PwC US Partners Ordered To Sever Brokerage Ties Following Internal Probe

Table of Contents

Details of the Internal Probe at PwC US

An internal investigation at PwC US, triggered by [insert triggering event, e.g., an anonymous tip or a whistleblower complaint], uncovered serious violations of ethical guidelines and potentially applicable financial regulations. The investigation, which spanned [insert duration of investigation], involved [insert details about the scope and methodology of the investigation, e.g., a dedicated internal team, external legal counsel]. The probe focused on the nature of the relationships between PwC partners and various brokerage firms.

The specific violations uncovered involved partners using brokerage firms for personal gain, potentially influencing client investment decisions based on their personal financial interests, and engaging in other unethical practices that compromised PwC's duty of care to its clients. These actions violated [mention specific regulations, e.g., SEC regulations, internal PwC policies on conflicts of interest].

- Timeline of the investigation: [Insert key dates]

- Key findings of the probe: [Summarize key findings without revealing sensitive information]

- Types of brokerage relationships under scrutiny: [Specify types of relationships, e.g., personal accounts, managed accounts for family members]

- Examples of violations: [Provide anonymized examples illustrating the nature of the violations. E.g., "Partners were found to have steered clients towards investments that benefited their personal brokerage accounts."]

The Mandate to Sever Brokerage Ties

In response to the findings of the internal probe, PwC US has mandated that all its partners sever all ties with external brokerage firms. This sweeping mandate applies to [specify scope: all partners, specific geographic locations, etc.] and encompasses all types of brokerage relationships, including [specify types of relationships: personal accounts, family accounts, etc.].

This decision will undoubtedly have a significant impact on partners' personal finances and investment strategies. Many partners relied on these relationships for personal wealth management. The firm aims to demonstrate its commitment to transparency and prevent even the appearance of a conflict of interest.

- Specifics of the severance mandate: [Include details about the timeline for severance, the process for partners to comply, and any exceptions made.]

- PwC's rationale for the decision: [Highlight PwC's commitment to maintaining client trust, upholding its ethical standards, and adhering to regulations.]

- Potential consequences for partners who fail to comply: [Mention possible disciplinary actions, including termination.]

PwC's Response and Commitment to Compliance

PwC has issued a public statement acknowledging the findings of the internal investigation and outlining its commitment to rectifying the situation. [Insert quote from PwC's official statement]. The firm is undertaking a comprehensive overhaul of its compliance procedures and internal controls to prevent similar incidents from occurring in the future. This includes significant investments in enhanced training programs for partners, increased scrutiny of partner activities, and more robust internal audit processes.

- PwC's public statement regarding the probe and its outcome: [Summarize key points from the statement]

- New compliance measures being implemented: [Detail specific measures, e.g., independent review boards, enhanced conflict-of-interest policies]

- Increased training programs for partners: [Describe the scope and content of the training]

- Enhanced internal audit processes: [Explain how the audit processes will be improved to detect conflicts of interest]

Implications for the Financial Industry and Regulatory Oversight

The PwC situation has significant implications for the financial industry and regulatory oversight. Regulatory bodies are likely to launch their own investigations into PwC’s practices, potentially resulting in substantial fines and penalties for the firm. This event will undoubtedly affect investor confidence and trust not just in PwC but in the accounting profession as a whole.

- Potential regulatory investigations and penalties: [Discuss potential actions from regulatory bodies like the SEC]

- Impact on investor confidence and the reputation of the accounting profession: [Analyze the potential long-term effects on trust]

- Changes in industry best practices likely to emerge: [Discuss potential changes in corporate governance and ethical guidelines]

Conclusion: Understanding the PwC Brokerage Tie Severance and its Implications

The internal investigation at PwC, culminating in the mandated severance of brokerage ties, underscores the crucial importance of maintaining the highest ethical standards and preventing conflicts of interest within professional services firms. PwC's response, while significant, will be judged by its long-term effectiveness in rebuilding trust and ensuring compliance. The broader implications for the financial industry include potential regulatory changes and a renewed focus on corporate governance. Stay updated on the PwC case and its implications for the future of the accounting profession. Learn more about conflict of interest prevention in professional services to ensure similar situations are avoided in the future.

Featured Posts

-

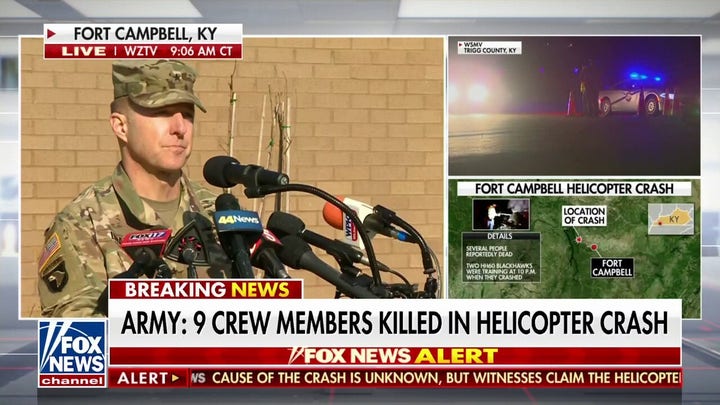

The D C Black Hawk Crash Examining Pilot Training And Decision Making

Apr 29, 2025

The D C Black Hawk Crash Examining Pilot Training And Decision Making

Apr 29, 2025 -

Discussion On Potential Charges Against Jeffrey Goldberg Benny Johnsons Perspective

Apr 29, 2025

Discussion On Potential Charges Against Jeffrey Goldberg Benny Johnsons Perspective

Apr 29, 2025 -

Analyzing The Ny Times Handling Of The January 29th Dc Air Disaster

Apr 29, 2025

Analyzing The Ny Times Handling Of The January 29th Dc Air Disaster

Apr 29, 2025 -

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025 -

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025

Latest Posts

-

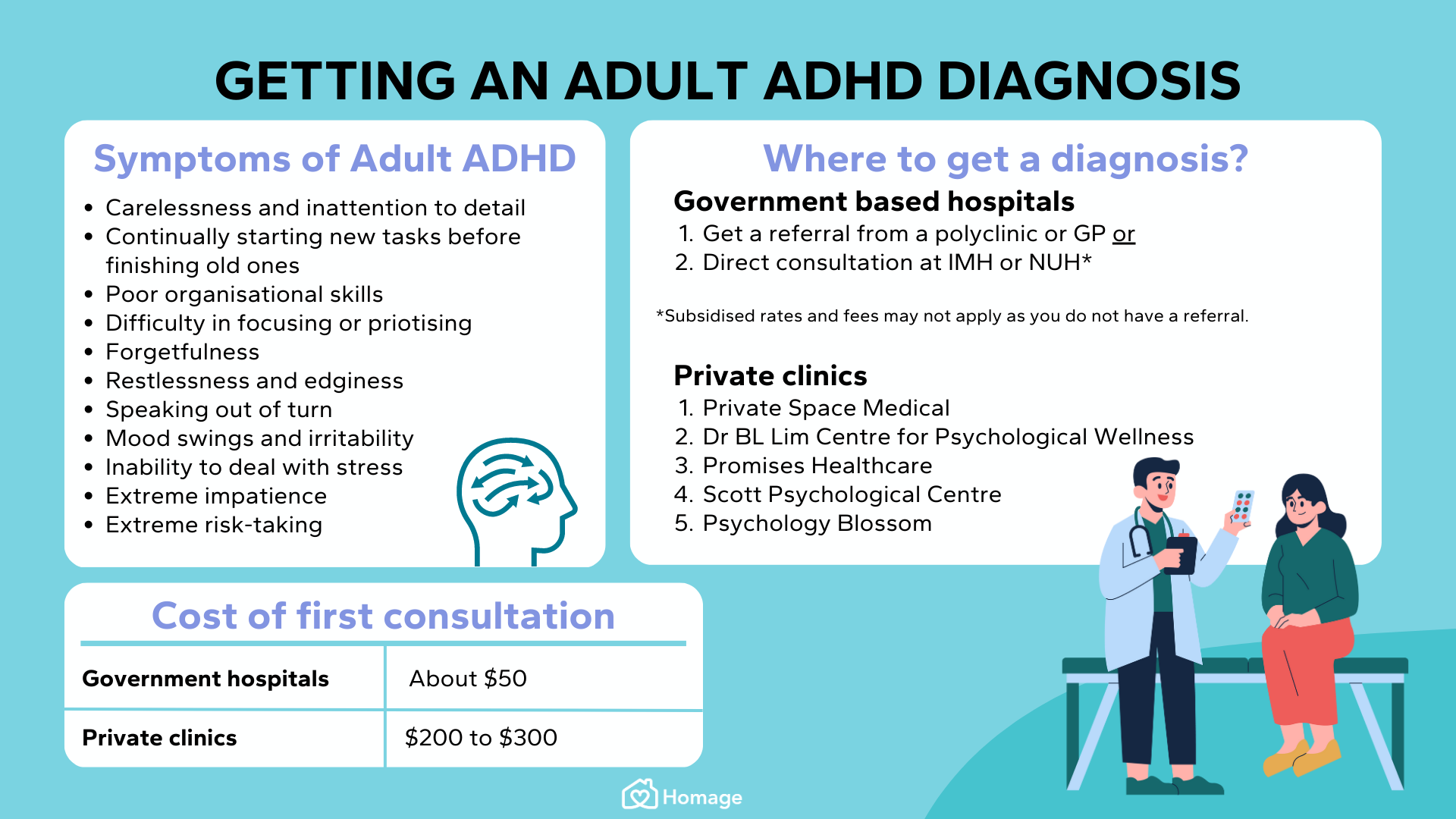

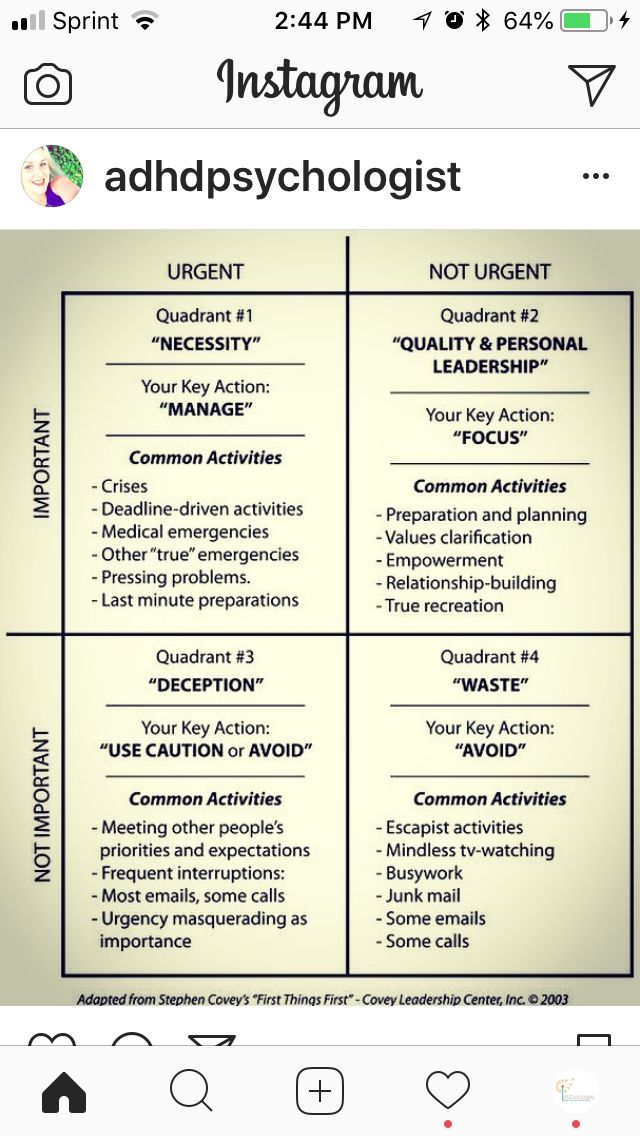

Suspect Adult Adhd A Guide To Diagnosis And Treatment

Apr 29, 2025

Suspect Adult Adhd A Guide To Diagnosis And Treatment

Apr 29, 2025 -

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025 -

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025 -

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025 -

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025