The Magnificent Seven's $2.5 Trillion Market Cap Decline

Table of Contents

Rising Interest Rates and Inflation's Impact on Tech Stocks

Rising interest rates are a primary culprit in the Magnificent Seven market cap decline. High-growth tech companies, often valued based on future earnings projections, are particularly vulnerable to rising interest rates. Higher rates increase the discount rate applied to future cash flows, thus reducing the present value of those future earnings and subsequently lowering the company's valuation. This is especially true for companies with significant debt burdens, as increased borrowing costs directly impact profitability.

Simultaneously, inflation has eroded consumer spending power. Consumers are less likely to splurge on discretionary tech products like new smartphones or smart home devices when facing increased costs for essential goods and services. This reduced consumer demand directly impacts the revenue streams of these tech giants, further impacting their market valuations.

- Increased borrowing costs for tech companies: Higher interest rates make it more expensive to secure loans and finance expansion plans.

- Reduced investor appetite for riskier assets: In a high-interest-rate environment, investors often shift towards safer, lower-risk investments.

- Lower consumer demand for discretionary tech products: Inflation forces consumers to prioritize essential spending, reducing demand for non-essential tech items.

- Decreased future earnings projections: Reduced demand and increased costs lead to lower projected future earnings, which directly impacts stock valuations.

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability, such as the ongoing war in Ukraine, adds another layer of complexity to the Magnificent Seven market cap decline. The war has created significant market volatility, impacting investor confidence and increasing uncertainty about future growth prospects. Supply chain disruptions, exacerbated by the war and other global events, have further hampered the tech sector's production and profitability. Increased input costs due to supply chain bottlenecks and reduced production capacity have contributed to squeezed profit margins.

- Increased input costs due to supply chain bottlenecks: Difficulties in sourcing raw materials and components translate to higher production costs.

- Uncertainty about future market access in key regions: Geopolitical instability creates uncertainty about future market access and regulatory environments in various countries.

- Reduced production capacity impacting revenue streams: Supply chain issues directly impact the ability of tech companies to meet consumer demand, lowering revenue.

- Increased risk premiums factored into stock valuations: The increased uncertainty associated with geopolitical instability and supply chain disruptions leads investors to demand higher returns, reducing valuations.

Regulatory Scrutiny and Antitrust Concerns

The Magnificent Seven are facing increasing regulatory scrutiny, particularly concerning antitrust issues. Investigations into potential monopolistic practices and concerns about market dominance are leading to increased regulatory compliance costs and potential penalties. This regulatory uncertainty creates negative investor sentiment and impacts future growth prospects, adding to the Magnificent Seven market cap decline.

- Ongoing antitrust investigations and potential penalties: Investigations can result in substantial fines and limitations on business practices.

- Increased regulatory compliance costs: Companies must invest significant resources in complying with increasingly stringent regulations.

- Potential limitations on future growth and acquisitions: Regulatory hurdles can restrict a company's ability to grow through acquisitions and expansion into new markets.

- Negative investor sentiment due to regulatory uncertainty: The uncertainty surrounding potential regulatory actions can lead to a sell-off in the affected companies' stocks.

Overvaluation and Market Correction

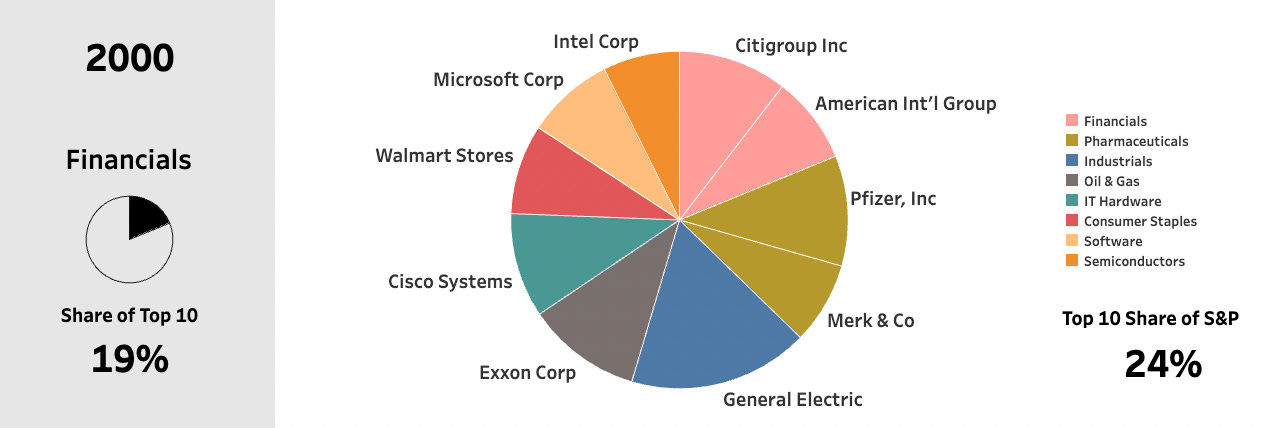

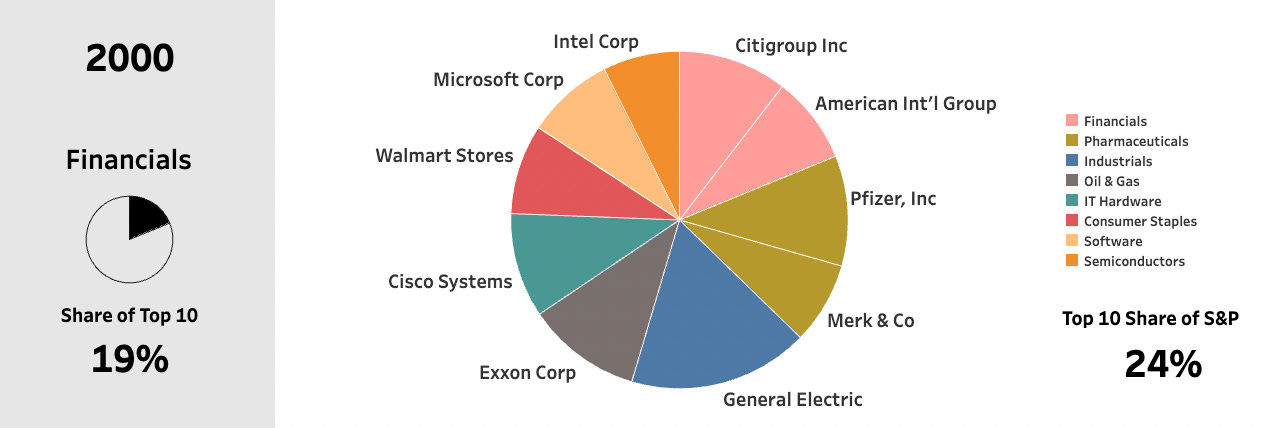

The significant decline in the Magnificent Seven's market capitalization can also be attributed to a market correction. It's possible that previous valuations were inflated due to a combination of factors, including speculative investing and quantitative easing policies that kept interest rates historically low. The current market correction represents a natural adjustment towards more sustainable valuations, with investors reassessing the true value and growth potential of these tech giants.

- Historical comparison of P/E ratios and market valuations: Comparing current valuations with historical data can highlight periods of overvaluation.

- Analysis of speculative investing driving initial price increases: Identifying speculative bubbles and unsustainable growth expectations is crucial.

- Discussion of the role of quantitative easing and low interest rates: Low interest rates can artificially inflate asset prices, creating a false sense of security.

- Identification of potential future growth opportunities: Despite the decline, the long-term growth potential of these companies remains a key factor.

Conclusion: Understanding and Navigating the Magnificent Seven's Market Cap Decline

The $2.5 trillion decline in the Magnificent Seven's market capitalization is a complex issue stemming from a confluence of factors: rising interest rates and inflation, geopolitical uncertainty and supply chain disruptions, regulatory scrutiny, and a market correction from potentially inflated valuations. Understanding these interconnected forces is crucial for investors and market analysts alike. While the short-term outlook may seem uncertain, the long-term prospects of these tech giants depend on their adaptability and ability to navigate these challenges. Stay informed about the "Magnificent Seven market cap decline" and its implications for your investment strategies by subscribing to our newsletter, following us on social media, or regularly checking our website for updates on the Magnificent Seven's market performance. Remember to conduct thorough research before making any investment decisions related to Magnificent Seven stocks.

Featured Posts

-

European Energy Market Solar Energy Oversupply Causes Price Collapse

Apr 29, 2025

European Energy Market Solar Energy Oversupply Causes Price Collapse

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025 -

Anthony Edwards Injury Impact On Timberwolves Lakers Game

Apr 29, 2025

Anthony Edwards Injury Impact On Timberwolves Lakers Game

Apr 29, 2025 -

April 8th Treasury Market Update Important Lessons Learned

Apr 29, 2025

April 8th Treasury Market Update Important Lessons Learned

Apr 29, 2025 -

Khazna Data Centers Saudi Arabia Expansion Following Silver Lake Investment

Apr 29, 2025

Khazna Data Centers Saudi Arabia Expansion Following Silver Lake Investment

Apr 29, 2025

Latest Posts

-

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025 -

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025 -

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025