Republican Resistance To Trump's Tax Plan: Key Groups And Obstacles

Table of Contents

Fiscal Hawks and Concerns about the National Debt

The Trump tax plan's projected impact on the national debt triggered strong opposition from fiscal conservatives within the Republican party. These "fiscal hawks," prioritizing fiscal responsibility and balanced budgets, viewed the proposed tax cuts as fiscally irresponsible.

The Role of Fiscal Conservatives

This group argued that the plan's substantial tax cuts, particularly individual tax cuts, would dramatically increase the national debt and lead to unsustainable deficits. Their concerns centered on:

- Increased national debt: The massive tax cuts, they argued, lacked sufficient offsetting spending cuts, leading to a ballooning national debt.

- Long-term economic consequences: They warned of long-term negative economic consequences, including higher interest rates and reduced economic growth due to increased government borrowing.

- Unsustainable deficits: The projected deficits were deemed unsustainable, threatening future economic stability and placing a significant burden on future generations.

- Impact on future generations: Fiscal conservatives emphasized the unfairness of saddling future generations with the debt incurred by the current generation's tax cuts.

Prominent figures like Senator Bob Corker voiced these concerns, publicly expressing skepticism about the plan's fiscal sustainability and urging more responsible fiscal policies. Their opposition highlighted a deep-seated tension within the Republican party between tax cuts and fiscal prudence.

Conservative Opposition Based on Principles

Beyond fiscal concerns, some conservatives opposed specific aspects of the Trump tax plan based on ideological principles. They argued that certain tax cuts contradicted core Republican tenets of limited government and free markets.

Rejection of Certain Tax Cuts as Unprincipled

This resistance centered on objections to:

- Corporate tax cuts: Some conservatives argued that the proposed corporate tax cuts were excessively generous, benefiting large corporations at the expense of smaller businesses and individuals.

- Perceived unfairness: Concerns were raised about the perceived unfairness of the tax cuts, with some arguing that they disproportionately benefited the wealthy.

- Lack of tax simplification: Critics argued that the plan failed to meaningfully simplify the tax code, perpetuating complexity and creating new loopholes.

- Loopholes and special interests: Opposition stemmed from concerns that the plan created new loopholes and benefited specific special interests, contradicting the principle of fair and equitable taxation.

These conservatives argued that the plan deviated from core Republican principles, prioritizing special interests over sound economic policy and limited government intervention. Their objections reflected a struggle within the party between pragmatic policy-making and adherence to strict ideological principles.

Specific Sectoral Concerns and Opposition

The potential negative impacts of the Trump tax plan on specific sectors and demographics fueled further Republican resistance. This opposition stemmed from concerns about the plan's consequences for specific constituencies.

Impact on Specific Industries and Demographics

Key areas of concern included:

- State and local tax deductions (SALT): The proposed elimination of the SALT deduction sparked significant opposition from representatives of high-tax states, predominantly those with a strong Republican presence.

- Impact on small businesses: Concerns were raised about the potential negative impact on small businesses, particularly regarding the changes to the pass-through deduction.

- Concerns about healthcare costs: Some Republicans expressed concerns about the plan's potential to increase healthcare costs, indirectly impacting their constituents.

- Effects on specific regions: The plan's regional disparities, particularly impacting high-tax states, led to opposition from Republicans representing those areas.

This sectoral resistance highlighted the challenges of crafting a universally appealing tax plan and the inherent conflicts between national-level policy and the needs of specific constituencies within the Republican party.

Intra-Party Power Struggles and Political Maneuvering

The Republican resistance to the Trump tax plan wasn't solely driven by policy disagreements. Intra-party power struggles and political maneuvering also played a significant role.

Factional Divisions within the Republican Party

The tax plan became a battleground for competing factions within the Republican party, each vying for influence and control. This led to resistance driven by:

- Competition for influence: Different factions within the party used their opposition to the plan as a tool to gain leverage and influence within the party.

- Disagreements over legislative strategy: Disputes arose over the best legislative strategy for passing the tax plan, with some factions advocating for more compromise and others pushing for a more uncompromising approach.

- Ideological divides within the party: Existing ideological divisions within the Republican party were exacerbated by the tax plan, further fueling internal conflict and resistance.

These internal power dynamics underscored the complex political realities within the Republican party, highlighting how policy disagreements are often intertwined with strategic calculations and intra-party competition.

Conclusion

The Republican resistance to Trump's tax plan was multifaceted, driven by a confluence of factors including fiscal conservatism, ideological objections, sectoral concerns, and intra-party power struggles. The opposition from fiscal hawks, principled conservatives, representatives of affected sectors, and competing factions within the party highlighted significant fault lines within the GOP. These internal divisions significantly impacted the legislative process and ultimately shaped the final form of the tax legislation. Understanding the nuances of this Republican resistance and the factors influencing GOP dissent is crucial for comprehending future tax legislation and the broader political landscape. Analyzing the differing perspectives on tax reform opposition within the party offers valuable insights into the challenges of navigating complex legislative processes and the enduring tension between fiscal conservatism and other Republican priorities. Further research is needed to understand the long-term consequences of this internal conflict and the evolving dynamics of Republican policy-making.

Featured Posts

-

Cancer Drug Setback Sends Akeso Shares Plummeting

Apr 29, 2025

Cancer Drug Setback Sends Akeso Shares Plummeting

Apr 29, 2025 -

Tragedy Strikes North Carolina University Fatal Shooting Incident

Apr 29, 2025

Tragedy Strikes North Carolina University Fatal Shooting Incident

Apr 29, 2025 -

University Shooting In North Carolina Leaves Seven Victims

Apr 29, 2025

University Shooting In North Carolina Leaves Seven Victims

Apr 29, 2025 -

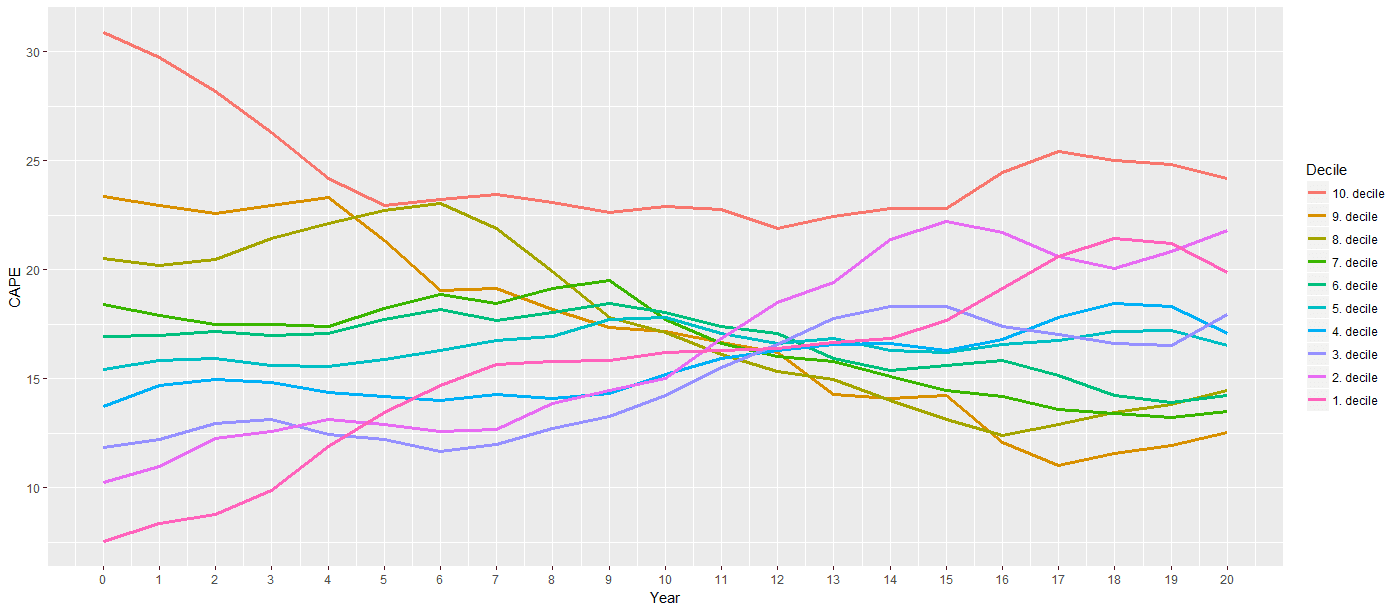

Understanding High Stock Market Valuations Bof As Investor Guidance

Apr 29, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

Apr 29, 2025 -

Understanding Ais Thought Processes A Surprisingly Simple Explanation

Apr 29, 2025

Understanding Ais Thought Processes A Surprisingly Simple Explanation

Apr 29, 2025

Latest Posts

-

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025 -

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025 -

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025