Tariff Uncertainty Drives U.S. Businesses To Cut Costs

Table of Contents

Increased Input Costs Due to Tariffs

Tariffs directly increase the cost of imported goods and raw materials, significantly impacting businesses' bottom lines. These increased costs are not simply passed on to consumers; they also directly affect a company's ability to compete and innovate. Industries heavily reliant on imported components, such as manufacturing and agriculture, are particularly vulnerable.

- Higher prices for imported components lead to increased production costs: The added tariff cost on raw materials translates into higher manufacturing costs, reducing profit margins. For example, a furniture manufacturer relying on imported wood may see its production costs skyrocket, making it difficult to compete with businesses sourcing domestically or from countries with lower tariffs.

- Reduced competitiveness in global markets due to higher prices: Increased production costs due to tariffs can make U.S. goods less competitive in the global marketplace. Higher prices may drive customers to seek alternatives from countries with lower production costs.

- Difficulty in accurately forecasting future costs due to fluctuating tariffs: The unpredictable nature of tariff changes makes long-term financial planning incredibly difficult. Businesses struggle to predict future costs, hindering investment and expansion plans. This uncertainty creates significant risk management challenges.

Supply Chain Disruptions and Restructuring

Tariff uncertainty is forcing many U.S. businesses to fundamentally rethink their supply chains. The reliance on global supply chains, once considered a cornerstone of efficiency and cost-effectiveness, is now viewed with increased scrutiny. Companies are actively pursuing strategies to reduce their dependence on potentially volatile international sources.

- Shifting sourcing to domestic suppliers or alternative countries: Nearshoring and reshoring are becoming increasingly popular strategies. Businesses are exploring sourcing components from domestic suppliers or from countries with more stable trade relations, even if it means slightly higher initial costs.

- Investing in new technologies to automate processes and reduce reliance on imported goods: Automation can help reduce dependence on imported components and labor. Investing in robotics and AI-driven solutions allows companies to become more self-sufficient and less vulnerable to tariff fluctuations.

- Increased transportation costs associated with supply chain changes: Shifting sourcing can lead to increased transportation costs. The longer distances involved in reshoring or sourcing from alternative countries can significantly impact logistics and overall expenses.

Cost-Cutting Measures Implemented by Businesses

To offset the impact of tariffs and maintain profitability, businesses are implementing various cost-cutting measures, some of which have significant long-term consequences.

- Layoffs and hiring freezes to reduce labor costs: Many companies are resorting to layoffs or hiring freezes to reduce their payroll expenses. This can have a devastating impact on employees and the broader economy.

- Cutting back on marketing and advertising budgets: Reduced marketing and advertising can harm brand visibility and market share in the long run.

- Negotiating better deals with suppliers to reduce input costs: Businesses are aggressively negotiating with suppliers to secure better prices and terms.

- Implementing efficiency improvements to streamline operations: Streamlining processes and reducing waste can help companies become more efficient and reduce overall costs.

The Impact on Economic Growth and Innovation

The widespread adoption of cost-cutting measures driven by tariff uncertainty has profound implications for the U.S. economy.

- Reduced investment in research and development due to budget constraints: Companies are often forced to reduce R&D spending, hindering innovation and long-term competitiveness.

- Slower economic growth due to decreased business investment and consumer spending: Uncertainty discourages business investment, leading to slower economic growth and impacting consumer confidence and spending.

- Potential job losses in industries affected by tariff uncertainty: The impact on employment can be significant, with potential job losses across various sectors.

Government Policies and Their Effects

Government policies play a crucial role in mitigating the negative effects of tariff uncertainty.

- Government subsidies or tax breaks to offset tariff costs: Targeted financial support can help businesses absorb the increased costs associated with tariffs.

- Investment in infrastructure to support domestic production: Improving infrastructure can reduce transportation costs and make domestic sourcing more attractive.

- Trade agreements to reduce or eliminate tariffs: Negotiating favorable trade agreements can minimize the impact of tariffs and promote more stable trade relationships.

Conclusion: Navigating Tariff Uncertainty and Protecting Your Business

Tariff uncertainty significantly impacts U.S. businesses, forcing them to implement various cost-cutting measures with broader economic implications. The challenges posed by fluctuating tariffs are substantial, requiring proactive strategies and adaptation. Businesses must develop comprehensive tariff mitigation strategies, including exploring alternative supply chains, investing in automation, and negotiating favorable deals with suppliers. Understanding the potential impact on your business and developing robust cost-cutting solutions is crucial for navigating this challenging environment. To learn more about managing tariff uncertainty and exploring effective cost-cutting strategies, consult resources from the U.S. Chamber of Commerce and the Small Business Administration. Proactive planning and adaptation are key to weathering the storm of tariff uncertainty and ensuring the long-term success of your business.

Featured Posts

-

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025 -

The Rise Of Otc Birth Control Redefining Reproductive Rights Post Roe

Apr 29, 2025

The Rise Of Otc Birth Control Redefining Reproductive Rights Post Roe

Apr 29, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of Lawsuit

Apr 29, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of Lawsuit

Apr 29, 2025 -

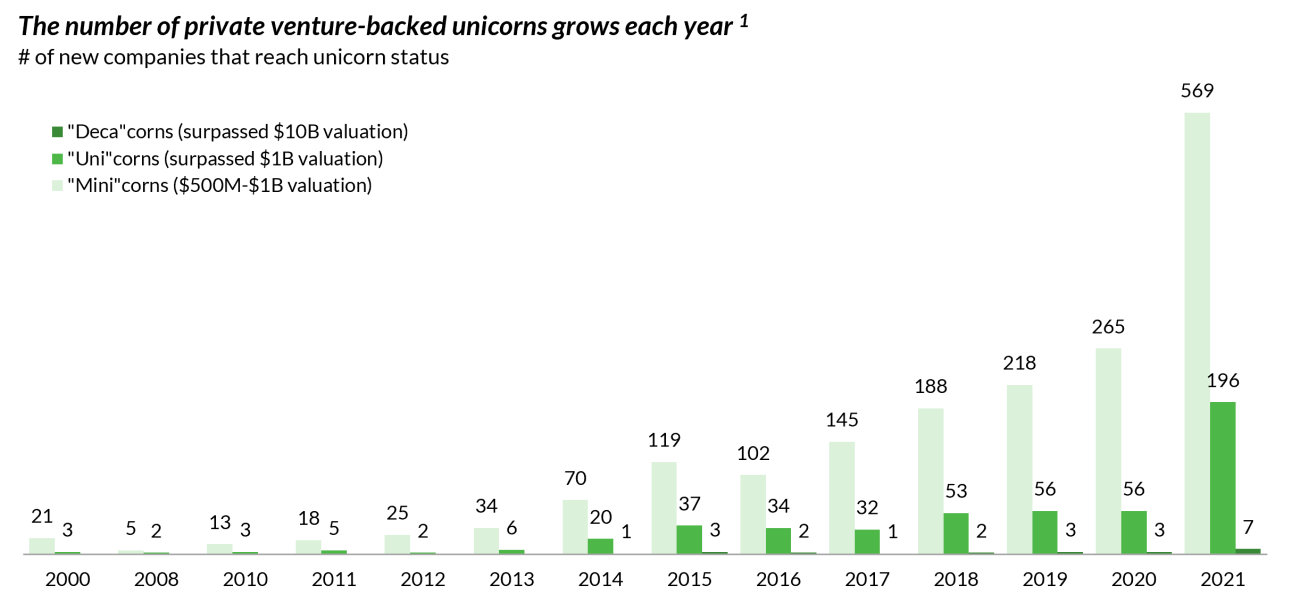

Venture Capital Secondary Market A Hot Investment Opportunity

Apr 29, 2025

Venture Capital Secondary Market A Hot Investment Opportunity

Apr 29, 2025 -

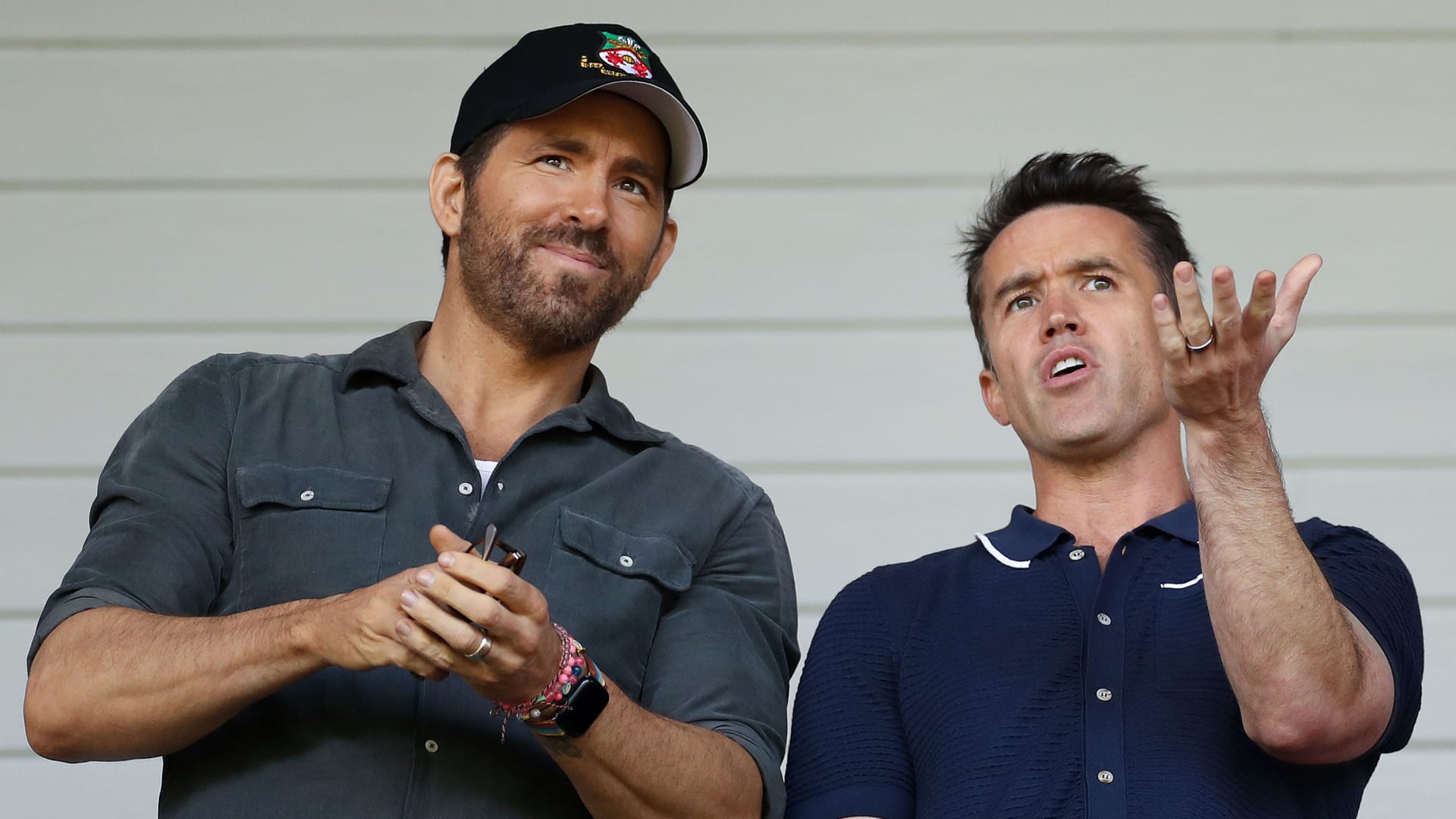

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025

Latest Posts

-

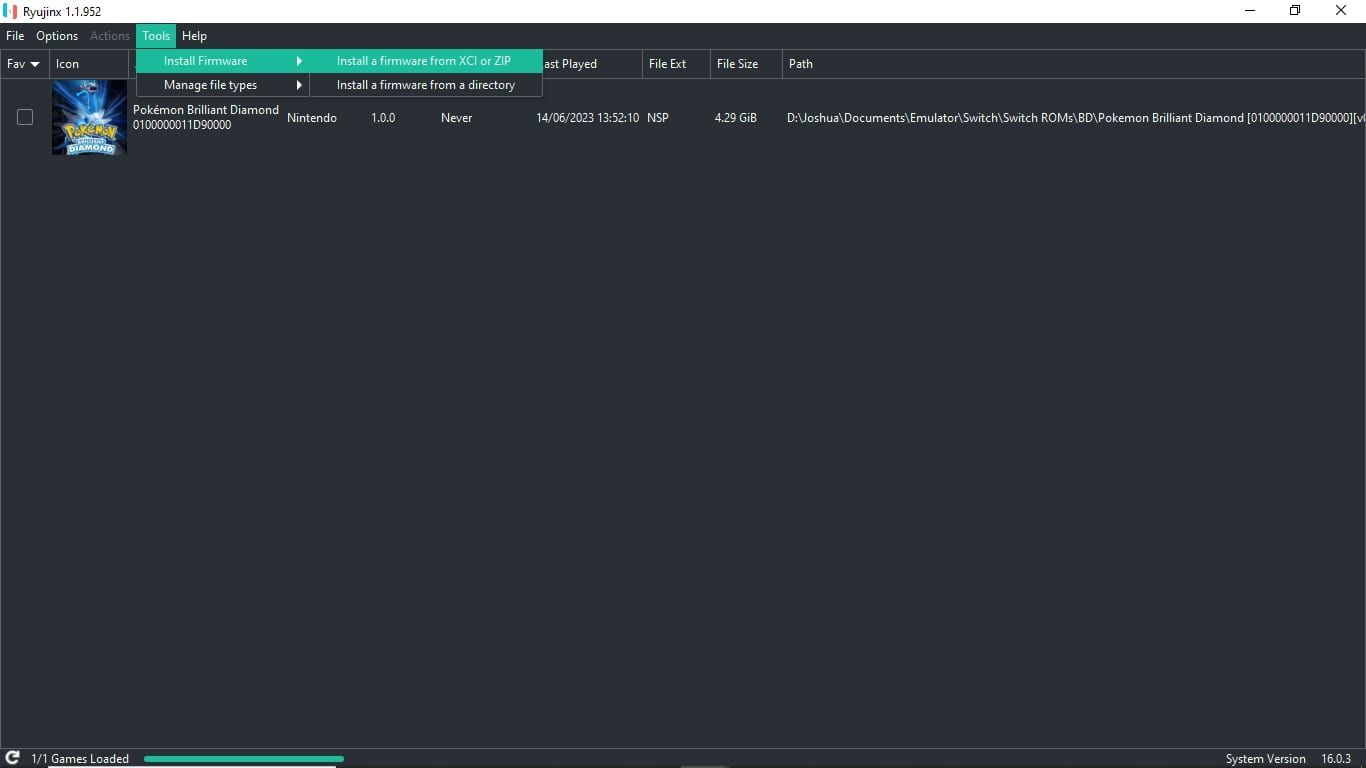

Ryujinx Emulator Development Halted Nintendos Involvement Explained

Apr 29, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Explained

Apr 29, 2025 -

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025 -

Perplexitys Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexitys Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

Assessing The Threat A Deep Dive Into Russias Military Posture In Europe

Apr 29, 2025

Assessing The Threat A Deep Dive Into Russias Military Posture In Europe

Apr 29, 2025 -

Kuxiu Solid State Power Bank A Premium Investment In Lasting Power

Apr 29, 2025

Kuxiu Solid State Power Bank A Premium Investment In Lasting Power

Apr 29, 2025