Market Crash: Seven Stocks Lose $2.5 Trillion This Year

Table of Contents

2.1 The Tech Wreck: Giants Taking the Biggest Hits

The technology sector bore the brunt of this market crash, with some of the biggest tech giants experiencing unprecedented declines.

2.1.1 Meta Platforms (META): Meta's market capitalization plummeted significantly, a consequence of several intertwined factors. The decline in advertising revenue, fueled by increased competition and a shift in user engagement, played a major role. Furthermore, the company's substantial investments in the metaverse haven't yielded the expected returns, weighing heavily on investor confidence.

- Percentage Loss: [Insert Specific Percentage – e.g., 40%]

- Impact on Market Capitalization: [Insert Specific Dollar Amount – e.g., $500 Billion loss]

- Analyst Predictions: Many analysts predict continued pressure on Meta's stock price until a clear path to profitability in the metaverse is demonstrated.

2.1.2 Amazon (AMZN): Amazon, a titan of e-commerce, also suffered a considerable market downturn. A slowdown in e-commerce growth, coupled with increased competition and the lingering effects of inflation, contributed to this decline. The company's cloud computing division, Amazon Web Services (AWS), while still strong, faced increased competition, impacting overall performance.

- Percentage Loss: [Insert Specific Percentage – e.g., 35%]

- Impact on Market Capitalization: [Insert Specific Dollar Amount – e.g., $400 Billion loss]

- Key Challenges Faced: Balancing growth with profitability in a challenging economic environment remains a key challenge for Amazon.

2.1.3 Apple (AAPL): Even the seemingly unshakeable Apple experienced a significant drop. Supply chain disruptions, slowing iPhone sales in key markets (e.g., China), and overall economic uncertainty all contributed to this decline. The high price point of Apple products also made them more vulnerable in a market where consumers are tightening their belts.

- Percentage Loss: [Insert Specific Percentage – e.g., 25%]

- Impact on Market Capitalization: [Insert Specific Dollar Amount – e.g., $300 Billion loss]

- Potential Future Scenarios: Apple's future performance will depend heavily on its ability to navigate supply chain issues and maintain demand for its products in a weakening global economy.

2.2 Beyond Tech: Other Sectors Feeling the Pinch

The market crash wasn't limited to the tech sector. Other major companies across various industries also experienced significant losses.

2.2.1 Microsoft (MSFT): Microsoft's decline can be attributed to several factors, including slowing PC sales, intense competition in the cloud computing market (against AWS and Google Cloud), and the overall macroeconomic headwinds impacting business spending.

- Percentage Loss: [Insert Specific Percentage]

- Impact on Market Capitalization: [Insert Specific Dollar Amount]

- Competitive Landscape Analysis: Microsoft faces fierce competition from both established players and emerging tech companies, requiring constant innovation to maintain its market share.

2.2.2 Alphabet (GOOGL): Alphabet, Google's parent company, faced significant losses due to changes in the advertising market, increased regulatory scrutiny, and rising competition. The slowing growth of digital advertising revenue significantly impacted its profitability.

- Percentage Loss: [Insert Specific Percentage]

- Impact on Market Capitalization: [Insert Specific Dollar Amount]

- Future Strategic Moves: Alphabet is likely to focus on diversifying its revenue streams and exploring new growth opportunities beyond advertising.

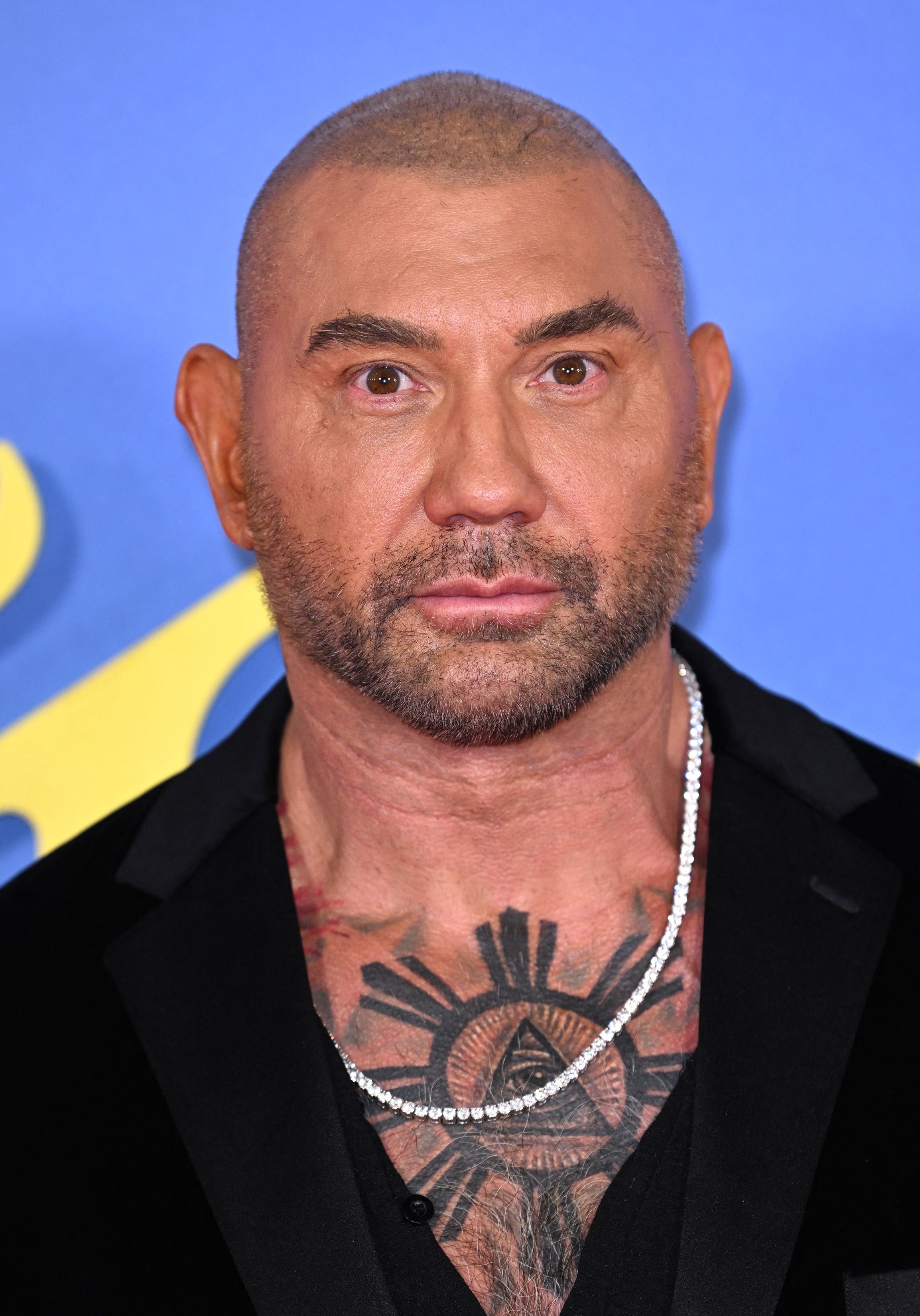

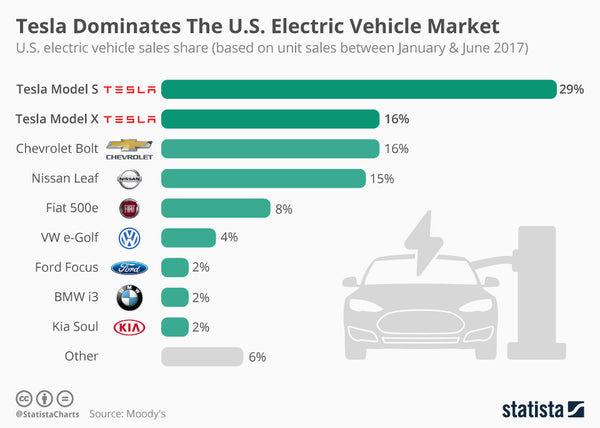

2.2.3 Tesla (TSLA): Tesla's downturn reflects a confluence of factors including production challenges, controversies surrounding CEO Elon Musk, and broader concerns within the electric vehicle (EV) market. Increased competition and softening demand contributed to the decline.

- Percentage Loss: [Insert Specific Percentage]

- Impact on Market Capitalization: [Insert Specific Dollar Amount]

- Analysis of Future Prospects: Tesla's future will hinge on its ability to overcome production bottlenecks, maintain its innovative edge, and successfully navigate intensifying competition in the EV sector.

2.2.4 NVIDIA (NVDA): NVIDIA, a leader in graphics processing units (GPUs), saw a significant decrease in value primarily due to reduced demand for gaming GPUs, fueled by economic uncertainty and competition. The slowdown in the cryptocurrency market also impacted the demand for their high-performance computing products.

- Percentage Loss: [Insert Specific Percentage]

- Impact on Market Capitalization: [Insert Specific Dollar Amount]

- Potential Recovery Scenarios: NVIDIA's recovery will depend on a resurgence in demand for gaming and high-performance computing, coupled with successful diversification into new markets.

2.3 Understanding the Underlying Causes of the Market Crash

This market crash wasn't a singular event but rather a consequence of various interconnected macroeconomic factors. High inflation, aggressive interest rate hikes by central banks, geopolitical instability (mention specific events if applicable), and growing recession fears all played significant roles in creating a climate of uncertainty and investor anxiety. This uncertainty led to increased market volatility and a significant sell-off. [Include data and charts if possible to support these claims].

3. Conclusion: Navigating the Aftermath of the Market Crash

The 2024 market crash resulted in a massive $2.5 trillion loss, impacting seven major stocks – Meta, Amazon, Apple, Microsoft, Alphabet, Tesla, and NVIDIA – significantly. This downturn highlights the inherent risks associated with investing and underscores the need for careful planning and diversification.

To navigate the aftermath of this market crash and prepare for future market downturns, investors must adopt a robust risk management strategy, including diversification across asset classes, and focus on long-term investment goals. Understanding the signs of a market crash and learning to navigate these periods effectively is crucial for success in the ever-evolving world of finance. Prepare for future market crashes by staying informed, diversifying your portfolio, and consulting with a financial advisor.

Featured Posts

-

Gambling On Catastrophe The Case Of The Los Angeles Wildfires

Apr 29, 2025

Gambling On Catastrophe The Case Of The Los Angeles Wildfires

Apr 29, 2025 -

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025 -

The China Factor How Market Shifts Affect Bmw Porsche And Other Automakers

Apr 29, 2025

The China Factor How Market Shifts Affect Bmw Porsche And Other Automakers

Apr 29, 2025 -

Anchor Brewing Company Shuts Down A Legacy Concludes

Apr 29, 2025

Anchor Brewing Company Shuts Down A Legacy Concludes

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Latest Posts

-

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025 -

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025 -

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025