Trump's China Tariffs: Higher Prices And Empty Shelves In The US?

Table of Contents

The Rationale Behind Trump's China Tariffs

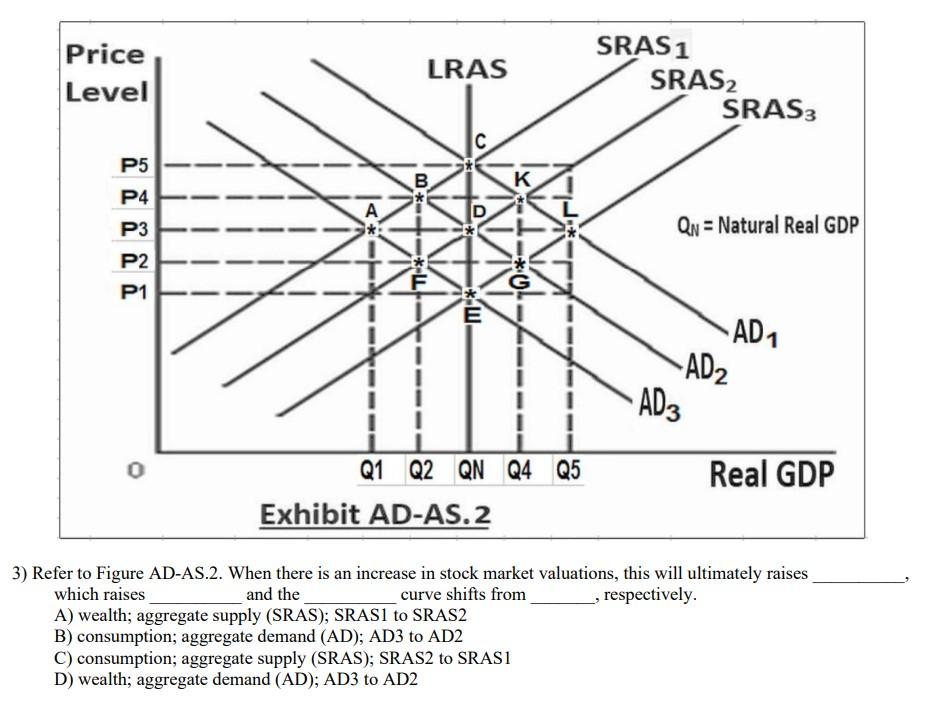

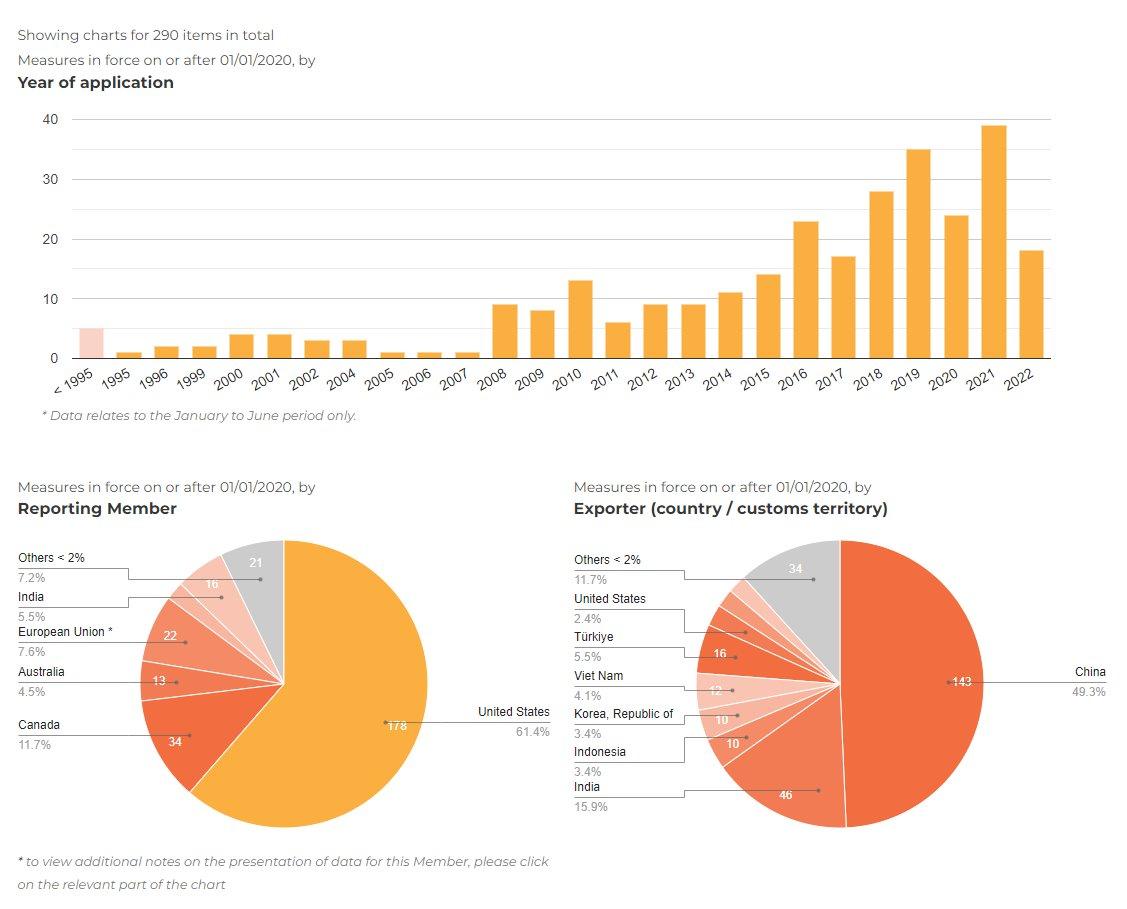

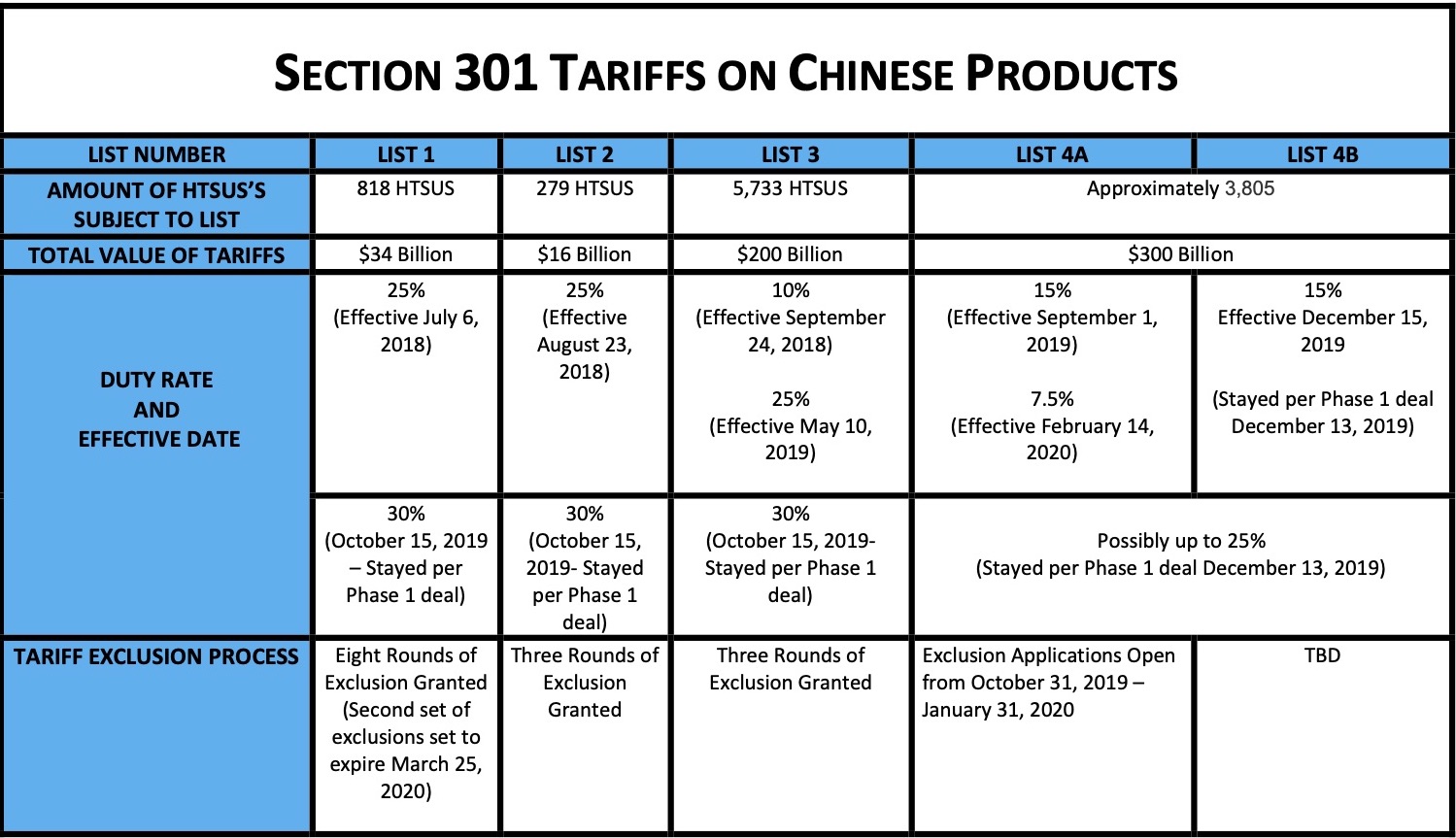

The primary objective of Trump's tariffs on Chinese imports was to address the significant US trade deficit with China and counter what the administration deemed unfair trade practices. The strategy involved imposing tariffs on a vast array of goods, ranging from steel and aluminum to consumer electronics and agricultural products.

- Goal: Reduce the US trade deficit with China and level the playing field for American industries.

- Methods: Imposition of tariffs ranging from 10% to 25% on hundreds of billions of dollars worth of Chinese imports.

- Arguments for Tariffs: Proponents argued the tariffs would:

- Protect American jobs, particularly in manufacturing.

- Boost domestic production and reduce reliance on foreign goods.

- Address concerns about intellectual property theft and forced technology transfer by Chinese companies.

- Counterarguments: Critics countered that the tariffs would:

- Lead to retaliatory tariffs from China, harming American exporters.

- Increase prices for American consumers, reducing their purchasing power.

- Disrupt global supply chains, leading to production delays and shortages.

Impact on Consumer Prices

One of the most immediate concerns surrounding Trump's tariffs was their impact on consumer prices. The evidence suggests a clear link between the tariffs and increased costs for American consumers.

- Increased Costs: Tariffs directly increased the cost of imported goods, which manufacturers often passed on to consumers in the form of higher prices.

- Supply Chain Disruptions: The tariffs complicated already complex global supply chains. Increased transportation costs, delays, and uncertainty added to the overall price of goods.

- Inflationary Pressures: The added costs contributed to inflationary pressures within the US economy, eroding the purchasing power of consumers.

- Specific Examples: Numerous studies documented price increases across various product categories. For example, furniture prices rose significantly due to tariffs on imported wood and components, and the cost of electronics also increased due to tariffs on imported parts.

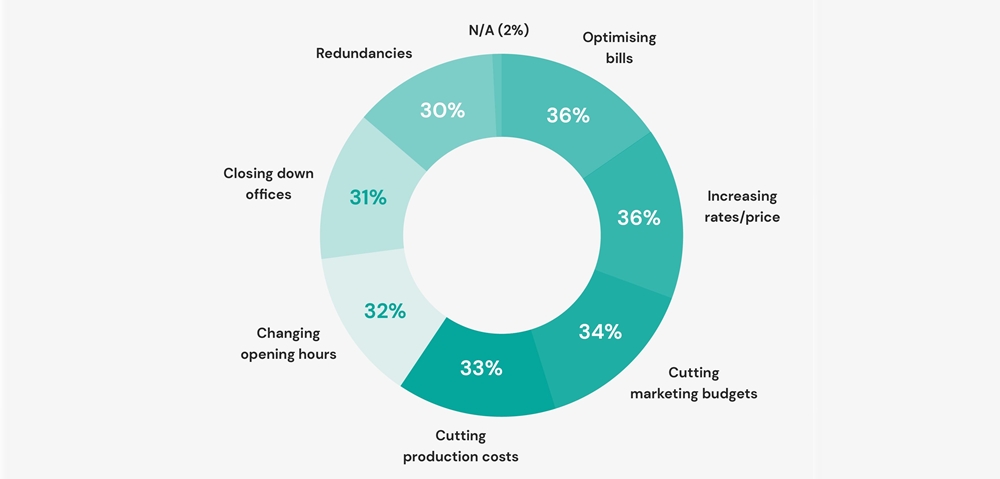

Impact on US Businesses

The tariffs' impact extended beyond consumers, significantly affecting American businesses. Many companies faced increased costs and reduced competitiveness.

- Increased Input Costs: American businesses reliant on imported raw materials and intermediate goods from China experienced significant increases in their input costs. This squeezed profit margins and forced some companies to raise prices or reduce production.

- Reduced Competitiveness: The tariffs made American businesses less competitive in both domestic and international markets. They faced higher production costs compared to their foreign competitors who sourced goods from outside China.

- Job Losses: While the administration argued tariffs would protect American jobs, some sectors experienced job losses due to reduced production and business closures. The impact varied across industries.

- Shifting Supply Chains: Many businesses attempted to diversify their supply chains, shifting sourcing away from China to other countries. This proved costly and logistically challenging, adding further complexities and costs.

The Empty Shelves Debate

One of the more dramatic claims made about the tariffs was that they led to "empty shelves" in American stores. However, the evidence supporting this claim is limited.

- Limited Evidence: While some isolated instances of product shortages occurred, there was no widespread, sustained impact on product availability in most retail stores.

- Other Contributing Factors: Several other factors contributed to supply chain disruptions and potential shortages, most notably the COVID-19 pandemic and increased consumer demand. Attributing these issues solely to the tariffs is an oversimplification.

- Regional Variations: The impact of tariffs on product availability likely varied across different regions of the US depending on the concentration of industries and consumer demand.

- Long-term Effects: The tariffs did, however, force a reassessment of supply chain resilience and spurred efforts to diversify sourcing, which may have long-term benefits in terms of reducing reliance on a single country.

Conclusion: Understanding the Lasting Effects of Trump's China Tariffs

Trump's tariffs on Chinese goods aimed to reshape US-China trade relations, but their ultimate impact remains a subject of ongoing debate. While intended to bolster American industries and jobs, the resultant price increases and supply chain disruptions raise serious questions about their overall effectiveness. The complex interplay of tariffs, the pandemic, and global economic factors makes it difficult to isolate the precise effects of the tariffs. Further research is crucial to fully understand the long-term consequences of these policies on the US economy. Understanding the full ramifications of these trade policies is vital for future economic strategies and informing discussions about future trade negotiations with China. To learn more about the ongoing effects of these trade policies, continue researching the economic impacts of Trump's China tariffs and their lasting consequences on the US economy.

Featured Posts

-

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 29, 2025

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 29, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 29, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 29, 2025 -

Blue Origins Rocket Launch Cancelled Due To Subsystem Failure

Apr 29, 2025

Blue Origins Rocket Launch Cancelled Due To Subsystem Failure

Apr 29, 2025 -

Germany Sees Significant Drop In Migration Following Border Control Tightening

Apr 29, 2025

Germany Sees Significant Drop In Migration Following Border Control Tightening

Apr 29, 2025 -

A Comprehensive Look At The Countrys New Business Hotspots

Apr 29, 2025

A Comprehensive Look At The Countrys New Business Hotspots

Apr 29, 2025

Latest Posts

-

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025 -

U S Businesses Implement Cost Cutting Strategies In Response To Tariffs

Apr 29, 2025

U S Businesses Implement Cost Cutting Strategies In Response To Tariffs

Apr 29, 2025 -

Cost Cutting Measures Rise As U S Companies Face Tariff Uncertainty

Apr 29, 2025

Cost Cutting Measures Rise As U S Companies Face Tariff Uncertainty

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025 -

U S Companies Slash Costs Amid Tariff Uncertainty

Apr 29, 2025

U S Companies Slash Costs Amid Tariff Uncertainty

Apr 29, 2025