Euronext Amsterdam Stock Market: 8% Increase After Trump's Tariff Delay

Table of Contents

Analyzing the 8% Surge: Immediate Market Reactions

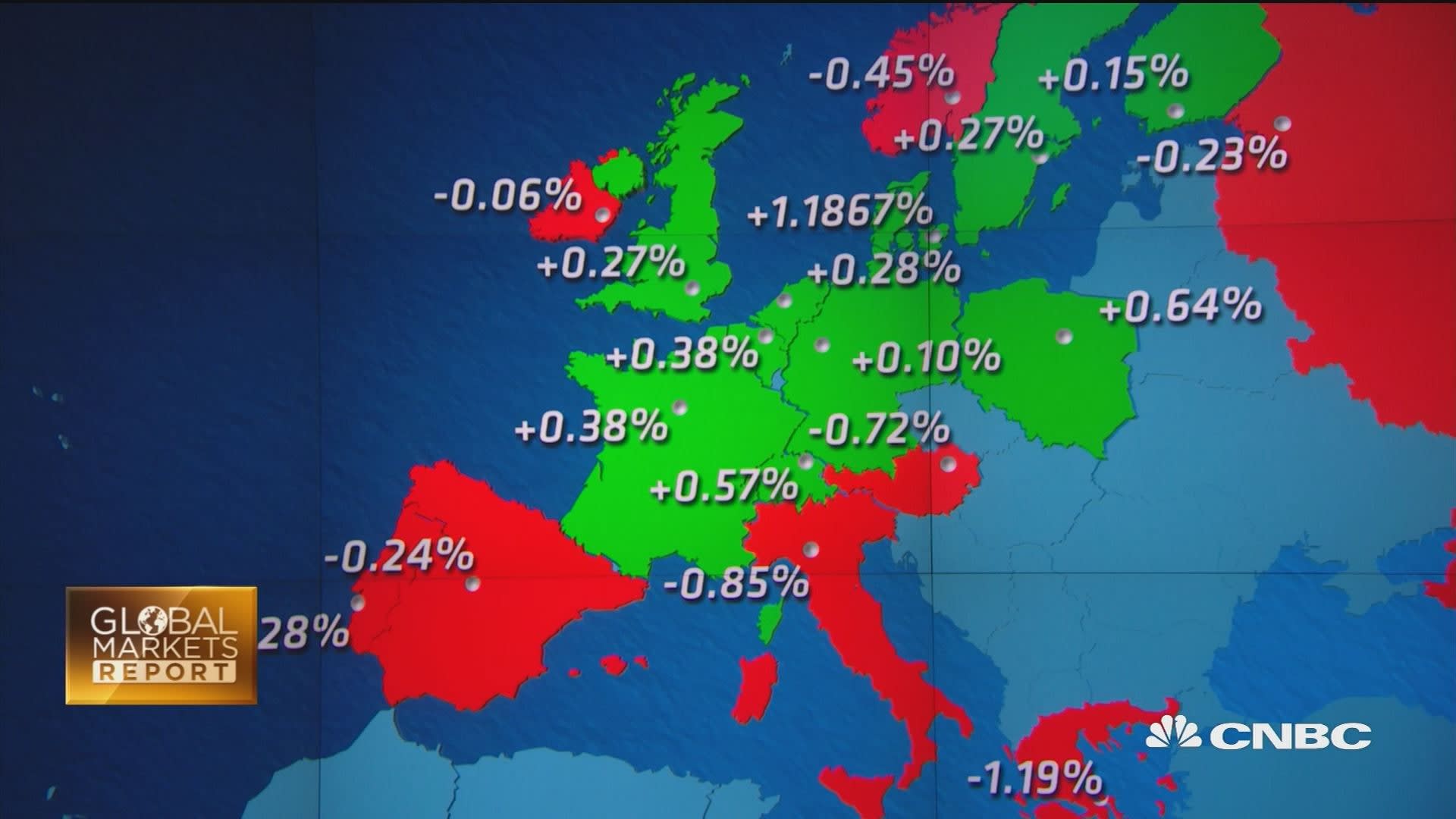

The announcement of the tariff delay triggered an almost instantaneous positive reaction in the Euronext Amsterdam market. The 8% increase, representing a substantial shift in stock prices, was widely observed across various sectors. While data visualizations (charts and graphs, if available, would be inserted here illustrating the sharp increase) would further clarify the extent of this surge, the overall effect was undeniable.

-

Specific Sector Performance: While many sectors benefited, technology and consumer discretionary stocks showed particularly strong gains, reflecting investor optimism about future growth prospects. Conversely, some sectors more heavily reliant on US exports experienced more moderate increases.

-

Exceptional Stock Performance: Several companies listed on Euronext Amsterdam saw their share prices jump significantly more than the average 8%. (Specific examples, with ticker symbols, would be included here if available).

-

Trading Volume: The delay announcement also led to a noticeable increase in trading volume on the Euronext Amsterdam exchange, indicating heightened investor activity and a strong desire to capitalize on the perceived opportunities.

-

Unusual Market Activity: While generally positive, the market displayed some unusual activity, with some stocks exhibiting high volatility in the immediate aftermath of the announcement, indicating rapid shifts in investor sentiment.

Understanding the Connection: Trump's Tariff Delay and Euronext Amsterdam

The relationship between US trade policy and the Euronext Amsterdam market is complex but undeniable. The threat of tariffs on European goods created uncertainty and negatively impacted investor confidence. This uncertainty directly affected businesses reliant on US trade, impacting their profitability and investment potential.

-

Interconnected Global Markets: The global nature of modern finance means that events in one market ripple outward, affecting others. The Euronext Amsterdam, while a European exchange, is intimately connected to global market sentiment.

-

Investor Confidence: Investor confidence is crucial for market stability. The tariff delay alleviated concerns about potential trade wars, boosting confidence and encouraging investment.

-

European Companies and US Trade: Several prominent European companies, particularly those in the automotive and manufacturing sectors, have significant business operations in the US. The tariff delay removed a significant threat to their profitability.

Beyond the Tariffs: Other Contributing Factors to the Increase

While the tariff delay was a significant factor, it's crucial to acknowledge that other elements may have contributed to the Euronext Amsterdam's 8% increase. A confluence of positive developments could have amplified the positive impact of the tariff news.

-

Positive Economic News: Positive macroeconomic indicators within the European Union, such as improved GDP growth forecasts or decreased unemployment figures, would have supported the positive market sentiment. (Specific examples would be cited here).

-

Strong Corporate Earnings: Positive corporate earnings reports from major companies listed on the Euronext Amsterdam could have further fueled the market's rise.

-

Monetary Policy Changes: Changes in interest rates or other monetary policy decisions by the European Central Bank could have influenced investor behavior and contributed to the market increase.

Looking Ahead: Predictions and Investment Strategies for Euronext Amsterdam

Predicting the future of any stock market is inherently challenging, but the tariff delay offers some insights into potential trends for the Euronext Amsterdam.

-

Short-Term and Long-Term Predictions: While the immediate impact was a significant surge, the long-term effects remain uncertain. Continued positive economic indicators and the absence of new trade disputes would suggest sustained growth. However, global economic uncertainty remains a significant factor.

-

Investment Strategies: Investors might consider diversifying their portfolios across various sectors within the Euronext Amsterdam market. Sectors less sensitive to US trade policy might offer more stability.

-

Market Volatility: Despite the positive news, investors should remain cautious and aware of potential market volatility. Unexpected events could easily reverse current trends.

Conclusion: Navigating the Euronext Amsterdam Stock Market After the Tariff Delay

The 8% increase in the Euronext Amsterdam stock market following the Trump tariff delay highlights the interconnectedness of global markets and the significant impact of trade policy on investor sentiment. While the tariff delay provided significant short-term relief, it's crucial to monitor the Euronext Amsterdam for sustained growth. Tracking Euronext Amsterdam stock prices, understanding contributing factors, and staying informed about economic and political developments are essential for making informed investment decisions. Learn more about investing in the Euronext Amsterdam market and stay updated on the latest news to navigate this dynamic environment successfully.

Featured Posts

-

Significant Stock Gains On Euronext Amsterdam 8 After Trumps Tariff Action

May 24, 2025

Significant Stock Gains On Euronext Amsterdam 8 After Trumps Tariff Action

May 24, 2025 -

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025 -

Annual General Meeting Of Shareholders 2025 Philipss Latest Announcements And Plans

May 24, 2025

Annual General Meeting Of Shareholders 2025 Philipss Latest Announcements And Plans

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Recenzja Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025

Recenzja Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025

Latest Posts

-

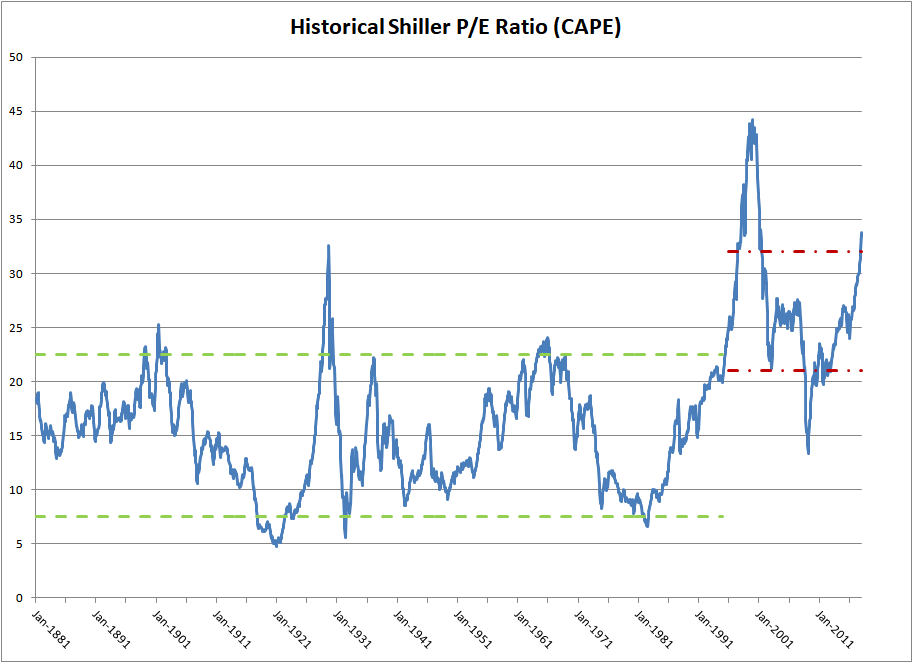

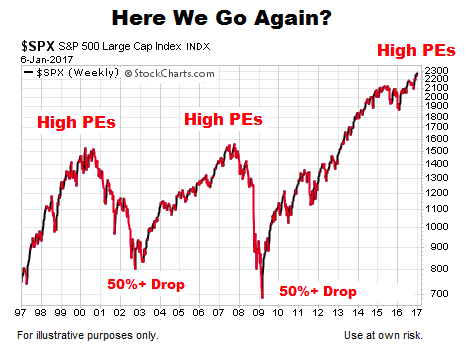

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025