Will Republican Divisions Sink Trump's Tax Bill?

Table of Contents

The Republican party faces a critical moment. Internal divisions threaten to derail President Trump's ambitious tax reform plan, raising questions about its ultimate fate and potential impact on the American economy. Will internal disagreements ultimately sink the bill, or can the party overcome its differences? This article explores the key factors at play, examining the potential consequences of both success and failure.

<h2>Factional Fights Within the Republican Party</h2>

Deep fissures within the Republican party are severely testing the viability of Trump's tax bill. The diverse ideologies and priorities of different factions are creating significant hurdles to passage.

<h3>The Freedom Caucus and their Demands</h3>

The Freedom Caucus, a powerful group of conservative Republicans, has emerged as a major obstacle. They are demanding significant alterations to the bill, potentially jeopardizing its passage.

- Specific Demands: Lower corporate tax rates than initially proposed, stricter spending limits tied to the tax cuts, and increased tax deductions for businesses.

- Political Power: The Freedom Caucus wields significant influence due to its ability to leverage its voting power to derail legislation. Their unwavering commitment to fiscal conservatism makes them a formidable force.

- Legislative Gridlock: Their resistance threatens to create legislative gridlock, potentially leading to the bill's complete failure or significant delay. The Freedom Caucus's hardline stance exemplifies the challenges of unifying the Republican party behind a single legislative agenda.

<h3>Moderate Republicans' Concerns</h3>

Moderate Republicans express concerns about the bill’s potential impact on the national debt and its disproportionate benefits for the wealthy.

- Specific Concerns: The substantial tax cuts for corporations and high-income earners, the projected increase in the national deficit, and the lack of sufficient provisions for middle- and lower-income families.

- Potential Compromises: Appeasement of moderate Republicans may necessitate compromises, such as targeted tax relief for middle-class families or adjustments to the corporate tax rate, potentially diluting the bill's overall impact.

- Fiscal Responsibility: Moderate Republicans' emphasis on fiscal responsibility highlights the internal struggle within the party between prioritizing tax cuts and maintaining fiscal sustainability.

<h3>Senate vs. House Divisions</h3>

Significant differences between the House and Senate versions of the bill create further obstacles. Reconciling these discrepancies will require substantial negotiation and compromise.

- Key Differences: Varying corporate tax rates, individual income tax brackets, and the treatment of specific deductions are key areas of divergence between the two chambers.

- Legislative Process: The process of resolving these discrepancies involves intricate negotiations between House and Senate committees and requires securing support from a sufficient number of legislators in both chambers.

- Bipartisan Compromise: While unlikely given the current political climate, the possibility of bipartisan compromise to bridge these gaps cannot be completely dismissed, though it would require significant concessions from both parties.

<h2>Economic Implications of the Bill's Failure</h2>

The potential failure of Trump's tax bill carries significant economic ramifications, impacting various sectors and stakeholders.

<h3>Impact on the Stock Market</h3>

The uncertainty surrounding the bill's passage is already impacting investor confidence and market volatility.

- Potential Stock Market Reactions: Failure could trigger a significant market downturn, particularly in sectors anticipated to benefit from the tax cuts. Conversely, passage could lead to a short-term rally.

- Economic Uncertainty: The ongoing uncertainty itself is detrimental to economic growth, discouraging investment and dampening consumer spending.

- Market Analysis: Experts are divided on the precise impact, with some predicting a mild correction and others forecasting a more substantial decline.

<h3>Effects on Businesses and Consumers</h3>

The bill's provisions have far-reaching implications for businesses and individual taxpayers.

- Corporate Tax Rates: Lower corporate tax rates could stimulate business investment and job creation, though the extent of this effect is debated.

- Individual Income Tax Rates: Changes to individual income tax rates will affect different income groups differently, with the potential for both winners and losers.

- Economic Stimulus: Proponents argue the tax cuts will boost economic activity; critics contend the benefits will disproportionately favor the wealthy, exacerbating income inequality.

<h3>Long-Term Fiscal Implications</h3>

The bill's long-term effects on the national debt and the federal budget deficit are a central point of contention.

- Potential Long-Term Effects: The proposed tax cuts are projected to increase the national debt significantly over the coming decade.

- Fiscal Sustainability: Concerns are raised about the long-term fiscal sustainability of the United States, especially given the aging population and rising healthcare costs.

- Long-Term Economic Outlook: The long-term economic consequences of a substantially increased national debt are complex and uncertain, with various potential negative scenarios.

<h2>Trump's Political Capital and the Fight for Passage</h2>

President Trump's political influence and ability to negotiate will be crucial in determining the bill's fate.

<h3>The President's Influence on Republican Legislators</h3>

Trump's ability to persuade wavering Republicans will be critical.

- Presidential Influence: The President’s influence is significant, but his leverage may be weakening amidst the growing internal divisions within the party.

- Legislative Negotiations: The President’s direct engagement in negotiations will be key, though the success of these efforts remains uncertain.

- Party Unity: Trump’s efforts to maintain party unity are facing a considerable challenge, given the deep ideological splits within the Republican ranks.

<h3>The Potential for a Bipartisan Compromise</h3>

While unlikely, the possibility of bipartisan cooperation cannot be ruled out.

- Potential Areas of Compromise: Areas of potential compromise could include targeted tax relief for the middle class or modifications to certain corporate tax provisions.

- Political Hurdles: The partisan political climate and the deep ideological differences between the two parties present substantial hurdles.

- Legislative Stalemate: Failure to reach any compromise could result in a legislative stalemate and the bill’s ultimate defeat.

<h3>Conclusion</h3>

The fate of Trump's tax bill remains uncertain. Deep divisions within the Republican party, combined with significant economic and political ramifications, make its passage far from guaranteed. The coming weeks will be pivotal in determining whether the party can overcome its internal conflicts. Will Republican unity prevail, or will these divisions ultimately sink Trump's ambitious tax bill? Stay informed to understand the continuing developments around this crucial legislation and its impact on your finances.

Featured Posts

-

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Wifes Murder

Apr 29, 2025

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Wifes Murder

Apr 29, 2025 -

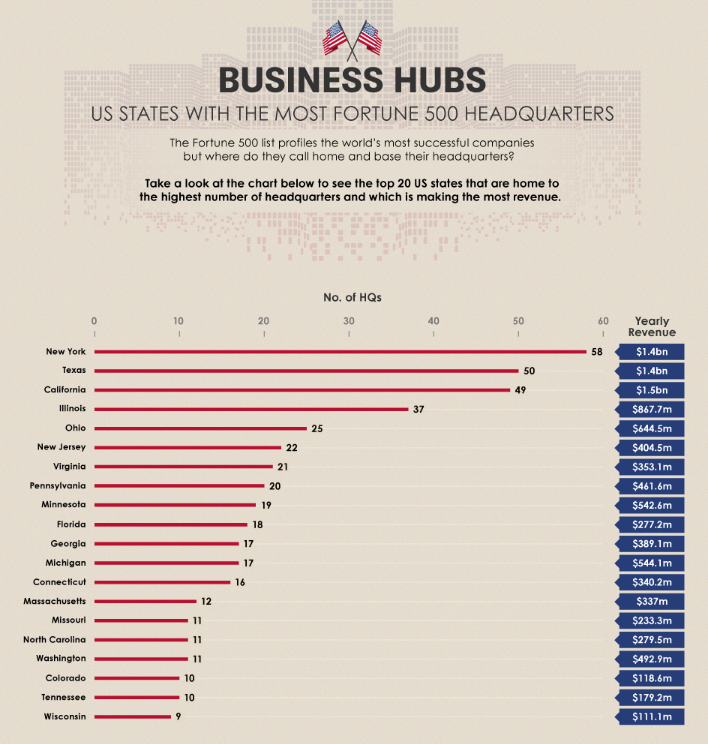

Uncovering The Countrys Next Big Business Hubs

Apr 29, 2025

Uncovering The Countrys Next Big Business Hubs

Apr 29, 2025 -

Perplexitys Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexitys Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

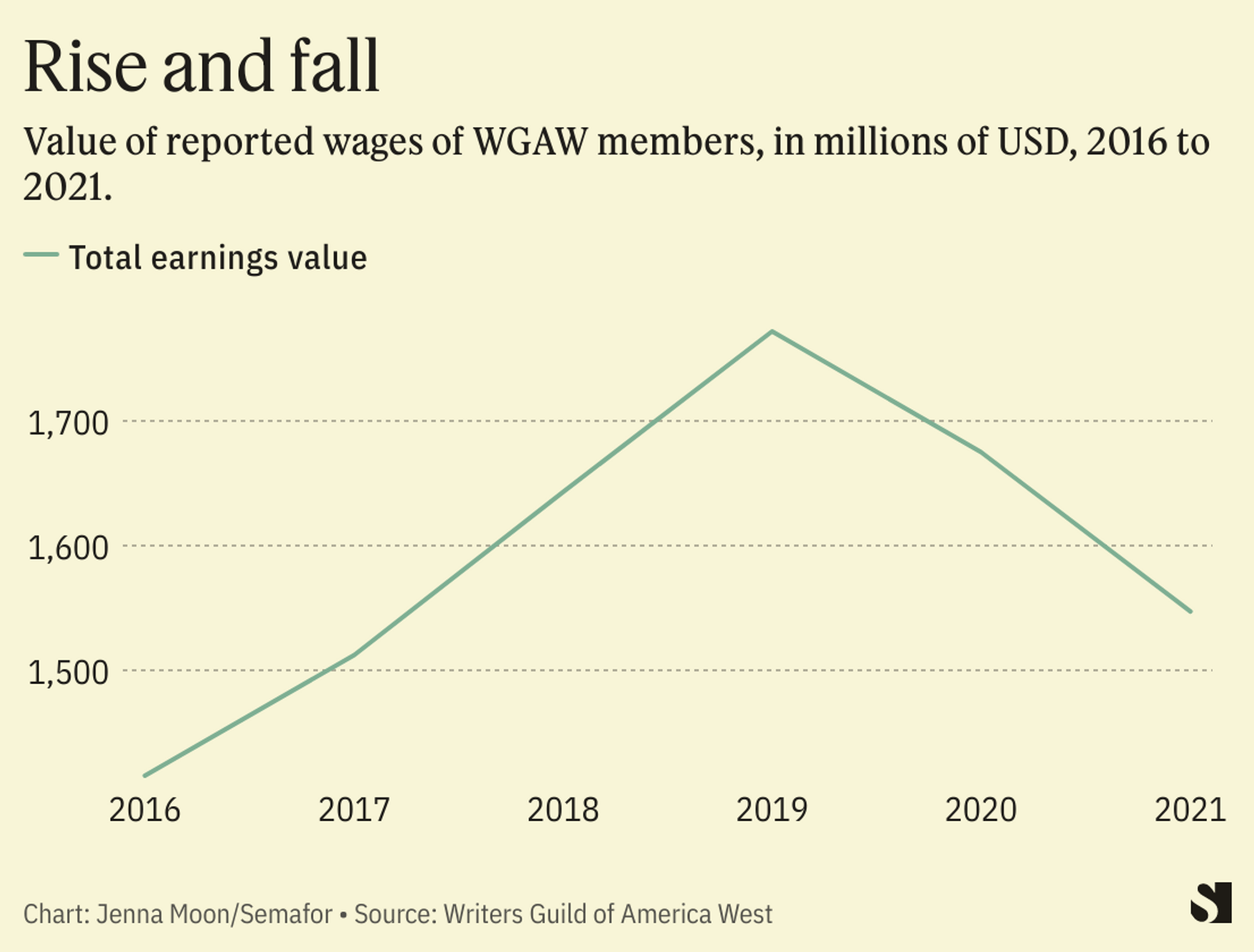

Actors And Writers Strike The Full Impact On Hollywood

Apr 29, 2025

Actors And Writers Strike The Full Impact On Hollywood

Apr 29, 2025 -

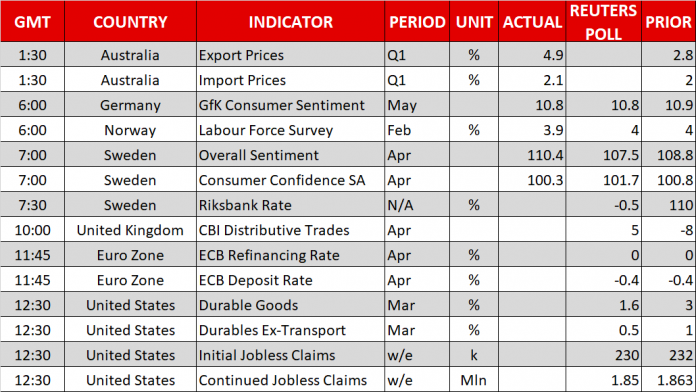

Inflation Remains Elevated The Ecb On The Impact Of Pandemic Support

Apr 29, 2025

Inflation Remains Elevated The Ecb On The Impact Of Pandemic Support

Apr 29, 2025

Latest Posts

-

Federal Charges Filed Millions Stolen Through Executive Office365 Compromises

Apr 29, 2025

Federal Charges Filed Millions Stolen Through Executive Office365 Compromises

Apr 29, 2025 -

Office365 Data Breach Millions Stolen Suspect Arrested

Apr 29, 2025

Office365 Data Breach Millions Stolen Suspect Arrested

Apr 29, 2025 -

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025 -

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025 -

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025