DSP's Top India Fund: Market Concerns Lead To Increased Cash Allocation

Table of Contents

Market Volatility and Uncertainty

The current market climate is characterized by significant volatility and uncertainty, driven by a confluence of global and domestic factors. This has prompted the fund managers of DSP's Top India Fund to adopt a more conservative approach.

Geopolitical Risks

Geopolitical instability is a major contributing factor to market uncertainty. The ongoing Ukraine conflict, for instance, has disrupted global supply chains, fueled inflation, and created significant uncertainty in energy markets. This uncertainty ripples through global markets, including India's.

- The war has led to increased energy prices, impacting inflation globally and in India.

- Supply chain disruptions have affected various sectors, creating uncertainty in production and delivery timelines.

- Investor sentiment has been negatively impacted by the ongoing geopolitical tensions, leading to increased market volatility.

Inflationary Pressures

Rising inflation is another key concern. Persistent inflationary pressures in India, coupled with global inflationary trends, are forcing central banks to tighten monetary policy. This affects investment decisions in several ways.

- Increased interest rates make borrowing more expensive for businesses, potentially impacting corporate earnings.

- Higher inflation erodes purchasing power, impacting consumer spending and economic growth.

- Investors may seek safer havens for their investments, potentially leading to capital outflows from equities.

Global Economic Slowdown

The threat of a global recession looms large, casting a shadow over economic growth prospects worldwide. India, while relatively insulated, is not immune to the effects of a global slowdown.

- A global recession could reduce demand for Indian exports, impacting export-oriented businesses.

- Reduced foreign investment flows could negatively affect the Indian stock market.

- The interconnectedness of global economies means that a slowdown in one region can have a ripple effect across others.

DSP's Top India Fund's Response

In response to these market uncertainties, DSP's Top India Fund has increased its cash allocation. This strategic shift reflects a cautious approach to navigating the current turbulent market conditions.

Increased Cash Allocation Strategy

The fund has reportedly increased its cash holdings by [Insert Percentage if available] %, aiming to mitigate potential losses and preserve capital. This move prioritizes risk mitigation over aggressive growth in the short term.

- Holding more cash reduces the fund's exposure to market fluctuations, limiting potential downside.

- This conservative strategy prioritizes capital preservation, which is crucial during periods of heightened uncertainty.

- The fund manager's rationale likely emphasizes the need for prudence in the face of significant macroeconomic headwinds.

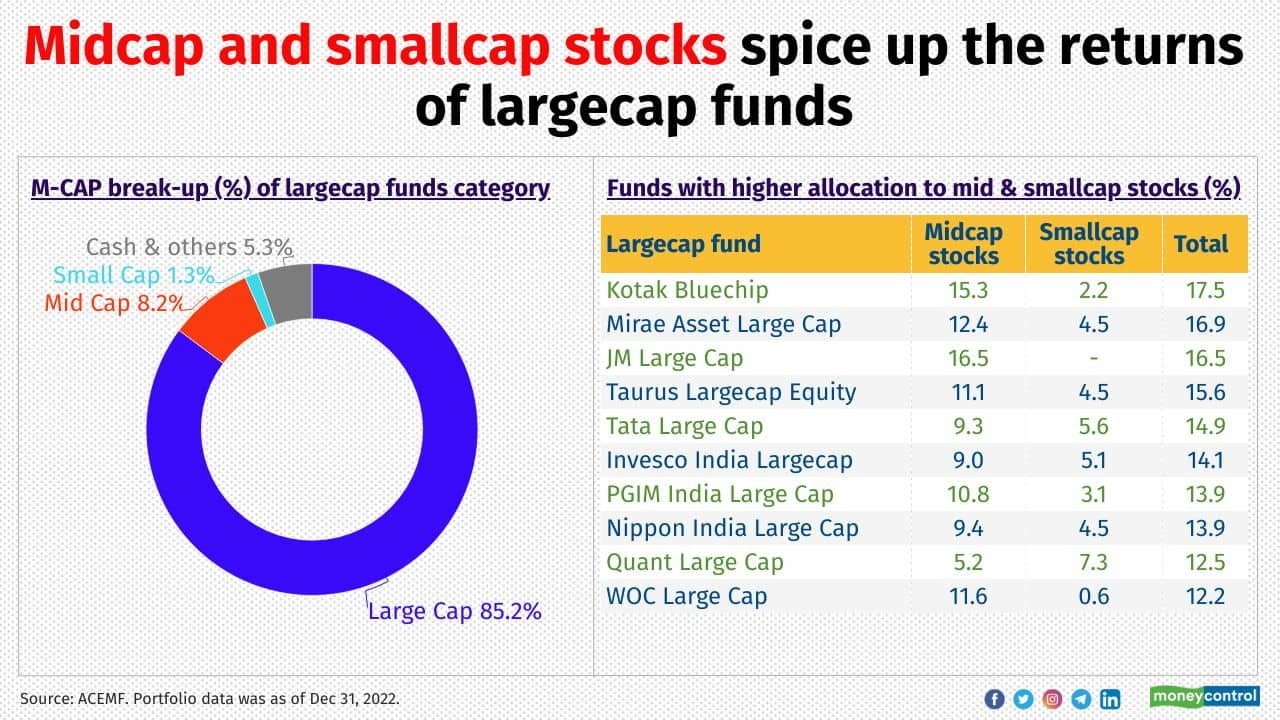

Impact on Fund Performance

The increased cash allocation will likely impact the fund's performance in the short term. While it may underperform benchmark indices during periods of market upswings, it aims to limit losses during downturns.

- The trade-off between risk and return is a key consideration. A conservative approach reduces potential gains but also lowers potential losses.

- Comparisons to benchmark indices and peer funds will be crucial to assess the effectiveness of the strategy over time.

- Long-term performance will be the ultimate measure of success for this adjusted strategy.

Investor Implications

For existing investors, this strategic shift may raise concerns, particularly if they had anticipated higher returns. Potential investors may also question the fund's suitability given the reduced equity exposure.

- Investors should carefully consider their risk tolerance and investment horizon before making any decisions.

- Adjusting portfolio allocations based on individual risk profiles may be necessary.

- Considering alternative investment options with different risk profiles is advisable.

Alternative Investment Strategies

Given the current market uncertainties, investors may want to explore alternative investment strategies that offer better protection during market downturns.

Defensive Asset Classes

Defensive asset classes, such as gold and government bonds, are often considered safer havens during periods of market volatility.

- Gold often acts as an inflation hedge and a safe haven asset during times of uncertainty.

- Government bonds typically offer lower returns but are considered less risky than equities.

Sector-Specific Opportunities

Certain sectors may be less vulnerable to market volatility. Investors might consider allocating funds to these sectors.

- Consumer staples often demonstrate resilience during economic downturns, as they cater to essential needs.

- Pharmaceuticals and utilities are generally considered defensive sectors less susceptible to market fluctuations.

Conclusion

The increase in cash allocation by DSP's Top India Fund reflects the prevailing market concerns: heightened volatility driven by geopolitical risks, inflationary pressures, and the potential for a global economic slowdown. This strategic shift prioritizes capital preservation over aggressive growth in the short term. While this may lead to lower short-term returns, it aims to minimize potential losses and protect investor capital during uncertain times. To learn more about DSP's Top India Fund and its updated investment strategy, visit their website or contact a financial advisor. Invest wisely with DSP's Top India Fund, understanding the implications of the shift in its investment strategy for your portfolio.

Featured Posts

-

Reliance Earnings Surprise Boost For Indian Large Cap Stocks

Apr 29, 2025

Reliance Earnings Surprise Boost For Indian Large Cap Stocks

Apr 29, 2025 -

China Regulator Approves Hengrui Pharmas Hong Kong Stock Listing

Apr 29, 2025

China Regulator Approves Hengrui Pharmas Hong Kong Stock Listing

Apr 29, 2025 -

Lynas Rare Earths Seeks Us Aid For Texas Refinery Amidst Cost Increases

Apr 29, 2025

Lynas Rare Earths Seeks Us Aid For Texas Refinery Amidst Cost Increases

Apr 29, 2025 -

Understanding The Russian Militarys Impact On European Security

Apr 29, 2025

Understanding The Russian Militarys Impact On European Security

Apr 29, 2025 -

160km

Apr 29, 2025

160km

Apr 29, 2025

Latest Posts

-

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025

Huaweis Exclusive Ai Chip A Deep Dive Into Its Specifications And Potential

Apr 29, 2025 -

Chinas Huawei Unveils New Ai Chip Technology Closing The Gap On Nvidia

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Technology Closing The Gap On Nvidia

Apr 29, 2025 -

Exclusive Huawei Develops Cutting Edge Ai Chip To Rival Nvidia

Apr 29, 2025

Exclusive Huawei Develops Cutting Edge Ai Chip To Rival Nvidia

Apr 29, 2025 -

Exclusive Report Elite Colleges Form Secret Group To Resist Trump

Apr 29, 2025

Exclusive Report Elite Colleges Form Secret Group To Resist Trump

Apr 29, 2025 -

Huaweis New Ai Chip A Challenger To Nvidias Dominance

Apr 29, 2025

Huaweis New Ai Chip A Challenger To Nvidias Dominance

Apr 29, 2025