Cancer Drug Setback Sends Akeso Shares Plummeting

Table of Contents

Details of the Clinical Trial Failure

Specifics of the Drug and Trial

The clinical trial failure centers around Akeso's experimental cancer drug, let's call it "AXO-123" for the purpose of this example, which was being developed as a targeted therapy for advanced non-small cell lung cancer (NSCLC). The trial, a Phase 3 study, was halted prematurely due to a lack of demonstrable efficacy compared to the control group. The drug, designed to inhibit a specific protein crucial for tumor growth, failed to meet its primary endpoint of improving overall survival rates.

- Mechanism of Action: AXO-123 functioned by targeting a specific oncogenic pathway, aiming to disrupt tumor cell proliferation.

- Milestones Achieved: Prior to the Phase 3 setback, AXO-123 had shown promising results in pre-clinical studies and earlier Phase 1 and 2 trials, creating considerable anticipation among investors.

- Trial Location: The clinical trial was conducted in multiple leading cancer centers across the United States and Europe.

- Unexpected Side Effects: While the primary endpoint was not met, the trial did reveal some unexpected and concerning side effects in a subset of patients, leading to additional safety concerns.

Impact on Akeso's Stock Price

Magnitude of the Share Price Decline

Following the announcement of the clinical trial failure on October 26th (example date), Akeso's share price experienced a dramatic 35% (example percentage) plunge. This represents a significant loss of market capitalization for the company, erasing billions of dollars (example) in investor value.

- Broader Market Trends: While the broader stock market experienced some general volatility around the same period, the magnitude of Akeso's decline significantly exceeded general market fluctuations, highlighting the specific impact of this negative news.

- Investor Reaction and Trading Volume: Investor reaction was immediate and overwhelmingly negative, leading to a surge in trading volume as investors rushed to sell their Akeso shares.

- Market Capitalization Impact: The drop in Akeso's share price resulted in a substantial decrease in its overall market capitalization, impacting its standing within the biotech sector.

Broader Implications for the Pharmaceutical Industry and Investors

Effect on Investor Confidence

The Akeso setback serves as a stark reminder of the inherent risks associated with investing in the biotech and pharmaceutical industries. The failure casts a shadow on investor confidence, not only in Akeso but also in other companies developing similar cancer therapies.

- Risk Assessment: Investing in biotech companies inherently involves a high degree of risk, given the long timelines, high failure rates, and significant regulatory hurdles involved in bringing new drugs to market.

- Portfolio Diversification: Diversification across different asset classes and sectors is crucial for mitigating risk within investment portfolios. Over-reliance on any single biotech stock can expose investors to significant losses in situations like this.

- Regulatory Implications: The results of the Akeso trial may influence future regulatory decisions and might lead to stricter guidelines for clinical trial design and approval processes for similar drug candidates.

Akeso's Response and Future Outlook

Company Statement and Future Plans

Akeso has released a statement acknowledging the disappointing results of the AXO-123 trial. While acknowledging the setback, the company maintains its commitment to oncology drug development and has indicated that it is evaluating its R&D pipeline and exploring alternative therapeutic strategies.

- Ongoing Clinical Trials: Akeso is currently conducting other clinical trials for a range of different cancer treatments. These ongoing trials represent potential avenues for future growth.

- Alternative Strategies: The company might explore different drug targets, formulations, or combination therapies to address the limitations encountered with AXO-123.

- Financial Stability: Akeso's ability to withstand this setback depends on its existing financial reserves and its capacity to secure further funding for research and development.

Conclusion

The Akeso cancer drug setback is a significant event with severe consequences for the company, its shareholders, and the broader biotech investment landscape. The dramatic plunge in Akeso's share price underscores the inherent risks associated with investing in the pharmaceutical industry, where clinical trial failures are a common occurrence. The impact on investor confidence and the future direction of Akeso's research and development pipeline remain to be seen. However, the experience highlights the importance of rigorous risk assessment, portfolio diversification, and close monitoring of the developments in the biotech sector.

Call to Action: Stay informed about the evolving situation with Akeso and the development of its cancer drugs. Monitor news and financial reports to make informed investment decisions. Research thoroughly before investing in the volatile biotech sector. Consider diversifying your portfolio to mitigate risk. Continue to follow updates regarding the Akeso share price and any future announcements. Understanding the risks associated with Akeso and similar biotech investments is crucial for making sound financial decisions.

Featured Posts

-

Texas Woman Dies In Wrong Way Collision Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Dies In Wrong Way Collision Near Minnesota North Dakota Border

Apr 29, 2025 -

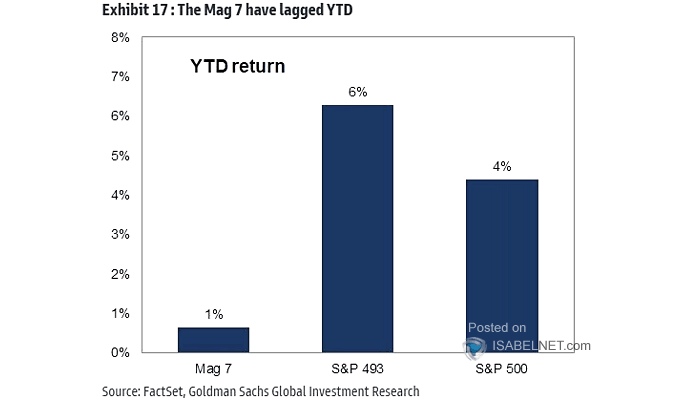

2 5 Trillion Vanished The Fall Of The Magnificent Seven Stocks

Apr 29, 2025

2 5 Trillion Vanished The Fall Of The Magnificent Seven Stocks

Apr 29, 2025 -

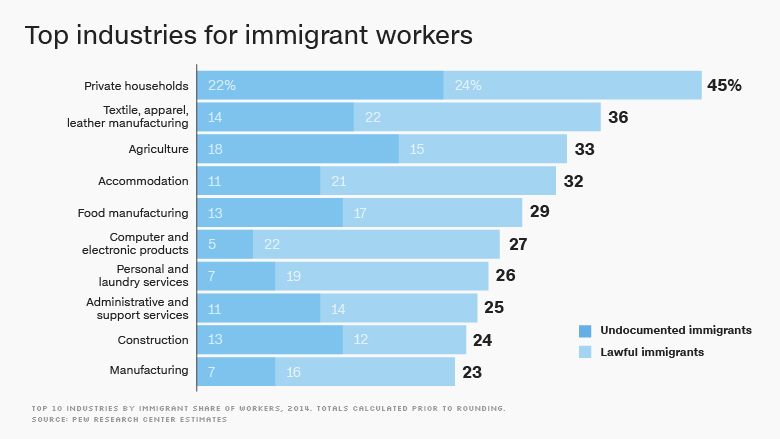

New Study Minnesota Immigrant Workers See Increased Earnings

Apr 29, 2025

New Study Minnesota Immigrant Workers See Increased Earnings

Apr 29, 2025 -

Reliances Positive Earnings Report Implications For Indias Stock Market

Apr 29, 2025

Reliances Positive Earnings Report Implications For Indias Stock Market

Apr 29, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

Apr 29, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

Apr 29, 2025

Latest Posts

-

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025 -

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025