Navigating High Stock Market Valuations: Advice From BofA

Table of Contents

Understanding Current Market Valuations

Key Valuation Metrics

Several key metrics help assess market valuations. Understanding these is crucial for making informed investment decisions during periods of high valuations:

-

Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating an overvalued market. Currently, the S&P 500 P/E ratio is [Insert Current Data – cite source].

-

Shiller P/E (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable valuation measure. A high CAPE ratio can suggest overvaluation, even if the current P/E ratio appears reasonable. The current CAPE ratio is [Insert Current Data – cite source].

-

Price-to-Sales ratio (P/S): This compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings. A high P/S ratio might indicate overvaluation. The average P/S ratio for the S&P 500 is currently [Insert Current Data – cite source].

These metrics, when considered together, provide a more comprehensive picture of market valuation than any single metric alone.

BofA's Perspective on Current Valuations

BofA's recent reports [cite specific BofA reports or analyses with links] suggest [Summarize BofA's assessment of current market valuations – e.g., "that current valuations are elevated compared to historical averages, posing significant risks"].

- Key Risk: BofA highlights the risk of a market correction due to overvaluation and potential interest rate hikes.

- Potential Opportunity: Despite the risks, BofA may identify specific sectors or companies that offer attractive investment opportunities despite the overall high valuation environment (mention if applicable, citing the source).

- Overall Outlook: Summarize BofA's overall outlook on the market, emphasizing any cautionary notes or positive expectations.

Strategic Approaches for High Valuation Markets

Diversification Strategies

Diversification is paramount in high valuation markets. Spreading investments across various asset classes reduces the impact of market downturns:

- Asset Class Diversification: Include bonds, real estate, alternative investments (private equity, commodities) to balance risk.

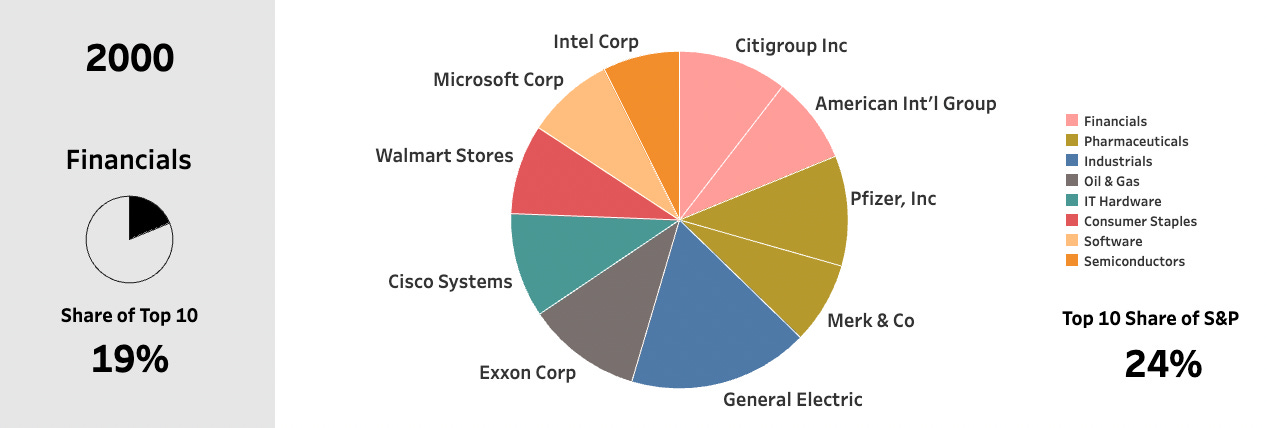

- Sector Diversification: Don't over-concentrate in any single sector; spread investments across various industries.

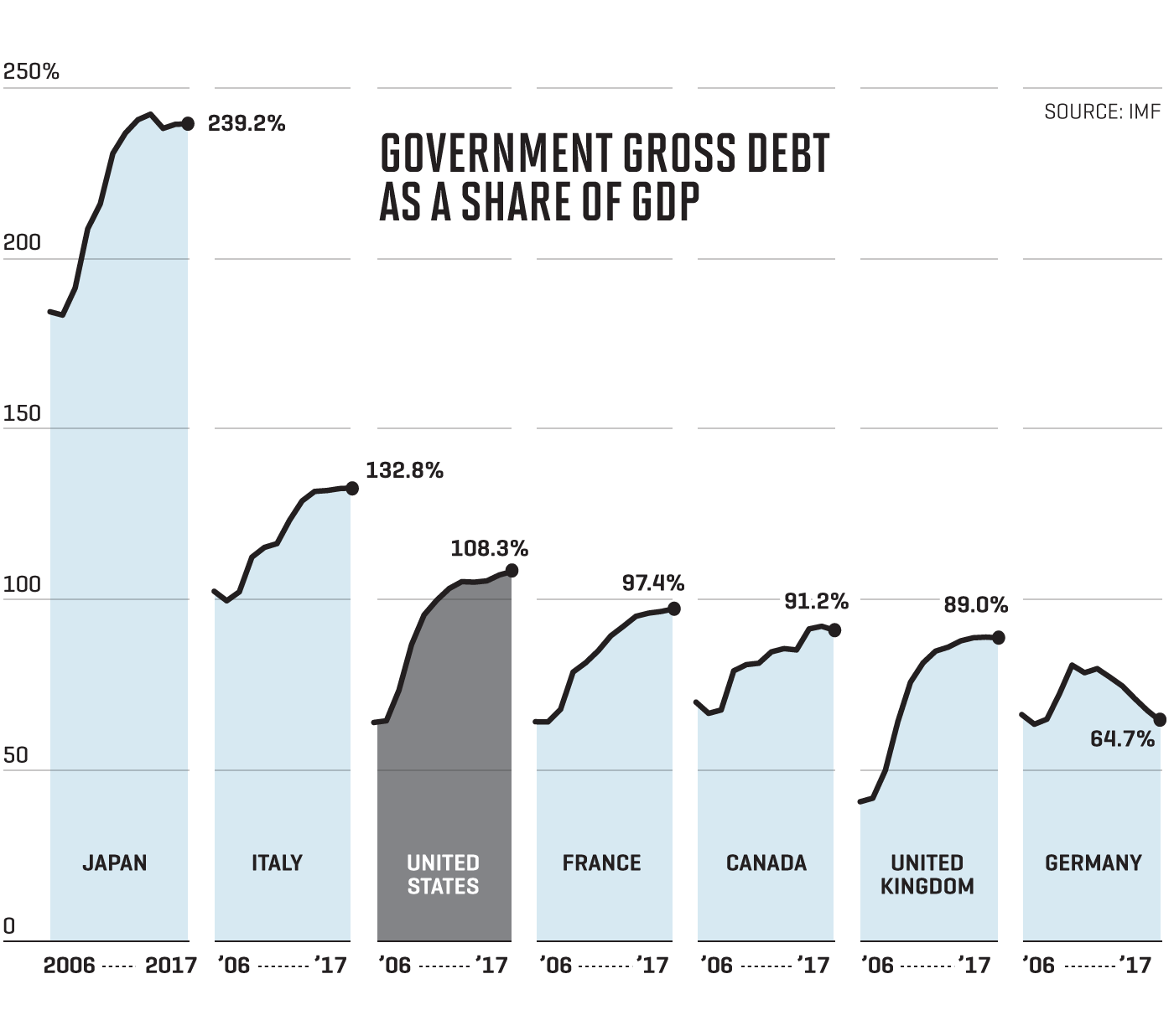

- Geographic Diversification: Invest in companies and assets across different regions to reduce country-specific risks.

Defensive Investment Strategies

Protecting capital is crucial in volatile markets. Consider these defensive strategies:

- Value Investing: Focus on undervalued companies with strong fundamentals and potential for future growth.

- Dividend Investing: Generate income through dividend-paying stocks, providing a cushion against market fluctuations.

- Hedging Strategies: Explore hedging techniques (options, futures) to protect against potential losses.

- Focus on Fundamentals: Prioritize companies with strong balance sheets, consistent earnings, and low debt.

Growth vs. Value Investing in High Valuation Environments

The choice between growth and value investing depends on your risk tolerance and investment horizon. BofA's stance [cite BofA research if available] on this topic should be summarized here.

- Growth Investing (Pros): Potential for high returns if the market continues its upward trajectory.

- Growth Investing (Cons): Higher risk of significant losses if the market corrects.

- Value Investing (Pros): Lower risk and potentially higher returns if undervalued companies outperform.

- Value Investing (Cons): Slower growth potential compared to growth stocks.

Risk Management in High Valuation Markets

Identifying Potential Risks

High stock market valuations present several risks:

- Market Corrections: Overvalued markets are susceptible to significant price drops.

- Inflation: Rising inflation erodes purchasing power and can impact corporate earnings.

- Interest Rate Hikes: Increased interest rates can dampen economic growth and reduce investor appetite for riskier assets.

Mitigating Investment Risks

Investors can take steps to mitigate these risks:

- Stop-Loss Orders: Set automatic sell orders to limit potential losses.

- Position Sizing: Diversify across multiple investments, limiting exposure to any single asset.

- Stress Testing Your Portfolio: Simulate various market scenarios (e.g., a 20% market drop) to understand potential impact on your portfolio.

BofA's Recommendations for Navigating High Valuations

BofA's recommendations [cite specific BofA publications or analyst commentary with links] often emphasize a cautious approach during periods of high stock market valuations. These recommendations might include [summarize their key recommendations, which should align with the strategies discussed previously].

- Actionable Step 1: [Summarize a specific recommendation]

- Actionable Step 2: [Summarize a specific recommendation]

- Actionable Step 3: [Summarize a specific recommendation]

Conclusion

Successfully navigating high stock market valuations requires a strategic approach that combines a thorough understanding of key valuation metrics, diversified portfolio construction, and robust risk management techniques. BofA's insights emphasize the need for caution and a focus on defensive strategies, while also highlighting potential opportunities for savvy investors. Don't let high stock market valuations catch you off guard. Take control of your investment strategy today by reviewing BofA's research and analysis for further insights and consulting with a financial advisor to develop a personalized plan tailored to your risk tolerance and investment goals. Remember, carefully managing your exposure to high stock market valuations is crucial for preserving and growing your wealth.

Featured Posts

-

Lakers Vs Timberwolves Latest On Anthony Edwards Injury

Apr 29, 2025

Lakers Vs Timberwolves Latest On Anthony Edwards Injury

Apr 29, 2025 -

Understanding High Stock Market Valuations A Bof A Analysis For Investors

Apr 29, 2025

Understanding High Stock Market Valuations A Bof A Analysis For Investors

Apr 29, 2025 -

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025 -

10 New Nuclear Reactors Approved In China A Major Expansion

Apr 29, 2025

10 New Nuclear Reactors Approved In China A Major Expansion

Apr 29, 2025 -

Clinical Trial Failure Impacts Akesos Market Value

Apr 29, 2025

Clinical Trial Failure Impacts Akesos Market Value

Apr 29, 2025

Latest Posts

-

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025 -

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025