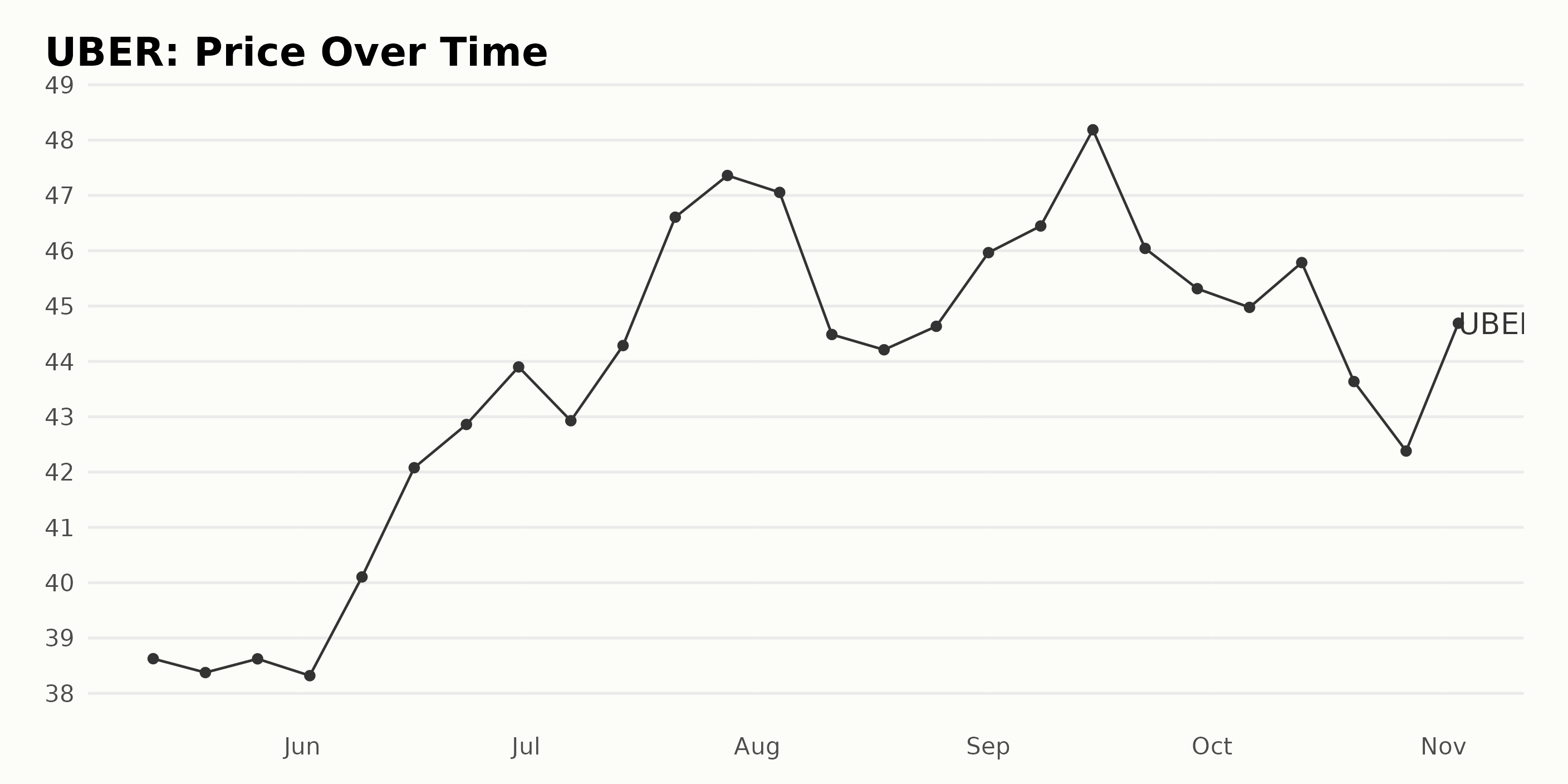

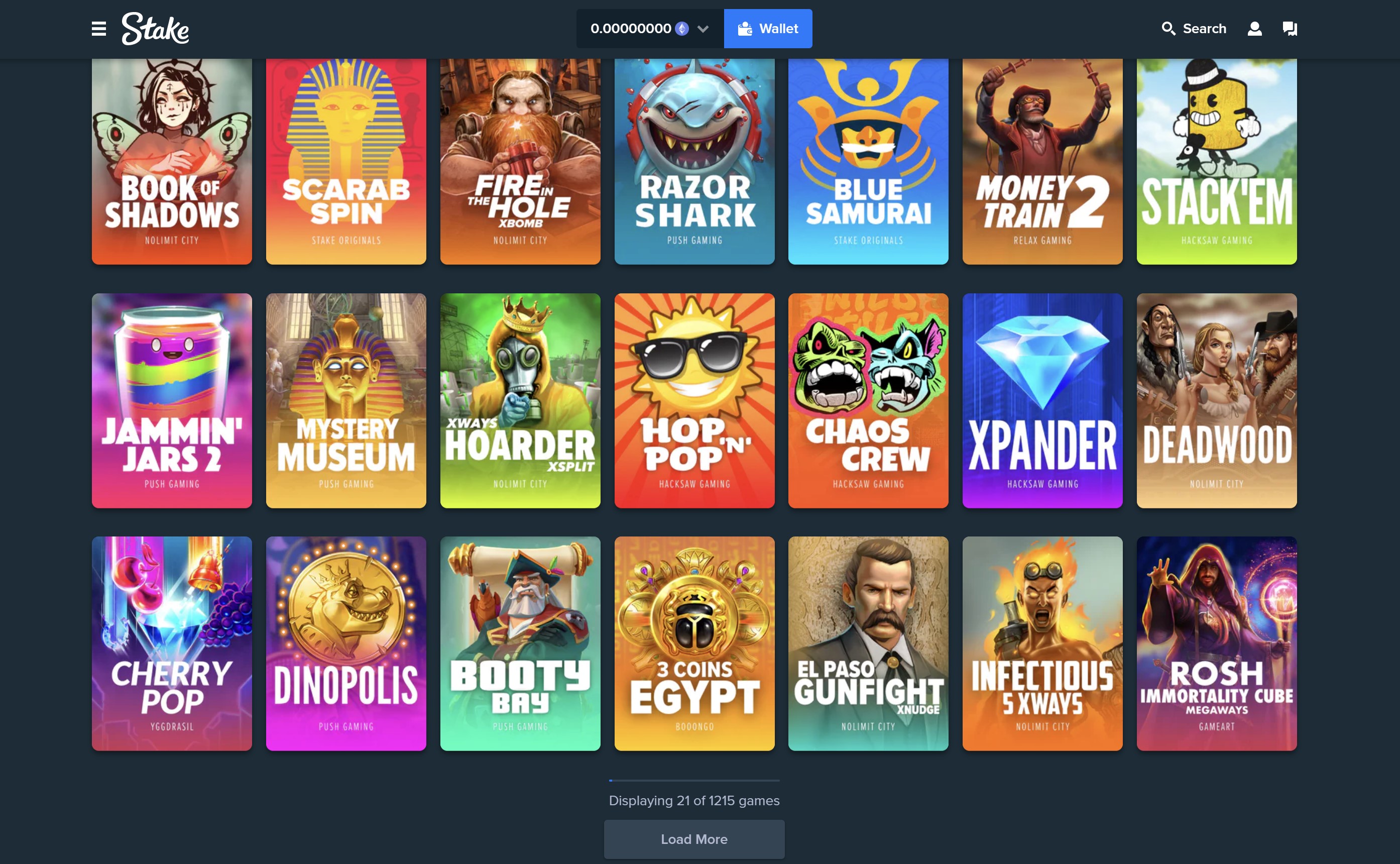

Analyzing Uber's Stock Performance During Economic Slowdowns

Table of Contents

Historical Performance of Uber Stock During Recessions

The 2008 Financial Crisis and its Impact on Uber (pre-IPO):

While Uber wasn't publicly traded during the 2008 financial crisis, its early growth trajectory was undoubtedly affected by the economic downturn. The recession presented challenges such as:

- Increased competition: Existing taxi services and nascent competitors fought for a shrinking market of discretionary spending on transportation.

- Funding challenges: Securing venture capital funding became more difficult as investors adopted a more risk-averse approach.

- Adjusting to economic hardship: Uber had to adapt its pricing and marketing strategies to appeal to consumers increasingly conscious of costs.

The COVID-19 Pandemic and its Effect on Uber Stock:

The COVID-19 pandemic delivered a significant blow to Uber's stock price. Lockdowns and travel restrictions led to a dramatic decrease in ride-sharing demand. However, Uber's diversification into food delivery through Uber Eats played a crucial role in mitigating the impact:

- Stock price plummet: The initial reaction saw a sharp decline in Uber's stock price as ridership plummeted.

- Diversification strategies (Uber Eats): Uber Eats experienced a surge in demand, partially offsetting the losses in the ride-sharing segment.

- Government stimulus impact: Government stimulus packages and unemployment benefits influenced consumer spending, impacting both ride-sharing and food delivery demand.

- Recovery timeline: Uber's stock price recovery was gradual, reflecting the slow return of travel and economic activity.

Comparing Uber's Performance to Other Transportation Stocks:

Benchmarking Uber against competitors like Lyft during economic slowdowns provides valuable context. Lyft, being a direct competitor in the ride-sharing space, experienced similar challenges during the pandemic. Analyzing their relative performances highlights the impact of specific strategies and market factors:

- Comparative analysis with Lyft: A comparative analysis reveals similarities and differences in their responses to economic shocks, highlighting the effectiveness of their respective business models and strategies.

- Public transportation ridership trends during recessions: Comparing Uber's performance to public transportation ridership trends during recessions illustrates the shifting dynamics of consumer preferences in times of economic hardship.

Factors Influencing Uber's Stock Performance During Economic Slowdowns

Consumer Spending Habits and Ride-Sharing Demand:

Ride-sharing services like Uber are significantly impacted by consumer spending habits. Economic slowdowns typically lead to reduced discretionary spending:

- Discretionary spending reductions: Ride-sharing is often viewed as a non-essential expense, resulting in reduced demand during recessions.

- Increased reliance on public transport during recessions: Cost-conscious consumers might opt for cheaper alternatives like public transport.

- Price sensitivity of consumers: Uber's pricing strategies and their effectiveness during economic downturns become crucial factors influencing demand.

Impact of Fuel Prices and Inflation on Uber's Profitability:

Fluctuations in fuel prices and inflation directly affect Uber's operational costs and profitability:

- Effect on driver compensation: Rising fuel costs can impact driver earnings, potentially affecting driver supply and ultimately impacting Uber's ability to maintain service levels.

- Passing costs onto consumers: Uber may need to increase fares to offset rising costs, potentially reducing demand further.

- Hedging strategies: The company's strategies to mitigate the impact of fuel price volatility are a crucial aspect of its financial health.

Uber's Diversification Strategies and their Role in Mitigation:

Uber's diversification beyond ride-sharing, particularly through Uber Eats, plays a significant role in mitigating the impact of economic downturns:

- Growth of Uber Eats during lockdowns: The food delivery segment experienced robust growth during lockdowns, providing a crucial buffer against the decline in ride-sharing revenue.

- Contribution to overall revenue: The contribution of Uber Eats to Uber's overall revenue is a key factor in its resilience during economic hardship.

- Resilience of different business segments: Analyzing the relative resilience of different business segments provides insight into Uber's overall robustness during economic downturns.

Predicting Future Uber Stock Performance During Potential Economic Slowdowns

Analyzing Current Economic Indicators and their Potential Impact:

Monitoring current macroeconomic indicators is crucial for predicting Uber's future performance:

- Interest rates: Rising interest rates can negatively impact consumer spending and investment, potentially affecting Uber's growth.

- Inflation rates: High inflation erodes consumer purchasing power, directly impacting ride-sharing demand.

- Unemployment figures: Increased unemployment reduces disposable income, leading to lower demand for ride-sharing services.

- Geopolitical events: Global events can create uncertainty, impacting investment sentiment and potentially affecting Uber's stock price.

Evaluating Uber's Financial Health and Resilience:

Analyzing Uber's financial health is essential to assess its resilience to economic headwinds:

- Debt levels: High debt levels can make the company more vulnerable during economic downturns.

- Cash reserves: Strong cash reserves provide a cushion to weather economic storms.

- Profitability margins: Healthy profit margins indicate better financial health and resilience.

- Strategic investments: Investments in technology and expansion could influence future performance.

Expert Opinions and Market Forecasts:

Consulting expert opinions and market forecasts provides valuable insights:

- Consensus estimates: Understanding the consensus view of financial analysts regarding Uber's future performance helps gauge market sentiment.

- Range of forecasts: Acknowledging the range of possible outcomes highlights the inherent uncertainty in stock market predictions.

- Potential risks and opportunities: Identifying potential risks and opportunities allows for a more nuanced assessment of Uber's future prospects.

Conclusion

Analyzing Uber's stock performance during economic slowdowns reveals a complex interplay of factors, including consumer spending habits, fuel prices, inflation, and the company's diversification strategies. While past performance doesn't guarantee future results, understanding these influences is vital for investors. The resilience shown by Uber Eats during the pandemic highlights the importance of diversification, but the inherent sensitivity of ride-sharing to economic downturns remains a key consideration. By understanding the nuances of Uber's stock performance during economic slowdowns, investors can make more informed decisions regarding their portfolio allocation. Continue researching Uber's stock performance during economic slowdowns to further refine your investment strategy.

Featured Posts

-

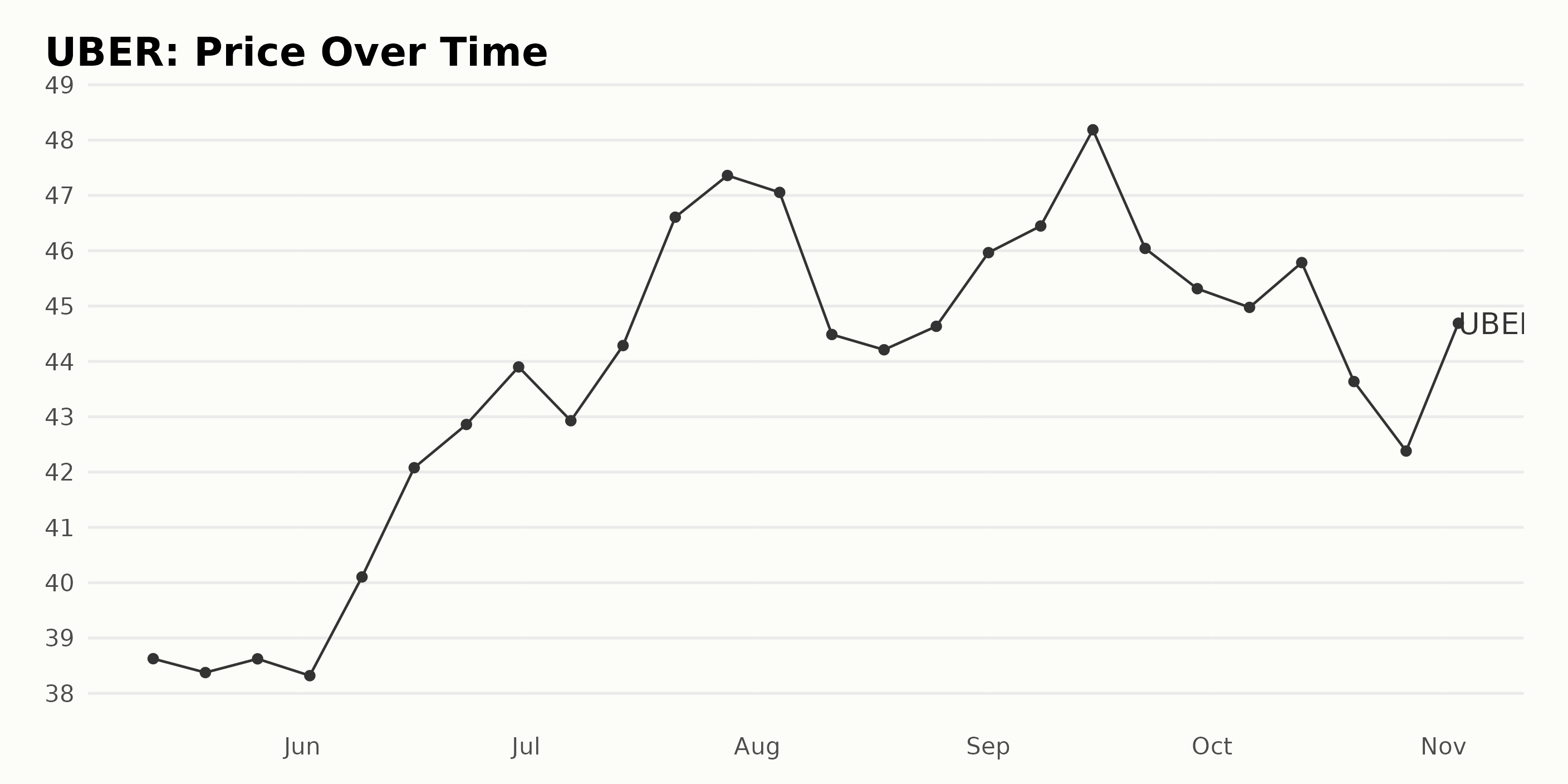

Rare Earth Minerals Fueling A New Cold War

May 17, 2025

Rare Earth Minerals Fueling A New Cold War

May 17, 2025 -

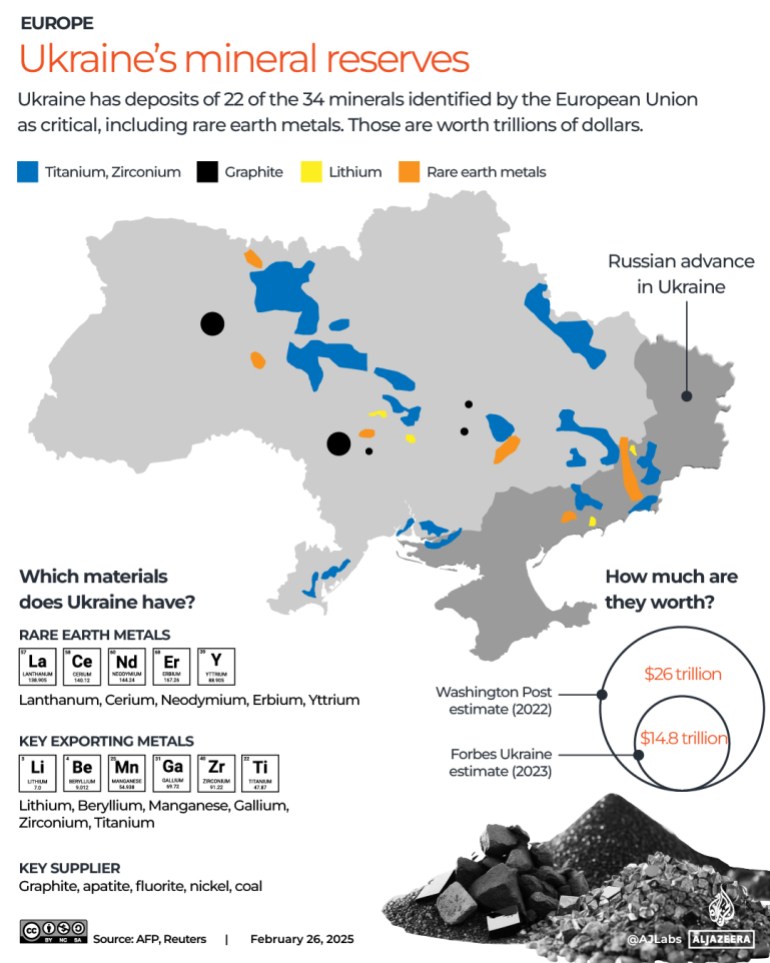

Best Alternatives To Stake Casino Top Sites For 2025

May 17, 2025

Best Alternatives To Stake Casino Top Sites For 2025

May 17, 2025 -

Student Loan Debt How It Impacts Your Mortgage Application

May 17, 2025

Student Loan Debt How It Impacts Your Mortgage Application

May 17, 2025 -

Market Movers Rockwell Automation Angi Borg Warner And Wednesdays Stock Surge

May 17, 2025

Market Movers Rockwell Automation Angi Borg Warner And Wednesdays Stock Surge

May 17, 2025 -

Understanding The Value Of Middle Managers In Todays Workplace

May 17, 2025

Understanding The Value Of Middle Managers In Todays Workplace

May 17, 2025

Latest Posts

-

Knicks Brunson Exits Lakers Game After Overtime Ankle Injury

May 17, 2025

Knicks Brunson Exits Lakers Game After Overtime Ankle Injury

May 17, 2025 -

Jalen Brunsons Return Knicks Pistons Playoff Push

May 17, 2025

Jalen Brunsons Return Knicks Pistons Playoff Push

May 17, 2025 -

Jalen Brunsons Wife Who Is Ali Marks A Look Into The Nba Stars Personal Life

May 17, 2025

Jalen Brunsons Wife Who Is Ali Marks A Look Into The Nba Stars Personal Life

May 17, 2025 -

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025 -

Jalen Brunson Injury Assessing The Impact On The New York Knicks

May 17, 2025

Jalen Brunson Injury Assessing The Impact On The New York Knicks

May 17, 2025