Significant Stock Gains On Euronext Amsterdam (8%) After Trump's Tariff Action

Table of Contents

The Euronext Amsterdam stock market experienced a surprising 8% surge following a recent announcement of tariff actions by President Trump. This unexpected jump in Euronext Amsterdam stock gains has sent ripples through the financial world, leaving investors wondering about the implications and potential future trends. Understanding the reasons behind this significant increase is crucial for navigating the complexities of the current global market. This article delves into the details of this unexpected market movement, analyzing the potential causes and implications for investors interested in Euronext Amsterdam stock gains.

Analyzing the Unexpected 8% Jump on Euronext Amsterdam

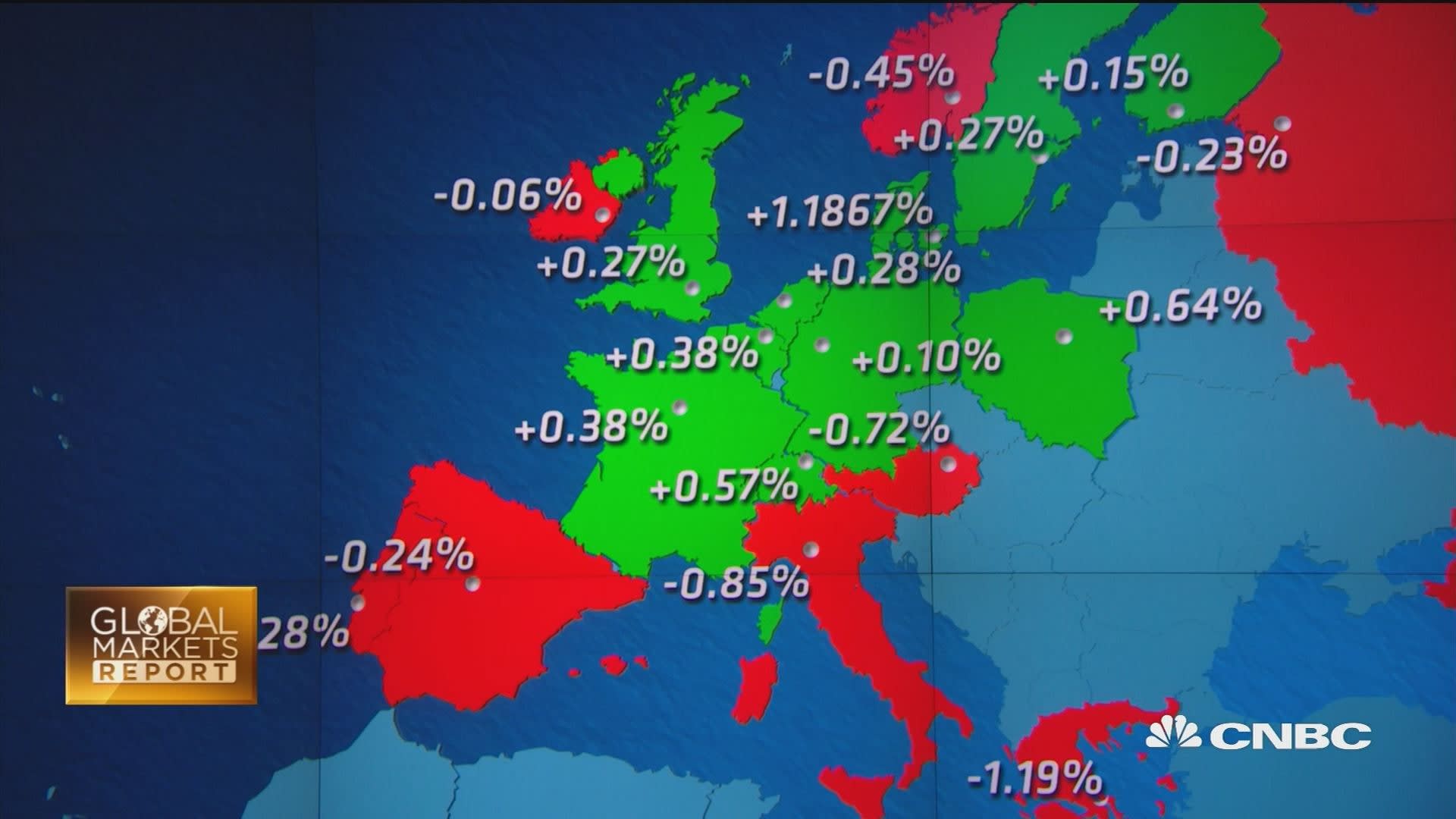

The Euronext Amsterdam market showed a remarkable resilience in the face of anticipated negative impacts from President Trump's tariff announcements. Prior to the announcement, the market had been relatively stable, showing modest growth. However, immediately following the news, a significant increase of approximately 8% was observed across various indices on Euronext Amsterdam, between [Start Date] and [End Date]. This surge contrasted sharply with the more cautious reactions seen in other major European stock exchanges.

- Specific examples of companies showing significant gains: [Company A] saw a [percentage]% increase, while [Company B] experienced a [percentage]% rise. These gains were largely concentrated in the [sector] sector.

- Comparison to other European stock exchanges' reactions: The FTSE 100 in London, for example, showed only a [percentage]% change, indicating a localized effect of the tariff news on Euronext Amsterdam.

- Mention of any unusual trading volume on Euronext Amsterdam: Trading volume on Euronext Amsterdam increased by [percentage]%, suggesting a surge in investor activity triggered by the unexpected market reaction.

The Impact of Trump's Tariff Actions on European Markets

President Trump's specific tariff actions targeted [Specific targeted goods or industries]. The counterintuitive Euronext Amsterdam stock gains in response to these tariffs could be attributed to several factors:

-

Investors anticipating a less severe impact than initially feared: The market may have already priced in a worse-case scenario, resulting in a positive reaction when the actual impact proved less severe than expected.

-

A shift in investment strategies: Investors might have reallocated their portfolios, favoring companies on Euronext Amsterdam perceived as less vulnerable to the tariffs or even benefiting from them indirectly.

-

A specific sector benefiting unexpectedly from the tariffs: Certain sectors might have experienced an unexpected boon from the tariff changes, leading to disproportionately high gains on Euronext Amsterdam.

-

Explanation of the affected industries and their connection to the US: The [Specific Industry] sector, for instance, has strong ties to the US market but may have found alternative supply chains or experienced increased domestic demand due to the tariffs.

-

Discussion of potential hedging strategies employed by investors: Investors may have employed various hedging strategies to mitigate the potential negative effects of the tariffs, leading to a more positive overall market response.

-

Mention of any expert opinions or analyst predictions on the future market trends: Analysts at [Financial Institution] predict continued growth for [Specific Sector] in the short term.

Understanding the Volatility of Euronext Amsterdam and Global Markets

The stock market's inherent volatility is a key factor to consider. Reactions to political and economic events are often unpredictable, and the 8% surge on Euronext Amsterdam highlights this unpredictability. While Trump's tariff actions were a major factor, other contributing elements may include:

-

Currency fluctuations: Changes in the Euro's exchange rate against the US dollar could have influenced investor decisions.

-

Positive economic data releases: Positive economic indicators from the Netherlands or the Eurozone could have further boosted market sentiment.

-

Mention of risk factors involved in investing in Euronext Amsterdam: Investing in Euronext Amsterdam carries inherent risks, including geopolitical uncertainty and market fluctuations.

-

Advice for investors on managing risk in volatile markets: Diversification and a long-term investment strategy are crucial for mitigating risk in volatile markets.

-

Reference to relevant economic indicators influencing the market: Keeping an eye on key economic indicators like inflation, unemployment rates, and consumer confidence is vital for making informed investment decisions.

Long-Term Implications for Euronext Amsterdam and Investors

Whether the 8% Euronext Amsterdam stock gains represent a temporary spike or the start of a longer-term trend remains to be seen. The long-term impact of Trump's tariff actions on Euronext Amsterdam and the broader European economy is uncertain and will depend on several evolving factors.

- Predictions for future market performance based on current trends: Continued growth in specific sectors, such as [Specific Sector], is anticipated. However, overall market volatility is likely to persist.

- Recommendations for investors regarding their portfolios in light of the situation: Investors should carefully review their portfolios, considering diversification and risk tolerance.

- Discussion of the potential for further volatility on Euronext Amsterdam: The market remains susceptible to further shifts in response to geopolitical events and economic data releases.

Conclusion: Navigating the Future of Euronext Amsterdam Stock After Tariff Uncertainty

In conclusion, the significant 8% Euronext Amsterdam stock gains following President Trump's tariff announcement underscore the unpredictable nature of global markets. While the initial reaction defied expectations, understanding the contributing factors—ranging from investor anticipation to specific sector benefits—is crucial. The volatility of Euronext Amsterdam and its susceptibility to both domestic and international events highlight the importance of prudent investment strategies. To make informed decisions regarding Euronext Amsterdam stock gains and potential future movements, it is imperative to stay informed about ongoing developments on Euronext Amsterdam, global market trends, and relevant economic indicators. Monitor Euronext Amsterdam stock performance closely and adapt your investment strategy accordingly to capitalize on potential Euronext Amsterdam stock gains while mitigating risk.

Featured Posts

-

Exploring The Planned M62 Relief Route Through Bury

May 24, 2025

Exploring The Planned M62 Relief Route Through Bury

May 24, 2025 -

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 24, 2025

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 24, 2025 -

Guccis Supply Chain Leadership Change Understanding The Implications For The Brand

May 24, 2025

Guccis Supply Chain Leadership Change Understanding The Implications For The Brand

May 24, 2025 -

Mia Farrow And Sadie Sink Broadway Stars Unite

May 24, 2025

Mia Farrow And Sadie Sink Broadway Stars Unite

May 24, 2025 -

Is It Ethical To Bet On The Los Angeles Wildfires Exploring The Moral Implications

May 24, 2025

Is It Ethical To Bet On The Los Angeles Wildfires Exploring The Moral Implications

May 24, 2025

Latest Posts

-

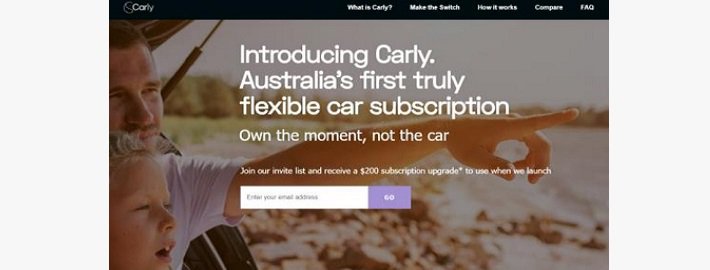

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025