Hengrui Pharma's Hong Kong Share Sale Approved By Chinese Authorities

Table of Contents

Details of the Hengrui Pharma Hong Kong Share Sale

Scale and Significance of the Offering

The Hengrui Pharma Hong Kong share sale represents a substantial undertaking, poised to significantly impact the company's capitalization and bolster its position within China's burgeoning pharmaceutical industry. While the precise details of the offering's size remain to be fully disclosed, preliminary reports suggest a considerable number of shares will be offered, potentially raising hundreds of millions, if not billions, of dollars. This infusion of capital is vital for Hengrui Pharma's continued growth and expansion.

- Estimated Value: While the final valuation is pending, industry analysts predict a substantial figure, potentially placing Hengrui Pharma among the top-tier pharmaceutical companies listed in Hong Kong.

- Number of Shares Offered: The exact number of shares remains undisclosed but is expected to be substantial, allowing for significant capital injection.

- Expected Timeline: The timeline for the share sale is likely to unfold over the coming months, subject to regulatory filings and market conditions.

- Potential Investors: A wide range of international and domestic investors are expected to participate, drawn by Hengrui Pharma's strong track record and growth potential.

Keyword focus: Hengrui Pharma share sale, IPO size, market capitalization, funding, investment opportunities.

Regulatory Approvals and Processes

Securing approval for the Hengrui Pharma Hong Kong share sale required navigating a complex regulatory landscape. The process involved multiple steps and approvals from key regulatory bodies in both China and Hong Kong. The successful completion of this process underscores Hengrui Pharma's commitment to regulatory compliance and transparency.

- Key Regulatory Bodies Involved: The approval process likely involved China's National Medical Products Administration (NMPA), the Securities and Futures Commission of Hong Kong, and the Hong Kong Stock Exchange (HKEX).

- Duration of the Approval Process: The duration of the approval process highlights the rigorous scrutiny involved in such large-scale offerings. While the exact timeline isn't publicly available, it's likely to have spanned several months, if not longer.

- Conditions Attached (if any): While specific conditions haven't been publicly disclosed, it's likely that certain conditions were attached to the approval to ensure regulatory compliance and protect investor interests.

- Significance of the Approval: The approval signals a vote of confidence in Hengrui Pharma and its future prospects, paving the way for its expansion and access to international capital markets.

Keyword focus: Chinese regulatory approval, Hong Kong Stock Exchange, regulatory compliance, pharmaceutical regulations, licensing.

Implications for Hengrui Pharma

Access to Capital and Growth

The Hong Kong share sale will provide Hengrui Pharma with significant access to capital, enabling accelerated growth across various key areas of its business. This injection of funds is expected to fuel innovation and expansion, strengthening Hengrui Pharma's competitive advantage within the global pharmaceutical industry.

- Investment in R&D: A major portion of the raised capital will likely be directed towards research and development, accelerating the development of new drugs and therapies.

- Expansion into new markets: The capital will support expansion into new international markets, increasing the reach of Hengrui Pharma's products and services.

- Potential mergers and acquisitions: The increased financial strength could facilitate strategic acquisitions of other pharmaceutical companies, further expanding Hengrui Pharma's portfolio and capabilities.

- Strengthening of market position: The share sale will enable Hengrui Pharma to solidify its position as a major player in the Chinese pharmaceutical market and expand its influence internationally.

Keyword focus: Hengrui Pharma growth, capital raising, R&D investment, market expansion, acquisitions.

Enhanced International Profile and Brand Recognition

Listing on the Hong Kong Stock Exchange will significantly elevate Hengrui Pharma's international profile and brand recognition. This increased visibility will attract foreign investment and bolster its reputation as a leading pharmaceutical innovator.

- Increased investor interest: The Hong Kong listing will attract the attention of international investors seeking opportunities in the rapidly growing Chinese pharmaceutical market.

- Improved brand image: A successful listing on a major international exchange enhances Hengrui Pharma's credibility and brand reputation globally.

- Access to international talent: Increased visibility can facilitate the recruitment of top international talent, further driving innovation and growth.

- Potential partnerships: The higher profile can lead to strategic partnerships with international pharmaceutical companies, fostering collaboration and knowledge sharing.

Keyword focus: International investment, brand building, global expansion, pharmaceutical market, competitive advantage.

Impact on the Broader Market

Attracting Foreign Investment in China's Pharmaceutical Sector

Hengrui Pharma's successful share sale sends a powerful signal to other Chinese pharmaceutical companies considering similar listings. This move can encourage further foreign direct investment into the sector, driving growth and innovation.

- Positive signal for the industry: The successful listing demonstrates the viability of Chinese pharmaceutical companies accessing international capital markets.

- Increased foreign direct investment: The share sale can act as a catalyst, attracting more foreign investment into China's dynamic pharmaceutical sector.

- Fostering competition: Increased competition can spur innovation and improve the quality and affordability of pharmaceutical products.

- Economic growth: Greater foreign investment contributes to economic growth, creating jobs and boosting the overall economy.

Keyword focus: Chinese pharmaceutical industry, foreign investment in China, market trends, economic growth, stock market performance.

Competition and Market Dynamics

The Hengrui Pharma share sale will undoubtedly influence the competitive landscape within the pharmaceutical sector in both China and Hong Kong. Its impact will vary across different segments of the market.

- Potential impact on competitors: Existing competitors will need to adapt to the increased competition from a stronger, better-funded Hengrui Pharma.

- Market share changes: The share sale could lead to shifts in market share, with Hengrui Pharma potentially gaining a stronger position.

- Pricing dynamics: The increased competition may influence pricing dynamics, potentially affecting the affordability of certain drugs.

- Innovation: Increased competition should stimulate further innovation, benefiting consumers and healthcare systems.

Keyword focus: Market competition, pharmaceutical market analysis, industry dynamics, market share, pricing strategies.

Conclusion

Hengrui Pharma's successful approval for a Hong Kong share sale marks a significant milestone for the company, the Chinese pharmaceutical industry, and the broader investment landscape. This move provides Hengrui Pharma with considerable access to capital, boosts its international profile, and is likely to catalyze further foreign investment into the Chinese pharmaceutical sector. The share sale's impact on competition and market dynamics remains to be fully seen, but the overall effect is likely to be positive, fostering innovation and driving economic growth.

Call to Action: Stay informed about the developments of this landmark Hengrui Pharma Hong Kong share sale and its impact on the future of the Chinese pharmaceutical market. Follow us for more updates on Hengrui Pharma's progress and other significant happenings in the industry. Learn more about investing in leading Chinese pharmaceutical companies and explore the potential of the Hengrui Pharma share sale.

Featured Posts

-

The Future Of Search Perplexity Ceos Strategy To Beat Google In The Ai Browser Battle

Apr 29, 2025

The Future Of Search Perplexity Ceos Strategy To Beat Google In The Ai Browser Battle

Apr 29, 2025 -

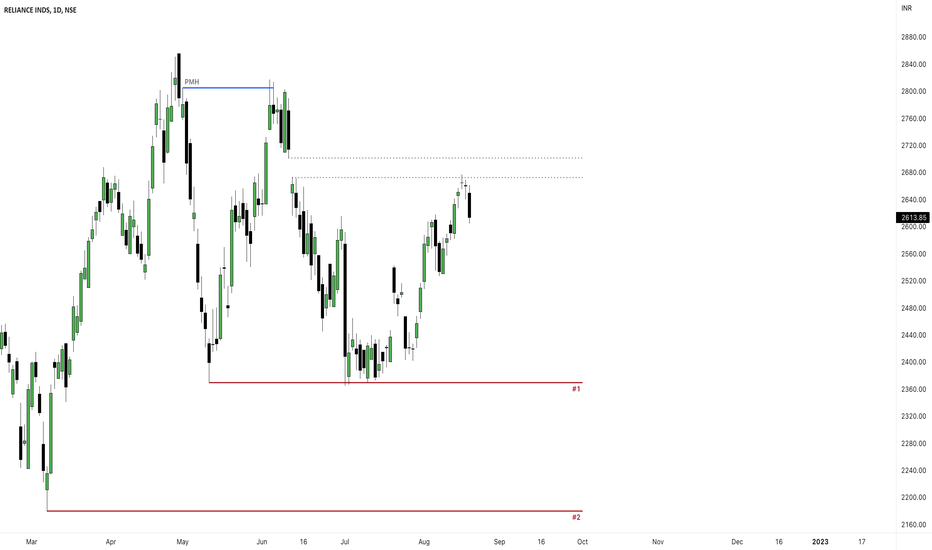

Strong Earnings Drive Reliance Shares To 10 Month Peak

Apr 29, 2025

Strong Earnings Drive Reliance Shares To 10 Month Peak

Apr 29, 2025 -

Chat Gpt Creator Open Ai Faces Ftc Investigation Key Questions And Concerns

Apr 29, 2025

Chat Gpt Creator Open Ai Faces Ftc Investigation Key Questions And Concerns

Apr 29, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 29, 2025

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 29, 2025 -

Huaweis New Ai Chip A Challenger To Nvidias Dominance

Apr 29, 2025

Huaweis New Ai Chip A Challenger To Nvidias Dominance

Apr 29, 2025

Latest Posts

-

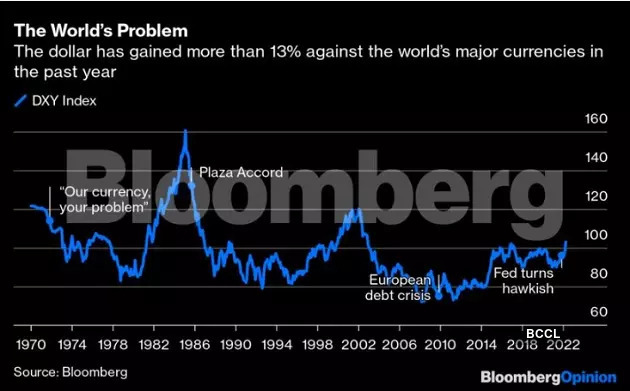

Is The U S Dollar Headed For Its Worst Performance Since Nixons Presidency

Apr 29, 2025

Is The U S Dollar Headed For Its Worst Performance Since Nixons Presidency

Apr 29, 2025 -

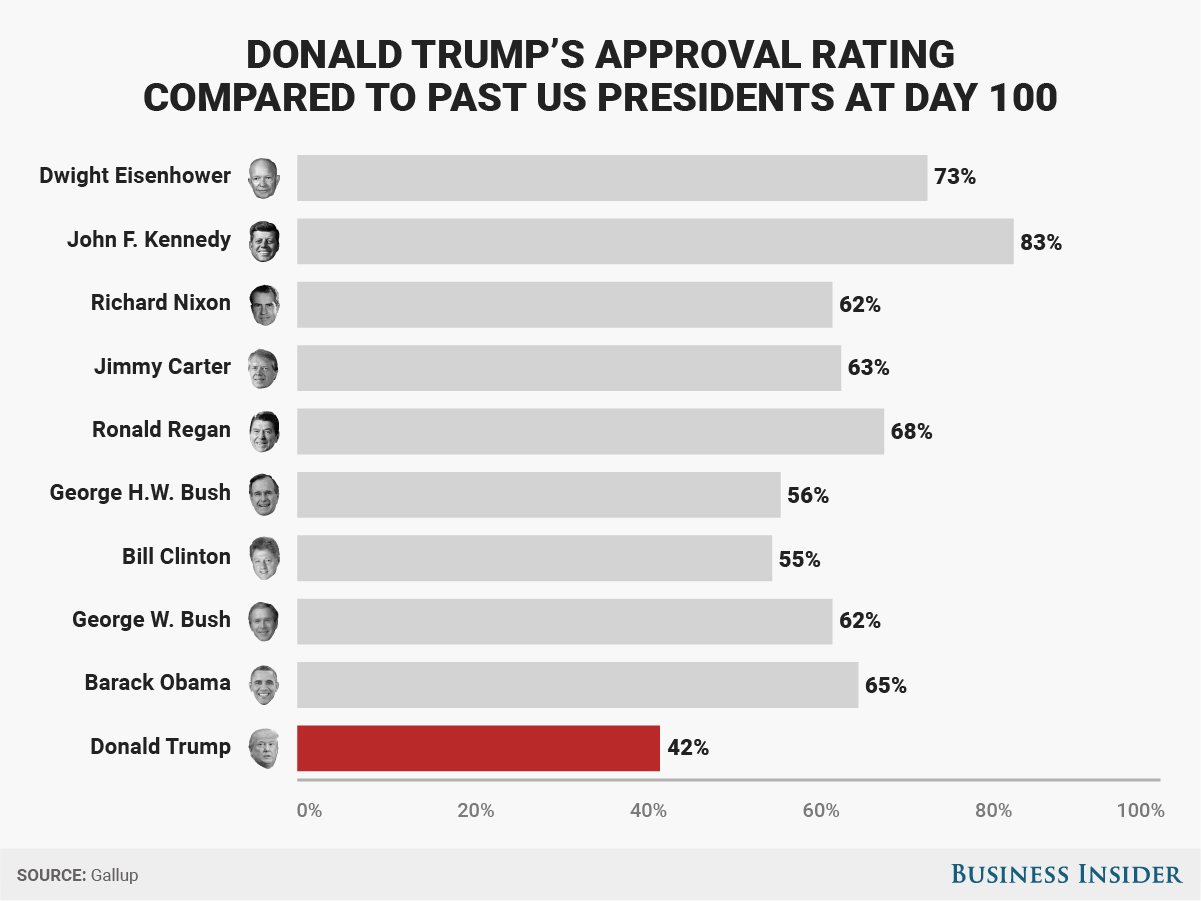

U S Dollars First 100 Days Under Scrutiny A Presidential Economic Comparison

Apr 29, 2025

U S Dollars First 100 Days Under Scrutiny A Presidential Economic Comparison

Apr 29, 2025 -

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025 -

Tech Giants Boost Us Stocks Tesla Leads The Charge

Apr 29, 2025

Tech Giants Boost Us Stocks Tesla Leads The Charge

Apr 29, 2025 -

Car Dealerships Step Up Opposition To Mandatory Ev Sales

Apr 29, 2025

Car Dealerships Step Up Opposition To Mandatory Ev Sales

Apr 29, 2025