Are High Stock Valuations A Worry? BofA's Analysis For Investors

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's assessment of current stock market valuations presents a nuanced picture. While acknowledging the elevated levels compared to historical averages, their analysis isn't a simple declaration of impending doom. Instead, they offer a more cautious outlook, emphasizing the need for careful risk management.

-

Valuation Metrics: BofA employs a variety of valuation metrics in its analysis, including the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller P/E), and other forward-looking measures. These metrics consider both current earnings and projected future earnings growth.

-

BofA's Conclusions: BofA's conclusions suggest that while certain sectors exhibit signs of overvaluation, a blanket statement of market-wide overvaluation is premature. Their findings highlight a significant disparity in valuations across different sectors and industries.

-

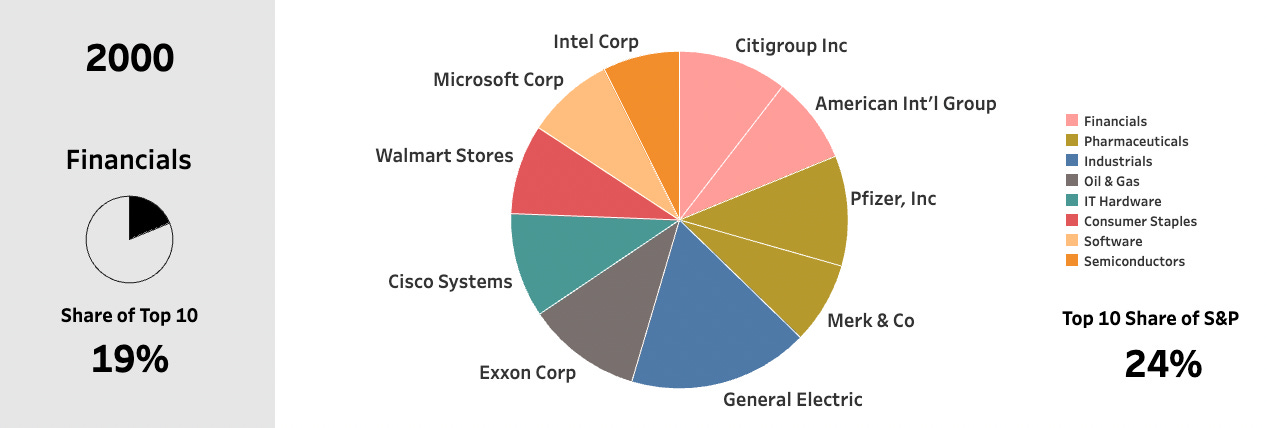

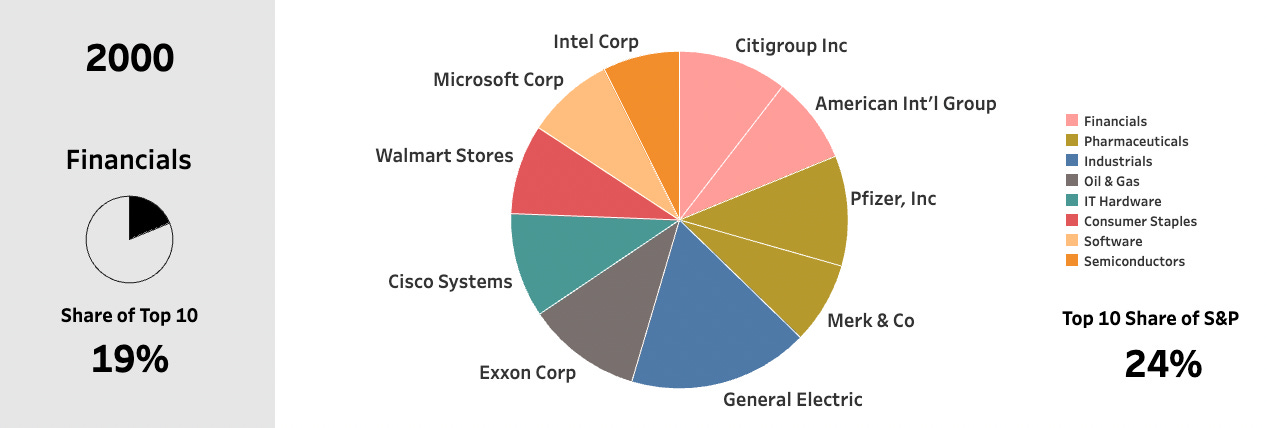

Sector-Specific Analysis: BofA's analysis highlights specific sectors that appear relatively overvalued, such as certain technology sub-sectors known for rapid growth but also high price-to-earnings multiples. Conversely, some more traditionally valued sectors may appear comparatively undervalued, depending on the metric used. This underscores the importance of granular analysis rather than broad generalizations.

Factors Contributing to High Stock Valuations

Several interconnected economic and market factors are driving current high stock valuations. Understanding these factors is critical to assessing the risks and opportunities presented by the market.

-

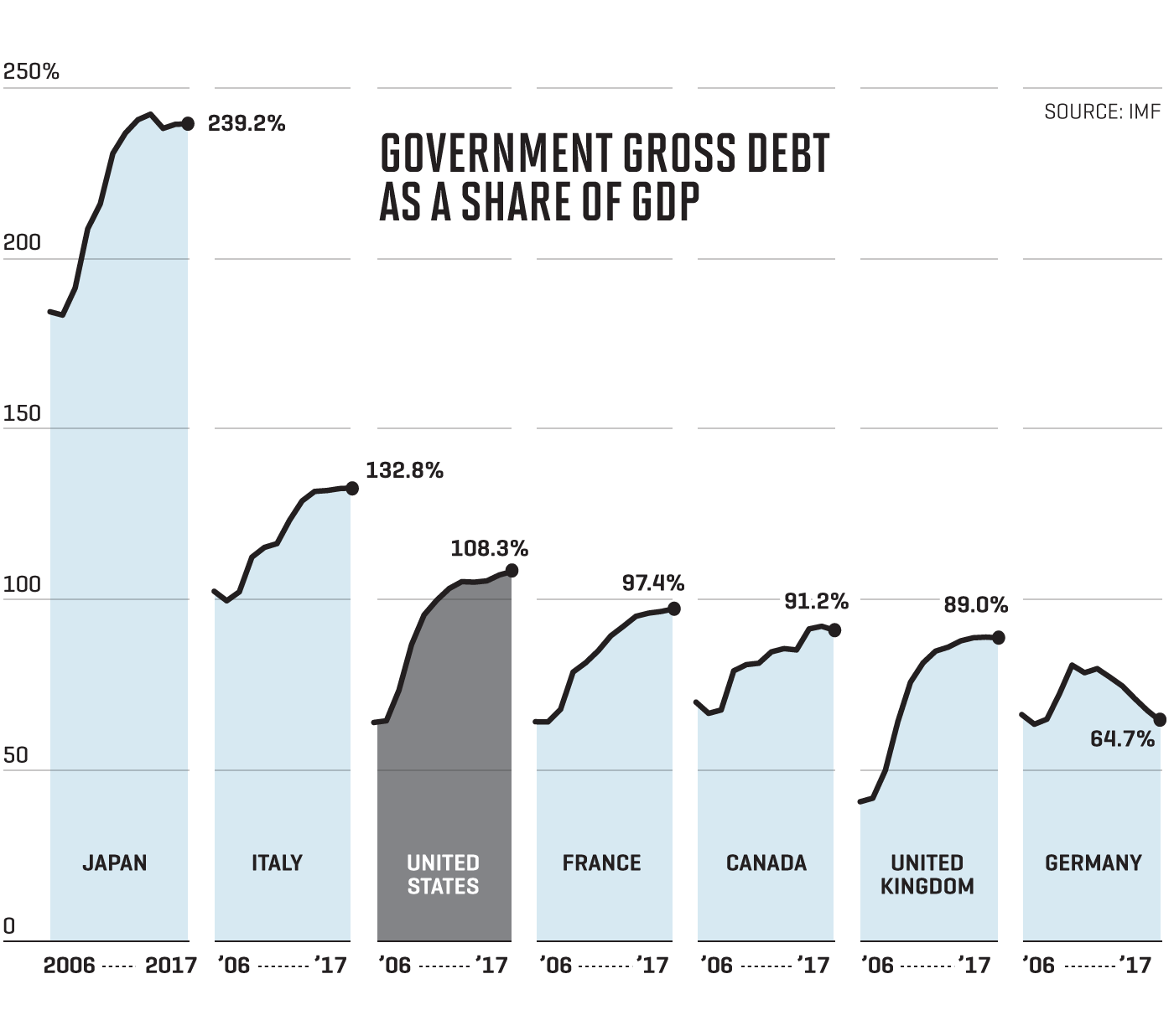

Low Interest Rates: Historically low interest rates have fueled investor demand for higher-yielding assets, including stocks. This has pushed up stock prices, even in the face of uncertain economic conditions. The easy access to cheap capital through low interest rates further amplifies this trend.

-

Strong Corporate Earnings (and Growth Expectations): While not uniformly across all sectors, strong corporate earnings reports, especially from tech giants, have supported higher stock valuations. Furthermore, investor expectations of future earnings growth play a significant role in maintaining these valuations.

-

Inflationary Pressures: Inflation introduces complexity. While inflation can negatively impact stock valuations by eroding purchasing power and raising interest rates, it also sometimes prompts investors to seek inflation hedges, potentially boosting demand for certain stock classes.

-

Geopolitical Uncertainties: Global geopolitical events and uncertainties, such as ongoing trade disputes or regional conflicts, can create volatility and influence investor sentiment. Risk-averse investors might seek safety in established companies, pushing up valuations in more stable sectors.

-

Quantitative Easing and Monetary Policy: Monetary policy actions, such as quantitative easing (QE), have injected significant liquidity into the markets, lowering borrowing costs and influencing asset prices. These policies have played a considerable role in supporting high stock valuations.

Risk Assessment and Mitigation Strategies

High stock valuations inherently present risks. Understanding and mitigating these risks is crucial for investors.

-

Market Corrections and Crashes: The risk of a market correction or even a more severe crash is always present, especially when valuations are elevated. History shows that high valuations are often followed by periods of significant market decline.

-

Risk Mitigation Strategies: Investors can mitigate risk through diversification across different asset classes, sectors, and geographies. Hedging strategies, using options or other derivatives, can also provide some protection against market downturns.

-

Long-Term vs. Short-Term Strategies: Maintaining a long-term investment horizon is generally recommended, as it allows for weathering market fluctuations and benefiting from long-term growth. Focusing on short-term gains can be particularly risky in a high-valuation environment.

-

BofA's Recommendations: BofA generally recommends a cautious approach, emphasizing selective investment strategies, diversification, and a thorough understanding of individual company fundamentals. Their advice strongly leans toward risk management in this environment.

Alternative Investment Opportunities

In a market characterized by high stock valuations, investors may consider exploring alternative investment opportunities:

-

Bonds and Fixed-Income Investments: Bonds, particularly those with higher credit ratings, can provide stability and predictable returns, serving as a counterbalance to the volatility of equities.

-

Real Estate: Real estate can be a valuable addition to a diversified portfolio, offering potential for long-term capital appreciation and rental income.

-

Commodities: Commodities, such as gold or oil, may act as inflation hedges and provide diversification benefits.

-

Other Alternatives: Other alternative assets like private equity, infrastructure investments, or hedge funds can offer further diversification, though these often come with higher minimum investments and less liquidity.

Conclusion

BofA's analysis of high stock valuations highlights a complex situation, not simply a clear-cut overvaluation. While some sectors display signs of overvaluation, others may not. Several key factors, including low interest rates, strong earnings (in certain sectors), inflation, geopolitical events, and monetary policy, have all contributed to the current market environment. The potential for market corrections remains a significant risk. Understanding the implications of high stock valuations for your portfolio is crucial. Learn how to navigate the challenges of high stock valuations by diversifying your assets, employing risk mitigation strategies, and adopting a long-term investment perspective. Consult with a qualified financial advisor to develop a robust investment strategy tailored to your risk tolerance and financial goals in the face of high stock valuations. Stay informed about market trends and the ongoing analysis surrounding high stock valuations to make informed investment decisions.

Featured Posts

-

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 29, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 29, 2025 -

China Market Headwinds Challenges Faced By Bmw Porsche And Other Auto Brands

Apr 29, 2025

China Market Headwinds Challenges Faced By Bmw Porsche And Other Auto Brands

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025 -

Anthony Edwards Injury Status Latest News On Timberwolves Lakers Game

Apr 29, 2025

Anthony Edwards Injury Status Latest News On Timberwolves Lakers Game

Apr 29, 2025 -

Dsps Top India Fund Market Concerns Lead To Increased Cash Allocation

Apr 29, 2025

Dsps Top India Fund Market Concerns Lead To Increased Cash Allocation

Apr 29, 2025

Latest Posts

-

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025 -

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025