Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is NAV? Simply put, Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. It's essentially the value of the ETF's underlying holdings, adjusted for expenses. Understanding the NAV is key to tracking the ETF's performance and making sound investment choices. This article will delve into the specifics of the Amundi Dow Jones Industrial Average UCITS ETF NAV, providing you with the knowledge you need to navigate your investment confidently.

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is a passively managed Exchange Traded Fund that aims to track the performance of the Dow Jones Industrial Average (DJIA). This means the ETF's portfolio closely mirrors the 30 large-cap, blue-chip companies that make up this iconic US stock market index. Investing in this Dow Jones Industrial Average ETF offers several advantages:

- Diversification: Instant diversification across 30 leading American companies, reducing overall portfolio risk.

- Low Cost: Generally, ETFs have lower expense ratios compared to actively managed funds, offering cost-effective exposure to the DJIA.

- Liquidity: Being an ETF, it's typically traded like a stock, providing easy access to buying and selling.

- Transparency: The holdings are publicly available, offering transparency to investors.

- Passive Investment: The ETF tracks the index passively, requiring less management compared to actively managed funds.

This makes it a popular choice for investors seeking exposure to the US large-cap market through a UCITS ETF structure, suitable for investors across Europe.

Key Features of the ETF

- Ticker Symbol: (Check the specific ticker symbol depending on the exchange it trades on)

- Expense Ratio: (Check the current expense ratio on the provider's website)

- Minimum Investment: (Usually relatively low, allowing for accessibility)

- Management Fees: (Typically low for passively managed ETFs)

- Currency: Usually USD or EUR depending on the share class

Who should invest in this ETF?

This ETF is ideal for investors who:

- Have a long-term investment horizon: The ETF is best suited for investors seeking long-term growth aligned with the DJIA's performance.

- Seek diversification: Investors looking to diversify their portfolio with exposure to the US large-cap market.

- Have a moderate to high risk tolerance: While diversified, exposure to the stock market always carries risk.

- Prefer passive investment strategies: Investors who prefer a low-maintenance investment approach.

- Understand basic investment concepts: While relatively straightforward, investors should have a basic understanding of ETFs and market risks.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The Calculation Process

The Amundi Dow Jones Industrial Average UCITS ETF NAV is calculated daily, usually at the market close. The process involves:

- Determining the market value of each holding: The market price of each of the 30 stocks in the DJIA is obtained.

- Aggregating the values: The total market value of all holdings is calculated.

- Subtracting liabilities: Any liabilities, such as management fees or other expenses, are deducted from the total asset value.

- Dividing by the number of shares: The resulting net asset value is then divided by the total number of outstanding ETF shares to arrive at the NAV per share. This represents the net asset value calculation.

Factors Affecting NAV

Several factors influence the daily NAV fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF:

- Market movements of underlying stocks: The primary driver is the performance of the 30 constituent companies of the DJIA. Positive movements increase the NAV, and negative movements decrease it.

- Currency fluctuations: If you are investing in a share class denominated in a currency other than the underlying assets, exchange rate movements will impact the NAV.

- Dividends received: Dividends received from the underlying companies are reinvested, increasing the NAV.

- Expense ratio: The expense ratio, representing the management fees, gradually reduces the NAV over time.

Where to find the NAV

You can typically find the daily NAV updates for the Amundi Dow Jones Industrial Average UCITS ETF on:

- Amundi's website: The ETF provider's website is the most reliable source.

- Financial news websites: Major financial news sources often provide real-time NAV data.

- Brokerage platforms: Your brokerage account will typically display the current NAV.

Using NAV to Make Informed Investment Decisions

NAV and Investment Timing

While the NAV provides a snapshot of the ETF's underlying asset value, it's not a foolproof indicator for buy or sell decisions. It's just one piece of the puzzle. Consider market trends, your investment goals, and overall risk tolerance alongside the NAV before making any investment timing decisions. Market timing based solely on daily NAV fluctuations is risky. A long-term investment strategy is generally recommended for this ETF.

NAV and Performance Measurement

Changes in the NAV reflect the ETF's performance over time. However, for a complete performance analysis, consider both the NAV changes and any dividends received. Total return, which includes both NAV appreciation and dividend yield, offers a more holistic picture of your investment’s performance.

Comparing NAV to Market Price

The market price of the ETF should closely track its NAV, particularly for actively traded ETFs like this one. However, small deviations can occur due to factors like bid-ask spread and trading volume. Significant premiums or discounts to the NAV might warrant further investigation.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for informed investment decision-making. This guide covered the ETF's characteristics, how its NAV is calculated, the factors that influence it, and how to use this information for better investment strategy. Remember that NAV is only one element to consider. Learn more about Amundi Dow Jones Industrial Average UCITS ETF NAV and the broader investment landscape. To understand your ETF investments better and invest wisely using NAV data, consider further research on Amundi's website or consulting with a financial advisor.

Featured Posts

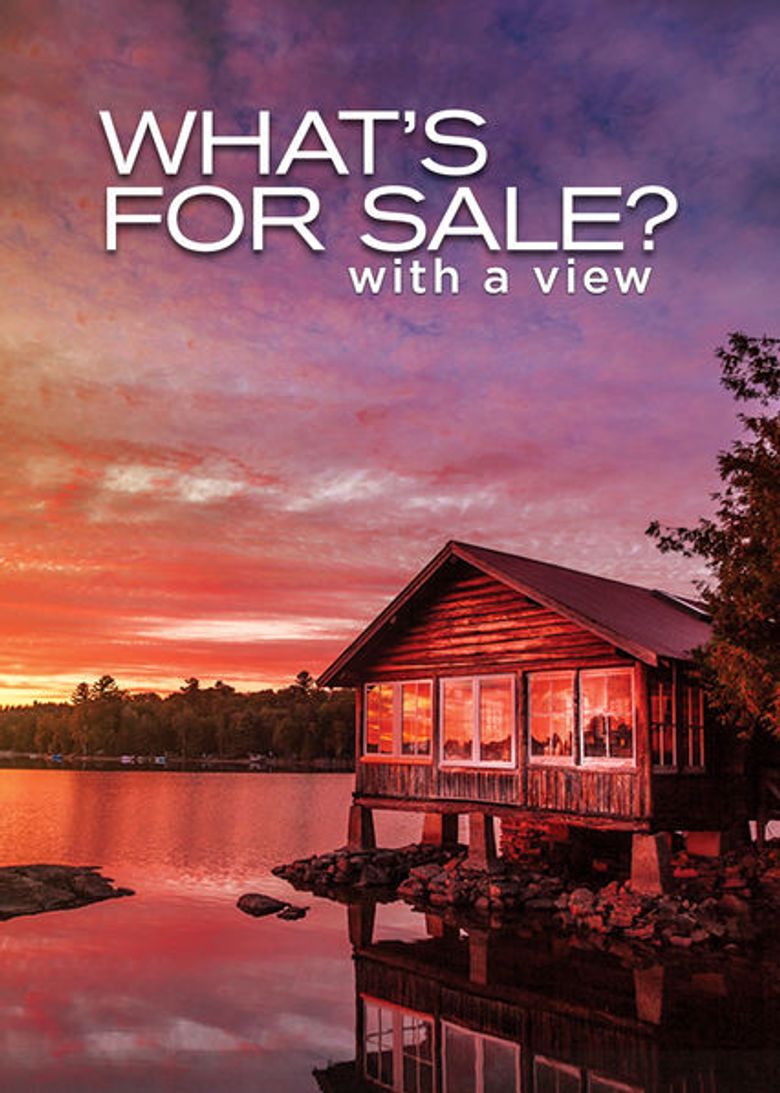

-

The Ultimate Guide To Escaping To The Country

May 24, 2025

The Ultimate Guide To Escaping To The Country

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Full Lineup And Ticket Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Full Lineup And Ticket Information

May 24, 2025 -

The Reality Of Airplane Accidents Visualizing Safety Statistics

May 24, 2025

The Reality Of Airplane Accidents Visualizing Safety Statistics

May 24, 2025 -

Powerful Horoscopes For 5 Zodiac Signs March 20 2025

May 24, 2025

Powerful Horoscopes For 5 Zodiac Signs March 20 2025

May 24, 2025 -

Analysis Open Ais Interest In Jony Ives Ai Technology

May 24, 2025

Analysis Open Ais Interest In Jony Ives Ai Technology

May 24, 2025

Latest Posts

-

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Menu

May 24, 2025

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Menu

May 24, 2025 -

Odd Burger Expands Reach Vegan Meals Now At 7 Eleven Canada

May 24, 2025

Odd Burger Expands Reach Vegan Meals Now At 7 Eleven Canada

May 24, 2025 -

Burclar Ve Zeka Bir Iliski Var Mi

May 24, 2025

Burclar Ve Zeka Bir Iliski Var Mi

May 24, 2025 -

Londons Odd Burger Vegan Meals Coming To 7 Eleven Across Canada

May 24, 2025

Londons Odd Burger Vegan Meals Coming To 7 Eleven Across Canada

May 24, 2025 -

En Akilli Burclar Zeka Duezeyleri Ve Oezellikleri

May 24, 2025

En Akilli Burclar Zeka Duezeyleri Ve Oezellikleri

May 24, 2025