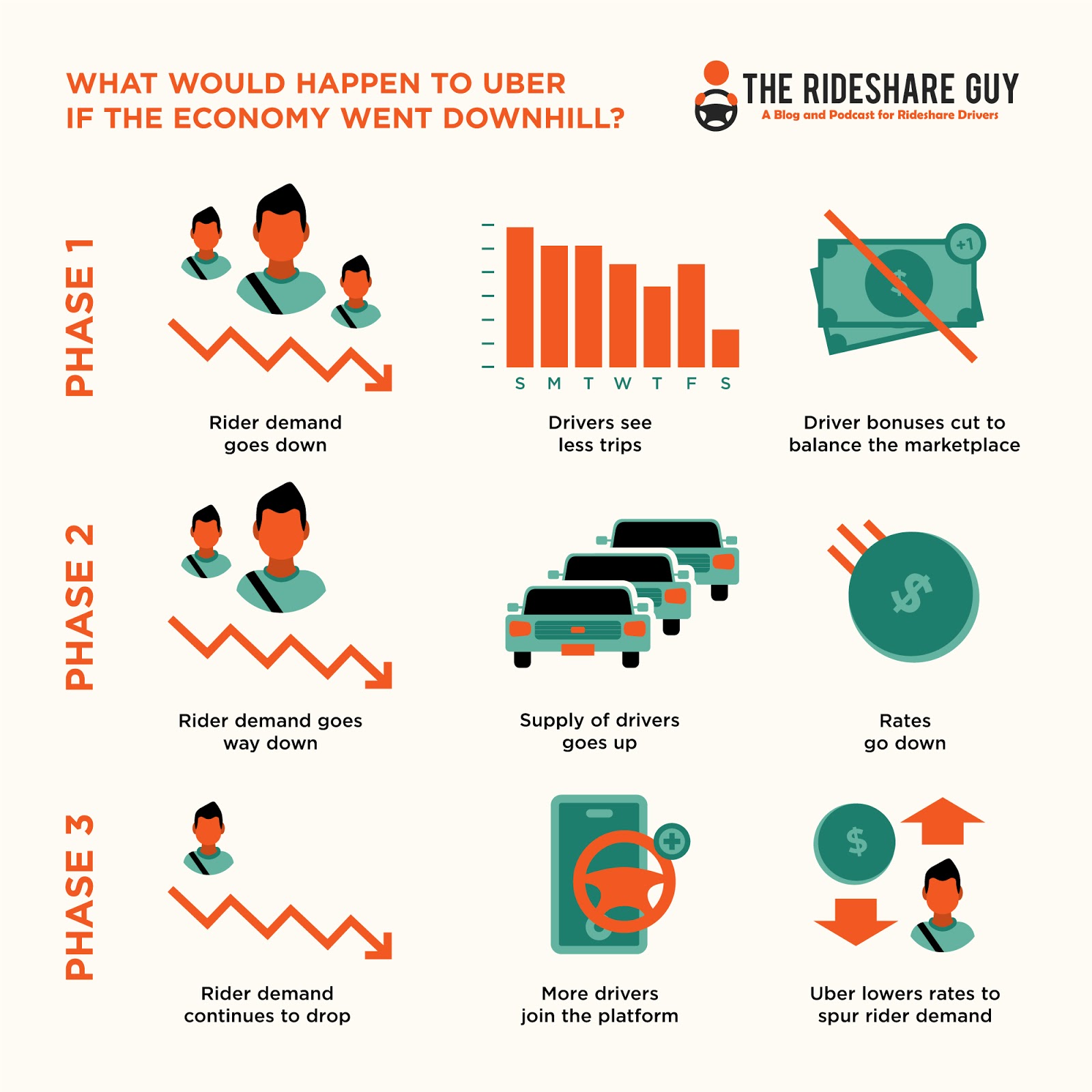

Uber's Business Model and Recession Resilience

Uber's business model, while seemingly reliant on discretionary spending, possesses some inherent resilience to economic downturns. However, the degree of that resilience is a matter of ongoing debate amongst financial analysts and investors.

Demand Elasticity in Transportation

Ride-sharing services like Uber aren't purely discretionary. While leisure travel might decrease during a recession, essential travel – commuting to work, doctor's appointments, airport transfers – remains relatively stable. However, the type of ride might change.

- Factors influencing demand: Job losses directly impact commuting needs. Reduced discretionary income may lead to a shift from premium ride options to cheaper alternatives. Increased unemployment benefits might offset some demand reduction.

- Mitigation strategies: Uber could adjust pricing dynamically, offering discounts and promotions to maintain volume during slower periods. They could also focus marketing on essential travel needs rather than leisure trips. A greater emphasis on cost control and operational efficiency would be crucial.

Diversification and Revenue Streams

Uber's expansion beyond ride-sharing into food delivery (Uber Eats), freight transportation (Uber Freight), and other services significantly diversifies its revenue streams. This diversification offers a buffer against economic shocks.

- Comparative recession-resistance: Uber Eats, while still discretionary, may experience less dramatic drops than ride-sharing during a recession, as people still order food even when cutting back on other expenses. Uber Freight, transporting goods, is generally less sensitive to economic fluctuations than passenger transportation.

- Synergies: Uber can leverage its existing network and driver base to cross-promote services. For example, a driver waiting for a ride-sharing request could simultaneously accept food delivery orders through Uber Eats.

Macroeconomic Factors Impacting Uber Stock

Macroeconomic forces play a significant role in Uber's performance and its stock's value. Understanding these forces is essential for assessing its recession-proofing capabilities.

Interest Rate Hikes and Inflation

Rising interest rates and inflation significantly impact Uber's operational costs and investor sentiment.

- Impact on costs: Higher interest rates increase borrowing costs, affecting Uber's expansion plans and debt servicing. Inflation drives up fuel prices, labor costs, and the cost of vehicle maintenance, squeezing profit margins.

- Investor sentiment: During economic uncertainty, investors tend to shift towards safer assets, potentially leading to a sell-off in higher-risk stocks like Uber's. This shift can influence the stock price regardless of Uber's underlying financial performance.

Consumer Spending and Discretionary Income

Consumer spending directly correlates with Uber's revenue. Changes in consumer confidence significantly influence the demand for ride-sharing services.

- Historical data: Analyzing Uber's performance during previous economic downturns can offer valuable insights into its resilience. This analysis should consider the specific nature of those downturns and Uber's position at the time.

- Changing consumer behavior: A shift in consumer preferences towards cheaper alternatives or increased use of public transportation could negatively impact Uber's market share during a recession.

Expert Opinions and Market Analysis

Predicting the future of Uber stock during a recession involves analyzing various expert opinions and conducting thorough market research.

Bullish vs. Bearish Perspectives

Financial analysts hold differing views on Uber's recession resilience.

- Bullish perspectives: Some analysts highlight Uber's diversification, potential for cost-cutting, and the essential nature of some of its services as reasons for optimism. They may point to Uber's historical performance during previous economic slowdowns. (Source needed)

- Bearish perspectives: Other analysts emphasize the sensitivity of ride-sharing to economic downturns, the impact of rising costs, and the competitive landscape as reasons for concern. (Source needed)

Valuation and Stock Price Predictions

Assessing Uber's valuation and analyzing stock price predictions from reputable financial institutions provides further insight.

- Valuation metrics: Examining key metrics like the Price-to-Earnings (P/E) ratio and other relevant financial ratios helps to determine if the stock is overvalued or undervalued.

- Analyst predictions: Numerous financial institutions provide stock price predictions, often including scenarios for different economic conditions. These predictions should be considered alongside other factors before making any investment decisions. (Source needed)

Investing in Uber Stock During Uncertain Times - A Final Verdict

Can Uber stock survive a recession? The answer remains nuanced. While Uber's diversification provides a degree of insulation against economic shocks, its reliance on discretionary spending and sensitivity to macroeconomic factors remain significant concerns. The impact of interest rate hikes, inflation, and changes in consumer behavior will be crucial in determining Uber's performance during a downturn.

Key takeaways: The future of Uber stock hinges on a combination of factors: its ability to adapt its business model to changing economic conditions, its success in managing operational costs amidst inflation, and the overall strength of the economy. The level of diversification and the resilience of each segment play a crucial role.

Call to action: Investing in any stock involves risk. Before making any investment decisions regarding Uber stock or other investments during a potential recession, conduct thorough research and consider your personal risk tolerance and financial goals. Learn more about the risks and rewards of investing in Uber stock during a potential recession to make informed decisions regarding your Uber stock investment during this period of economic uncertainty.

Featured Posts

-

Seattle Mariners Vs Detroit Tigers Key Injuries And Series Outlook March 31 April 2

May 17, 2025

Seattle Mariners Vs Detroit Tigers Key Injuries And Series Outlook March 31 April 2

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitukset Laskussa Vuoden Alussa

May 17, 2025

Elaekeyhtioeiden Osakesijoitukset Laskussa Vuoden Alussa

May 17, 2025 -

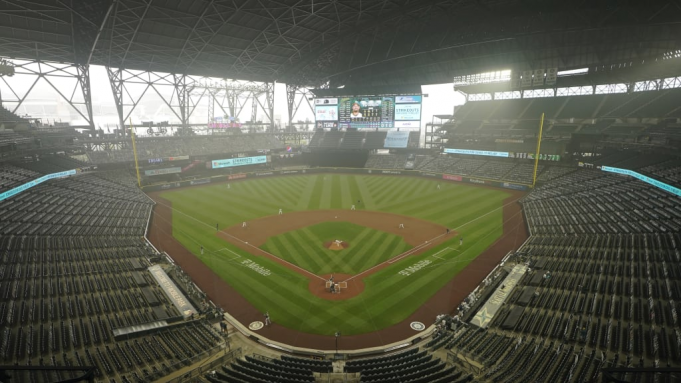

Fortnites Item Shop Update A Disappointment For Fans

May 17, 2025

Fortnites Item Shop Update A Disappointment For Fans

May 17, 2025 -

New York Daily News Historical Archives May 2025

May 17, 2025

New York Daily News Historical Archives May 2025

May 17, 2025 -

Exclusive Rfk Jr S Hhs Proposal To End Routine Covid 19 Vaccination For Children And Pregnant Women

May 17, 2025

Exclusive Rfk Jr S Hhs Proposal To End Routine Covid 19 Vaccination For Children And Pregnant Women

May 17, 2025

Latest Posts

-

Ancaman Rudal Houthi Dubai Dan Abu Dhabi Dalam Bahaya

May 17, 2025

Ancaman Rudal Houthi Dubai Dan Abu Dhabi Dalam Bahaya

May 17, 2025 -

Analyzing Proxy Statements Form Def 14 A Tips And Strategies

May 17, 2025

Analyzing Proxy Statements Form Def 14 A Tips And Strategies

May 17, 2025 -

Peringatan Houthi Ancaman Rudal Memicu Ketegangan Di Teluk

May 17, 2025

Peringatan Houthi Ancaman Rudal Memicu Ketegangan Di Teluk

May 17, 2025 -

Decoding The Proxy Statement Form Def 14 A A Practical Overview

May 17, 2025

Decoding The Proxy Statement Form Def 14 A A Practical Overview

May 17, 2025 -

Houthi Yaman Ancaman Rudal Baru Sasar Dubai Dan Abu Dhabi

May 17, 2025

Houthi Yaman Ancaman Rudal Baru Sasar Dubai Dan Abu Dhabi

May 17, 2025