Apple Price Target Lowered, But Is It Still A Good Investment?

Table of Contents

<meta name="description" content="Recent analysts have lowered their Apple price target. Should you still invest in Apple stock? We analyze the situation and offer insights.">

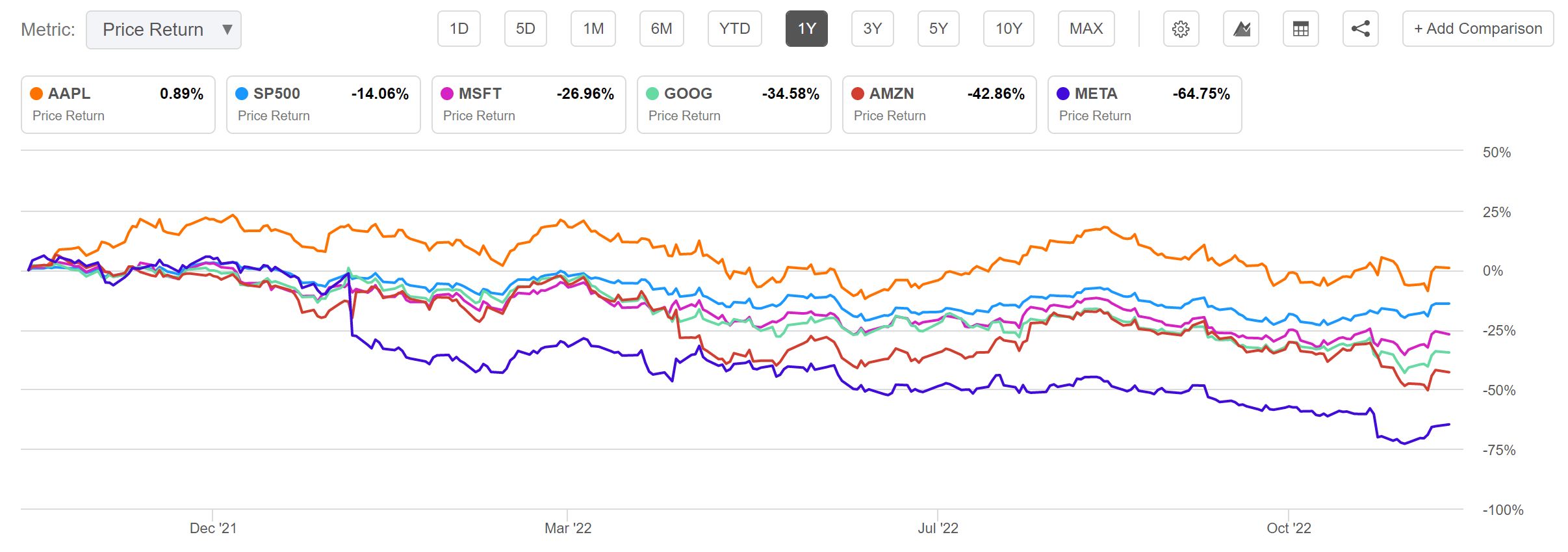

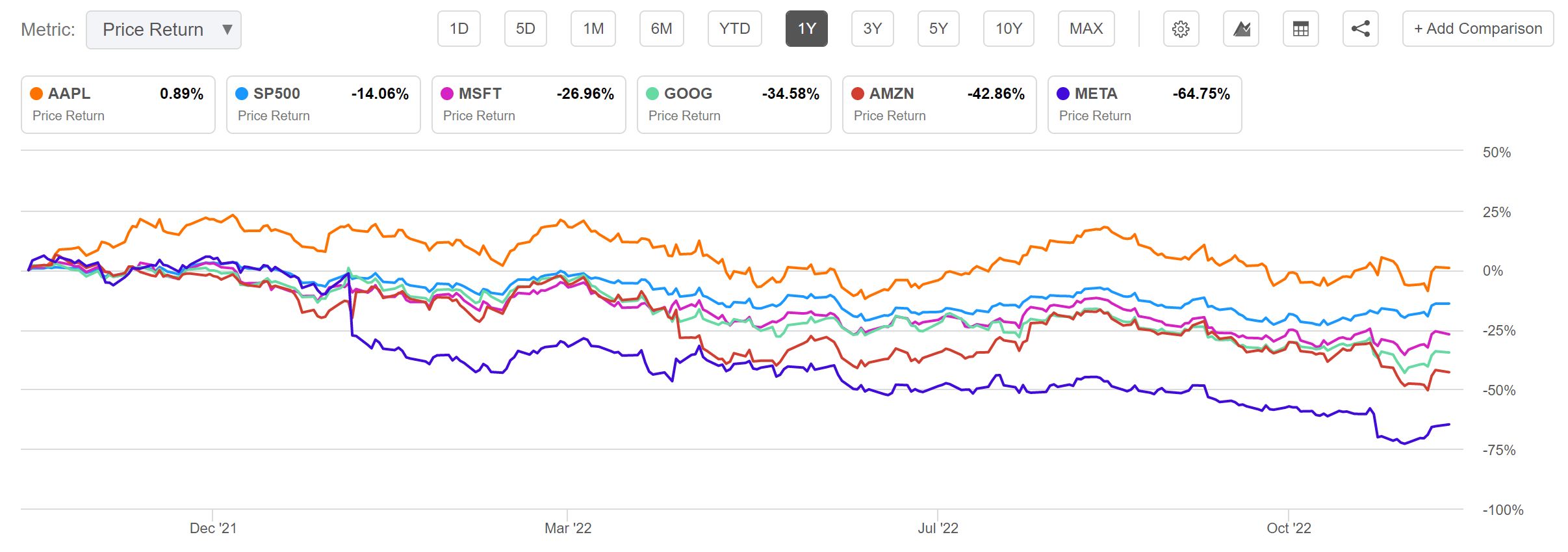

The tech giant Apple, a consistent player in the stock market, has recently seen its price target lowered by several analysts. This news has sparked considerable debate within the investment community, leaving many to question: is Apple still a worthwhile investment? This article will delve into the reasons behind the lowered price target, examining whether Apple remains a strong addition to your portfolio. We'll weigh the concerns against Apple's inherent strengths to help you make an informed decision.

<h2>Reasons for the Lowered Apple Price Target</h2>

Several factors contribute to the recent downward revision of Apple's price target by analysts. Understanding these factors is crucial to assessing the current investment climate.

<h3>Economic Slowdown and Reduced Consumer Spending</h3>

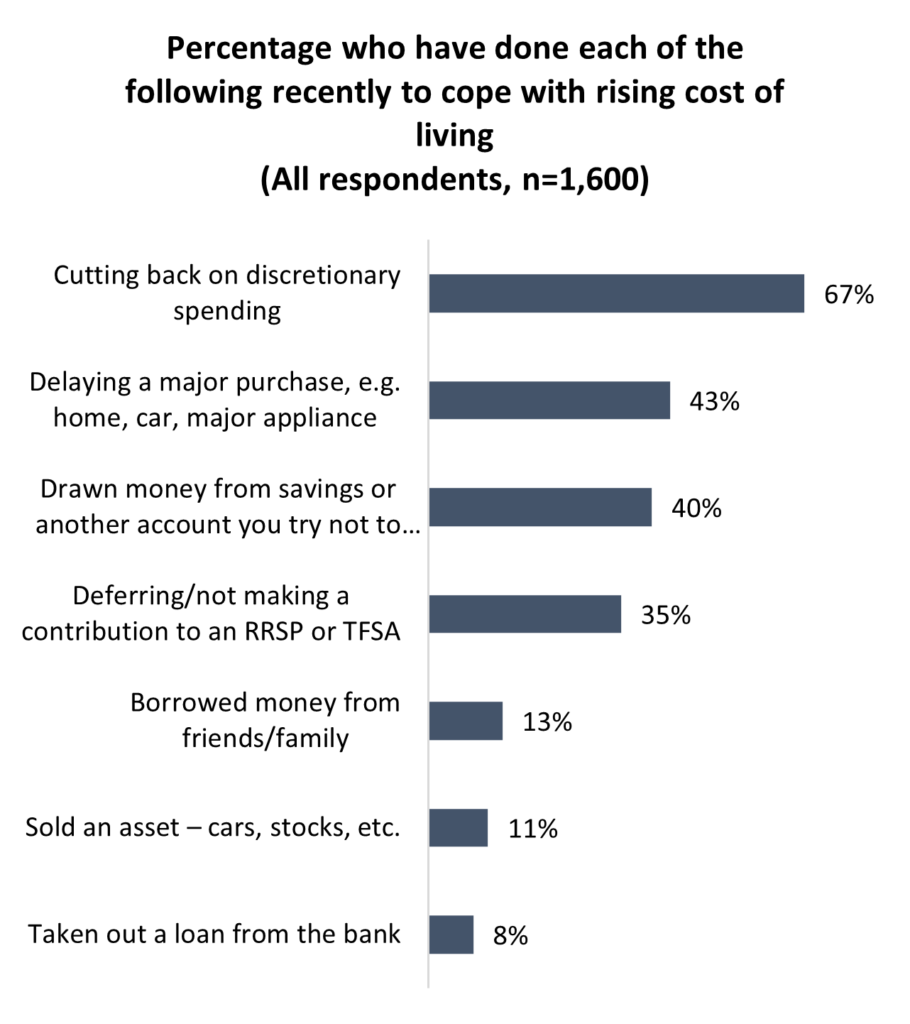

Global inflation and recessionary fears are significantly impacting consumer spending, particularly on discretionary items like electronics. This downturn directly affects Apple's sales, as consumers become more cautious with their purchases.

- Declining iPhone sales in certain regions: Reports indicate a slowdown in iPhone sales, particularly in regions heavily affected by economic uncertainty.

- Lower-than-expected demand for new Apple products: The launch of new products hasn't generated the anticipated surge in demand, suggesting a broader shift in consumer behavior.

- Increased competition in the smartphone market: Intense competition from Android manufacturers offering comparable features at lower price points puts pressure on Apple's market share. This increased competition is a factor affecting the Apple price target.

<h3>Supply Chain Issues and Production Challenges</h3>

Persistent global supply chain disruptions continue to hamper Apple's production capabilities. These disruptions translate directly into reduced profitability and potential delays.

- Component shortages affecting production timelines: Shortages of crucial components lead to delays in manufacturing and fulfilling orders.

- Rising shipping and transportation costs: Increased logistics costs directly impact Apple's margins and overall profitability.

- Impact on Apple's overall revenue projections: Supply chain issues significantly affect Apple's ability to meet revenue projections, influencing analyst predictions and the Apple price target.

<h3>Concerns about Future Innovation and Growth</h3>

Some analysts express concern regarding the pace of Apple's innovation, questioning whether the company can maintain its growth trajectory in the long term.

- Competition from Android devices with innovative features: Competitors are constantly innovating, introducing features that challenge Apple's dominance.

- Slower-than-expected growth in services revenue: While Apple's services sector is a significant revenue stream, its growth rate may not be as robust as previously anticipated.

- Market saturation in mature product categories: Apple faces challenges in achieving significant growth in established product categories like iPhones and iPads, necessitating diversification into new markets.

<h2>Counterarguments: Why Apple Might Still Be a Good Investment</h2>

Despite the concerns outlined above, several compelling arguments suggest that Apple remains a strong investment opportunity.

<h3>Strong Brand Loyalty and Ecosystem</h3>

Apple enjoys unparalleled brand loyalty and a robust, integrated ecosystem. This loyalty translates to stable, recurring revenue and a resilient customer base.

- High customer retention rates: Apple users demonstrate significant loyalty, often remaining within the Apple ecosystem for years.

- Recurring revenue from services like Apple Music and iCloud: These subscription services provide a consistent stream of revenue, mitigating some of the risks associated with hardware sales.

- Strong brand appeal attracting new customers: The Apple brand continues to attract new users, ensuring a steady flow of customers.

<h3>Diversification into New Markets and Services</h3>

Apple's strategic diversification into new markets and services offers significant growth potential and mitigates risks associated with reliance on a single product category.

- Growth in Apple Watch and AirPods sales: These wearables represent significant growth areas for Apple.

- Potential for significant growth in AR/VR: Apple's investment in augmented and virtual reality technologies holds substantial long-term growth potential.

- Expansion into the healthcare market: Apple's foray into healthcare offers another avenue for significant future growth.

<h3>Long-Term Growth Potential</h3>

Despite short-term challenges, Apple's long-term growth prospects remain positive due to its strong financial position and continued commitment to research and development.

- Strong cash reserves and financial stability: Apple possesses substantial financial resources, providing a buffer against economic downturns.

- Continued investment in research and development: Apple's ongoing investment in R&D fuels future innovation and positions the company for long-term growth.

- Potential for disruptive innovation in future products: Apple's history of disruptive innovation suggests the potential for future breakthroughs that could redefine its markets.

<h2>Conclusion</h2>

While the lowered Apple price target reflects legitimate concerns about economic conditions, supply chain disruptions, and the pace of innovation, Apple's strengths remain considerable. Its loyal customer base, diversified product portfolio, and commitment to research and development indicate a strong foundation for long-term growth. However, whether Apple is a good investment for you depends on your individual risk tolerance and investment strategy. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Carefully analyze your investment goals and assess the potential for both gains and losses before deciding whether Apple stock aligns with your portfolio.

Featured Posts

-

Stock Market Reaction Analyzing Todays Bond Sell Off Dow Movement And Bitcoin Surge

May 24, 2025

Stock Market Reaction Analyzing Todays Bond Sell Off Dow Movement And Bitcoin Surge

May 24, 2025 -

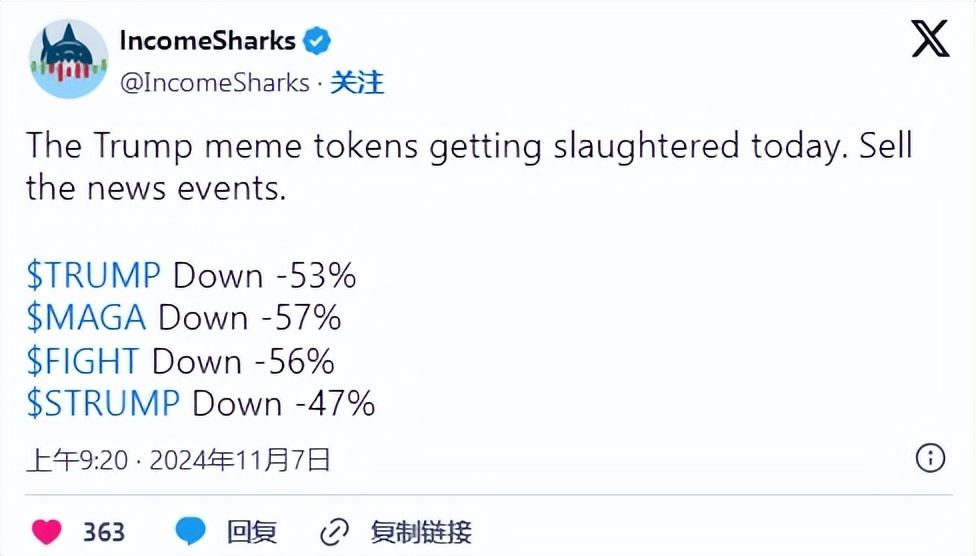

Investigating Anonymity At Trumps High Price Memecoin Dinner

May 24, 2025

Investigating Anonymity At Trumps High Price Memecoin Dinner

May 24, 2025 -

The Agony Of Waiting My Story

May 24, 2025

The Agony Of Waiting My Story

May 24, 2025 -

Sean Penn Defends Woody Allen Renewed Scrutiny Of Sexual Abuse Claims

May 24, 2025

Sean Penn Defends Woody Allen Renewed Scrutiny Of Sexual Abuse Claims

May 24, 2025 -

Michael Caine Remembers Filming A Sex Scene With Mia Farrow A Surprising Story

May 24, 2025

Michael Caine Remembers Filming A Sex Scene With Mia Farrow A Surprising Story

May 24, 2025

Latest Posts

-

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025 -

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025 -

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025 -

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025 -

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025