Understanding High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook is cautiously optimistic, acknowledging the elevated valuations but also highlighting the potential for continued growth driven by strong corporate earnings in certain sectors. Their analysis relies heavily on several key valuation metrics to gauge the market’s health. These include:

-

Price-to-Earnings ratio (P/E): BofA often cites the S&P 500's P/E ratio, comparing it to historical averages. Currently, while specific numbers fluctuate, BofA's reports consistently highlight elevated P/E ratios compared to long-term historical averages. This suggests that stocks are, on average, trading at a premium relative to their earnings.

-

Price-to-Sales ratio (P/S): This metric provides a broader perspective, especially useful for companies with negative earnings or inconsistent profitability. BofA's analysis of P/S ratios across various sectors helps identify potentially overvalued and undervalued areas.

-

Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations, offering a longer-term view of valuation. BofA often incorporates this into their analysis to provide a more nuanced understanding of the market's long-term valuation trends.

Bullet Points:

- BofA recently reported a S&P 500 P/E ratio significantly above its historical average (Specific numbers would need to be sourced from recent BofA reports and inserted here).

- The comparison to historical averages reveals a premium valuation compared to past market cycles.

- BofA's sector-specific analysis might highlight technology as a potentially overvalued sector while identifying undervalued opportunities in more cyclical industries (this needs to be verified with actual BofA reports).

(Insert relevant charts and graphs from BofA reports here, with proper attribution. For example: "Source: Bank of America Securities, [Report Date and Title]")

Factors Contributing to High Stock Market Valuations

Several intertwined factors contribute to the current high stock market valuations.

Macroeconomic Factors:

- Low Interest Rates: Historically low interest rates have lowered the discount rate used in present value calculations, increasing the value of future earnings streams. This makes stocks appear more attractive relative to bonds and other fixed-income investments.

- Quantitative Easing (QE): Previous rounds of QE injected significant liquidity into the market, driving up asset prices, including stocks.

- Inflation Expectations: While inflation can negatively impact valuations, moderate inflation expectations can sometimes be viewed positively if earnings growth keeps pace or exceeds the inflation rate.

Company-Specific Factors:

- Strong Earnings Growth: Many companies have demonstrated strong earnings growth, supporting higher stock prices.

- Technological Advancements: The rapid pace of technological innovation has created numerous high-growth companies with significant market potential, driving valuations in the technology sector and beyond.

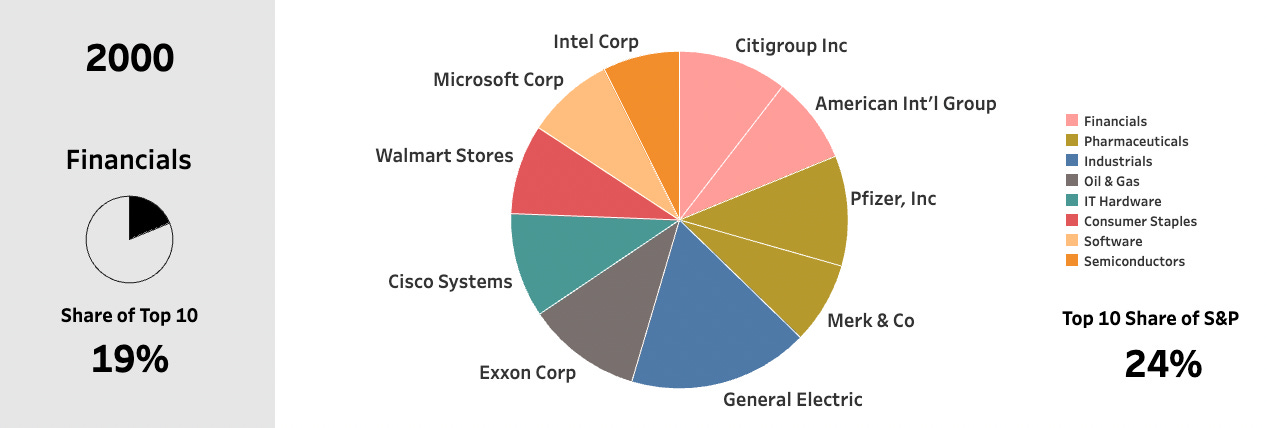

- Market Dominance: The dominance of a few large companies in various sectors can contribute to elevated market-wide valuations.

Bullet Points:

- Low interest rates directly impact discounted cash flow models used for valuation.

- Inflation erodes future earnings' purchasing power, creating uncertainty in valuation models.

- Examples of companies driving valuations (e.g., large tech firms, etc., need to be cited with specific data).

Potential Risks Associated with High Stock Market Valuations

Investing in a highly valued market carries inherent risks.

- Increased Vulnerability to Market Corrections: High valuations make markets more susceptible to sharp declines if investor sentiment shifts negatively, or if unexpected economic events occur.

- Potential for Lower Future Returns: Stocks purchased at high valuations generally offer lower potential returns compared to those bought at lower valuations.

- Rising Interest Rates: A rise in interest rates can lead to a decrease in stock valuations as investors shift towards higher-yielding fixed-income investments.

Bullet Points:

- Historical examples of market corrections following periods of high valuations (cite specific examples and data).

- Rising interest rates increase borrowing costs for companies, impacting profitability and valuations.

- BofA's suggested risk mitigation strategies (needs to be sourced from their reports – e.g., diversification, hedging strategies).

Investment Strategies for Navigating High Stock Market Valuations

Based on BofA's analysis, several investment strategies can help navigate these high valuations:

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce overall portfolio risk.

- Value Investing: Focus on companies trading below their intrinsic value, potentially offering better long-term returns.

- Defensive Stocks: Consider investing in companies less sensitive to economic cycles, providing relative stability during market corrections.

Bullet Points:

- Specific asset allocation suggestions based on BofA's recommendations (needs to be sourced from their reports).

- Sector-specific recommendations based on BofA's analysis of overvalued and undervalued sectors.

- Advice on market timing (with clear disclaimers, emphasizing that timing the market is notoriously difficult).

Understanding High Stock Market Valuations – Key Takeaways and Next Steps for Investors

BofA's analysis highlights elevated stock market valuations, presenting both opportunities and risks. While strong corporate earnings in some sectors support current prices, the elevated P/E ratios and other valuation metrics signal potential vulnerability to corrections. Understanding these high stock market valuations is crucial for investors. Diversification, value investing, and a focus on defensive stocks are potential strategies for mitigating risk.

Understanding high stock market valuations is crucial for navigating today's market. Utilize BofA's analysis and other resources to formulate a robust investment strategy that aligns with your risk tolerance and financial goals. Stay informed about shifts in high stock market valuations to make sound investment decisions. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Lynas Rare Earths Seeks Us Aid For Texas Refinery Amidst Cost Increases

Apr 29, 2025

Lynas Rare Earths Seeks Us Aid For Texas Refinery Amidst Cost Increases

Apr 29, 2025 -

Exclusive Huawei Develops Cutting Edge Ai Chip To Rival Nvidia

Apr 29, 2025

Exclusive Huawei Develops Cutting Edge Ai Chip To Rival Nvidia

Apr 29, 2025 -

Blue Origins Rocket Launch Cancelled Due To Subsystem Failure

Apr 29, 2025

Blue Origins Rocket Launch Cancelled Due To Subsystem Failure

Apr 29, 2025 -

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025 -

Hengrui Pharmas Hong Kong Share Sale Approved By Chinese Authorities

Apr 29, 2025

Hengrui Pharmas Hong Kong Share Sale Approved By Chinese Authorities

Apr 29, 2025

Latest Posts

-

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025 -

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025