Reliance Industries Shares Jump After Positive Earnings Report

Table of Contents

Strong Performance Across Key Business Segments

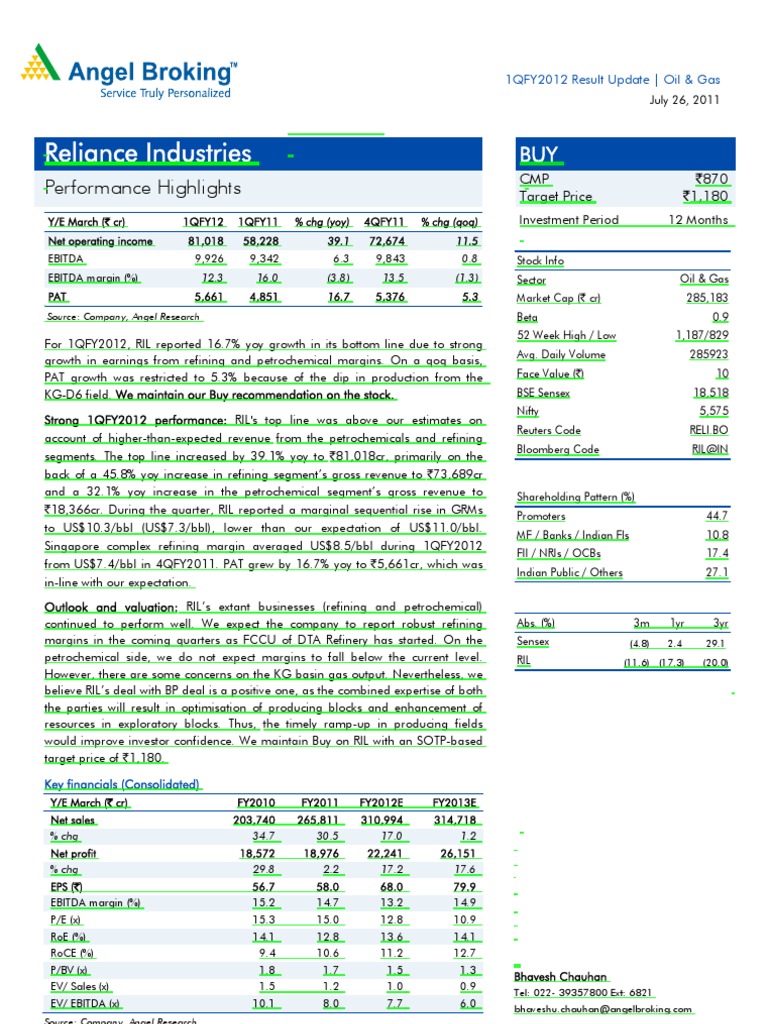

Reliance Industries' Q2 earnings showcased impressive growth across its major divisions, solidifying its position as a dominant player in the Indian market. This broad-based strength is a key driver of the increased investor interest in Reliance Industries shares.

Reliance Petrochemicals Division Shows Robust Growth

The petrochemicals division demonstrated exceptional performance, exceeding expectations in sales and profit margins. Strong global demand and efficient operational management contributed to this success.

- Increased Revenue: Petrochemical sales saw a significant percentage increase (insert specific percentage here), driven by robust demand for key products like polyethylene and polypropylene.

- Improved Profit Margins: Profit margins expanded by (insert specific percentage here) due to optimized production processes and favorable pricing conditions. This highlights the division's ability to navigate volatile market conditions and maintain profitability.

- Key Product Performance: Specific product categories like (mention specific high-performing products) witnessed particularly strong growth, contributing significantly to the overall performance of Reliance Petrochemicals. This robust performance is a major positive for Reliance Industries earnings.

Reliance Jio's Continued Subscriber Growth and Revenue Expansion

Reliance Jio, the telecom arm of Reliance Industries, continues its impressive growth trajectory. The company's strategic initiatives and expansion in digital services have fueled subscriber growth and increased revenue.

- Subscriber Base Expansion: Jio added (insert specific number) new subscribers during the quarter, increasing its market share. This expansion reflects the appeal of Jio's affordable data plans and diverse range of digital services.

- ARPU Increase: The average revenue per user (ARPU) increased to (insert specific amount), demonstrating improved monetization strategies. This is a significant indicator of the increasing value Jio delivers to its subscribers.

- New Initiatives: The launch of (mention new services or initiatives) contributed to Jio's growth, attracting new users and increasing revenue streams. The success of these initiatives reinforces Jio's position as a leader in the telecom sector. This success is crucial for the overall health of Reliance Industries shares.

Reliance Retail Demonstrates Resilience and Expansion

Reliance Retail, a key driver of Reliance Industries' growth, showed resilience and significant expansion during Q2.

- Sales Growth: Reliance Retail witnessed (insert specific percentage) growth in sales, showcasing the strength of its retail operations and its ability to tap into India's expanding consumer market.

- Expansion Plans: The company's continued expansion into new markets and product categories through new store openings and strategic partnerships helped drive sales growth. This reflects the company’s ambitious growth strategy.

- New Partnerships: Collaborations with (mention specific partners) have diversified Reliance Retail’s offerings and expanded its reach to a wider customer base, further contributing to its impressive performance. This is an important factor driving the positive performance of Reliance Retail.

Factors Contributing to the Share Price Surge

The sharp increase in Reliance Industries shares is driven by a confluence of factors, primarily the exceptional Q2 results and positive future prospects.

Exceeding Market Expectations

The Q2 earnings report significantly surpassed analyst predictions, boosting investor confidence. Key metrics like revenue, profit margins, and subscriber growth exceeded expectations, contributing to the positive market reaction. This earnings beat is a key reason for the surge in the share price.

Positive Future Outlook

Reliance Industries' guidance for future performance is positive, further enhancing investor sentiment. Upcoming projects and initiatives are expected to drive continued growth across various business segments, contributing to the long-term value of Reliance Industries shares. This positive outlook is a major driver of investor confidence.

Investor Sentiment and Market Conditions

The overall market sentiment towards Reliance Industries is positive, reflecting investor confidence in the company’s long-term growth potential. Favorable broader market conditions also contributed to the share price increase. The combination of positive company-specific factors and a supportive market environment created an ideal situation for a surge in the share price of Reliance Industries shares.

Implications for Investors

The strong Q2 results have significant implications for investors considering Reliance Industries shares.

Potential for Further Growth

Reliance Industries' diversified business model and strong growth prospects suggest significant potential for further growth in the coming quarters and years. The company’s strategic investments in new technologies and its expansion into new markets present long-term growth opportunities. This makes Reliance Industries shares a potentially lucrative investment.

Strategies for Investors

Investors should consider their risk tolerance and investment goals when evaluating Reliance Industries shares. A long-term investment strategy might be suitable for those seeking exposure to a diversified conglomerate with strong growth potential. However, it is important to conduct thorough research and consider diversification within your investment portfolio.

Conclusion

The strong Q2 earnings report has fueled a significant surge in Reliance Industries shares. The robust performance across its diverse business segments, exceeding market expectations, and a positive future outlook all contributed to investor confidence. This makes Reliance Industries shares a compelling investment opportunity for those seeking exposure to a diversified conglomerate with strong growth potential. Consider carefully your own risk tolerance and investment strategy before making any decisions regarding Reliance Industries shares. Remember to conduct your own thorough research before investing.

Featured Posts

-

Nationwide Sanctuary City List Trumps Planned Executive Action

Apr 29, 2025

Nationwide Sanctuary City List Trumps Planned Executive Action

Apr 29, 2025 -

Stock Market Valuation Concerns Bof As Rationale For Investor Calm

Apr 29, 2025

Stock Market Valuation Concerns Bof As Rationale For Investor Calm

Apr 29, 2025 -

Exclusive University Alliance Challenges Trumps Education Policies

Apr 29, 2025

Exclusive University Alliance Challenges Trumps Education Policies

Apr 29, 2025 -

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025 -

China Market Headwinds Challenges Faced By Bmw Porsche And Other Auto Brands

Apr 29, 2025

China Market Headwinds Challenges Faced By Bmw Porsche And Other Auto Brands

Apr 29, 2025

Latest Posts

-

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025 -

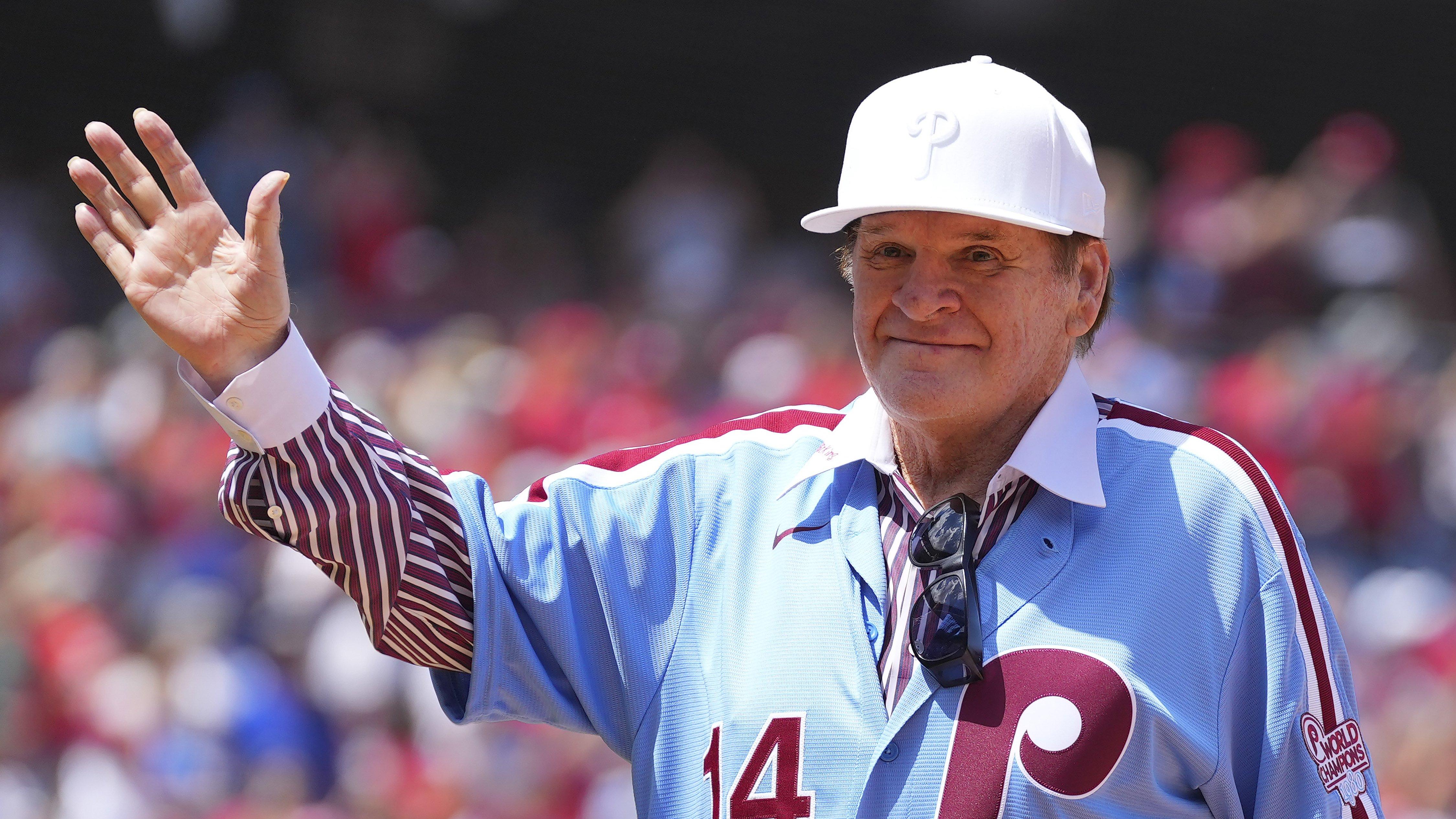

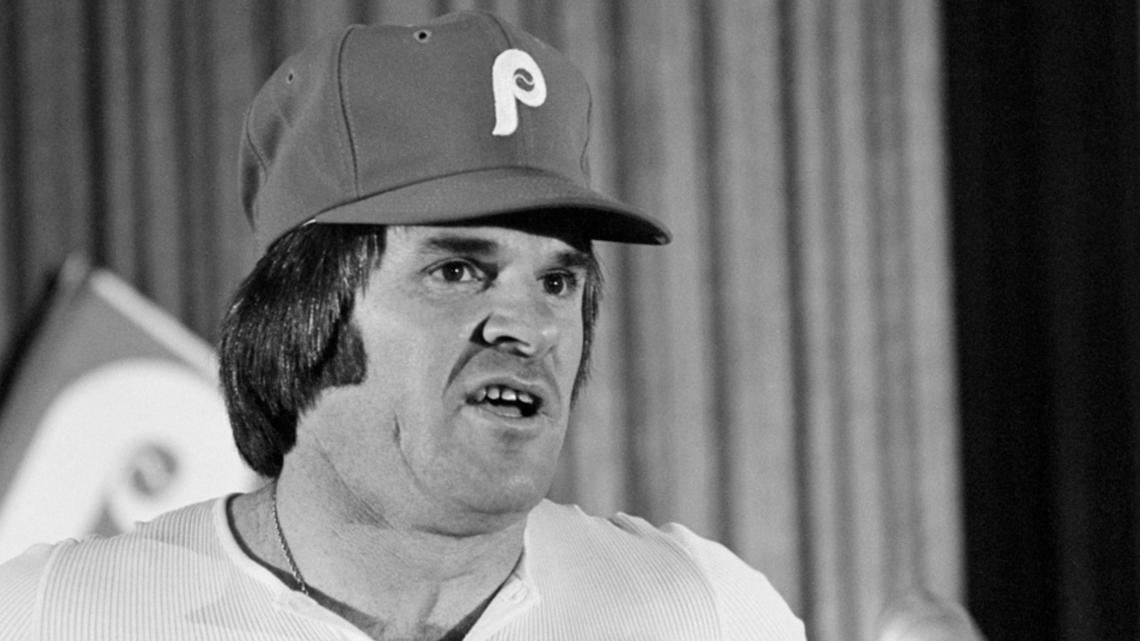

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025 -

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025