$2.5 Trillion Vanished: The Fall Of The Magnificent Seven Stocks

Table of Contents

The Rise and Fall of the Magnificent Seven

The Magnificent Seven's meteoric rise was fueled by innovation, disruptive technologies, and strong market leadership. They dominated their respective sectors, shaping the technological landscape and becoming household names. Their initial success can be attributed to:

- Groundbreaking Innovation: Each company pioneered transformative technologies that reshaped industries. Apple with the iPhone, Microsoft with Windows and cloud computing, Google with search and advertising, Amazon with e-commerce, Nvidia with GPUs, Tesla with electric vehicles, and Meta with social media.

- Strong Market Leadership: These companies established dominant market positions, often achieving near-monopoly status in their respective niches.

- Aggressive Expansion: Strategic acquisitions and expansion into new markets fueled rapid growth.

Key Milestones and Periods of Growth (Examples):

- Apple: Launch of the iPhone (2007), App Store (2008), consistent growth in services revenue.

- Microsoft: Dominance in the operating systems market, successful cloud computing strategy with Azure.

- Alphabet: Market leadership in online advertising, development of Android operating system.

- Amazon: Rapid expansion of e-commerce, dominance in cloud computing (AWS).

- Nvidia: Breakthroughs in GPU technology, expansion into AI and data centers.

- Tesla: Pioneering electric vehicle technology, expansion into energy storage.

- Meta: Global dominance in social networking, expansion into virtual reality (Metaverse).

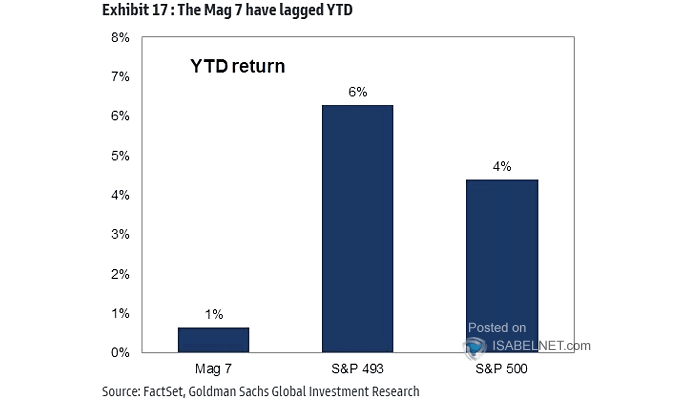

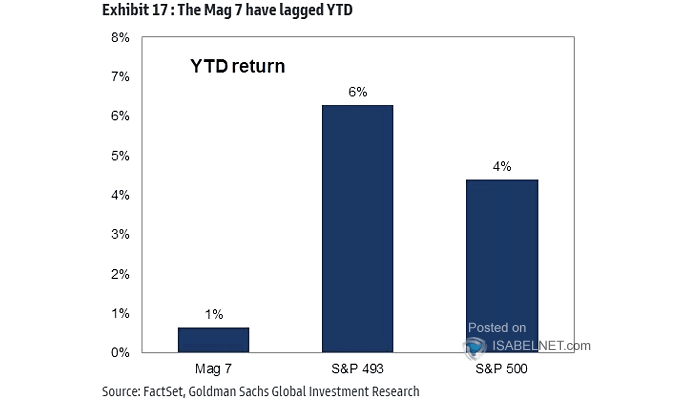

However, this period of rapid growth was followed by a significant shift in market sentiment. Factors contributing to their decline include a tech bubble bursting, market correction, growth stock downturn and valuation concerns. The once seemingly unstoppable growth of the Magnificent Seven encountered headwinds, leading to a substantial drop in their collective market capitalization.

Macroeconomic Factors Contributing to the Decline

Several macroeconomic factors played a significant role in the decline of the Magnificent Seven stocks.

Inflation and Rising Interest Rates

Rising inflation and subsequent interest rate hikes by central banks globally significantly impacted investor behavior. Higher interest rates make borrowing more expensive, reducing corporate investment and slowing economic growth. This negatively affected the valuations of growth stocks, including the Magnificent Seven, as investors shifted towards safer, higher-yielding assets.

- Correlation between interest rates and tech stock performance: Historically, higher interest rates correlate with lower tech stock valuations, as investors demand higher returns in a higher-interest-rate environment.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, including the war in Ukraine and heightened US-China tensions, created significant uncertainty in global markets. Simultaneously, supply chain disruptions caused by the pandemic and other factors led to increased production costs and delays, impacting the profitability of several Magnificent Seven companies.

Recession Fears

Growing concerns about a potential global recession further dampened investor confidence. Recessionary pressures and economic uncertainty led to a "risk-off" sentiment, prompting investors to sell growth stocks, particularly those with high valuations and less immediate profitability. Keywords like economic uncertainty, recessionary pressures, and risk-off sentiment perfectly capture this climate of fear.

Sector-Specific Challenges Faced by the Magnificent Seven

Beyond macroeconomic headwinds, each company faced unique challenges within their respective sectors.

Apple's iPhone Sales Slowdown

Apple, while still incredibly profitable, experienced a slowdown in iPhone sales growth, impacting its overall revenue and stock price. Factors contributing to this slowdown include increased competition, saturated markets in some regions, and the higher cost of the newer models.

Microsoft's Cloud Computing Competition

Microsoft faces increasing competition in the cloud computing market from Amazon Web Services (AWS) and Google Cloud. Maintaining its market share and achieving continued growth in this fiercely competitive space presents an ongoing challenge.

Alphabet's Advertising Revenue Concerns

Alphabet, heavily reliant on advertising revenue, experienced a slowdown in growth due to factors like increased competition, the economic slowdown, and changes in digital advertising regulations.

Amazon's E-commerce Slowdown and Expansion Costs

Amazon's e-commerce growth has slowed after a pandemic-fueled surge. Simultaneously, the company's massive investments in new initiatives and expansion into various sectors have impacted its profitability.

Nvidia's Chip Demand Concerns

Nvidia, a leader in graphics processing units (GPUs), experienced fluctuations in demand for its chips due to macroeconomic factors and competition. The chip market is cyclical, making Nvidia’s performance susceptible to economic downturns and shifts in technological trends.

Tesla's Production Challenges and Elon Musk's Activities

Tesla’s stock performance has been affected by several factors, including production challenges, increased competition in the electric vehicle market, and the often unpredictable actions and statements of its CEO, Elon Musk.

Meta's Metaverse Struggles and Advertising Revenue Dip

Meta's significant investment in the metaverse has yet to yield substantial returns, while its advertising revenue has faced headwinds similar to Alphabet's. The metaverse's long-term viability and Meta’s ability to navigate the changing digital advertising landscape remain crucial factors for its future.

Conclusion

The $2.5 trillion loss experienced by the Magnificent Seven stocks underscores the inherent risks in investing in growth stocks, particularly during periods of macroeconomic uncertainty. The decline highlights the impact of inflation, rising interest rates, geopolitical instability, sector-specific challenges, and shifts in investor sentiment.

Key Takeaways:

- Diversification is crucial for mitigating risk.

- Understanding macroeconomic factors is essential for informed investment decisions.

- Risk management strategies should be implemented to protect investments during market downturns.

Understanding the dynamics behind the fall of the Magnificent Seven stocks is crucial for informed investment decisions. Continue your research into the Magnificent Seven stocks and other growth equities to make well-informed choices about your portfolio. Staying informed about market trends and macroeconomic factors is key to navigating the complexities of the stock market.

Featured Posts

-

Kuxius Revolutionary Solid State Power Bank Durability And Performance Compared

Apr 29, 2025

Kuxius Revolutionary Solid State Power Bank Durability And Performance Compared

Apr 29, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In The Blockchain Space

Apr 29, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In The Blockchain Space

Apr 29, 2025 -

Beyond Quinoa Discover The Next Generation Of Healthy Grains

Apr 29, 2025

Beyond Quinoa Discover The Next Generation Of Healthy Grains

Apr 29, 2025 -

Canada Election 2023 Mark Carneys Faltering Campaign Momentum

Apr 29, 2025

Canada Election 2023 Mark Carneys Faltering Campaign Momentum

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025

Latest Posts

-

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025 -

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025 -

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025