Nine African Countries Affected By PWC's Departure: Understanding The Reasons

Table of Contents

The Nine Affected African Countries

PWC's withdrawal affects a significant number of African nations. While the exact list may vary depending on the specifics of the announcement, a representative group of nine countries may include (this list is illustrative and may not be exhaustive):

-

Angola: PWC held a substantial market share in Angola's auditing sector, serving numerous multinational corporations and local businesses. The departure could lead to increased competition among remaining firms, but also potential challenges for businesses seeking auditing services.

-

Botswana: Known for its relatively stable economy, Botswana's reliance on PWC for auditing and advisory services could create short-term disruption. The impact may be less severe compared to countries with weaker regulatory frameworks.

-

Burundi: PWC's presence in Burundi, while perhaps smaller than in other nations, still provided important auditing capabilities. Its absence could negatively impact foreign investment and the country's overall economic outlook.

-

Eritrea: In countries like Eritrea, characterized by political complexities and economic challenges, PWC's departure could hinder economic development and complicate efforts to attract foreign direct investment.

-

Lesotho: Similar to Burundi, PWC's withdrawal from Lesotho will likely create a gap in the market for high-quality auditing services, potentially affecting investor confidence.

-

Malawi: The impact on Malawi's business community is likely to be substantial, given PWC's significant role in the country's financial landscape. Local firms will need to quickly adapt and increase their capacity.

-

Namibia: Namibia’s relatively stable economy might lessen the immediate impact, but the long-term effects on attracting future investment remain a concern.

-

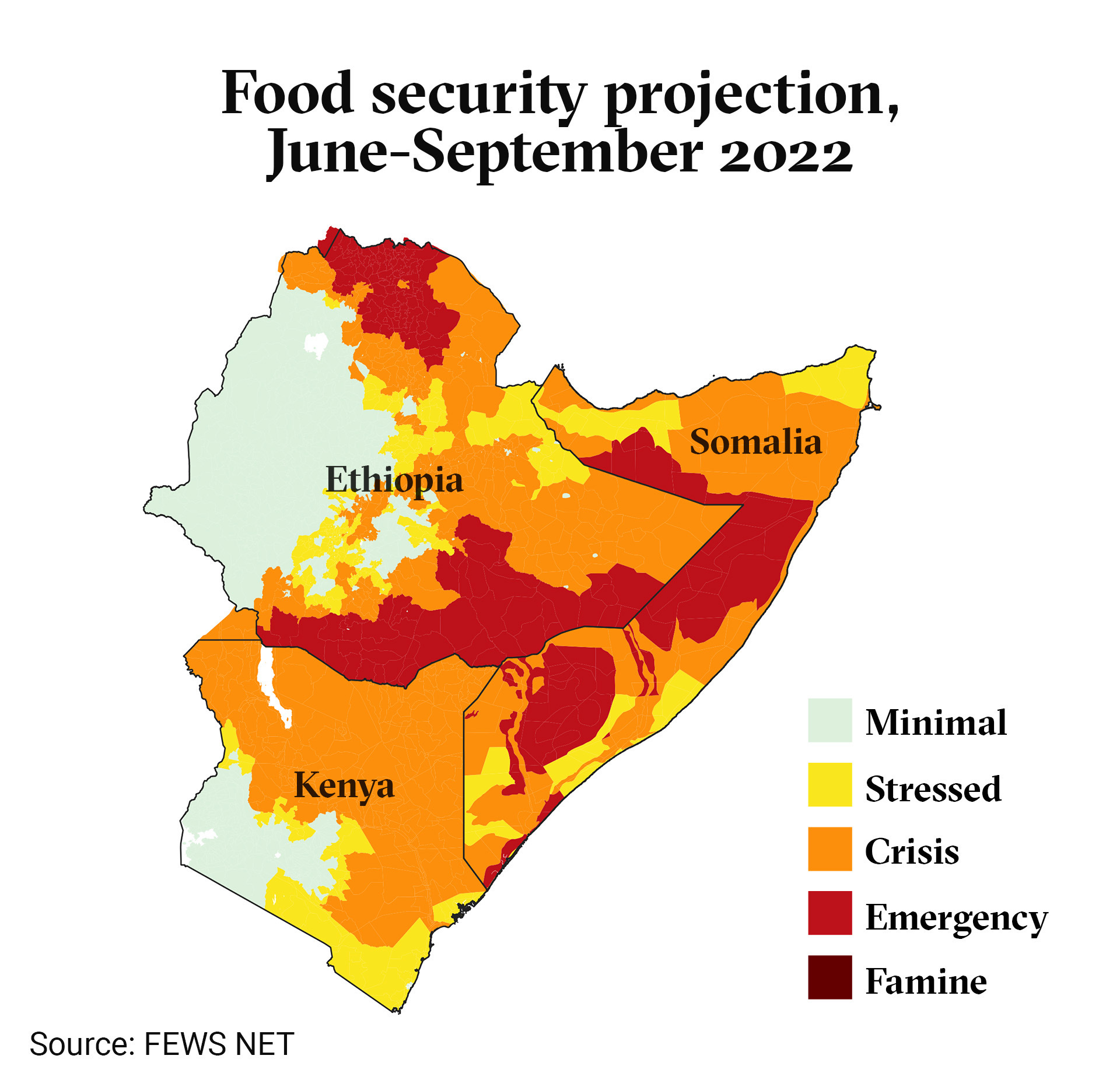

Somalia: Given the fragility of Somalia's economy and political climate, PWC's departure is likely to be felt acutely, impacting efforts towards economic stability and development.

-

Zimbabwe: Zimbabwe's struggling economy faces added pressure with PWC's withdrawal. The departure might affect access to international financial markets and investor trust.

The significance of PWC's presence in each country varied, but its departure undoubtedly leaves a void in the audit and assurance services market.

Reasons Behind PWC's Withdrawal: A Multifaceted Issue

PWC's decision to withdraw is not solely attributable to a single factor but rather a complex interplay of challenges.

Regulatory Scrutiny and Compliance Costs

Increased regulatory burdens and compliance costs in certain African countries have made operations increasingly difficult and potentially unprofitable.

- Stringent anti-money laundering (AML) regulations: The increasingly stringent AML regulations, while necessary to combat financial crime, can impose significant compliance costs on firms like PWC.

- Tax compliance complexities: Navigating complex and ever-changing tax laws across various African countries adds substantial operational overhead.

- Increased auditing requirements: More rigorous auditing standards and reporting requirements increase the cost of doing business.

Reputational Risk and Ethical Concerns

Operating in certain African markets presents significant reputational risks and ethical challenges.

- Exposure to corruption allegations: The potential for entanglement in corruption scandals can severely damage a firm's reputation.

- Difficulty maintaining ethical standards in challenging environments: Upholding ethical standards in environments with weak governance structures can be extremely difficult.

- Negative publicity affecting client relationships: Any negative publicity associated with operations in a particular country can damage client relationships and lead to lost business.

Economic Instability and Market Volatility

Economic downturns and political instability in some African nations also played a crucial role in PWC's decision.

- Currency devaluation: Fluctuations in currency exchange rates can severely impact profitability.

- Political uncertainty: Political instability and uncertainty create a volatile business environment, making long-term planning and investment challenging.

- Economic recession: Economic downturns reduce demand for professional services, making operations unsustainable.

Consequences of PWC's Departure for Affected Nations

The implications of PWC's departure are far-reaching.

Impact on the Audit and Accounting Sector

- Increased competition: The departure creates a vacuum, leading to heightened competition among remaining firms, potentially benefiting some and challenging others.

- Job losses: PWC's withdrawal will inevitably result in job losses, impacting the livelihoods of employees and local communities.

- Challenges for smaller firms: Smaller accounting firms may struggle to handle the influx of clients and the increased workload.

Implications for Foreign Investment

- Reduced investor confidence: The withdrawal could damage investor confidence in the regulatory environments of the affected countries.

- Shift to other markets: Investors may seek alternative markets with more stable regulatory frameworks and transparent business practices.

- Slower economic growth: Reduced foreign investment will undoubtedly hinder economic growth in these countries.

Need for Regulatory Reform

- Improved regulatory frameworks: African governments need to improve their regulatory frameworks to create a more attractive environment for foreign investment.

- Streamlined compliance processes: Simplification and streamlining of compliance procedures are crucial to reduce costs and burdens for businesses.

- Governmental role: Governments play a critical role in fostering a transparent and predictable business climate through effective policies and efficient governance.

Conclusion

PWC's departure from nine African countries highlights the complexities of operating in the region. The consequences, ranging from impacts on the accounting sector to diminished foreign investment and slower economic growth, are significant. Addressing the underlying issues through regulatory reform, improved transparency, and a stronger focus on ethical conduct is paramount to mitigate the negative effects of PWC's withdrawal and attract future investment. Understanding the reasons behind PWC's departure from Africa is a crucial first step in building a more robust and sustainable business environment. To ensure continued growth and stability, addressing these challenges and promoting a more inviting business climate are essential. Further analysis of PWC's departure and its ramifications is vital for a comprehensive understanding of this pivotal development.

Featured Posts

-

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025 -

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025 -

Trumps Posthumous Pardon For Pete Rose A Controversial Decision

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Controversial Decision

Apr 29, 2025 -

Buying Tickets For The Capital Summertime Ball 2025 A Practical Guide

Apr 29, 2025

Buying Tickets For The Capital Summertime Ball 2025 A Practical Guide

Apr 29, 2025 -

Pw C Cuts Ties Over A Dozen Countries Affected By Recent Controversies

Apr 29, 2025

Pw C Cuts Ties Over A Dozen Countries Affected By Recent Controversies

Apr 29, 2025

Latest Posts

-

Spetsialna Fitnes Trenirovka I Lektsiya Za Raka Na Grdata Podark Za 8 Mart Ot Onkokhirurg I Trenor

Apr 30, 2025

Spetsialna Fitnes Trenirovka I Lektsiya Za Raka Na Grdata Podark Za 8 Mart Ot Onkokhirurg I Trenor

Apr 30, 2025 -

Prof Iva Khristova Aktualna Informatsiya Za Gripnata Situatsiya

Apr 30, 2025

Prof Iva Khristova Aktualna Informatsiya Za Gripnata Situatsiya

Apr 30, 2025 -

I Ygeia Mas Se Ines Pos Oi Ypologistes Tha Allaksoyn Ta Panta

Apr 30, 2025

I Ygeia Mas Se Ines Pos Oi Ypologistes Tha Allaksoyn Ta Panta

Apr 30, 2025 -

Iva I Siyana Postizheniya I Bdeschi Planove

Apr 30, 2025

Iva I Siyana Postizheniya I Bdeschi Planove

Apr 30, 2025 -

Zascho Toploto Vreme Pomaga Sreschu Gripa Mnenie Na Prof Iva Khristova

Apr 30, 2025

Zascho Toploto Vreme Pomaga Sreschu Gripa Mnenie Na Prof Iva Khristova

Apr 30, 2025