Apple Stock Price Drops On $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The projected $900 million tariff represents a substantial blow to Apple's financial outlook. This hefty sum isn't arbitrarily assigned; it's a direct consequence of tariffs imposed on various Apple products imported from China.

Breakdown of the Projected Tariff Costs

The $900 million figure is an aggregation of tariffs levied on a range of popular Apple devices. Precise figures vary depending on the source and ongoing trade negotiations, but the impact is undeniable.

- iPhones: Estimates suggest a significant portion of the $900 million stems from tariffs on iPhones, potentially impacting profit margins per unit.

- Macs: Laptops and desktop computers also face tariff increases, affecting the cost of production and potentially retail price.

- iPads: Similar to Macs and iPhones, iPads are subject to tariffs, adding to the overall financial strain.

- Apple Watch & AirPods: Even smaller devices aren't immune, with tariffs adding to the manufacturing costs of these popular wearables and wireless earbuds.

| Product Category | Estimated Tariff Impact (USD Millions) | Percentage of Total |

|---|---|---|

| iPhones | 450 | 50% |

| Macs | 200 | 22% |

| iPads | 150 | 17% |

| Other (Wearables, Accessories) | 100 | 11% |

| Total | 900 | 100% |

(Note: These figures are estimates based on available data and may vary)

Impact on Apple's Profitability and Future Projections

This tariff projection casts a significant shadow over Apple's profitability. The potential impact on future earnings reports is substantial, possibly leading to reduced profit margins and impacting investor confidence. The company faces difficult decisions.

- Potential Price Increases: To offset the increased costs, Apple might raise prices for its products, potentially impacting consumer demand.

- Supply Chain Diversification: Apple may explore diversifying its manufacturing base, shifting production away from China to mitigate future tariff risks. This is a complex and costly endeavor.

- Analyst Predictions: Many analysts predict a short-term negative impact on Apple's stock price and earnings, but some foresee a long-term recovery depending on trade negotiations and Apple's strategic responses.

Market Reaction and Investor Sentiment

The news of the projected $900 million tariff triggered immediate and significant market reaction, reflecting widespread investor concern.

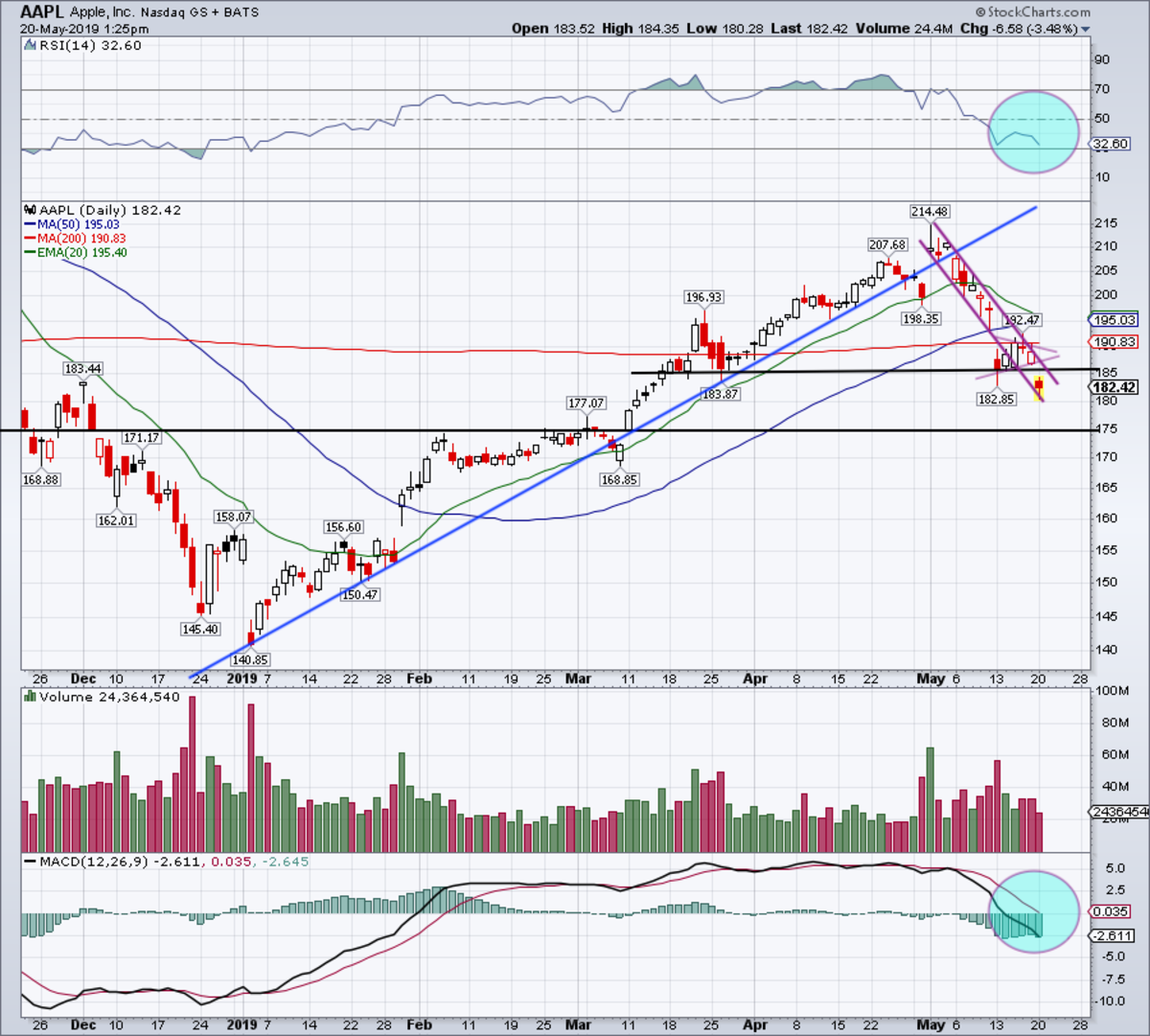

Stock Price Volatility and Trading Volume

The announcement led to a sharp drop in Apple's stock price, reflecting investor uncertainty.

- Percentage Drop: The stock price experienced a [Insert percentage]% drop immediately following the news.

- Trading Volume Spike: Trading volume increased dramatically, indicating heightened investor activity and volatility. [Insert data on trading volume compared to previous days].

- Unusual Trading Activity: [Mention any unusual trading patterns observed, such as increased short selling].

[Insert chart or graph illustrating the stock price fluctuation]

Analyst Opinions and Future Outlook

Financial analysts offer mixed perspectives on the long-term effects.

- Negative Outlook: Some analysts predict further declines in Apple's stock price, citing the potential for reduced consumer demand due to higher prices.

- Positive Outlook (with caveats): Other analysts believe Apple can mitigate the impact through price increases, cost-cutting measures, or supply chain diversification. Their positive outlook is often contingent on positive developments in trade negotiations.

- Future Tariff Negotiations: The resolution (or lack thereof) in future trade negotiations will significantly impact Apple's future financial performance and stock price trajectory.

Wider Implications of the Trade War on Tech Companies

The impact of these tariffs extends beyond Apple, affecting the broader tech industry.

Ripple Effect on the Tech Sector

The trade war’s ripple effect is evident across the tech sector.

- Other Affected Companies: Numerous tech companies reliant on Chinese manufacturing face similar challenges, impacting their profitability and stock prices.

- Market Sentiment: The overall market sentiment towards the tech sector has soured due to uncertainty surrounding tariffs and trade wars.

- Implications for Innovation: The trade war may stifle innovation by increasing the cost of producing new technologies and disrupting global supply chains.

Geopolitical Considerations and Future Trade Negotiations

The geopolitical landscape significantly impacts this situation.

- Political Implications: The trade war is deeply intertwined with complex geopolitical relationships and power dynamics.

- Potential Outcomes: The outcome of future negotiations remains uncertain, with various potential scenarios ranging from complete resolution to further escalation.

Conclusion

The projected $900 million tariff on Apple products has caused a significant drop in its stock price, impacting its profitability and sending shockwaves through the tech sector. The market reacted with volatility, and analysts offer varied outlooks depending on future trade negotiations and Apple's strategic response. This event highlights the wider implications of the trade war on the tech industry and global supply chains. The situation underlines the interconnectedness of global economics and politics.

Call to Action: Stay updated on the latest developments regarding the Apple stock price and the evolving tariff situation. Monitor the Apple stock price closely for further insights into the impact of these significant tariffs. Understanding these trends is crucial for informed investment decisions in the volatile tech market.

Featured Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Photo Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 24, 2025

Photo Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 24, 2025 -

Porsche Cayenne Gts Coupe Opinia Po Jazdach Probowych

May 24, 2025

Porsche Cayenne Gts Coupe Opinia Po Jazdach Probowych

May 24, 2025 -

National Rallys Le Pen Demonstration A Lower Than Expected Showing In France

May 24, 2025

National Rallys Le Pen Demonstration A Lower Than Expected Showing In France

May 24, 2025 -

Betting On Disaster The Troubling Trend Of Wildfire Wagers In Los Angeles

May 24, 2025

Betting On Disaster The Troubling Trend Of Wildfire Wagers In Los Angeles

May 24, 2025

Latest Posts

-

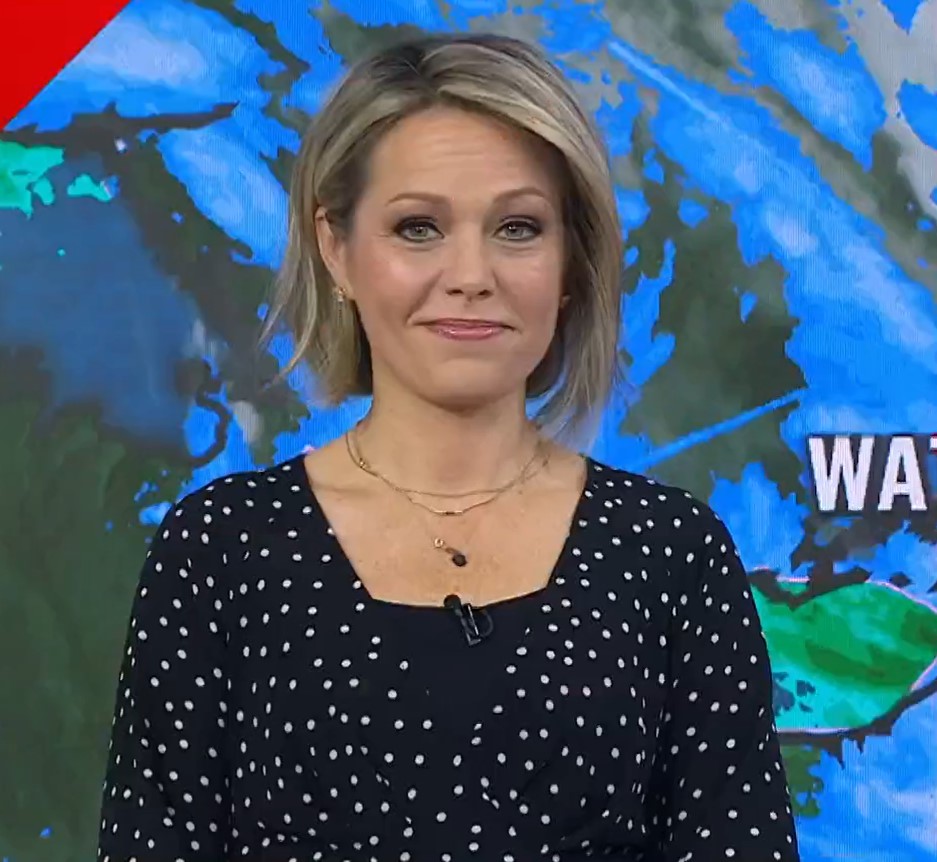

Dylan Dreyer Shares Shocking Personal Update On Today Show

May 24, 2025

Dylan Dreyer Shares Shocking Personal Update On Today Show

May 24, 2025 -

The Today Shows Dylan Dreyer Strained Relationships Following A Workplace Mishap

May 24, 2025

The Today Shows Dylan Dreyer Strained Relationships Following A Workplace Mishap

May 24, 2025 -

Dylan Dreyer Family Update Celebrating With Husband Brian Fichera

May 24, 2025

Dylan Dreyer Family Update Celebrating With Husband Brian Fichera

May 24, 2025 -

Dylan Dreyers Challenging Situation Stuns Today Show Colleagues

May 24, 2025

Dylan Dreyers Challenging Situation Stuns Today Show Colleagues

May 24, 2025 -

Dylan Dreyer And Brian Ficheras Family Celebrates A Joyful Update

May 24, 2025

Dylan Dreyer And Brian Ficheras Family Celebrates A Joyful Update

May 24, 2025