Is The Bank Of Canada Making A Mistake? Rosenberg Weighs In

Table of Contents

Rosenberg's Critique of the Bank of Canada's Interest Rate Hikes

David Rosenberg's central argument against the Bank of Canada's aggressive interest rate hikes centers on the belief that the Bank is overestimating the persistence of inflation and underestimating the lagged effects of its policy decisions on the Canadian economy. He contends that the current approach risks tipping the economy into a deeper recession than currently projected. Rosenberg supports his claims by pointing to several key economic indicators:

-

Evidence: Rosenberg cites weakening consumer spending, a slowing housing market, and declining business investment as evidence that the economy is already significantly slowing. He argues that the full impact of previous interest rate hikes has yet to be felt, suggesting a delayed and potentially more severe economic contraction.

-

Analysis of Predicted Downturn: Rosenberg predicts a sharper economic downturn than the Bank of Canada's forecasts suggest. He believes the aggressive rate hikes will lead to a significant rise in unemployment and a prolonged period of subpar economic growth.

-

Specific Concerns Raised by Rosenberg:

- Overestimation of Inflation Persistence: Rosenberg argues that the current inflationary pressures are largely transitory and driven by supply chain disruptions and geopolitical factors, rather than underlying demand-pull inflation.

- Underestimation of Lagged Effects: He emphasizes the significant time lag between interest rate changes and their impact on the broader economy. This delay, he argues, means that the Bank of Canada's actions could lead to an overcorrection, causing unnecessary economic hardship.

- Neglect of Recession Potential: Rosenberg highlights the risk of triggering a deeper recession than anticipated, potentially leading to prolonged unemployment and slower economic recovery.

The Bank of Canada's Justification for its Actions

The Bank of Canada justifies its aggressive interest rate policy by citing its primary mandate: maintaining price stability. The Bank argues that persistent inflation erodes purchasing power and destabilizes the economy, requiring decisive action to bring inflation back to its 2% target.

-

Arguments for Aggressive Policy: The Bank contends that inflation is more entrenched than Rosenberg suggests, requiring a more forceful response to prevent a wage-price spiral. They point to robust labor markets and persistent upward pressure on wages as evidence of underlying inflationary pressures.

-

Economic Models and Forecasts: The Bank of Canada relies on sophisticated econometric models and extensive data analysis to inform its policy decisions. These models, they argue, predict a less severe economic slowdown than Rosenberg anticipates, suggesting that the current policy is appropriately calibrated to balance inflation control with economic growth.

-

Rationale for Actions:

- Maintaining Price Stability: Price stability is paramount to the Bank's mandate, requiring swift action to control inflation.

- Addressing Underlying Inflationary Pressures: The Bank believes that underlying inflationary pressures require a more aggressive approach than simply addressing transitory factors.

- Preventing a Wage-Price Spiral: A key concern is the potential for a self-perpetuating cycle of wage increases fueling further inflation.

Comparing Rosenberg's Predictions with the Bank of Canada's Projections

A significant divergence exists between Rosenberg's predictions and the Bank of Canada's projections regarding several key economic indicators:

-

Key Discrepancies:

- Differing Inflation Forecasts: Rosenberg anticipates a quicker decline in inflation than the Bank of Canada forecasts.

- Divergent Views on Economic Strength: Rosenberg believes the Canadian economy is significantly weaker than the Bank of Canada's assessment.

- Contrasting Assessments of Recession Risk: Rosenberg sees a substantially higher probability of a significant recession compared to the Bank's projections.

-

Methodology Differences: The differences in forecasts likely stem from varying methodologies and assumptions used in their respective economic models. Rosenberg's analysis may prioritize certain indicators or weigh them differently than the Bank of Canada's more comprehensive models.

-

Consequences of Differing Predictions: The differing projections carry significant implications for policy decisions and future economic outcomes. If Rosenberg’s predictions prove accurate, the Bank of Canada's current policy could exacerbate the economic downturn, prolonging the recovery period.

Alternative Monetary Policy Approaches

While the Bank of Canada has opted for aggressive interest rate hikes, alternative approaches could have been considered:

-

Potential Alternatives:

- Gradual Interest Rate Increases: A more gradual approach could have minimized the risk of triggering a sharp economic contraction.

- Targeted Fiscal Stimulus Measures: Government spending focused on boosting specific sectors could have helped offset the negative effects of interest rate hikes.

- Quantitative Easing or Unconventional Tools: These tools could have been utilized to further stimulate the economy if deemed necessary.

-

Feasibility and Drawbacks: The feasibility of these alternative approaches depends on various factors, including the severity of inflation, the state of the fiscal balance, and the potential risks associated with each strategy. Each approach comes with its own set of potential drawbacks and unintended consequences.

Conclusion

This article has explored David Rosenberg's insightful yet critical analysis of the Bank of Canada's monetary policy, juxtaposing his forecasts with the Bank's own projections. The significant divergence in opinions highlights the inherent complexity of navigating the current economic climate and the considerable uncertainty surrounding the future economic trajectory of Canada. Rosenberg’s warnings about the possibility of a steeper recession triggered by aggressive interest rate hikes should be taken seriously. While the Bank of Canada's mandate to maintain price stability is clear, the potential consequences of its actions on the Canadian economy necessitate ongoing monitoring and careful evaluation.

Call to Action: The debate surrounding the Bank of Canada's monetary policy continues to unfold. Stay informed on this crucial issue by following ongoing economic developments and keeping abreast of insightful analyses. For continued coverage on the Bank of Canada, its interest rate decisions, and their impact on the Canadian economy, continue to follow our updates.

Featured Posts

-

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 29, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 29, 2025 -

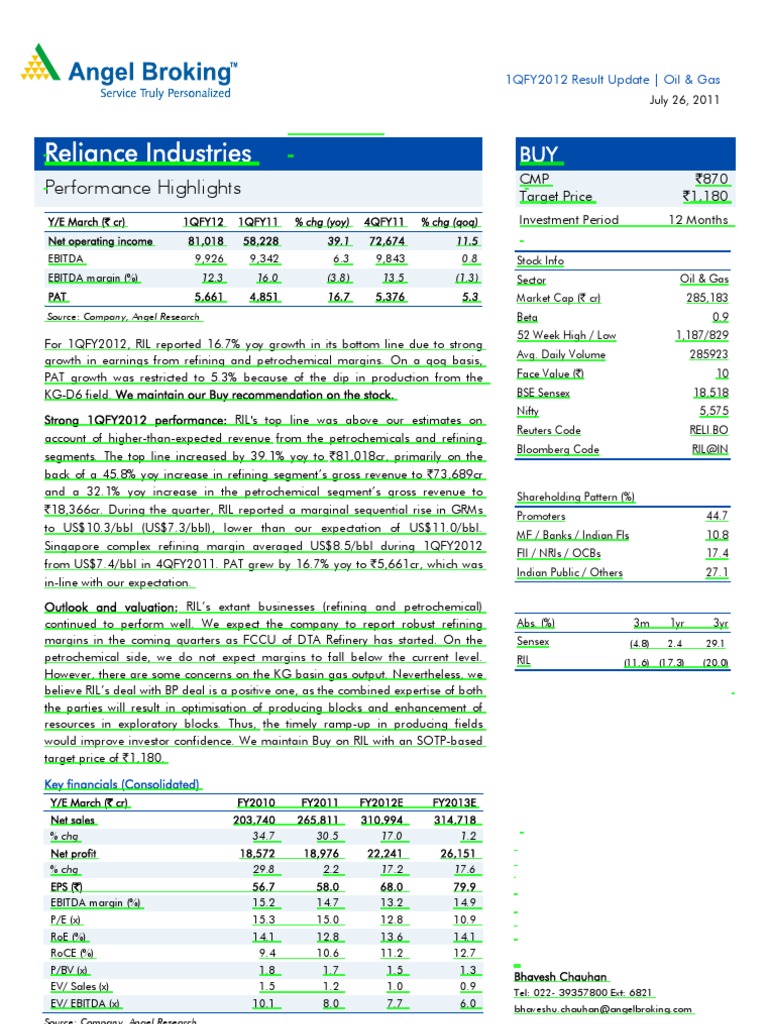

Reliance Industries Shares Jump After Positive Earnings Report

Apr 29, 2025

Reliance Industries Shares Jump After Positive Earnings Report

Apr 29, 2025 -

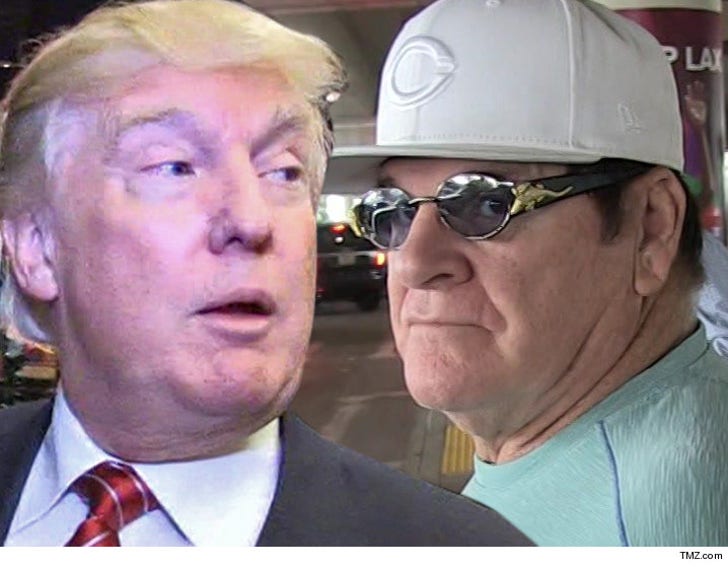

Trump Promises Pete Rose A Posthumous Pardon Following Mlb Criticism

Apr 29, 2025

Trump Promises Pete Rose A Posthumous Pardon Following Mlb Criticism

Apr 29, 2025 -

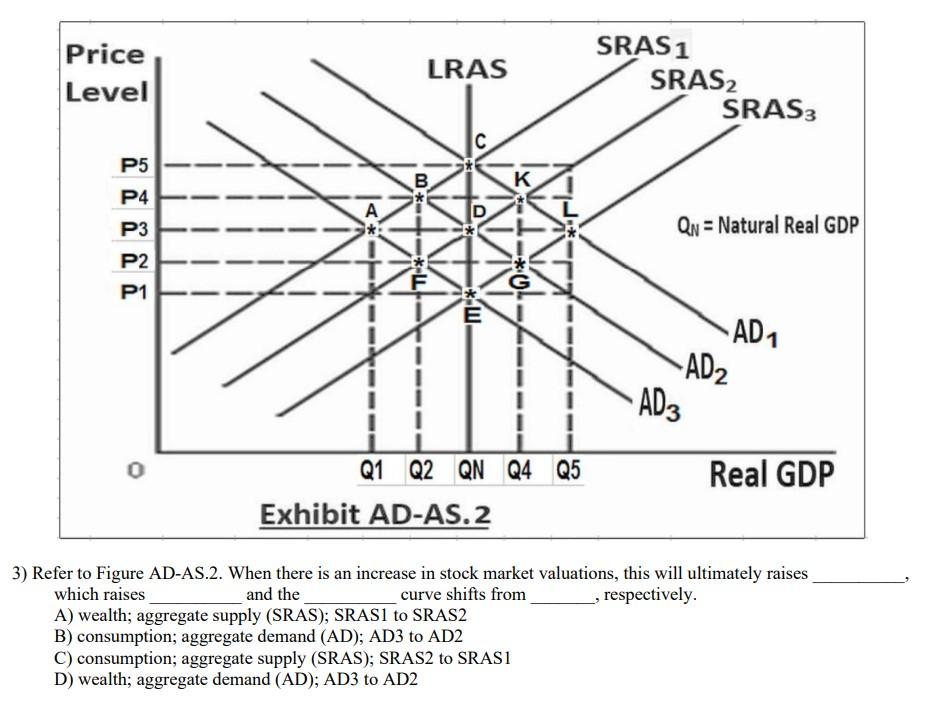

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 29, 2025

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 29, 2025 -

Louisville Shelter In Place Reflecting On Past Tragedy

Apr 29, 2025

Louisville Shelter In Place Reflecting On Past Tragedy

Apr 29, 2025

Latest Posts

-

Pw Cs Strategic Retreat Impact Of The Exit From Nine African Markets

Apr 29, 2025

Pw Cs Strategic Retreat Impact Of The Exit From Nine African Markets

Apr 29, 2025 -

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025 -

Nine African Countries Affected By Pwcs Departure Understanding The Reasons

Apr 29, 2025

Nine African Countries Affected By Pwcs Departure Understanding The Reasons

Apr 29, 2025 -

Erfolgsbilanz Deutsche Teams In Champions League Duellen

Apr 29, 2025

Erfolgsbilanz Deutsche Teams In Champions League Duellen

Apr 29, 2025 -

Analyse Deutsche Teams Im Champions League Vergleich

Apr 29, 2025

Analyse Deutsche Teams Im Champions League Vergleich

Apr 29, 2025