Stock Market Valuations: BofA's Reassuring Take For Investors

Table of Contents

BofA's Key Arguments for a Positive Outlook

BofA's analysis focuses on several key factors supporting a positive outlook despite recent market fluctuations. These factors paint a picture of resilience and growth, suggesting that the current market conditions may not be as dire as some predict. Their predictions are built upon a foundation of tangible data points, offering a reassuring perspective for investors.

-

Stronger-than-expected corporate earnings growth: BofA's analysts point to corporate earnings that have exceeded initial projections in several key sectors. For example, the technology sector has shown unexpected resilience, with many companies reporting better-than-anticipated profits despite concerns about a potential recession. Similarly, certain consumer staples companies have demonstrated consistent growth, indicating that consumer spending remains surprisingly robust. This strong earnings growth is a crucial underpinning of their positive market outlook.

-

Moderation of inflation: The recent slowing of inflation is a significant factor influencing BofA's positive stock market forecast. Lower inflation reduces the pressure on central banks to aggressively raise interest rates. This moderation, in turn, lessens the risk of a sharp economic downturn and supports higher equity valuations. The correlation between inflation and market valuations is undeniable, and this moderation is a positive indicator.

-

Resilient consumer spending: Despite economic headwinds like rising interest rates and persistent inflation, consumer spending has proven remarkably resilient. While certain discretionary spending categories may have slowed, essential spending and services have remained strong. This indicates continued underlying economic strength and contributes to the positive market outlook. Data points supporting this include robust retail sales figures and steady employment numbers.

-

Improved corporate profit margins: Many companies have demonstrated improved profit margins, indicating increased efficiency and pricing power. This reflects their ability to manage costs effectively and pass on price increases to consumers. This positive trend suggests a continued ability for companies to generate profits and sustain growth, underpinning the positive stock market predictions.

Addressing Concerns about High Valuations

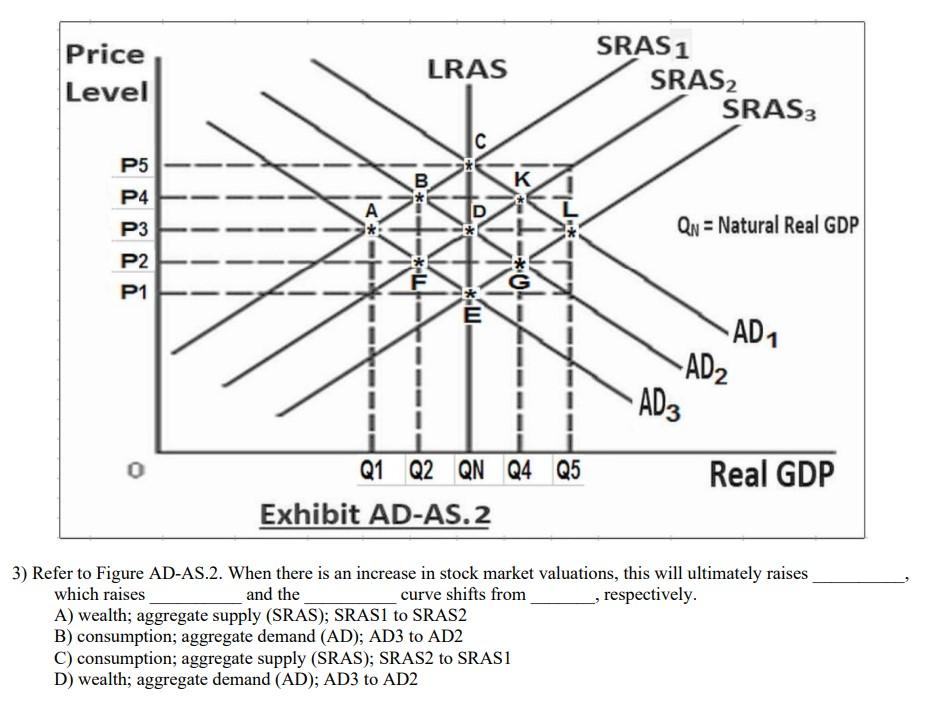

While acknowledging that some sectors remain richly valued, reflected in high Price-to-Earnings (P/E) ratios, BofA argues that overall valuations are not excessively high when considering future earnings growth. The analysis addresses common investor concerns head-on.

-

Comparing current P/E ratios to historical averages: BofA's analysis places current P/E ratios in historical context. While some sectors might appear expensive compared to long-term averages, the context of strong earnings growth helps to justify these valuations. This comparative approach mitigates concerns about overvaluation.

-

Highlighting the impact of interest rate changes on valuation multiples: The bank acknowledges the impact of interest rate changes on valuation multiples. However, they argue that the moderation of inflation and the anticipated slowing of interest rate hikes limit the negative impact on valuations. The analysis clearly articulates the nuanced relationship between interest rates and market valuations.

-

Discussing the potential for a market correction: BofA doesn't dismiss the possibility of a market correction. However, based on their analysis of fundamental factors, they emphasize the limited likelihood of a major downturn. They suggest that any correction is more likely to be a healthy adjustment than a catastrophic event.

-

Offering strategies for mitigating investment risks: The analysis also offers strategies for mitigating investment risks in a potentially volatile market. This includes diversification, focusing on quality companies with strong fundamentals, and employing a long-term investment horizon. These strategies help investors navigate potential market fluctuations effectively.

Specific Sectors BofA Highlights

BofA's report likely pinpoints specific sectors poised for growth. While the exact details may vary depending on the report's release, some likely candidates include:

-

Technology: The technology sector continues to be a significant driver of economic growth and innovation. Specific sub-sectors like artificial intelligence, cloud computing, and cybersecurity are likely highlighted due to their strong growth potential.

-

Renewable energy: The growing focus on sustainable energy sources presents significant investment opportunities in renewable energy technologies, including solar, wind, and other clean energy solutions. BofA likely considers this a high-growth sector with long-term potential.

-

Healthcare: The aging global population and continued advancements in medical technology create sustained demand within the healthcare sector, making it an attractive investment opportunity.

Conclusion

BofA's analysis offers a cautiously optimistic outlook on stock market valuations, emphasizing the importance of considering future earnings growth and understanding the broader economic context. While acknowledging risks inherent in any market, their report suggests that current valuations, considered against the backdrop of robust earnings growth and moderating inflation, are not excessively high and presents opportunities for discerning investors. Understanding stock market valuations is crucial for informed investment decisions. Stay informed about BofA's insights and other market analyses to refine your investment strategy. Learn more about how to effectively assess stock market valuations and make smart investment choices to navigate the complexities of the market effectively.

Featured Posts

-

Humanitarian Crisis In Gaza Urgent Need To Lift Israeli Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Urgent Need To Lift Israeli Aid Restrictions

Apr 29, 2025 -

The Hidden Cost Of Temu Unpacking The Impact Of Trumps Tariffs

Apr 29, 2025

The Hidden Cost Of Temu Unpacking The Impact Of Trumps Tariffs

Apr 29, 2025 -

Top Universities Unite Against Trump Administration An Exclusive Look

Apr 29, 2025

Top Universities Unite Against Trump Administration An Exclusive Look

Apr 29, 2025 -

Open Ai And The Ftc Understanding The Ongoing Investigation Into Chat Gpt

Apr 29, 2025

Open Ai And The Ftc Understanding The Ongoing Investigation Into Chat Gpt

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Latest Posts

-

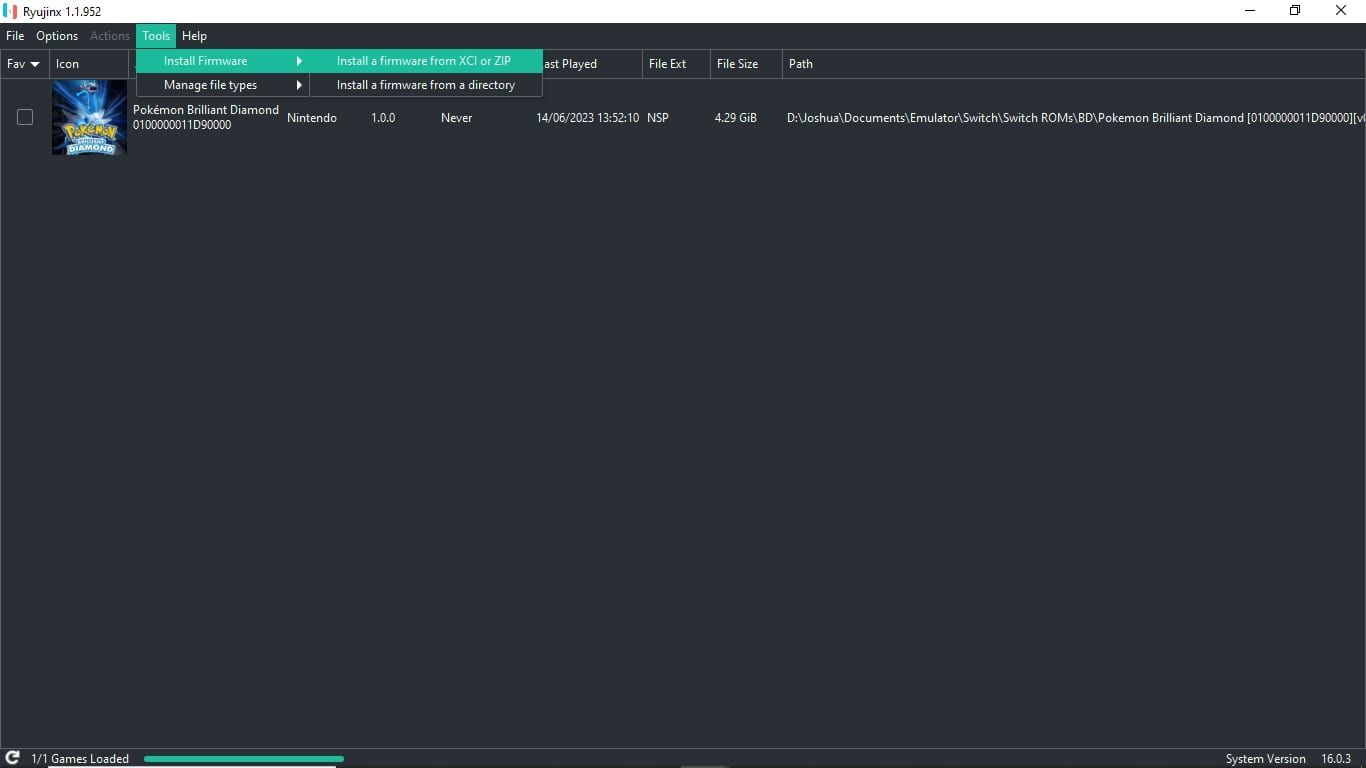

Ryujinx Emulator Development Halted Nintendos Involvement Explained

Apr 29, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Explained

Apr 29, 2025 -

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025 -

Perplexitys Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexitys Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

Assessing The Threat A Deep Dive Into Russias Military Posture In Europe

Apr 29, 2025

Assessing The Threat A Deep Dive Into Russias Military Posture In Europe

Apr 29, 2025 -

Kuxiu Solid State Power Bank A Premium Investment In Lasting Power

Apr 29, 2025

Kuxiu Solid State Power Bank A Premium Investment In Lasting Power

Apr 29, 2025