Frankfurt DAX Closes Sub-24,000: Market Summary

Table of Contents

Key Factors Contributing to the DAX Decline

The DAX's fall below 24,000 is a result of a confluence of factors impacting investor confidence and the overall health of the German economy. These market drivers are interconnected and contribute to a challenging environment for German businesses and the broader European market.

-

Rising Inflation and Weakening Consumer Spending: Persistent high inflation continues to erode consumer purchasing power. Increased prices for essential goods and services are forcing consumers to cut back on spending, impacting sales for many DAX-listed companies. This reduced consumer demand directly translates into lower profits and decreased investor confidence.

-

Increased Interest Rates and Higher Borrowing Costs: The European Central Bank's (ECB) efforts to combat inflation through interest rate hikes are increasing borrowing costs for businesses. This makes expansion and investment more expensive, hindering growth and potentially leading to job losses. Higher interest rates also make bonds more attractive compared to stocks, diverting investment away from the equity market.

-

Geopolitical Uncertainties and Investor Sentiment: The ongoing war in Ukraine, coupled with persistent tensions between the US and China, contributes to global geopolitical uncertainty. This uncertainty significantly impacts investor sentiment, leading to risk aversion and a sell-off in riskier assets like stocks. The energy crisis stemming from the war further exacerbates this uncertainty.

-

The Ongoing Energy Crisis and its Impact on German Industry: Europe's energy crisis, particularly impacting Germany’s reliance on Russian gas, continues to significantly strain businesses. High energy prices increase production costs and reduce profitability for many German companies, further contributing to the DAX decline.

-

Weak Corporate Earnings Reports: Several major DAX companies have recently released weaker-than-expected corporate earnings reports. These reports highlight the challenges faced by German businesses in the current economic climate and contribute to a negative market outlook.

Performance of Key DAX Sectors

The DAX decline didn't impact all sectors equally. Some sectors experienced sharper falls than others, reflecting the varying sensitivities to the factors mentioned above.

-

Automotive Industry: The automotive sector, a significant component of the DAX, experienced a [insert percentage change]% decline (replace with actual data). Supply chain disruptions, increased material costs, and weakening consumer demand all contributed to this downturn.

-

Technology Sector: The technology sector saw a [insert percentage change]% change (replace with actual data), mirroring global trends in tech valuations. Investor concerns about the sustainability of growth in the tech sector played a role in this performance.

-

Financial Services: The financial services sector showed a [insert percentage change]% change (replace with actual data). While relatively resilient, the sector is not immune to the broader market downturn and the increased interest rate environment.

-

Energy Sector: The energy sector's performance was mixed, with some companies benefiting from high energy prices while others faced challenges related to supply chain disruptions and geopolitical risks. The percentage change was [insert percentage change]% (replace with actual data).

Investor Sentiment and Market Volatility

The DAX's decline below 24,000 was accompanied by heightened market volatility and a palpable sense of uncertainty among investors.

-

Increased Trading Volume: Trading volume increased significantly during the period, indicating heightened activity and investor nervousness.

-

Significant Price Swings: The DAX experienced considerable intraday price swings, reflecting the market's struggle to find a stable equilibrium.

-

VDAX (Volatility Index): The VDAX, a measure of market volatility in the German stock market, likely showed a significant increase, reflecting investor fear and uncertainty (replace with actual VDAX data if available).

-

Overall Investor Confidence: Investor confidence is demonstrably low, with many adopting a wait-and-see approach before committing further capital to the German stock market.

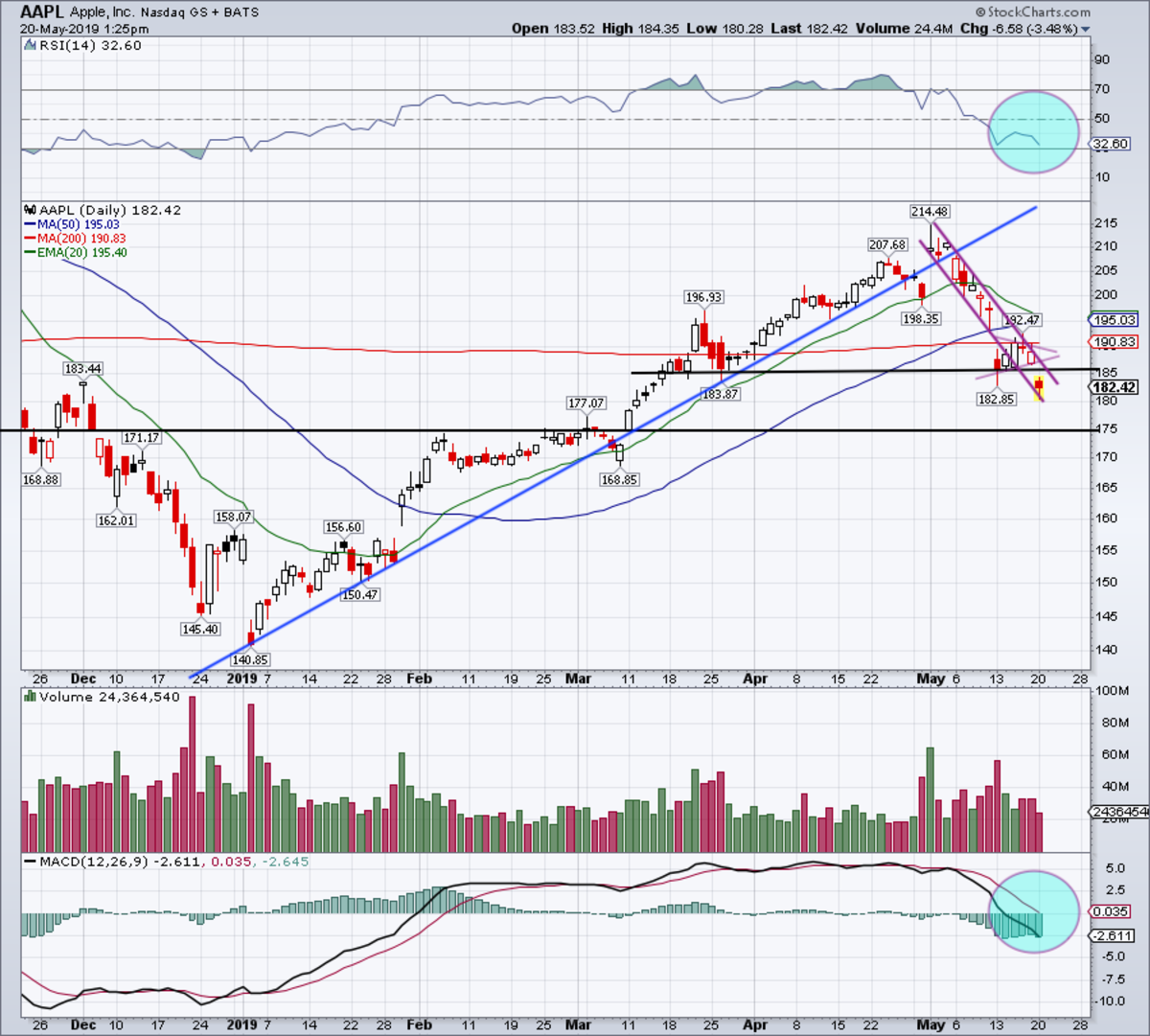

Technical Analysis of the DAX (Optional)

(This section should only be included if you have the expertise and data to support a technical analysis. Always include a disclaimer stating that technical analysis is not a guaranteed prediction of future market movements.)

A brief technical analysis could be included here, examining chart patterns, support and resistance levels, and potential trading signals. This section requires expertise and should only be included with appropriate disclaimers about the inherent risks and uncertainties involved in market predictions.

Conclusion

The Frankfurt DAX closing below 24,000 marks a significant event reflecting the combined impact of rising inflation, increased interest rates, geopolitical uncertainties, and the ongoing energy crisis in Europe. The varying performance across different DAX sectors highlights the challenges faced by German businesses. Investor sentiment remains cautious, leading to increased market volatility. Understanding these factors is crucial for navigating the current market conditions. To stay informed about future DAX movements and market trends, subscribe to our newsletter [link to newsletter], follow us on social media [link to social media], and check back regularly for further Frankfurt DAX market summaries and analyses. Stay updated on the Frankfurt DAX and its implications for the German and European economies.

Featured Posts

-

Porsche Cayenne 2025 A Complete Picture Gallery Of Interior And Exterior

May 24, 2025

Porsche Cayenne 2025 A Complete Picture Gallery Of Interior And Exterior

May 24, 2025 -

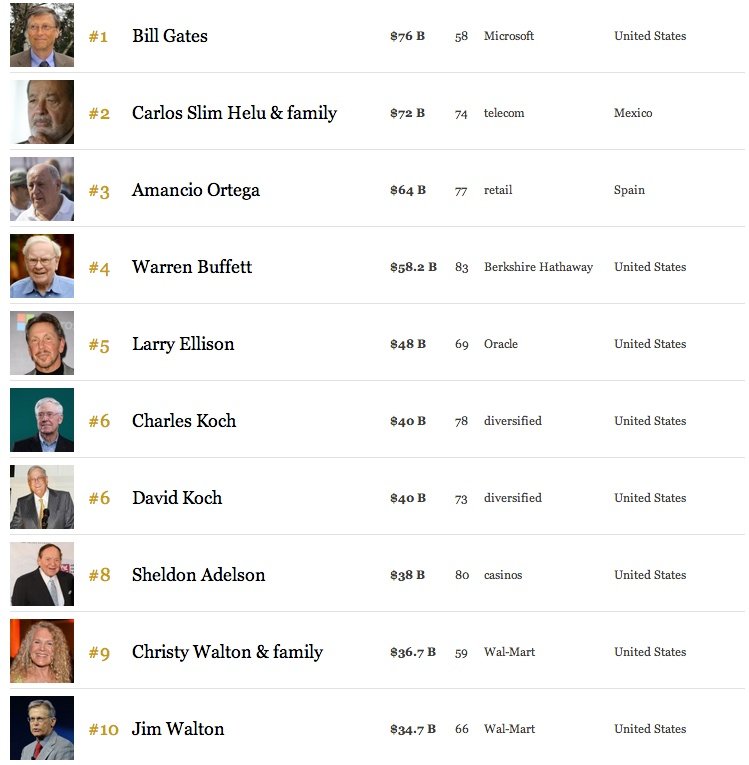

Uomini Piu Ricchi Del Mondo 2025 Musk In Vetta Zuckerberg E Bezos Inseguono Classifica Forbes

May 24, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk In Vetta Zuckerberg E Bezos Inseguono Classifica Forbes

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Analysis And Trends

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Analysis And Trends

May 24, 2025 -

Relocating To The Country Everything You Need To Know

May 24, 2025

Relocating To The Country Everything You Need To Know

May 24, 2025

Latest Posts

-

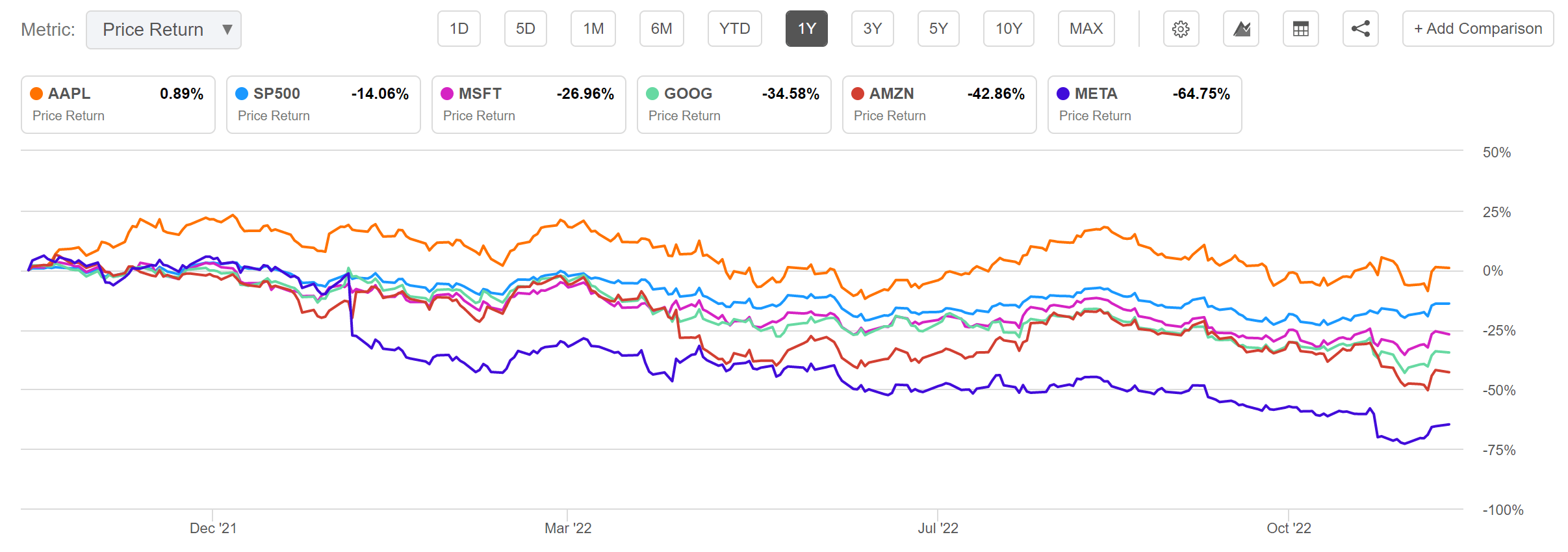

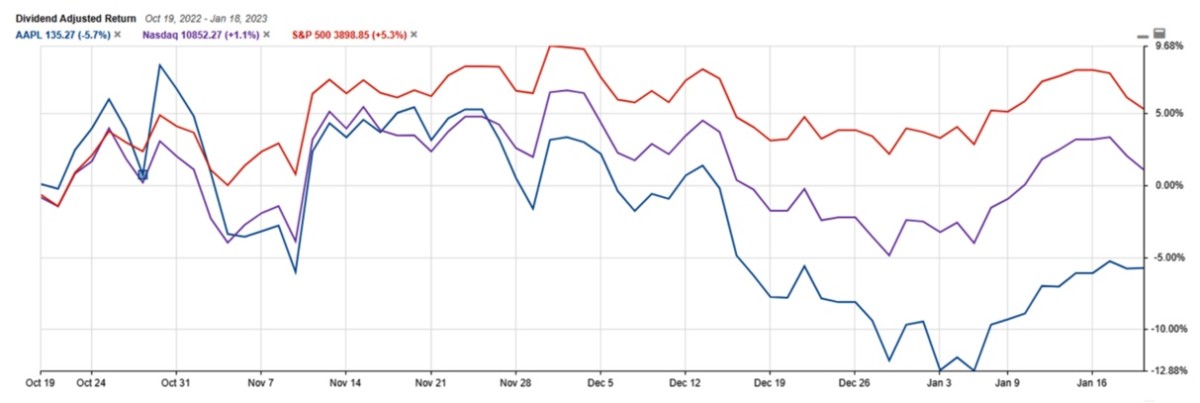

900 Million Tariff Hit Apple Stock Takes A Dive

May 24, 2025

900 Million Tariff Hit Apple Stock Takes A Dive

May 24, 2025 -

Apple Price Target Lowered But Is It Still A Good Investment

May 24, 2025

Apple Price Target Lowered But Is It Still A Good Investment

May 24, 2025 -

Pre Earnings Apple Stock Analysis Below Key Support Levels

May 24, 2025

Pre Earnings Apple Stock Analysis Below Key Support Levels

May 24, 2025 -

Apple Stock Price Drops On 900 Million Tariff Projection

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Projection

May 24, 2025 -

Should You Buy Apple Stock Now Wedbushs Perspective After Price Cut

May 24, 2025

Should You Buy Apple Stock Now Wedbushs Perspective After Price Cut

May 24, 2025