Inflation Remains Elevated: The ECB On The Impact Of Pandemic Support

Table of Contents

The ECB's Pandemic Support Measures

Faced with the unprecedented economic challenges posed by the COVID-19 pandemic, the ECB implemented a series of large-scale monetary policy interventions aimed at preventing a deeper economic downturn. These included the Pandemic Emergency Purchase Programme (PEPP) and Targeted Longer-Term Refinancing Operations (TLTROs).

-

Rationale: The primary goal of these measures was to inject liquidity into the financial system, stimulating lending to businesses and households, thereby supporting economic activity and preventing a credit crunch. The ECB aimed to maintain financial stability and prevent a severe recession.

-

Scale of Interventions: The PEPP, for instance, involved the purchase of €1.85 trillion of assets, significantly expanding the ECB's balance sheet. TLTROs provided banks with cheap, long-term funding, encouraging them to increase lending. This massive injection of liquidity represents a substantial increase in the money supply within the Eurozone.

-

Initial Positive Effects: These measures were largely successful in their initial objective. They prevented a more severe economic contraction, helping to stabilize financial markets and avert a widespread collapse of businesses. The initial impact was a significant reduction in borrowing costs, which boosted investment and helped prevent widespread bankruptcies.

The Link Between Pandemic Support and Inflation

While the ECB's pandemic support measures were crucial in mitigating the immediate economic fallout of the pandemic, they also potentially contributed to the subsequent surge in inflation. This connection can be analyzed through several key channels:

Increased Money Supply

The massive injection of liquidity through PEPP and TLTROs undeniably increased the money supply in the Eurozone. This increased money supply, according to basic monetary theory, puts upward pressure on prices.

-

Money Supply and Inflation: When the money supply grows faster than the economy's capacity to produce goods and services, the excess money chases a limited supply of goods, driving up prices. This is a classic example of demand-pull inflation.

-

Pent-Up Savings and Demand: Lockdowns and restrictions during the pandemic led to increased savings by households. As economies reopened, this pent-up demand, combined with the increased money supply, fueled further inflationary pressures.

-

Lag Effects: It's important to note that the impact of monetary policy on inflation often has a lag. The full inflationary consequences of the ECB's actions may not have been immediately apparent, but they contributed to the current elevated inflation levels.

Supply Chain Disruptions and Inflation

The pandemic also caused widespread supply chain disruptions, impacting the availability of goods and services. While not directly caused by the ECB's actions, the pandemic support measures may have indirectly influenced the recovery process.

-

Impact of Lockdowns: Prolonged lockdowns and restrictions hampered production, transportation, and logistics, leading to shortages and increased prices for many goods.

-

Mitigating or Exacerbating Supply Issues: It’s debatable whether the ECB's support helped mitigate or exacerbated these supply-side issues. While it prevented widespread business failures, it might have also prolonged the reliance on disrupted supply chains.

-

Alternative Explanations: It’s important to note that supply chain disruptions are a complex phenomenon, influenced by factors beyond the ECB’s control, including geopolitical events and changes in global trade patterns.

Demand-Pull Inflation

The combination of increased disposable income (due to government stimulus packages and the ECB's support) and pent-up demand fueled strong demand-pull inflation.

-

Increased Disposable Income: Government support measures and the low interest rates facilitated by the ECB increased household disposable income.

-

Consumer Confidence and Spending: This led to increased consumer confidence and spending, further boosting demand for goods and services.

-

Demand Outpacing Supply: In many cases, this increased demand outpaced the capacity of supply chains to meet it, contributing to upward price pressures.

The ECB's Current Response to Inflation

In response to the sustained high inflation, the ECB has shifted its monetary policy stance. This includes a series of interest rate hikes and a process of quantitative tightening (QT).

-

Objectives: The aim of these measures is to cool down the economy and reduce inflation towards the ECB's target level of 2%.

-

Effectiveness: The effectiveness of these measures is still unfolding. While interest rate hikes have increased borrowing costs, their impact on inflation takes time to materialize.

-

Risks and Challenges: Tightening monetary policy carries risks, potentially slowing economic growth or even triggering a recession. Balancing the need to control inflation with the need to support economic growth is a major challenge for the ECB.

Conclusion

The ECB's pandemic support measures, while vital in preventing a deeper economic crisis, may have inadvertently contributed to the current elevated inflation. The significant increase in the money supply, potentially exacerbated supply chain issues, and fueled demand-pull inflation. The ECB's subsequent shift towards tighter monetary policy, with interest rate hikes and QT, represents a necessary response to this situation. Understanding the complex relationship between the ECB's pandemic support and inflation is crucial for navigating the current economic landscape. Further research and analysis are needed to fully comprehend the long-term implications of these policies and to formulate effective strategies for maintaining price stability in the Eurozone. Stay informed on the latest developments regarding inflation and the ECB's monetary policy to make informed decisions regarding your investments and financial planning.

Featured Posts

-

Inter Miami Cf Lionel Messis Mls Schedule Live Streaming Options And Betting

Apr 29, 2025

Inter Miami Cf Lionel Messis Mls Schedule Live Streaming Options And Betting

Apr 29, 2025 -

Jan 6 Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 29, 2025

Jan 6 Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 29, 2025 -

Liverpools Unexpected Title Contention The Arne Slot Factor

Apr 29, 2025

Liverpools Unexpected Title Contention The Arne Slot Factor

Apr 29, 2025 -

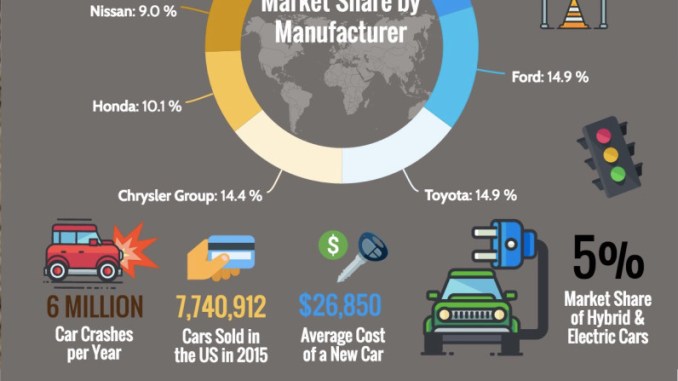

The Automotive Industrys China Problem Case Studies Of Bmw And Porsche

Apr 29, 2025

The Automotive Industrys China Problem Case Studies Of Bmw And Porsche

Apr 29, 2025 -

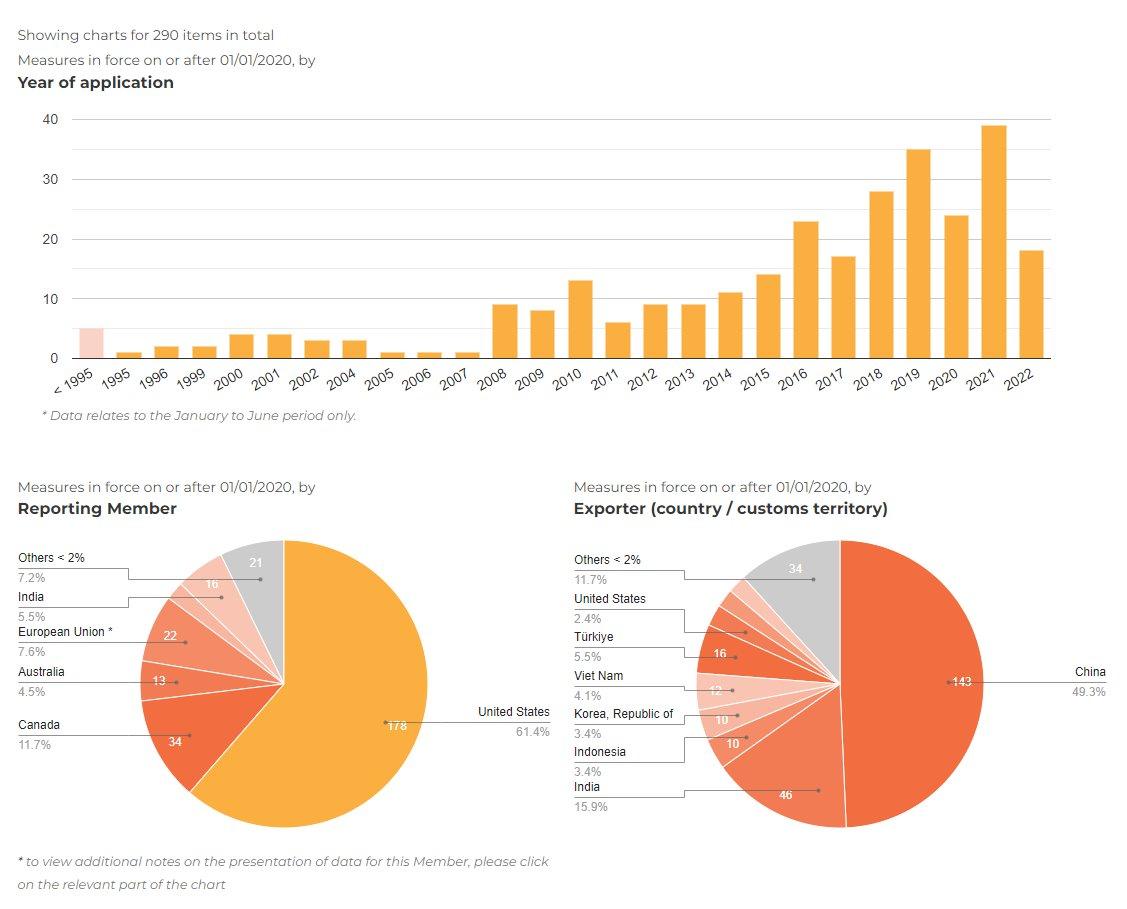

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025

Latest Posts

-

Fatal Wichita Black Hawk Crash Pilots Failed Turn Investigated

Apr 29, 2025

Fatal Wichita Black Hawk Crash Pilots Failed Turn Investigated

Apr 29, 2025 -

Communication Breakdown The Rebecca Lobach Black Hawk Accident

Apr 29, 2025

Communication Breakdown The Rebecca Lobach Black Hawk Accident

Apr 29, 2025 -

Black Hawk Helicopter Crash In Wichita Final Flight Details

Apr 29, 2025

Black Hawk Helicopter Crash In Wichita Final Flight Details

Apr 29, 2025 -

Black Hawk Helicopter And American Airlines Crash Report Details Contributing Factors

Apr 29, 2025

Black Hawk Helicopter And American Airlines Crash Report Details Contributing Factors

Apr 29, 2025 -

Investigation Reveals Fatal Errors In Black Hawk Helicopter And American Airlines Crash

Apr 29, 2025

Investigation Reveals Fatal Errors In Black Hawk Helicopter And American Airlines Crash

Apr 29, 2025