DSP Mutual Fund: Cautious Outlook On Indian Stocks, Increased Cash Reserves

Table of Contents

DSP Mutual Fund's Cautious Stance on Indian Equities

DSP Mutual Fund's decision to adopt a more cautious approach to Indian equities stems from a confluence of factors pointing towards a potentially challenging market environment. Their strategy reflects a prudent assessment of the current risks.

-

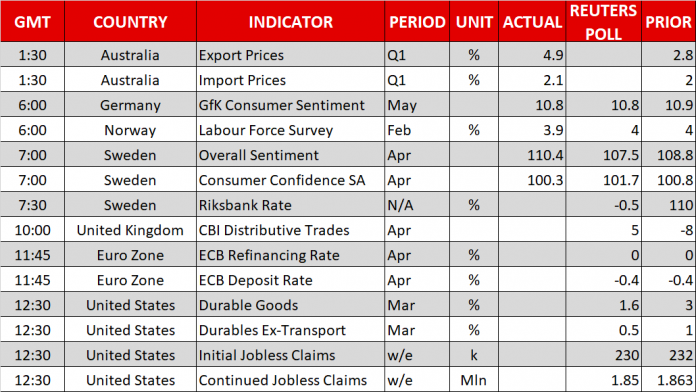

Global Macroeconomic Uncertainties: Global inflation remains stubbornly high, fueling fears of a global recession. This uncertainty impacts investor sentiment and can trigger capital outflows from emerging markets like India. The ripple effect on the Indian economy needs careful consideration.

-

Geopolitical Risks: Geopolitical tensions, including the ongoing conflict in Ukraine, contribute significantly to market volatility. These unpredictable events can disrupt supply chains, impact commodity prices, and negatively influence investor confidence in Indian stocks.

-

Valuation Concerns: Certain sectors within the Indian stock market appear overvalued, prompting concerns about potential corrections. A careful evaluation of individual stock valuations is crucial for risk mitigation, a key focus for DSP Mutual Fund's current strategy.

-

Interest Rate Hikes: Central banks worldwide, including the Reserve Bank of India (RBI), are grappling with inflation through interest rate hikes. Higher interest rates typically lead to decreased corporate profitability and lower valuations for equities, impacting returns on investments in the Indian stock market.

For instance, let's consider the performance of the Nifty 50 index, a key benchmark for the Indian stock market. While it has shown periods of growth, recent volatility reflects the global uncertainties influencing investor decisions. Similarly, the performance of several DSP Mutual Fund equity schemes needs to be considered in the context of these broader market trends.

Increased Cash Reserves: A Defensive Strategy

The increase in cash reserves is a strategic defensive maneuver by DSP Mutual Fund. By holding more cash, they aim to mitigate potential losses and position themselves for future opportunities. This approach prioritizes capital preservation over aggressive growth in the short term.

-

Market Downturn Protection: A higher cash position acts as a buffer against market downturns. During periods of volatility, the fund can better absorb losses and maintain stability for investors.

-

Strategic Buying Opportunities: A significant cash reserve allows DSP Mutual Fund to capitalize on potential buying opportunities that may arise during market corrections. This proactive approach is designed to generate higher returns in the long run.

-

Improved Liquidity: Increased cash reserves enhance the fund's liquidity, ensuring smooth operations and allowing them to meet investor redemptions efficiently, without compromising their investment strategy.

-

Comparative Analysis: Comparing DSP Mutual Fund's cash reserve strategy with other asset management companies in India reveals a shift towards more cautious strategies adopted by several funds. This shows a broader trend reflecting market sentiment.

From a risk-adjusted return perspective, the increased cash reserves contribute to a lower overall portfolio volatility, potentially leading to a lower standard deviation and a higher Sharpe ratio, thus demonstrating a conservative approach to managing investor funds.

Impact on Investors and Investment Strategies

DSP Mutual Fund's shift towards a more cautious stance has implications for both existing and prospective investors.

-

Lower Short-Term Returns: Investors should expect potentially lower short-term returns due to the increased cash holdings. The strategy prioritizes long-term stability and preservation of capital.

-

Long-Term Investment Focus: This approach underscores the importance of adopting a long-term investment horizon and having a suitable risk tolerance. Investing in DSP Mutual Fund requires patience and a focus on long-term growth.

-

Portfolio Adjustments: Investors might need to adjust their portfolios based on their individual risk profiles and financial goals. Diversification across various asset classes should be considered.

-

Alternative DSP Fund Options: Investors may want to explore other DSP Mutual Fund schemes that offer different risk-return profiles to suit their individual needs.

It’s crucial to address potential investor concerns regarding lower short-term returns. The strategy aims to protect capital during periods of uncertainty, ensuring long-term value preservation and growth.

Expert Opinions and Market Analysis

Several financial analysts have commented on DSP Mutual Fund's strategy. [Link to reputable financial news source 1] suggests that the move is a prudent response to the prevailing global uncertainty. [Link to reputable financial news source 2] highlights the growing consensus among asset managers regarding the need for a cautious approach in the current market climate. These expert opinions underscore the rationale behind DSP Mutual Fund's increased cash reserves and cautious outlook. Comparing their approach to other asset management companies' strategies provides valuable insights into market sentiment and prevailing investment philosophies. Predictions for future market trends often vary, and future performance will depend on many factors beyond the control of any fund manager.

Conclusion:

In summary, DSP Mutual Fund's decision to increase its cash reserves and adopt a cautious outlook on Indian equities reflects a prudent response to the current global economic climate and market uncertainties. This strategy prioritizes capital preservation and long-term growth, potentially leading to lower short-term returns but offering increased stability during periods of market volatility. Understanding this shift is paramount for investors. We encourage you to research DSP Mutual Fund further, understand their investment philosophy, and make informed decisions based on your risk tolerance and financial goals. Remember to consult a qualified financial advisor to discuss your investment options and determine the best course of action for your individual circumstances. Investing with DSP Mutual Fund, like any investment strategy, requires careful consideration of the current market conditions and your personal investment goals.

Featured Posts

-

Market Crash Seven Stocks Lose 2 5 Trillion This Year

Apr 29, 2025

Market Crash Seven Stocks Lose 2 5 Trillion This Year

Apr 29, 2025 -

Dysprosium The Rare Earth Element Disrupting The Electric Vehicle Industry

Apr 29, 2025

Dysprosium The Rare Earth Element Disrupting The Electric Vehicle Industry

Apr 29, 2025 -

Chainalysis Acquires Ai Startup Alterya Expanding Blockchain Capabilities

Apr 29, 2025

Chainalysis Acquires Ai Startup Alterya Expanding Blockchain Capabilities

Apr 29, 2025 -

Inflation Remains Elevated The Ecb On The Impact Of Pandemic Support

Apr 29, 2025

Inflation Remains Elevated The Ecb On The Impact Of Pandemic Support

Apr 29, 2025 -

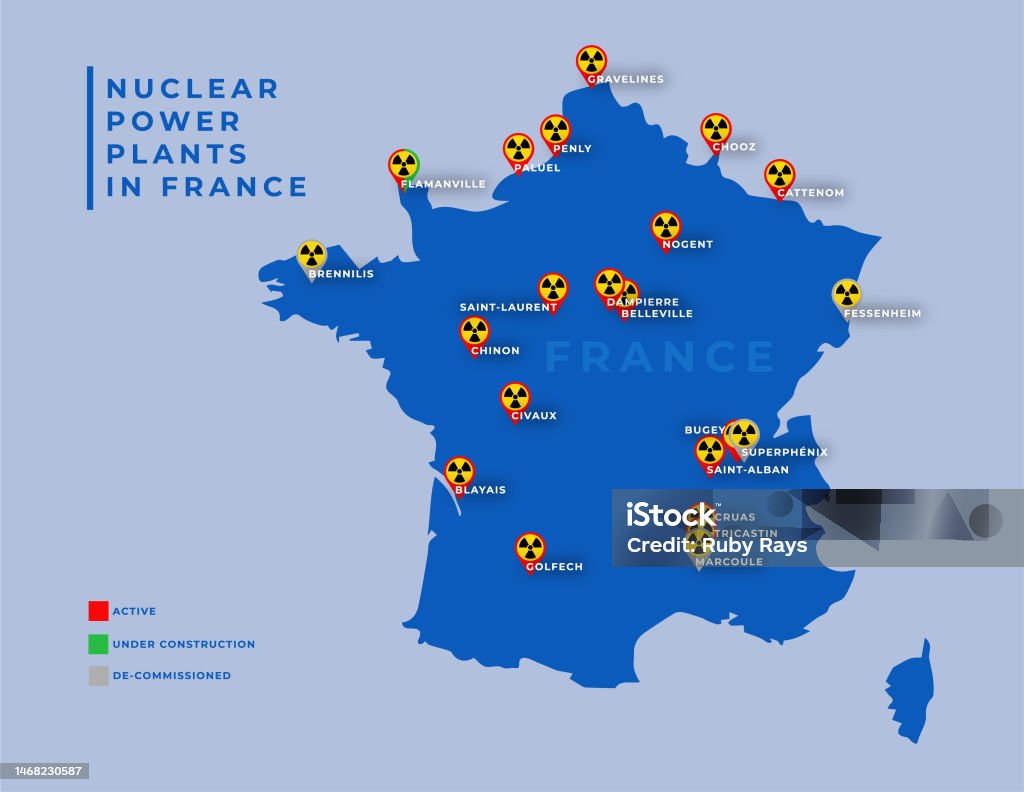

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025

Latest Posts

-

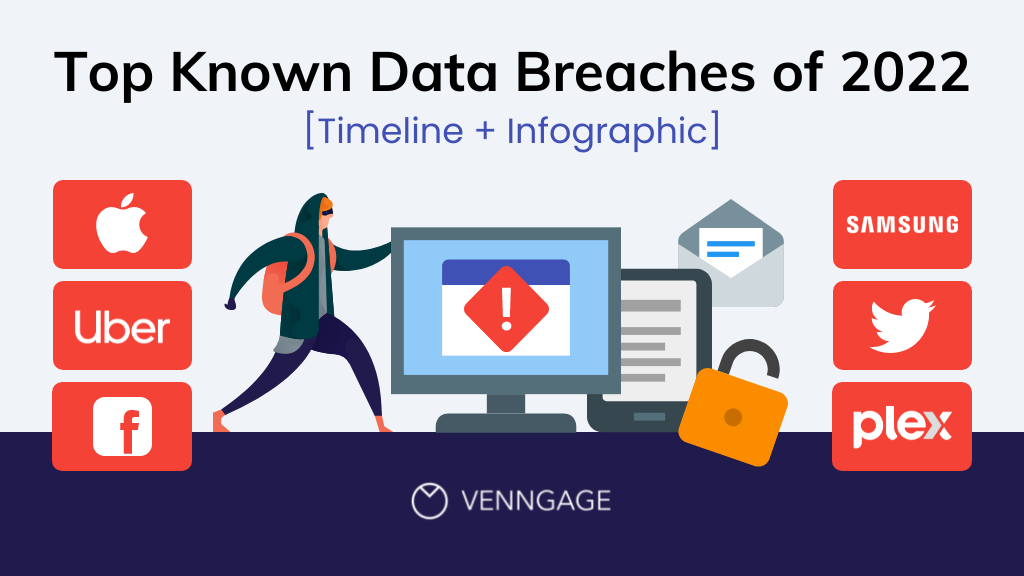

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025 -

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025 -

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Event

Apr 29, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Event

Apr 29, 2025