Pre-Earnings Apple Stock Analysis: Below Key Support Levels

Table of Contents

Technical Analysis of Apple Stock

Key Support Levels Breached

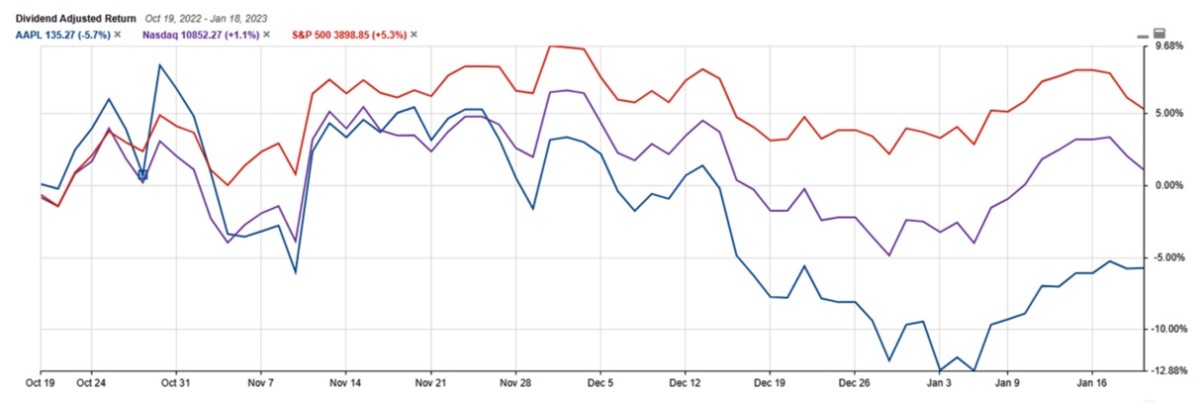

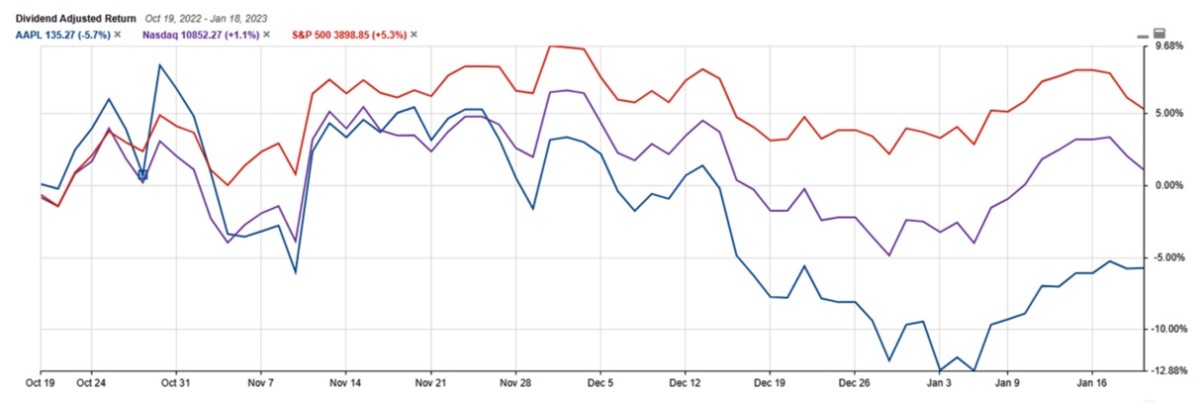

Apple stock has recently broken below several key support levels, signaling potential weakness. This pre-earnings Apple stock price action warrants close attention.

- Specific Price Levels: The $150 level, previously a strong support zone, has been decisively breached. Further, the 200-day moving average, a significant long-term indicator, has also been broken, adding to the bearish sentiment. These levels now act as resistance for the Apple stock price.

- Volume Confirmation: The break below these support levels was accompanied by significant volume, indicating strong selling pressure among investors. This high volume break through support is a strong bearish signal for pre-earnings Apple stock.

- Candlestick Patterns: The price action has shown several bearish candlestick patterns, such as consecutive closing lower lows and a bearish engulfing candle, reinforcing the downward momentum. These patterns strengthen concerns around pre-earnings Apple stock performance.

Indicators Suggesting Weakness

Several technical indicators point towards bearish momentum in the short term for Apple stock.

- RSI (Relative Strength Index): The RSI is currently below 30, indicating the stock is in oversold territory. While this could suggest a potential bounce, the sustained downtrend raises concerns about further downside. This oversold condition in Apple stock requires careful monitoring.

- MACD (Moving Average Convergence Divergence): The MACD has recently shown a bearish crossover, with the fast moving average crossing below the slow moving average. This bearish signal suggests further downward pressure on the Apple stock price.

- Negative Divergence: There is a negative divergence between price and the RSI; the price is making lower lows, while the RSI is forming higher lows. This divergence suggests weakening bullish momentum and potential further downside for pre-earnings Apple stock.

Fundamental Analysis of Apple

Pre-Earnings Expectations

Market expectations for Apple's upcoming earnings report are mixed, creating uncertainty around the Apple stock price prediction.

- Analyst Forecasts: While analysts generally anticipate strong revenue, concerns exist about potential EPS misses due to slowing iPhone sales and macroeconomic headwinds. The consensus estimates need to be considered in the context of the current market volatility.

- Recent Developments: Supply chain disruptions and increasing competition, particularly in the smartphone market, are potential factors that could impact Apple's performance and influence pre-earnings Apple stock sentiment.

- Product Launches: The impact of any upcoming product launches or announcements on investor sentiment remains to be seen. Positive news could potentially buoy the stock, while underwhelming announcements might add to the bearish pressure on pre-earnings Apple stock.

Macroeconomic Factors

Broader macroeconomic factors are also putting pressure on Apple stock.

- Rising Interest Rates: Rising interest rates make investing in growth stocks like Apple less attractive, as investors seek safer, higher-yield investments. This creates headwinds for pre-earnings Apple stock.

- Inflation and Consumer Spending: High inflation could reduce consumer spending on discretionary items like Apple products, impacting demand and potentially affecting the Apple stock price prediction.

- Market Sentiment: The overall negative market sentiment contributes to the bearish outlook for tech stocks, including Apple. This broader market sentiment could affect pre-earnings Apple stock more strongly than typical sector movements.

Potential Scenarios for Apple Stock Post-Earnings

Bullish Scenario (Beat Earnings Expectations)

If Apple surpasses earnings expectations, a significant price increase is possible.

- Positive Catalysts: A strong iPhone sales performance, exceeding analyst estimates for other product segments, and positive forward guidance could fuel a rally.

- Potential Price Target: In a bullish scenario, a move back towards the $170-$180 range is possible, potentially recovering some of the recent losses. This represents a significant upside for pre-earnings Apple stock.

Bearish Scenario (Miss Earnings Expectations)

A disappointing earnings report could lead to further price declines.

- Downside Risks: Lower-than-expected iPhone sales, weaker guidance, or negative news regarding supply chain issues could trigger substantial selling pressure.

- Potential Price Target: In a bearish scenario, further declines towards the $140-$150 range or even lower are possible. This highlights the downside risk for pre-earnings Apple stock.

Neutral Scenario (Meet Expectations)

If Apple meets expectations, limited price movement is likely.

- Range-Bound Trading: The stock could remain range-bound after the earnings report, with limited upside or downside potential.

- Breakout Signals: Close monitoring of technical indicators like the RSI and MACD will be crucial for identifying potential breakout signals. This is critical for navigating the pre-earnings Apple stock volatility.

Conclusion

This pre-earnings Apple stock analysis highlights significant risks associated with investing in Apple currently. The stock is trading below key support levels, indicating potential downside risk. While a positive earnings surprise could trigger a rally, the macroeconomic headwinds and bearish technical indicators suggest caution. Conduct thorough due diligence before making any investment decisions related to pre-earnings Apple stock. Consider your own risk tolerance and investment strategy when evaluating this analysis. Stay informed about pre-earnings Apple stock movements and market conditions. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 Tickets Everything You Need To Know

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Everything You Need To Know

May 24, 2025 -

From Bishop To Viral Tik Tok Star Pope Leos Unexpected Fame

May 24, 2025

From Bishop To Viral Tik Tok Star Pope Leos Unexpected Fame

May 24, 2025 -

Museum Programs In Crisis Examining The Consequences Of Trumps Budget Decisions

May 24, 2025

Museum Programs In Crisis Examining The Consequences Of Trumps Budget Decisions

May 24, 2025 -

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 24, 2025

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 24, 2025 -

Chetyre Vozmozhnykh Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025

Chetyre Vozmozhnykh Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025

Latest Posts

-

3 En Tutumlu Burc Sirlari Ve Paradan Tasarruf Etme Yollari

May 24, 2025

3 En Tutumlu Burc Sirlari Ve Paradan Tasarruf Etme Yollari

May 24, 2025 -

Paradan Tasarruf Eden 3 Burc Kimler En Az Harciyor

May 24, 2025

Paradan Tasarruf Eden 3 Burc Kimler En Az Harciyor

May 24, 2025 -

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025 -

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025 -

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025